This version of the form is not currently in use and is provided for reference only. Download this version of

Form RW-3

for the current year.

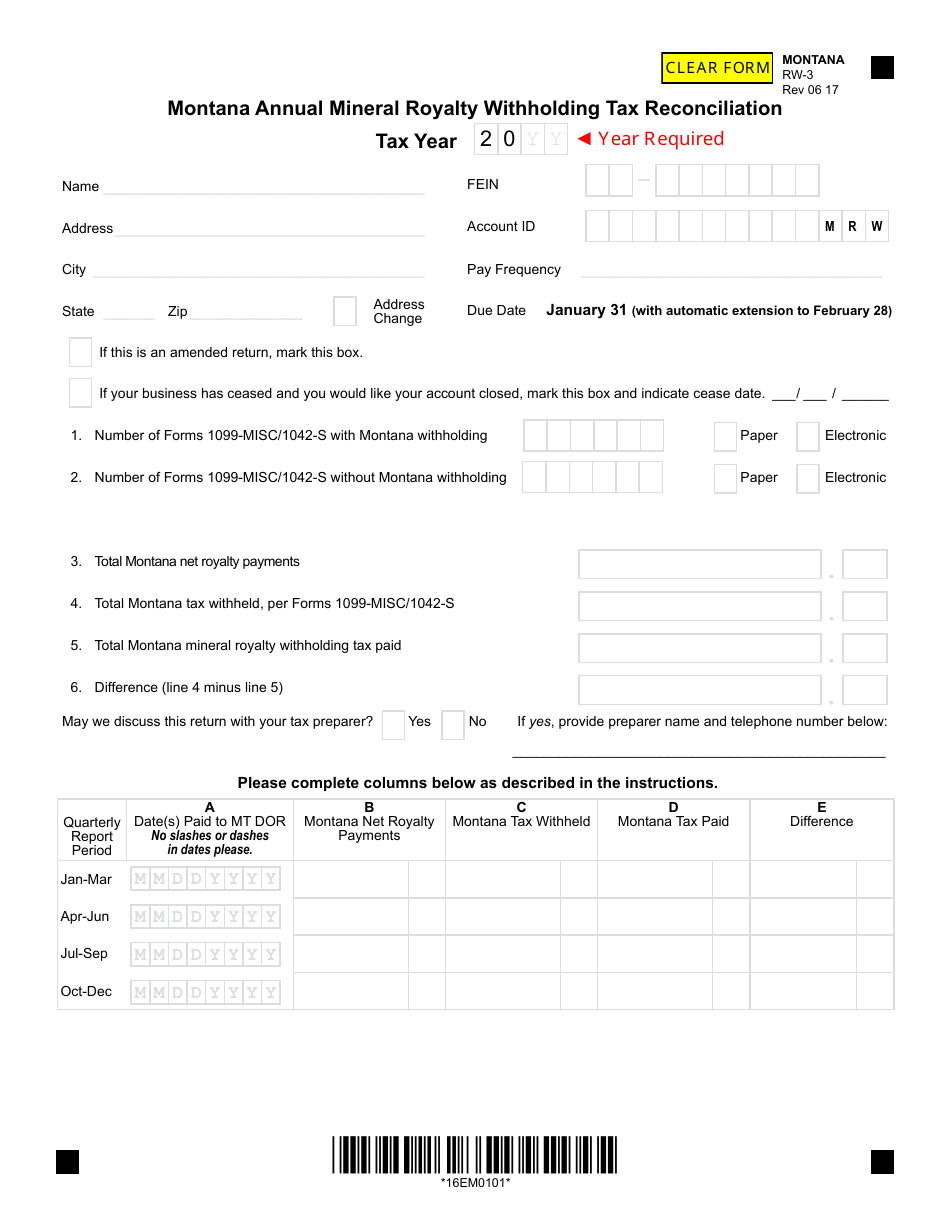

Form RW-3 Montana Annual Mineral Royalty Withholding Tax Reconciliation - Montana

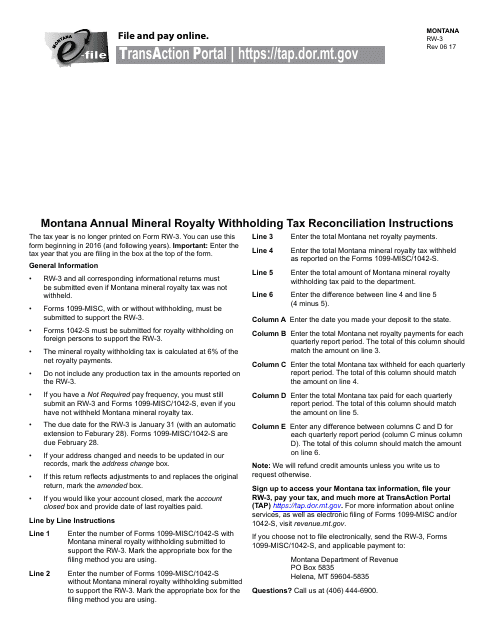

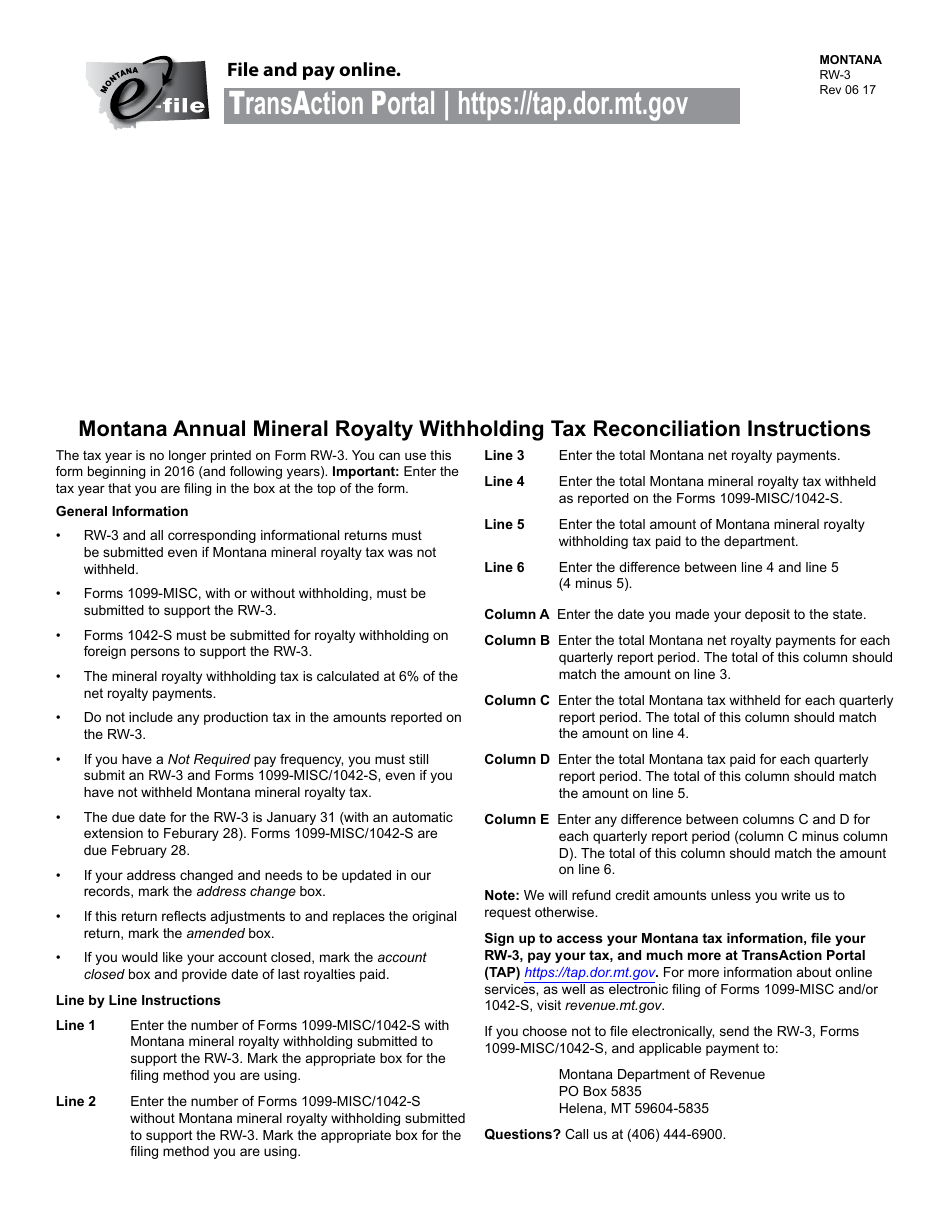

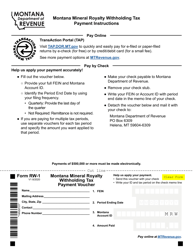

What Is Form RW-3?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW-3?

A: Form RW-3 is the Montana Annual Mineral RoyaltyWithholding Tax Reconciliation form.

Q: What is the purpose of Form RW-3?

A: The purpose of Form RW-3 is to reconcile the mineral royalty withholding tax withheld by the payers with the amounts reported on the payee's W-2G or 1099 forms.

Q: Who needs to file Form RW-3?

A: Payers who withhold mineral royalty taxes in Montana need to file Form RW-3.

Q: When is Form RW-3 due?

A: Form RW-3 is due on January 31st of each year.

Q: What is the penalty for late filing of Form RW-3?

A: The penalty for late filing of Form RW-3 is $10 per day, up to a maximum of $500.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW-3 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.