This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

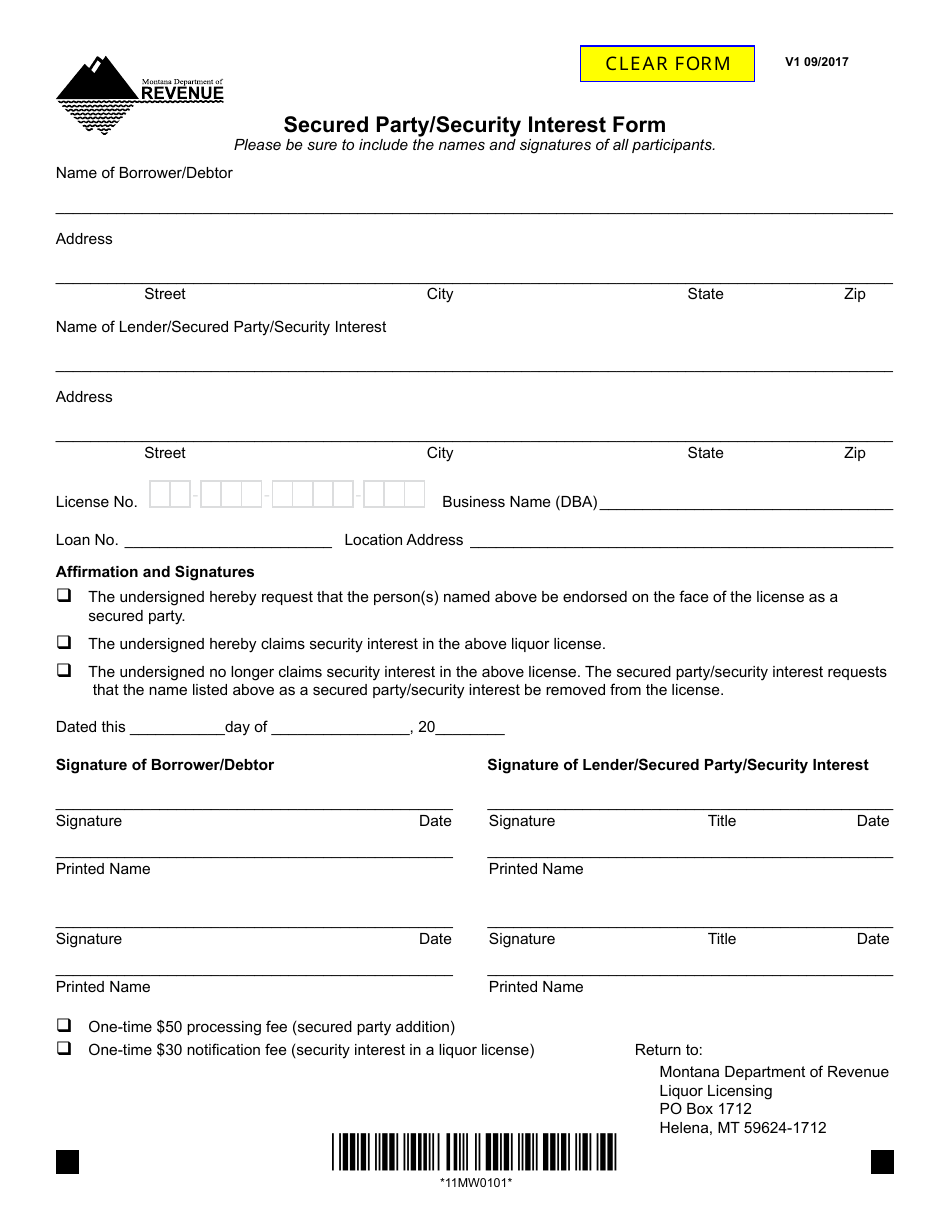

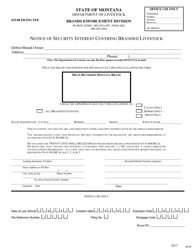

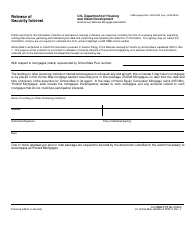

Secured Party / Security Interest Form - Montana

Secured Party/Security Interest Form is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is a secured party?

A: A secured party is a person or entity that has a security interest in a debtor's property.

Q: What is a security interest?

A: A security interest is a legal claim against a debtor's property to ensure the repayment of a debt or obligation.

Q: What is the Secured Party/Security Interest Form in Montana?

A: The Secured Party/Security Interest Form is a document used in Montana to establish or release a security interest on a debtor's property.

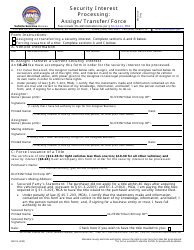

Q: When is the Secured Party/Security Interest Form used?

A: The form is typically used when a lender, such as a bank or financial institution, wants to secure their interest in property owned by a borrower to ensure repayment of a loan.

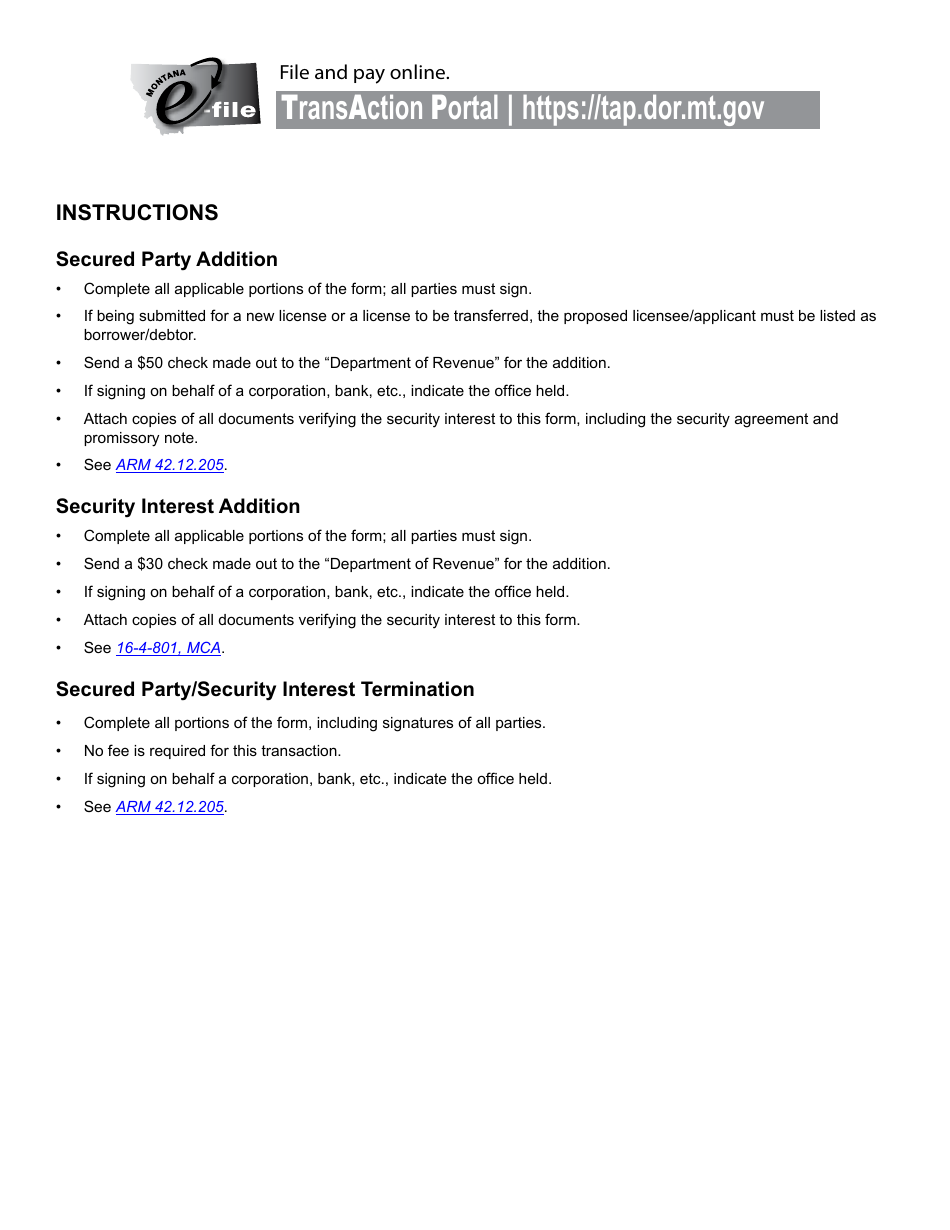

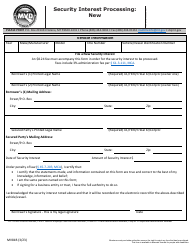

Q: How do I fill out the Secured Party/Security Interest Form in Montana?

A: The form requires information about the debtor, secured party, and the property being used as collateral. It must be completed accurately and signed by both parties.

Q: Is there a fee to file the Secured Party/Security Interest Form in Montana?

A: Yes, there is a filing fee associated with submitting the form. The fee amount can vary.

Q: What happens after filing the Secured Party/Security Interest Form?

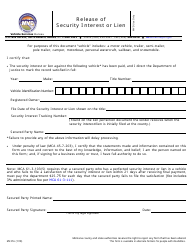

A: Once the form is filed with the appropriate authority, the security interest becomes a matter of public record and provides notice to other parties about the secured party's claim on the property.

Q: What should I do if I want to release a security interest in Montana?

A: To release a security interest in Montana, a Secured Party/Security Interest Form must be completed and filed, indicating the release of the security interest.

Q: Are there any specific requirements for the Secured Party/Security Interest Form in Montana?

A: Yes, the form must meet certain formatting requirements and include the necessary information. It is recommended to consult the Montana Secretary of State or a legal professional for guidance.

Form Details:

- Released on September 1, 2017;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.