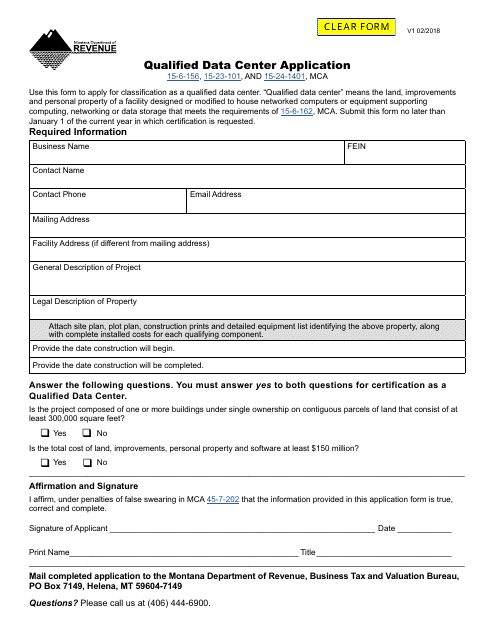

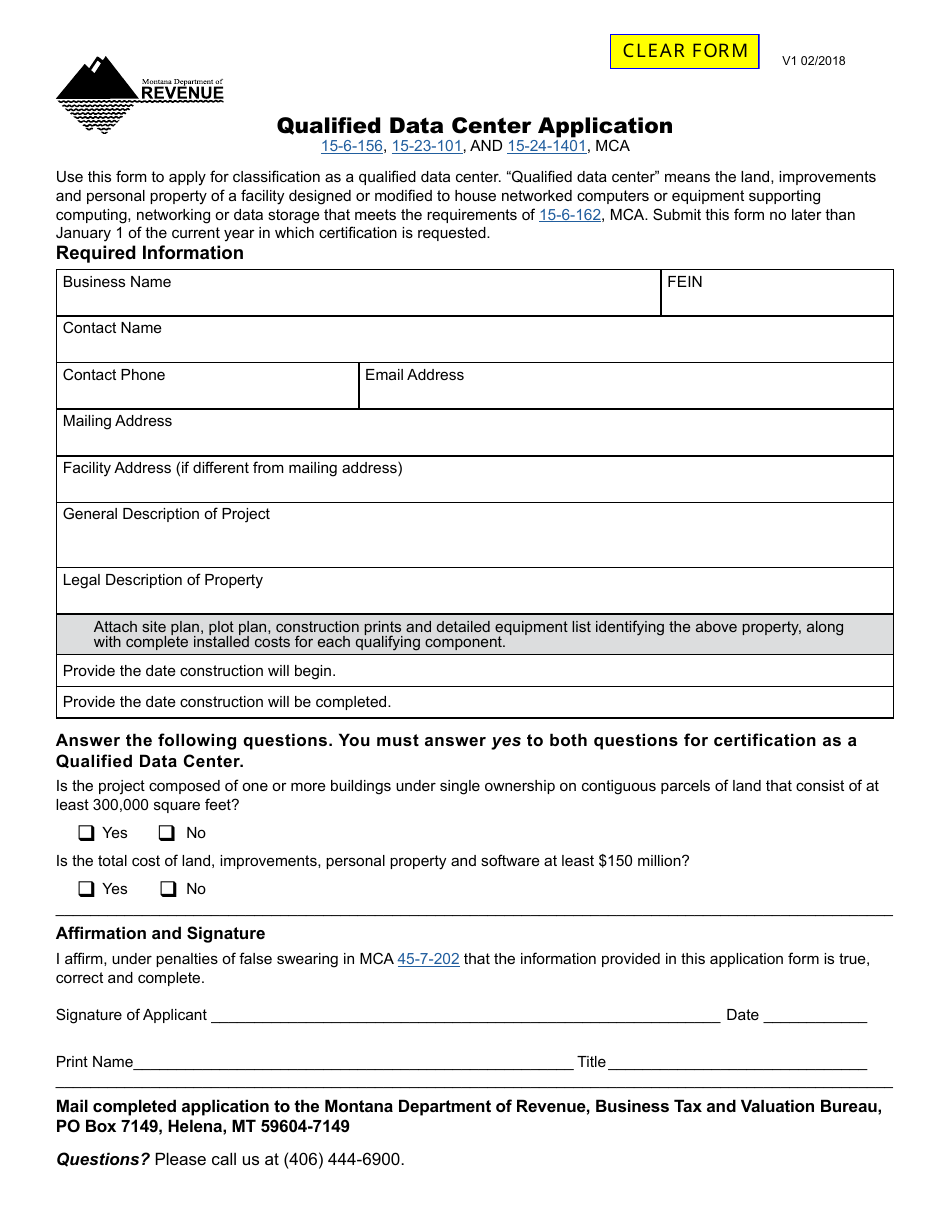

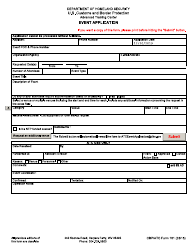

Qualified Data Center Application Form - Montana

Qualified Data Center Application Form is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is the Qualified Data Center Application Form?

A: The Qualified Data Center Application Form is a document required for companies applying to receive tax incentives for establishing a data center in Montana.

Q: What is a qualified data center?

A: A qualified data center refers to a facility that meets certain criteria set by the state of Montana in order to receive tax incentives.

Q: What are the tax incentives for qualified data centers in Montana?

A: Tax incentives for qualified data centers in Montana include a reduced business equipment tax and an exemption from sales taxes on data center equipment and energy usage.

Q: Who is eligible to apply for the Qualified Data Center Application Form?

A: Companies planning to establish a data center in Montana and meet the eligibility criteria can apply for the Qualified Data Center Application Form.

Q: How can I apply for the Qualified Data Center Application Form?

A: To apply for the Qualified Data Center Application Form, you need to contact the Montana Department of Commerce. They will provide you with the necessary application and guidance.

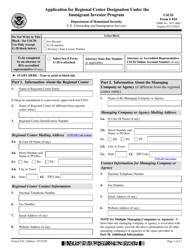

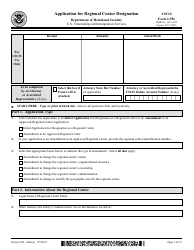

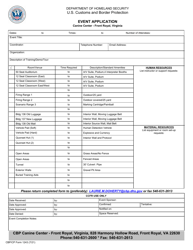

Q: What information is required in the Qualified Data Center Application Form?

A: The Qualified Data Center Application Form requires information about the company, the proposed data center project, employment projections, and other relevant details.

Q: What is the purpose of the Qualified Data Center Application Form?

A: The purpose of the Qualified Data Center Application Form is to evaluate and determine eligibility for tax incentives for data center projects in Montana.

Q: Are there any deadlines for submitting the Qualified Data Center Application Form?

A: Yes, there are specific deadlines for submitting the Qualified Data Center Application Form. It is recommended to contact the Montana Department of Commerce for the current deadlines.

Q: What are the benefits of establishing a qualified data center in Montana?

A: The benefits of establishing a qualified data center in Montana include tax incentives, reduced business equipment tax, and exemption from sales taxes on data center equipment and energy usage.

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.