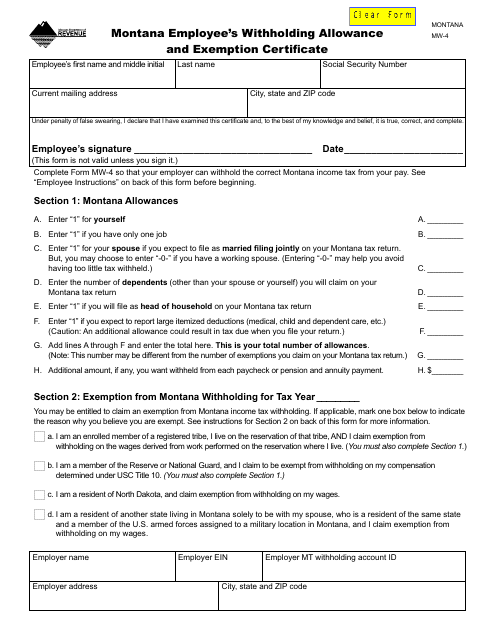

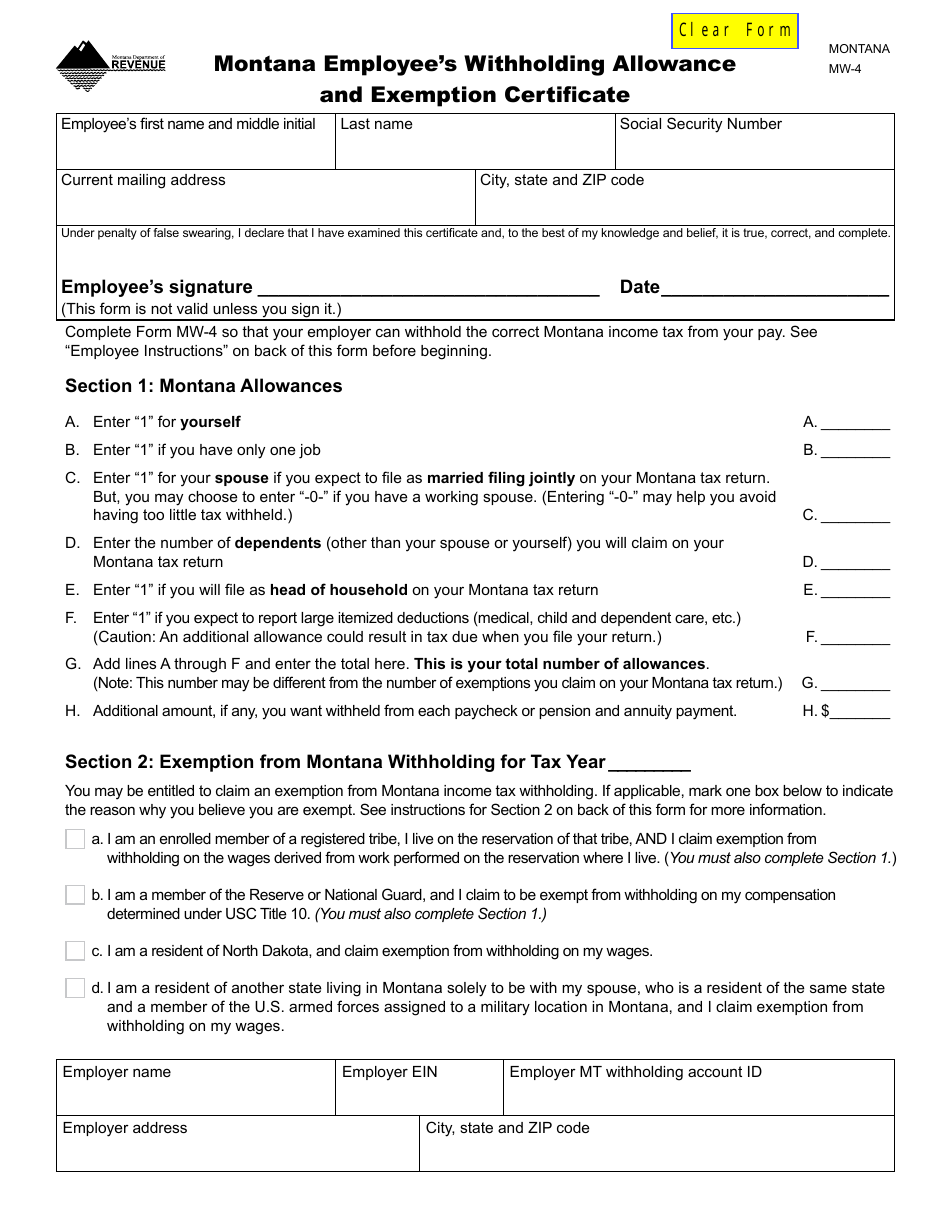

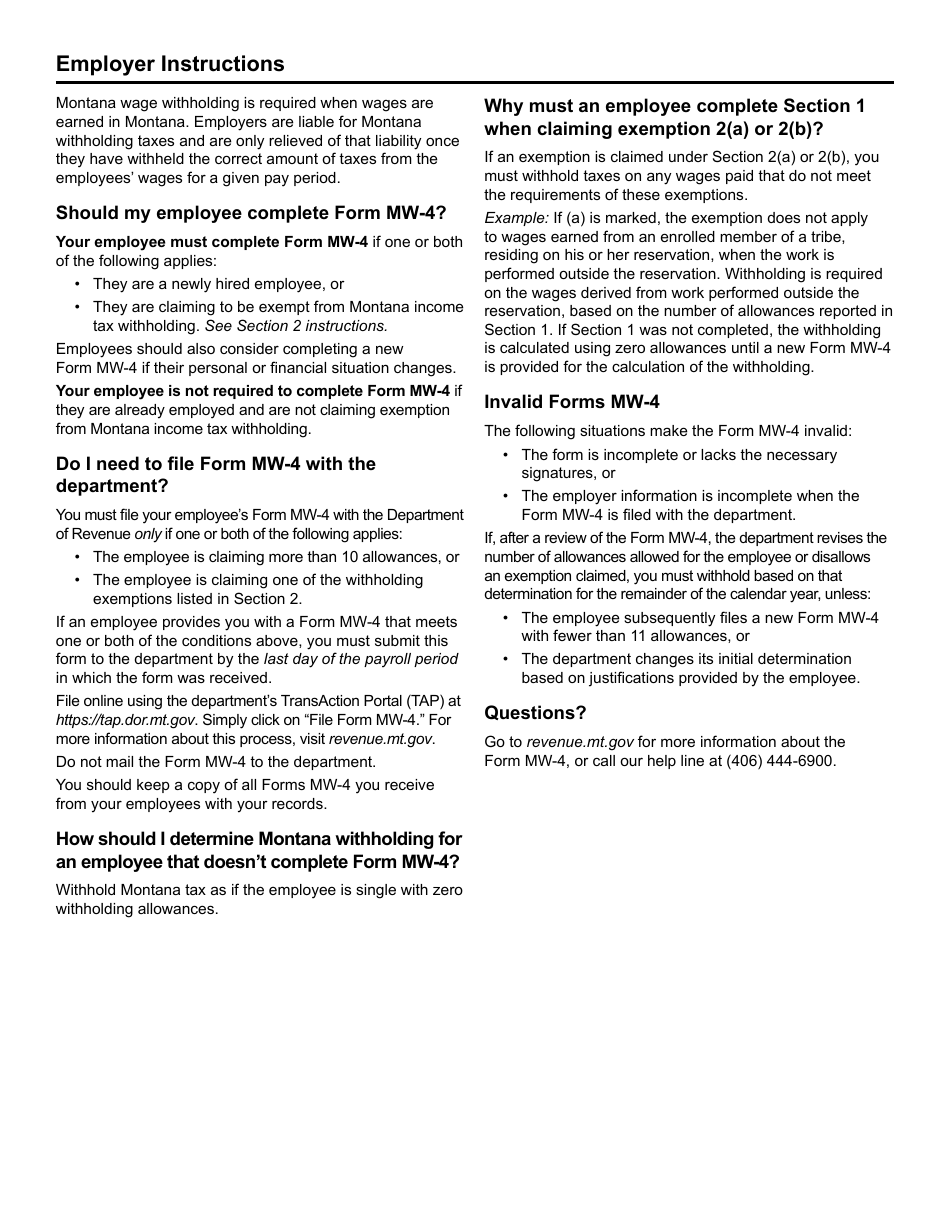

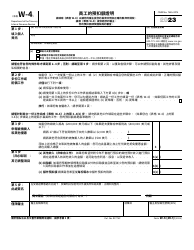

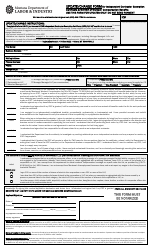

Form MW-4 Montana Employee's Withholding Allowance and Exemption Certificate - Montana

What Is Form MW-4?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MW-4?

A: Form MW-4 is the Montana Employee's Withholding Allowance and Exemption Certificate.

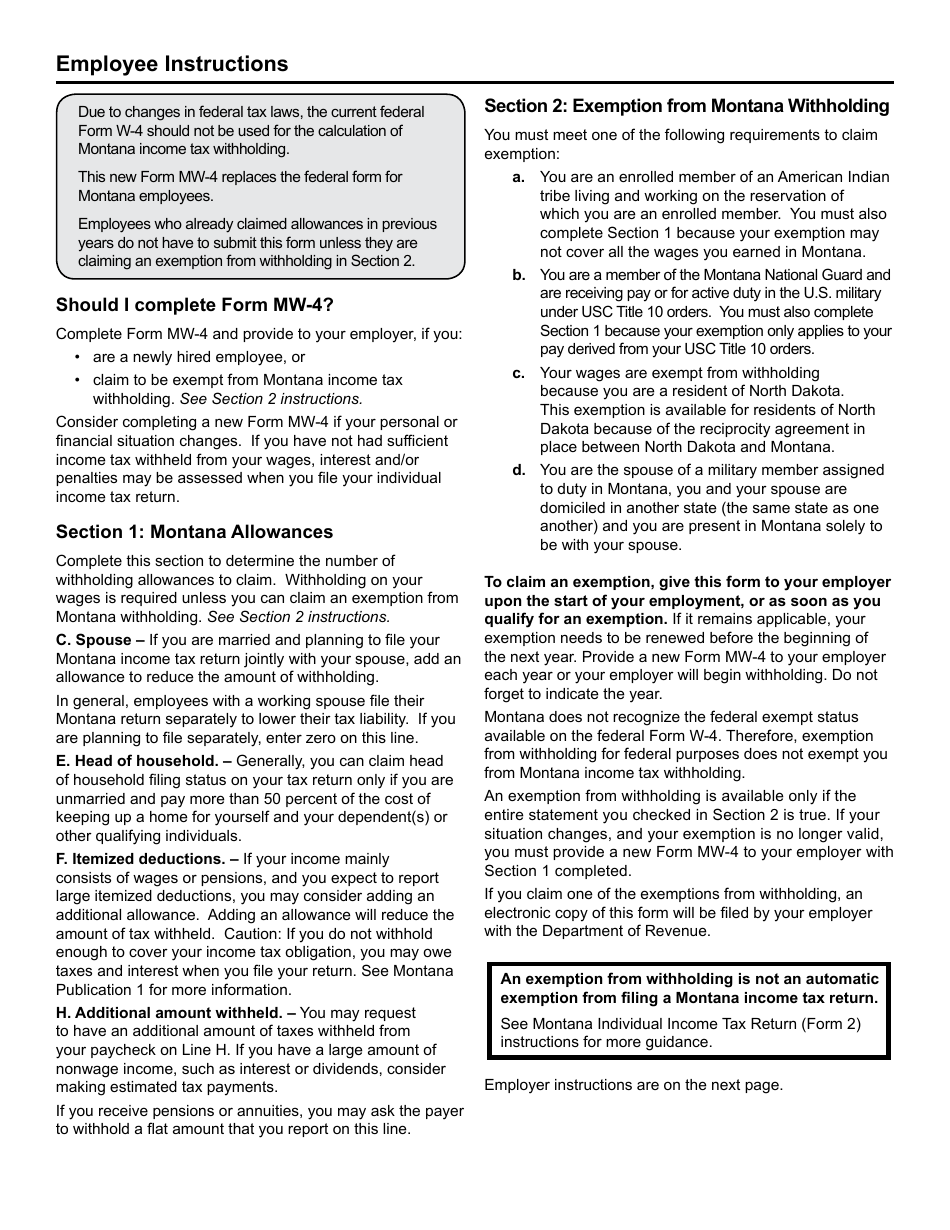

Q: Who needs to fill out Form MW-4?

A: Employees in Montana need to fill out Form MW-4.

Q: What is the purpose of Form MW-4?

A: The purpose of Form MW-4 is to determine how much state income tax should be withheld from an employee's wages.

Q: What information is required on Form MW-4?

A: Form MW-4 requires employees to provide their personal information, such as name, address, and Social Security number, as well as their filing status and number of allowances.

Q: When should Form MW-4 be filled out?

A: Form MW-4 should be filled out when an employee starts a new job or when their tax situation changes.

Q: Do I need to submit Form MW-4 every year?

A: No, you only need to submit Form MW-4 when there are changes to your withholding allowances or tax situation.

Form Details:

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MW-4 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.