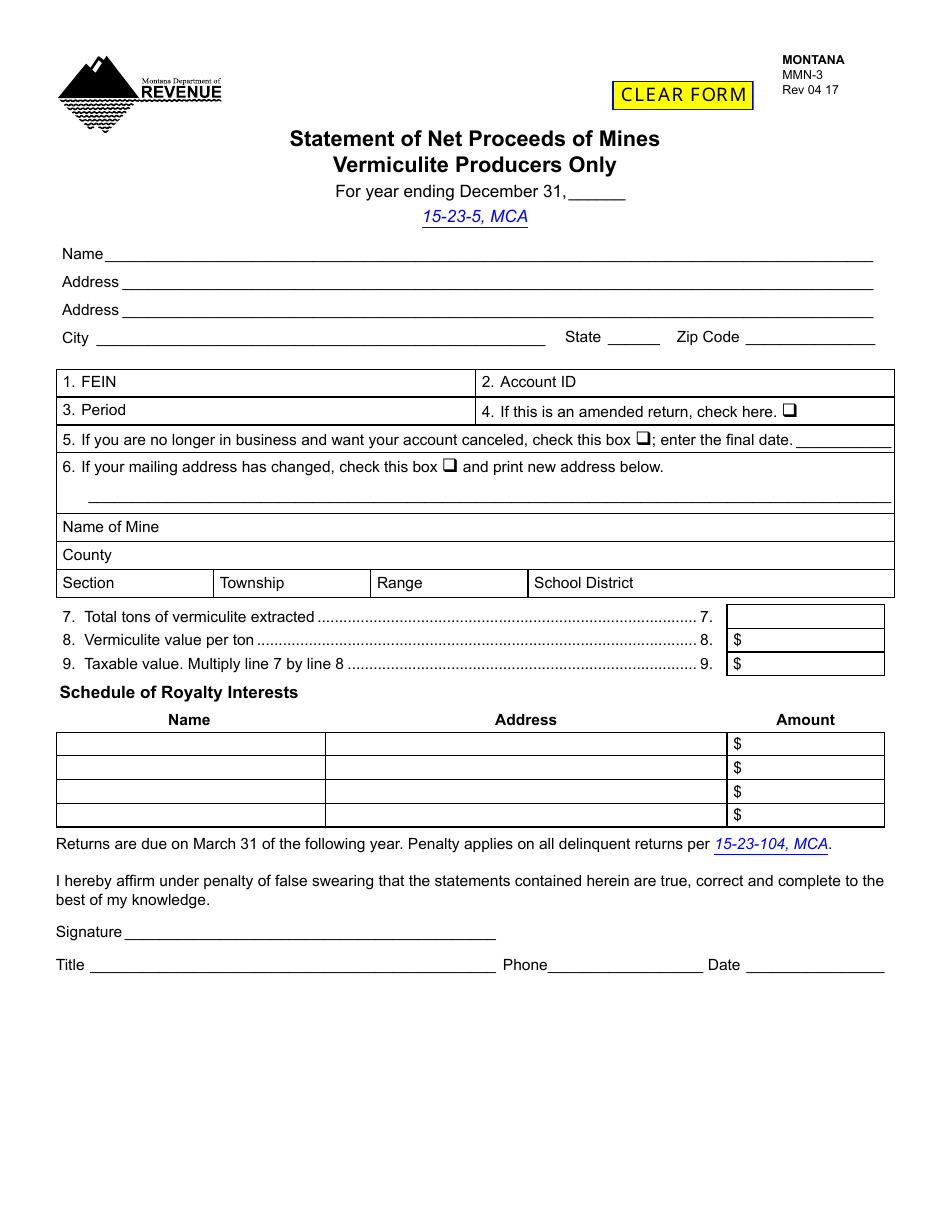

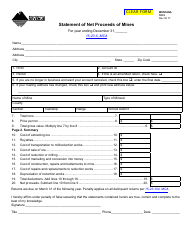

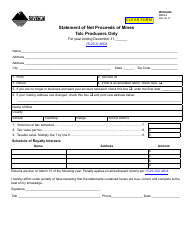

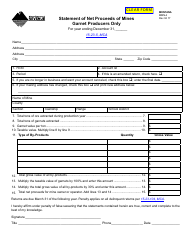

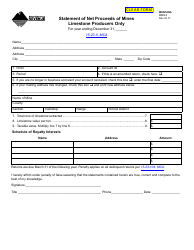

Form MMN-3 Statement of Net Proceeds of Mines - Vermiculite Producers Only - Montana

What Is Form MMN-3?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MMN-3?

A: Form MMN-3 is the Statement of Net Proceeds of Mines specifically for Vermiculite Producers in Montana.

Q: Who is required to file Form MMN-3?

A: Vermiculite Producers in Montana are required to file Form MMN-3.

Q: What is the purpose of Form MMN-3?

A: The purpose of Form MMN-3 is to report the net proceeds of mining vermiculite in Montana.

Q: What information is required on Form MMN-3?

A: Form MMN-3 requires information about the vermiculite production, sales, expenses, and royalties.

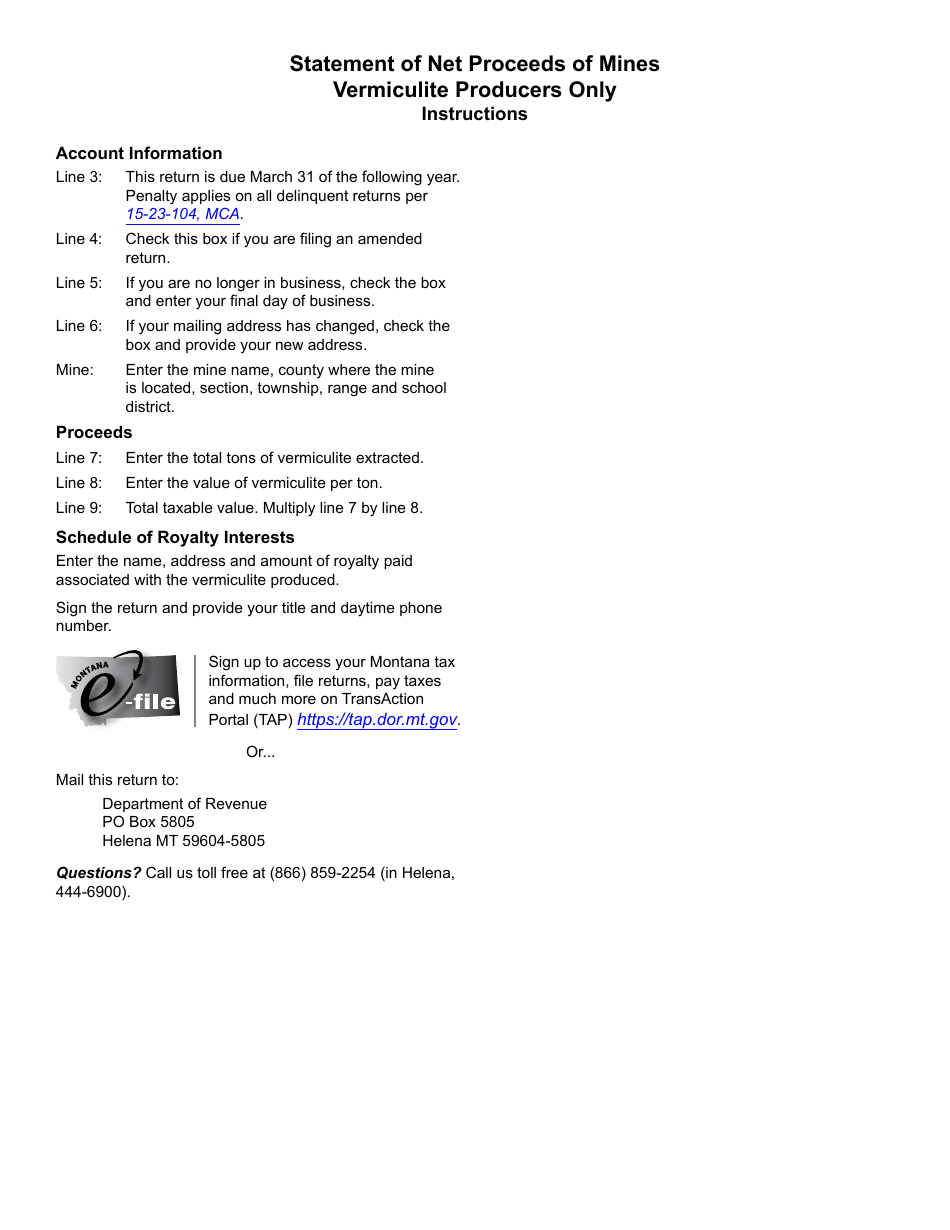

Q: When is the deadline for filing Form MMN-3?

A: The deadline for filing Form MMN-3 is typically April 15th of the following tax year.

Q: Are there any penalties for not filing Form MMN-3?

A: Yes, there may be penalties for not filing Form MMN-3 or for filing it late. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MMN-3 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.