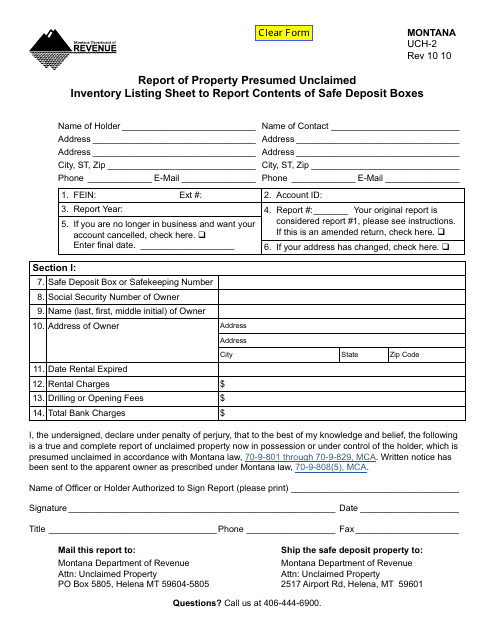

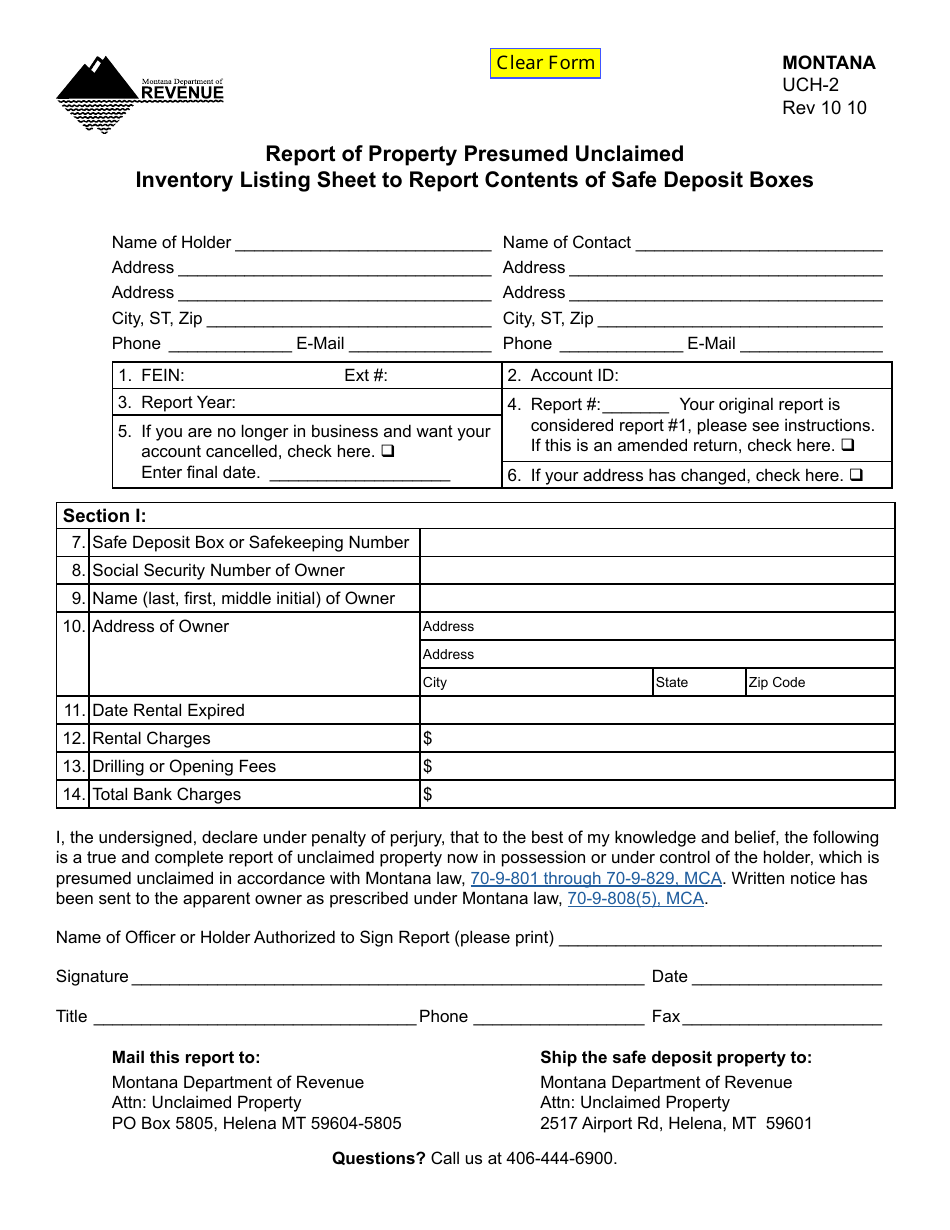

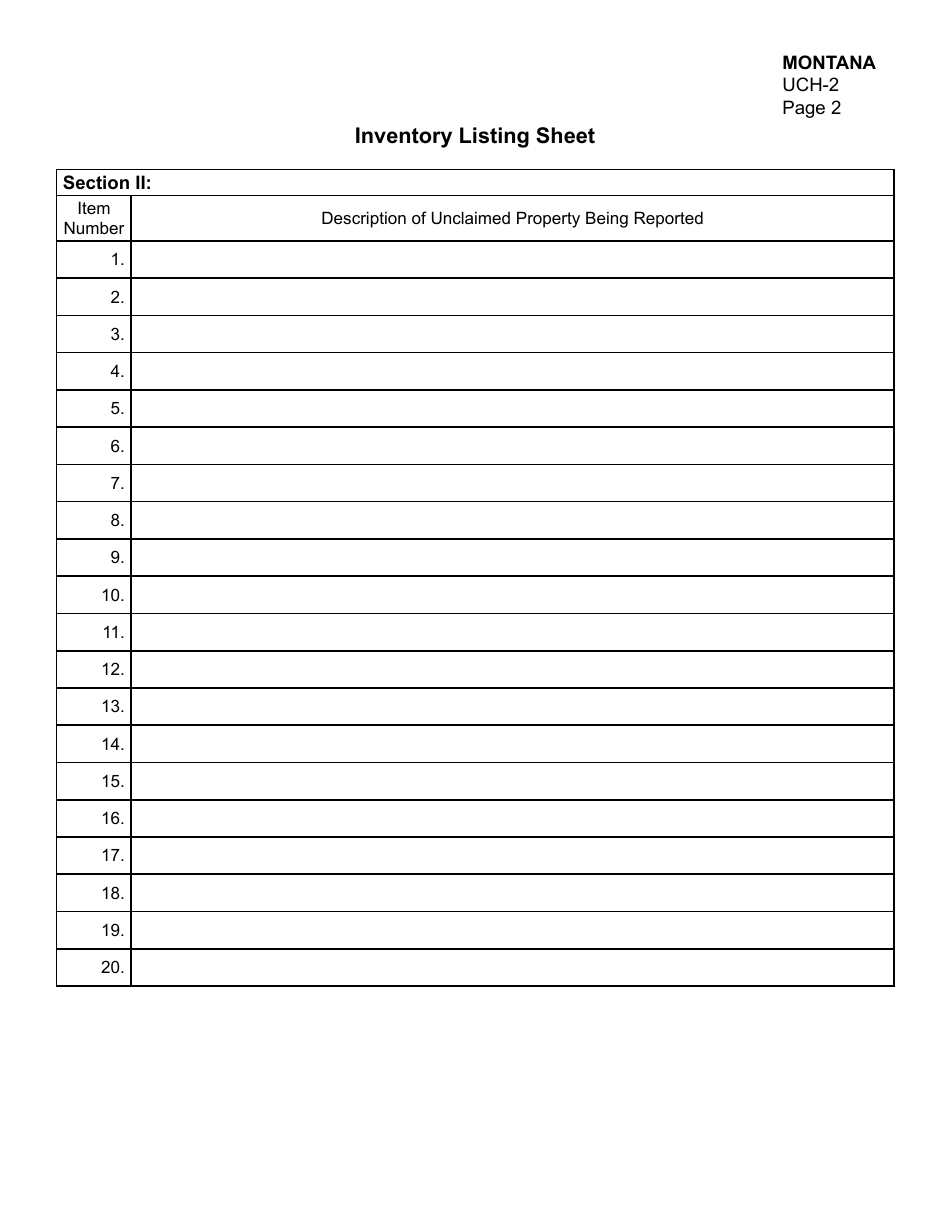

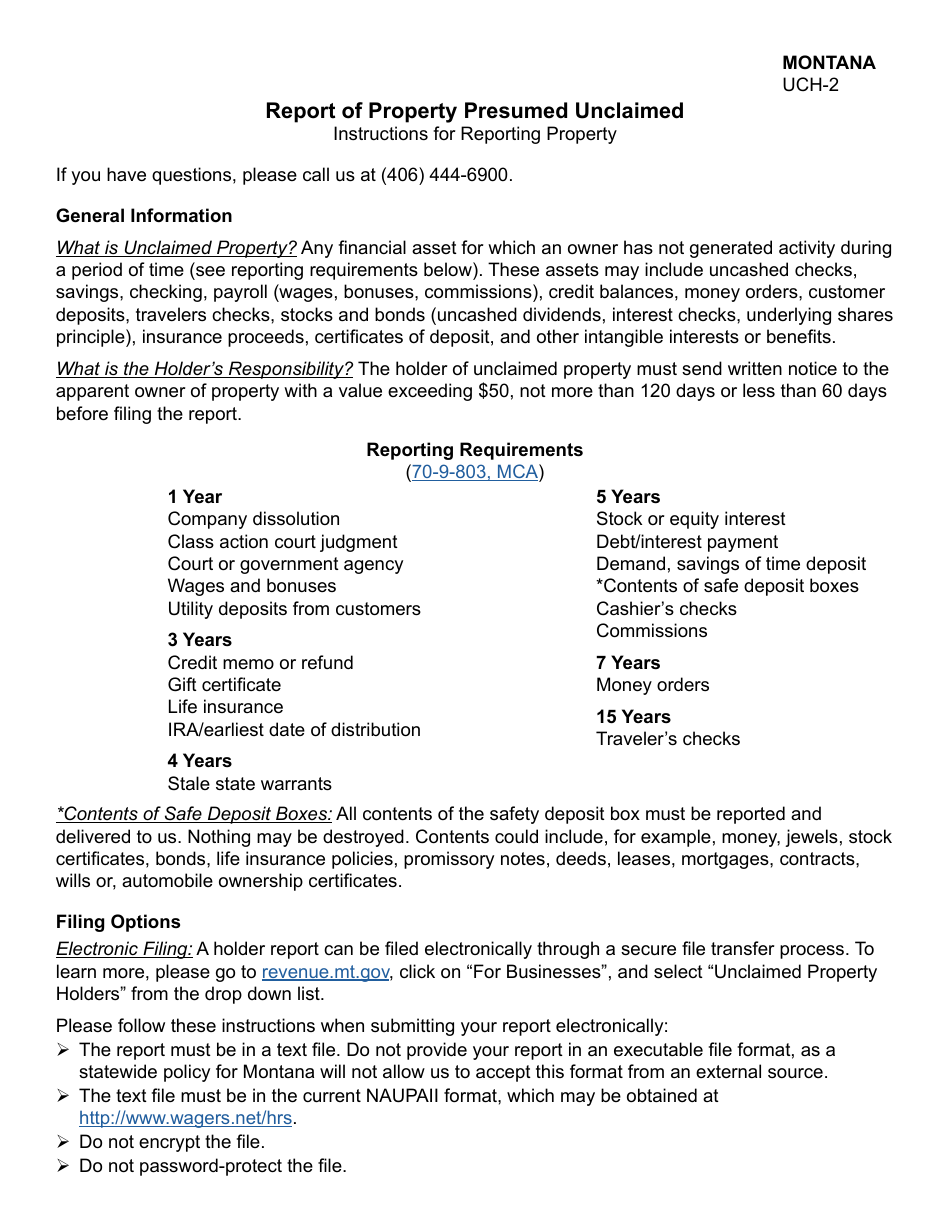

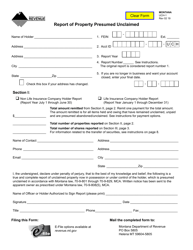

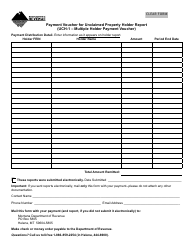

Form UCH-2 Report of Property Presumed Unclaimed Inventory Listing Sheet to Report Contents of Safe Deposit Boxes - Montana

What Is Form UCH-2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCH-2?

A: Form UCH-2 is a report used in Montana to disclose the contents of safe deposit boxes that are presumed unclaimed.

Q: Who needs to file Form UCH-2?

A: Any entity, such as a bank or credit union, that has custody of safe deposit boxes must file Form UCH-2.

Q: What is the purpose of filing Form UCH-2?

A: The purpose of filing Form UCH-2 is to report the contents of safe deposit boxes that have been abandoned or left unclaimed.

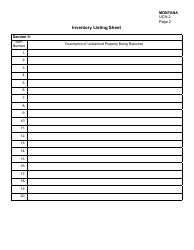

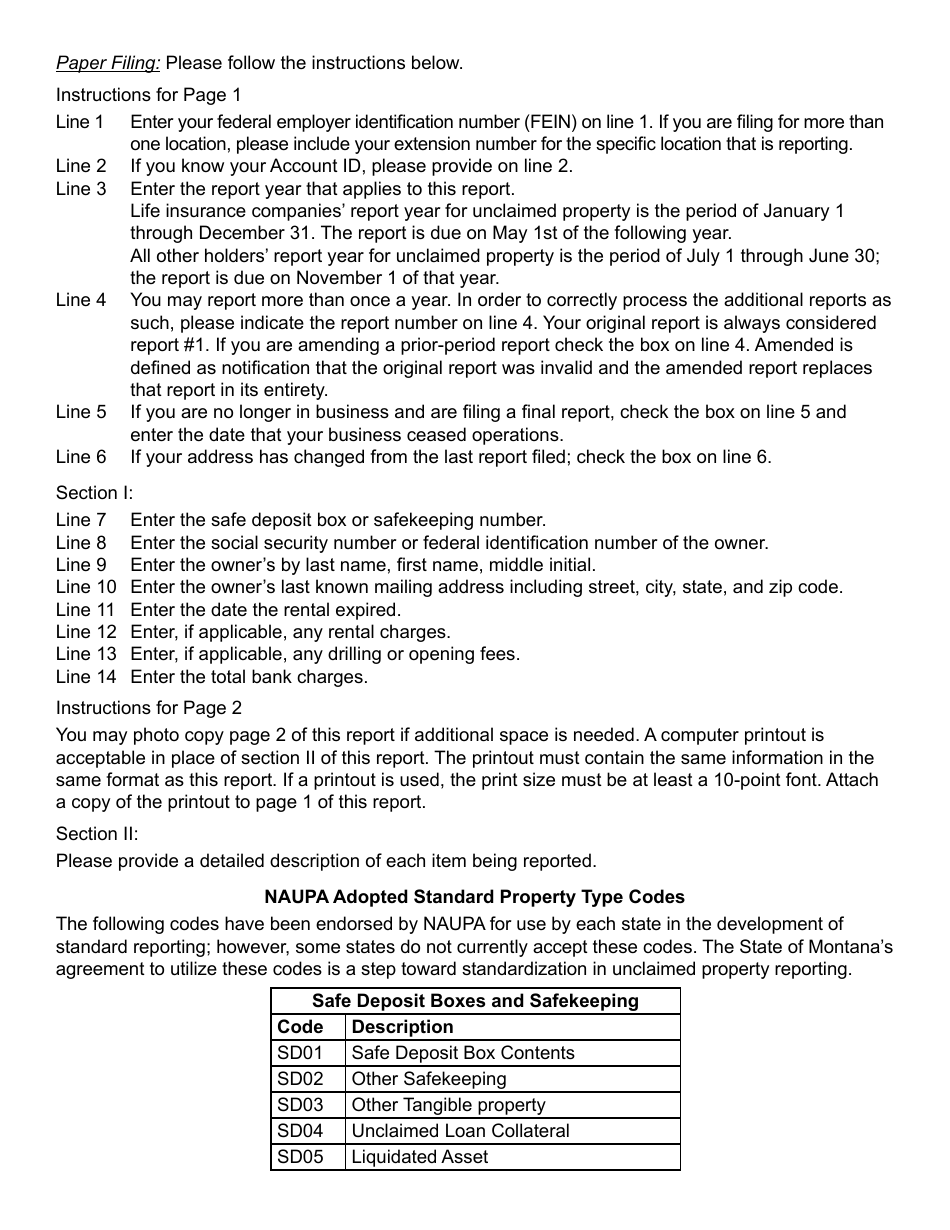

Q: What information is required on Form UCH-2?

A: Form UCH-2 requires information about the safe deposit box, its contents, and any attempts made to contact the owner.

Q: When is Form UCH-2 due?

A: Form UCH-2 must be filed by November 1st of each year for the period ending on June 30th.

Q: Are there any penalties for not filing Form UCH-2?

A: Yes, there can be penalties and interest imposed for failing to file Form UCH-2 or for reporting incomplete or inaccurate information.

Q: Is there a fee for filing Form UCH-2?

A: There is no fee for filing Form UCH-2.

Q: Are there any exemptions to filing Form UCH-2?

A: Certain financial institutions are exempt from filing Form UCH-2 if they meet specific criteria outlined in the Montana Code Annotated.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCH-2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.