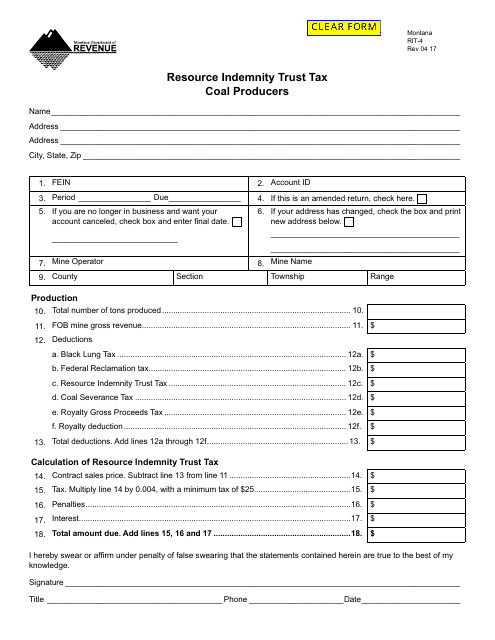

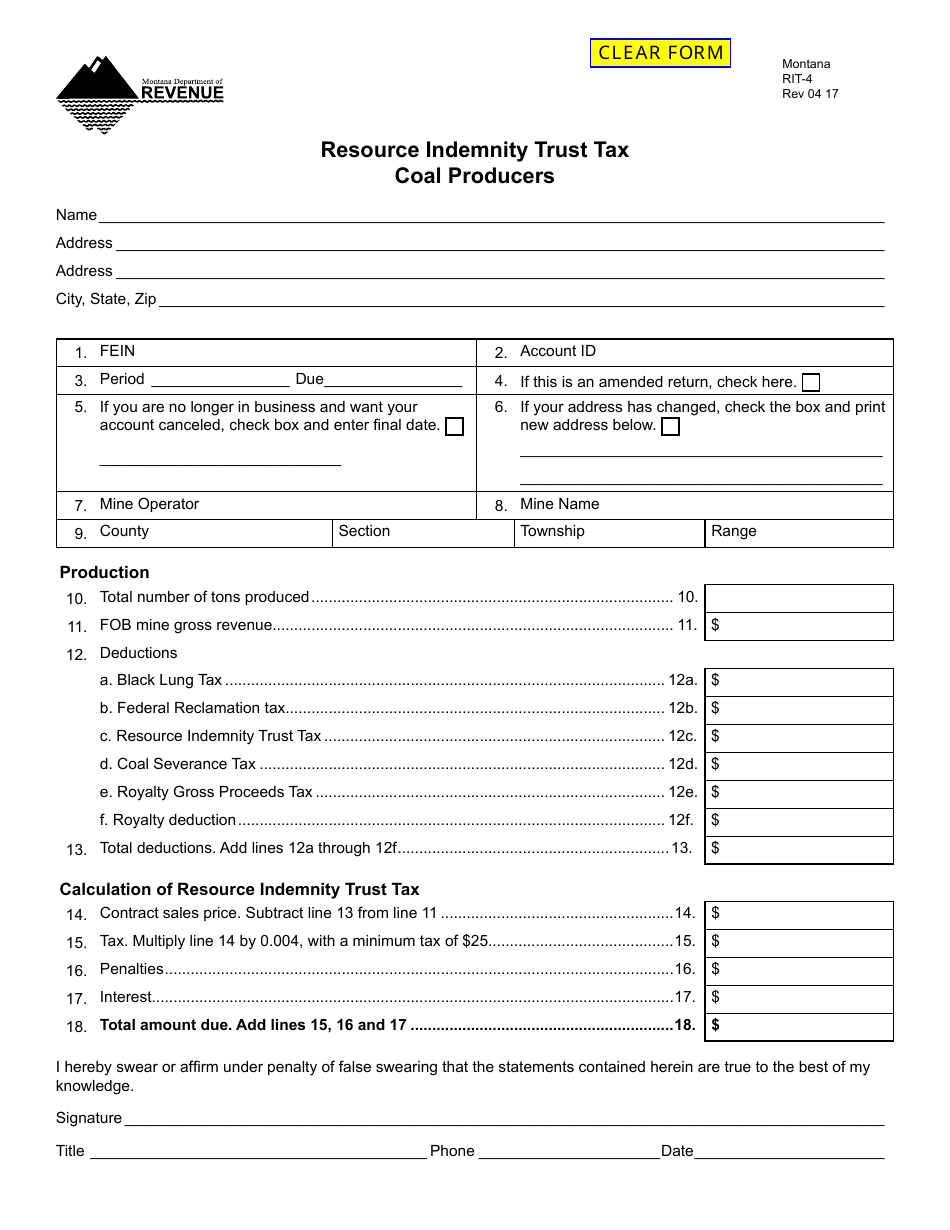

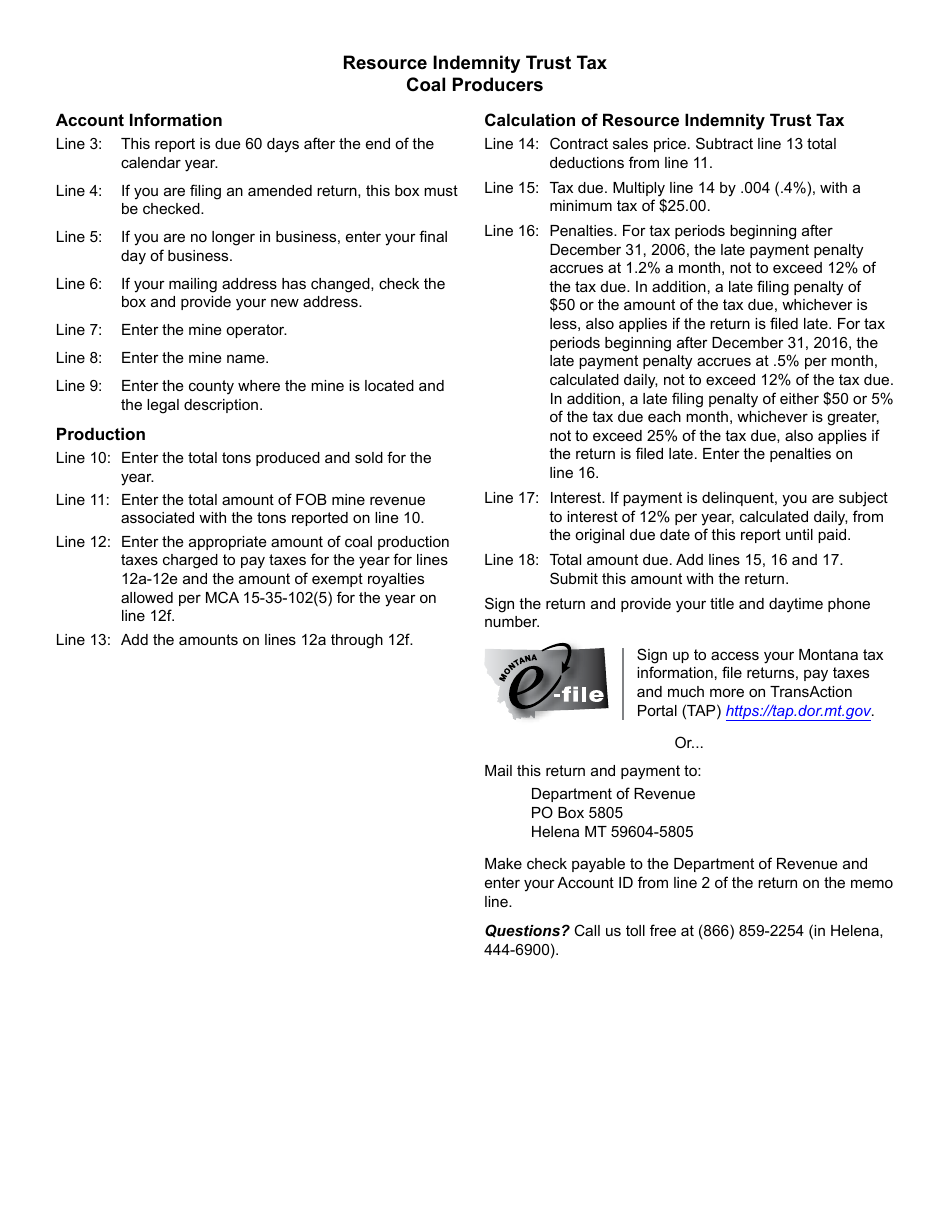

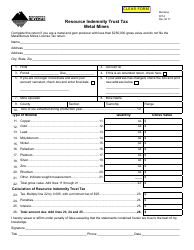

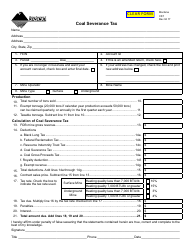

Form RIT-4 Resource Indemnity Trust Tax - Coal Producers - Montana

What Is Form RIT-4?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RIT-4?

A: Form RIT-4 is a tax form used by coal producers in Montana for reporting resource indemnity trust tax.

Q: Who is required to file Form RIT-4?

A: Coal producers in Montana are required to file Form RIT-4.

Q: What is the purpose of Form RIT-4?

A: The purpose of Form RIT-4 is to report and pay the resource indemnity trust tax for coal producers in Montana.

Q: What is the resource indemnity trust tax?

A: The resource indemnity trust tax is a tax imposed on coal producers in Montana based on the production and sale of coal.

Q: When is Form RIT-4 due?

A: Form RIT-4 is due on the last day of the month following the end of the calendar quarter in which the coal was produced.

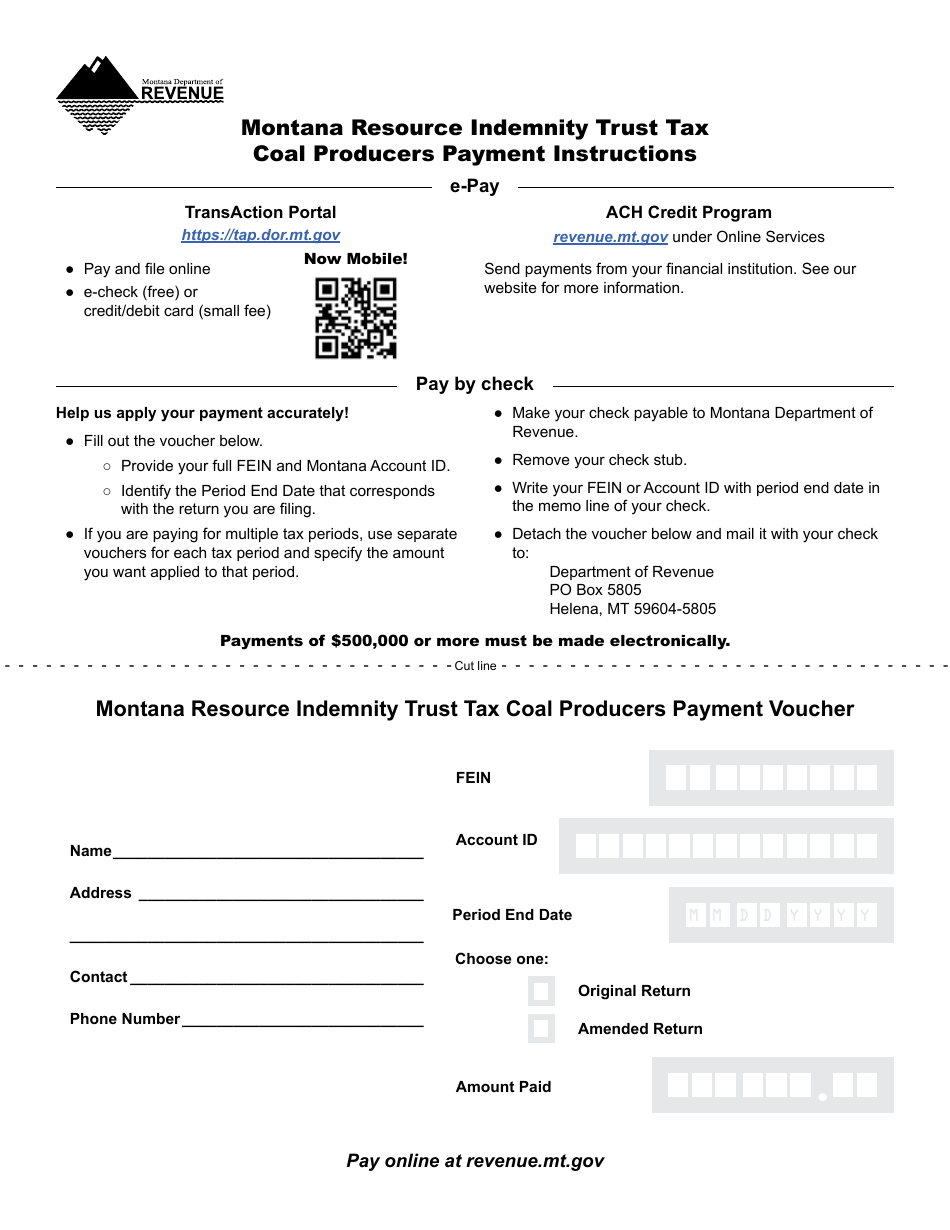

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

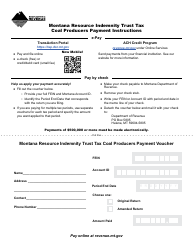

Download a fillable version of Form RIT-4 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.