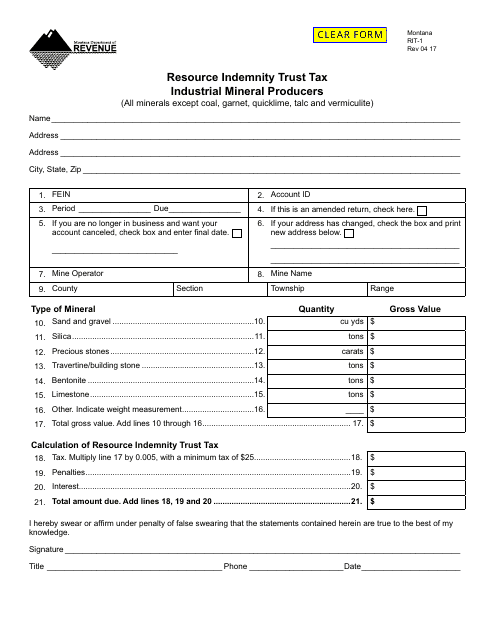

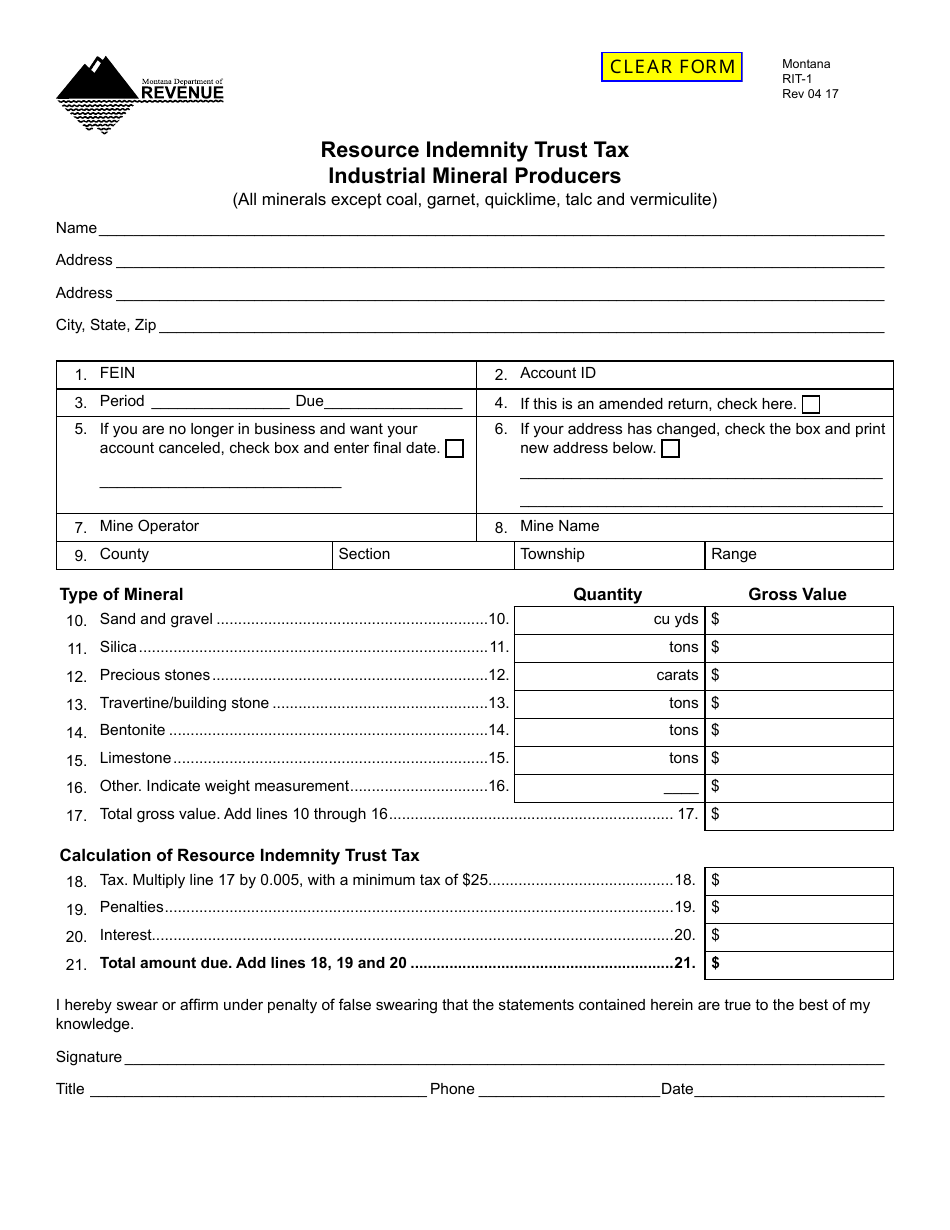

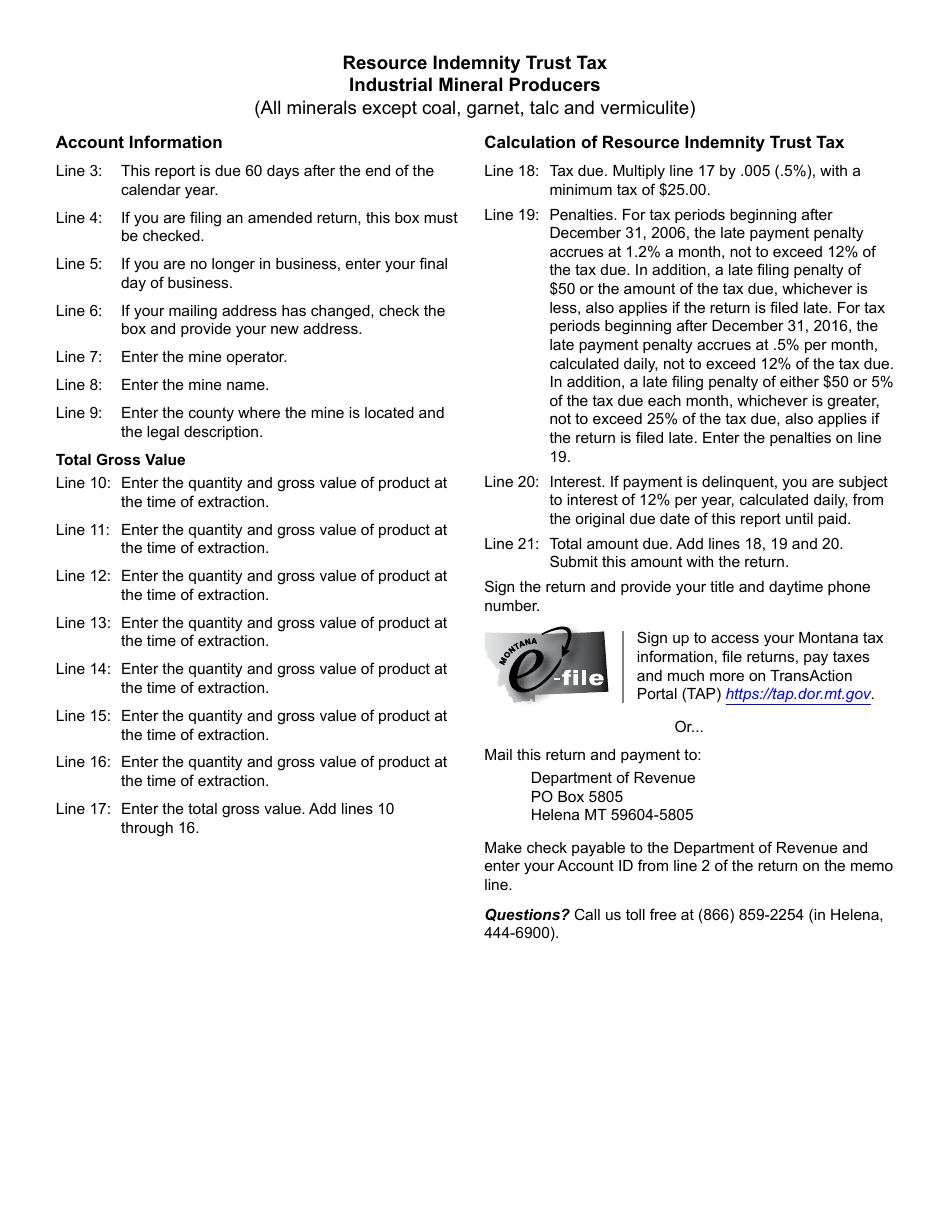

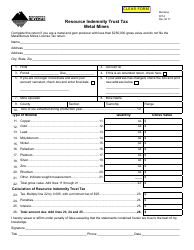

Form RIT-1 Resource Indemnity Trust Tax - Industrial Mineral Producers - Montana

What Is Form RIT-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RIT-1?

A: Form RIT-1 is a tax form used by industrial mineral producers in Montana to report their resource indemnity trust tax.

Q: Who needs to file Form RIT-1?

A: Industrial mineral producers in Montana need to file Form RIT-1.

Q: What is the resource indemnity trust tax?

A: The resource indemnity trust tax is a tax levied on the production of industrial minerals in Montana.

Q: When is Form RIT-1 due?

A: Form RIT-1 is due on or before the last day of the month following the end of the reporting period.

Q: What information is required on Form RIT-1?

A: Form RIT-1 requires information such as the producer's name, contact information, mineral production statistics, and tax payment details.

Q: Are there any penalties for late filing of Form RIT-1?

A: Yes, there may be penalties for late filing of Form RIT-1. It is important to file on time to avoid penalties.

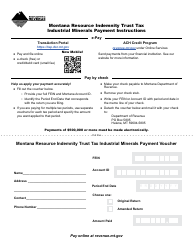

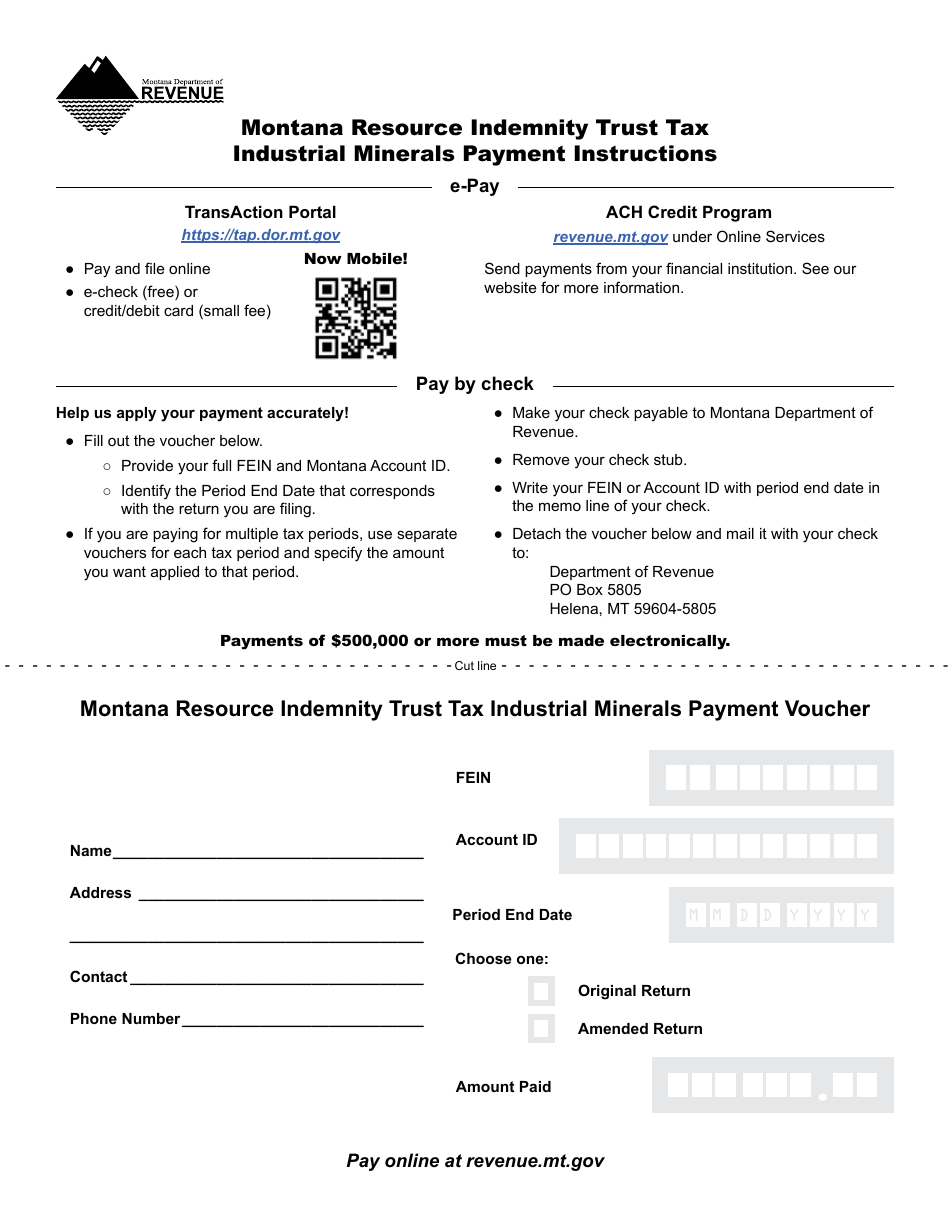

Q: How should I submit Form RIT-1?

A: Form RIT-1 can be submitted electronically through the Montana Department of Revenue's eFile system or by mail.

Q: Is there any tax relief available for resource indemnity trust tax?

A: Yes, there are certain tax credits and exemptions available for resource indemnity trust tax. Consult the Montana Department of Revenue for more information.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RIT-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.