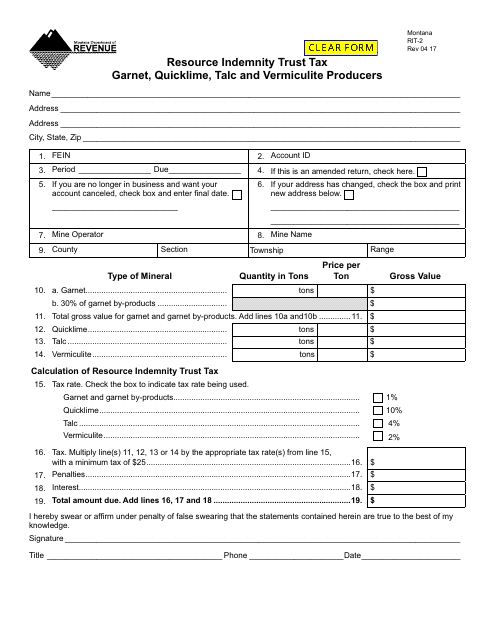

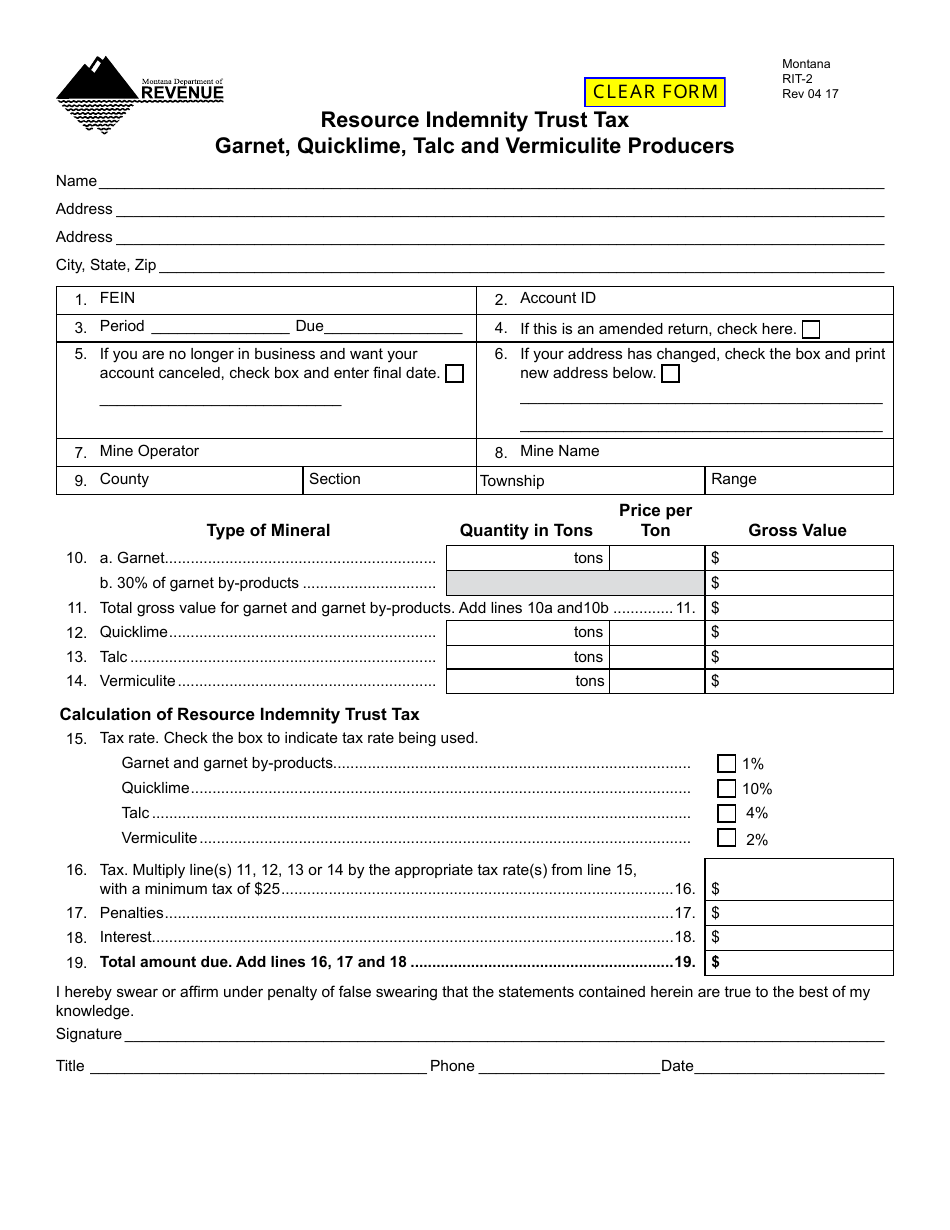

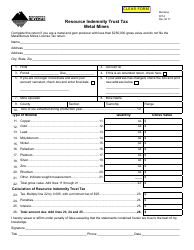

Form RIT-2 Resource Indemnity Trust Tax - Garnet, Quicklime, Talc and Vermiculite Producers - Montana

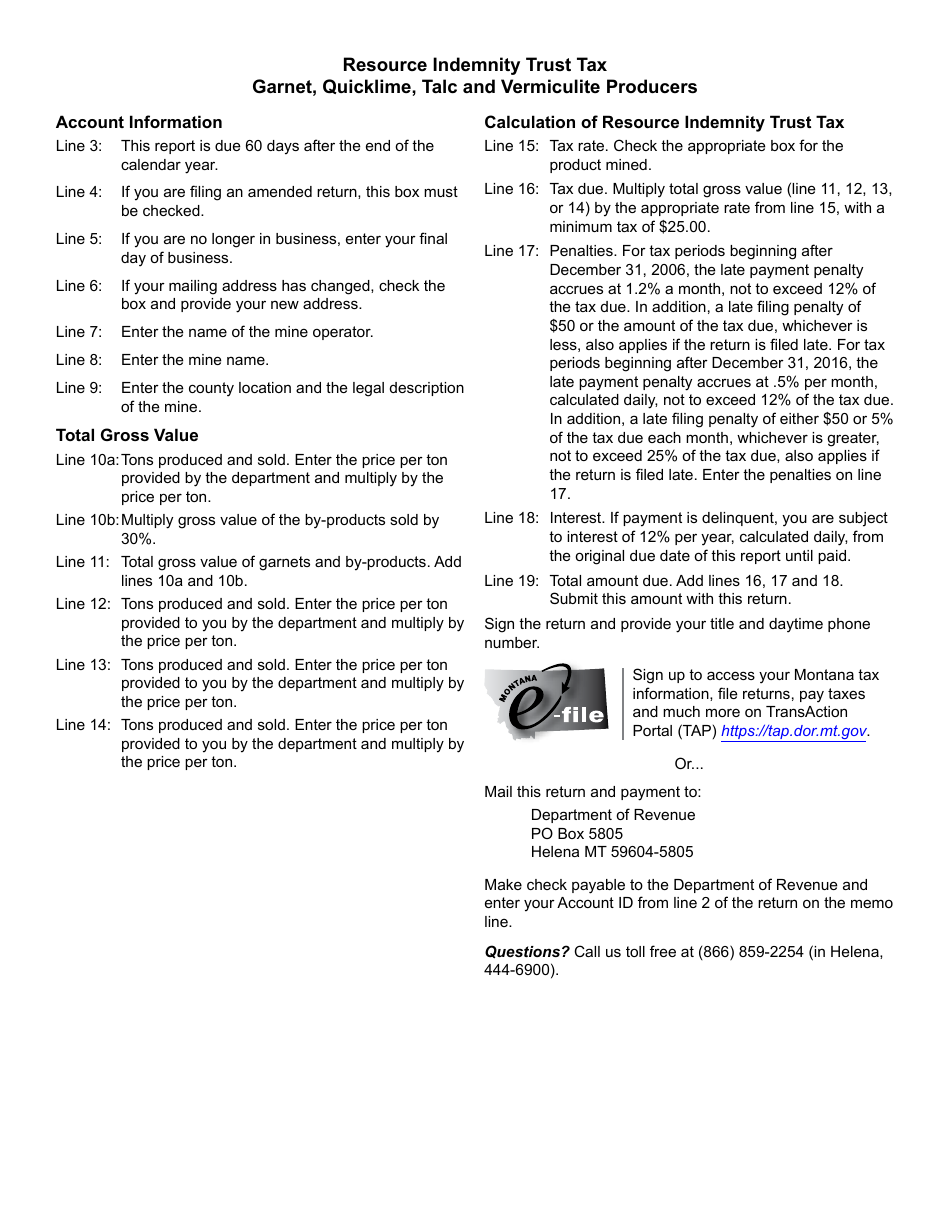

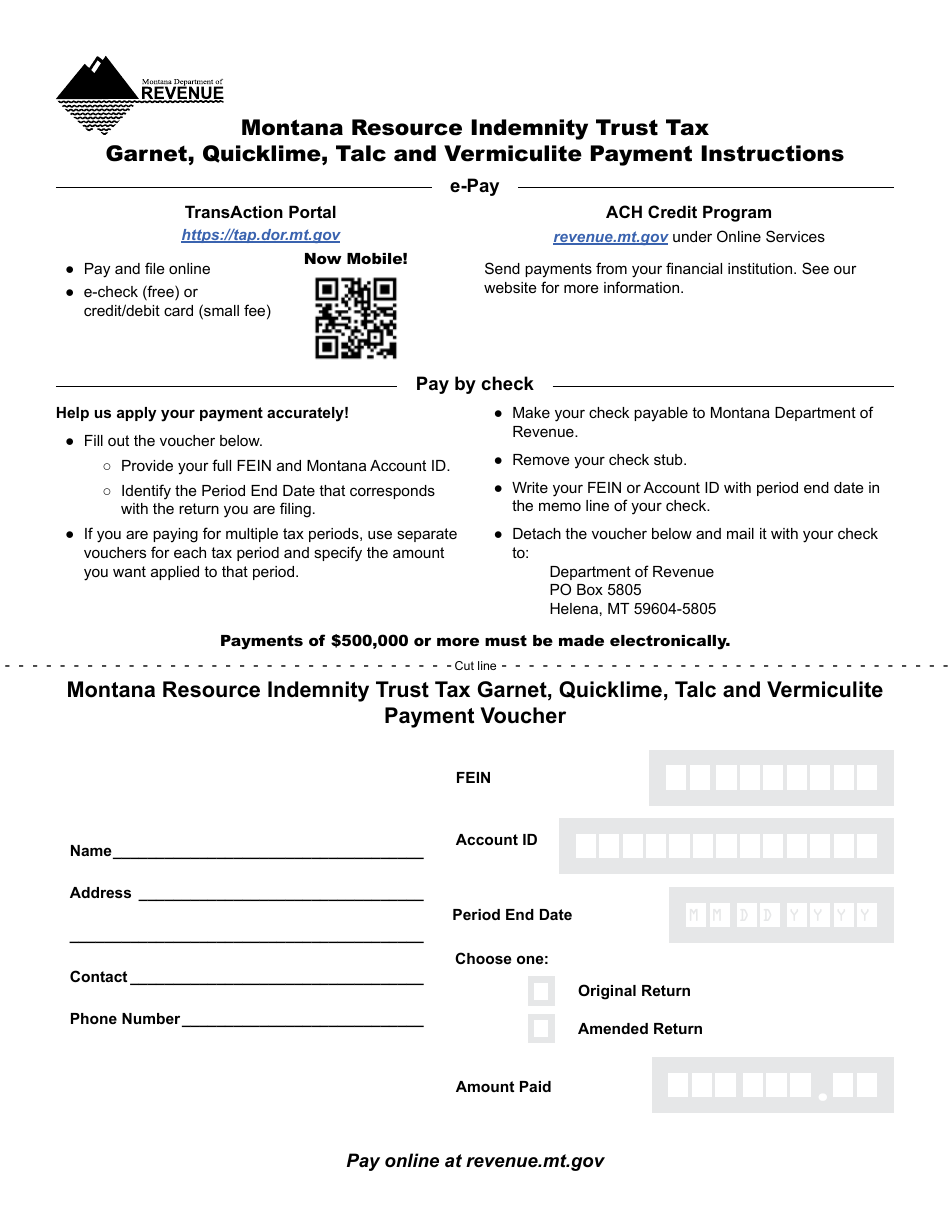

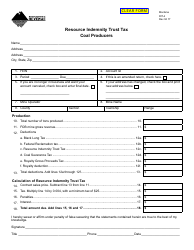

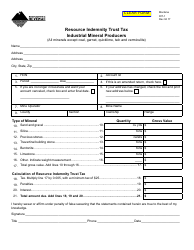

What Is Form RIT-2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RIT-2?

A: Form RIT-2 is a specific tax form for garnet, quicklime, talc, and vermiculite producers in Montana.

Q: Who needs to file Form RIT-2?

A: Garnet, quicklime, talc, and vermiculite producers in Montana need to file Form RIT-2.

Q: What is the purpose of Form RIT-2?

A: The purpose of Form RIT-2 is to calculate and report the Resource Indemnity Trust Tax for garnet, quicklime, talc, and vermiculite producers in Montana.

Q: What is the Resource Indemnity Trust Tax?

A: The Resource Indemnity Trust Tax is a specific tax imposed on garnet, quicklime, talc, and vermiculite producers in Montana to support the management and cleanup of impacted lands.

Q: When is the deadline to file Form RIT-2?

A: The deadline to file Form RIT-2 is typically April 15th of each year, unless an extension has been granted.

Q: Are there any penalties for late filing of Form RIT-2?

A: Yes, there may be penalties for late filing of Form RIT-2, including interest charges on any unpaid tax.

Q: How do I calculate the Resource Indemnity Trust Tax on Form RIT-2?

A: The Resource Indemnity Trust Tax on Form RIT-2 is calculated based on the production and sales of garnet, quicklime, talc, and vermiculite products in Montana.

Q: Who can I contact for assistance or more information about Form RIT-2?

A: You can contact the Montana Department of Revenue for assistance or more information about Form RIT-2.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RIT-2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.