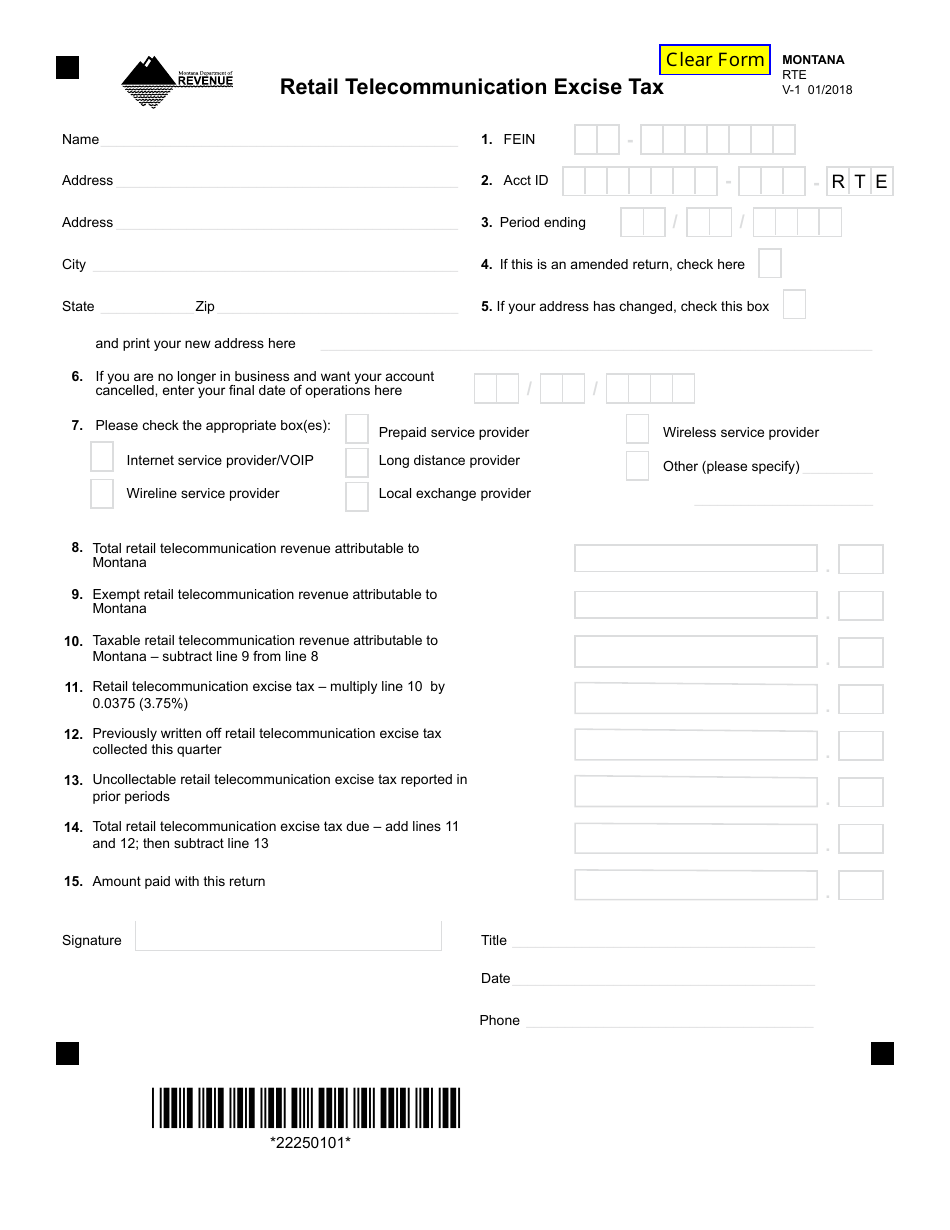

Form RTE Retail Telecommunication Excise Tax - Montana

What Is Form RTE?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RTE Retail Telecommunication Excise Tax?

A: The RTE Retail Telecommunication Excise Tax is a tax imposed on certain retail telecommunication services in Montana.

Q: Which telecommunication services are subject to the RTE Retail Telecommunication Excise Tax?

A: The RTE Retail Telecommunication Excise Tax applies to services such as voice calls, text messages, and data plans.

Q: Who is responsible for paying the RTE Retail Telecommunication Excise Tax?

A: The service providers or sellers of retail telecommunication services are responsible for collecting and remitting the tax to the state.

Q: How is the RTE Retail Telecommunication Excise Tax calculated?

A: The tax is calculated based on a percentage of the gross revenue collected by the service provider from retail telecommunication services.

Q: What is the current rate of the RTE Retail Telecommunication Excise Tax in Montana?

A: The current rate of the tax is 3.75% of the gross revenue.

Q: Are there any exemptions or deductions available for the RTE Retail Telecommunication Excise Tax?

A: No, there are no specific exemptions or deductions available for this tax.

Q: What is the purpose of the RTE Retail Telecommunication Excise Tax?

A: The tax is imposed to generate revenue for the state of Montana.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTE by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.