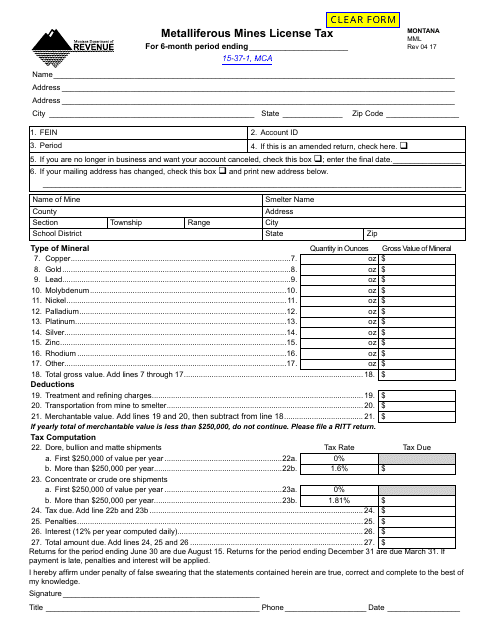

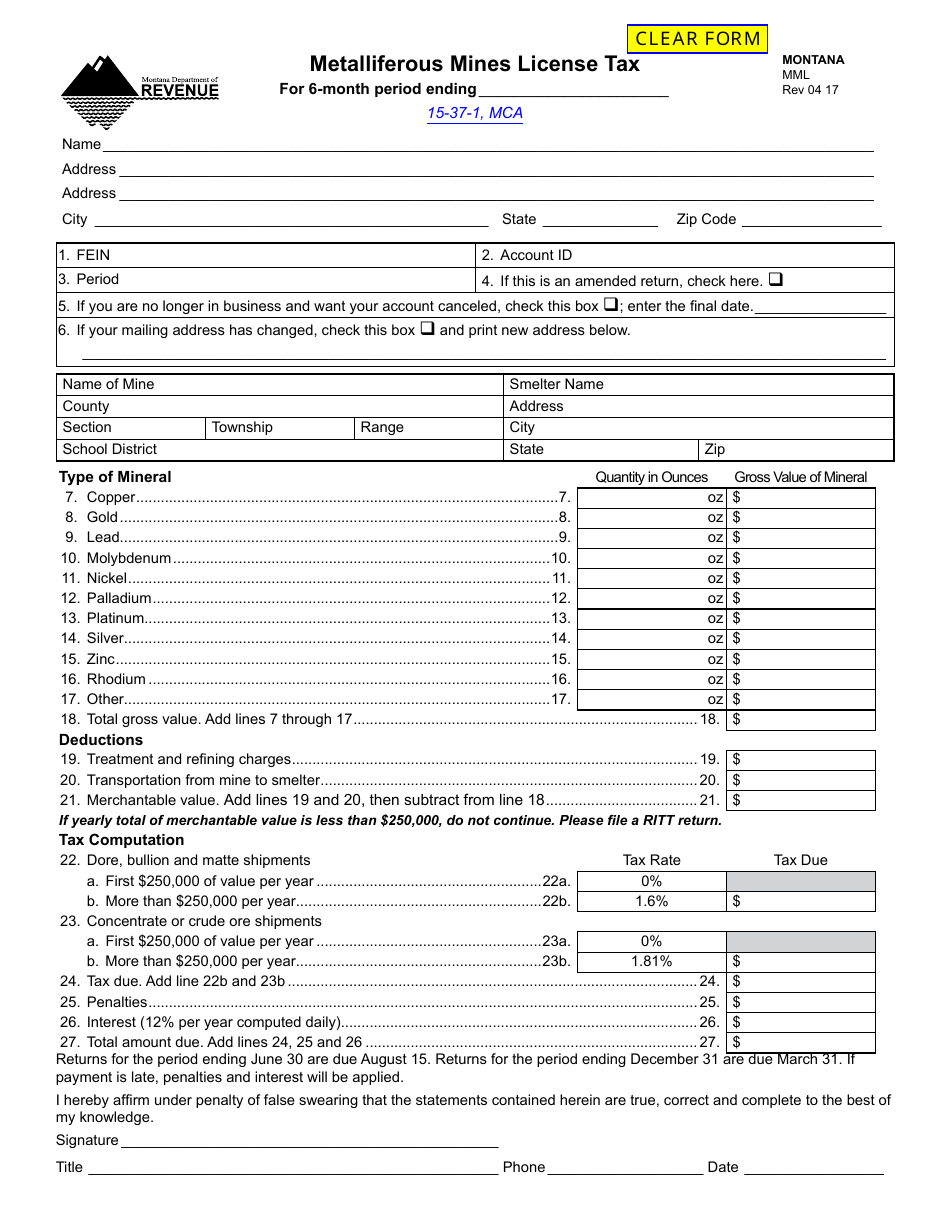

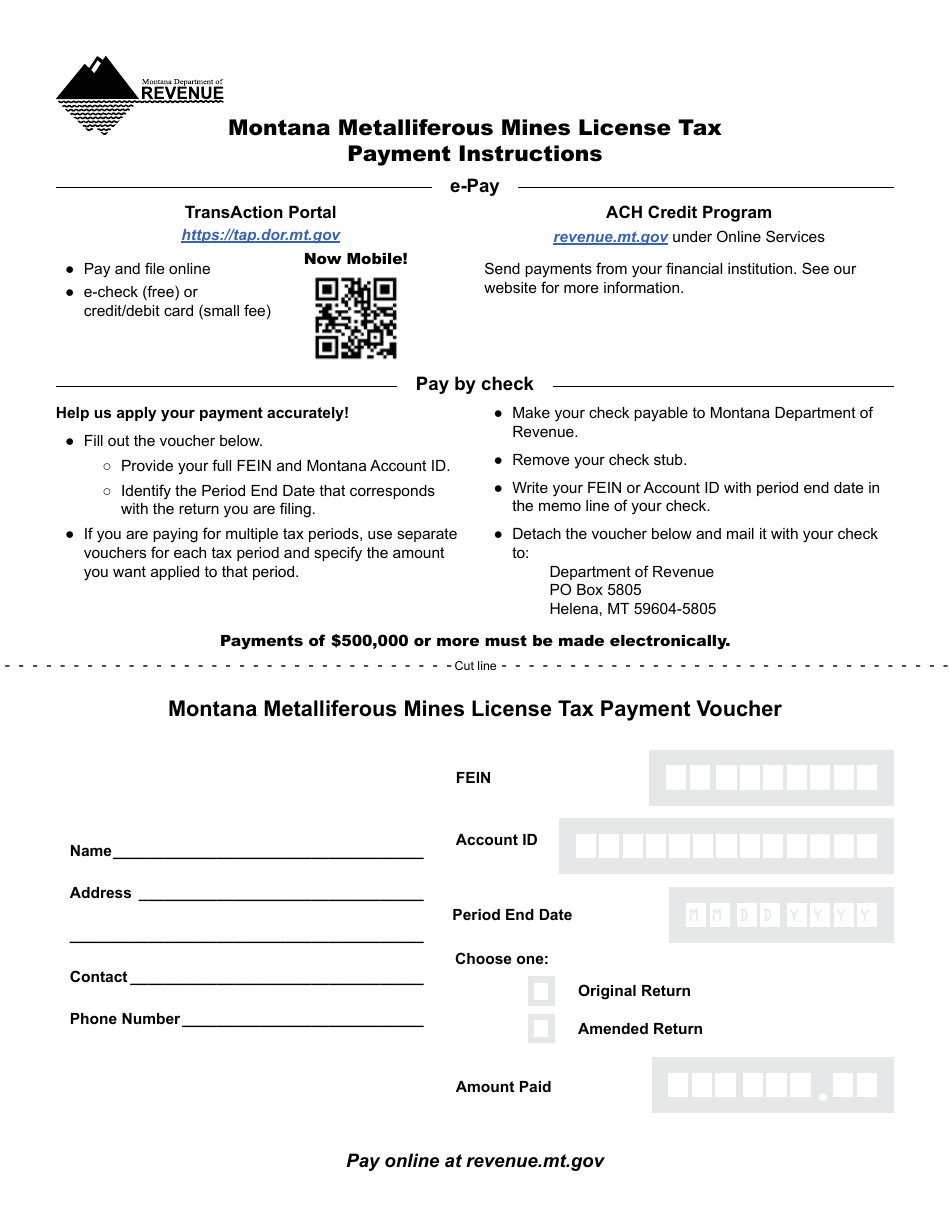

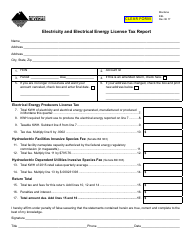

Form MML Metalliferous Mines License Tax - Montana

What Is Form MML?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MML?

A: Form MML stands for Metalliferous Mines License Tax.

Q: What is the purpose of Form MML?

A: Form MML is used to assess and collect taxes from metalliferous mines in Montana.

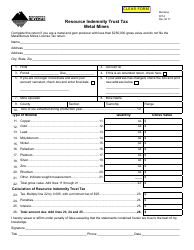

Q: What is a metalliferous mine?

A: A metalliferous mine is a mine that produces metallic minerals, such as gold, silver, copper, or lead.

Q: Why is there a tax on metalliferous mines?

A: The tax on metalliferous mines helps to generate revenue for the state of Montana and support various public services and programs.

Q: Who is required to file Form MML?

A: Metalliferous mine operators in Montana are required to file Form MML.

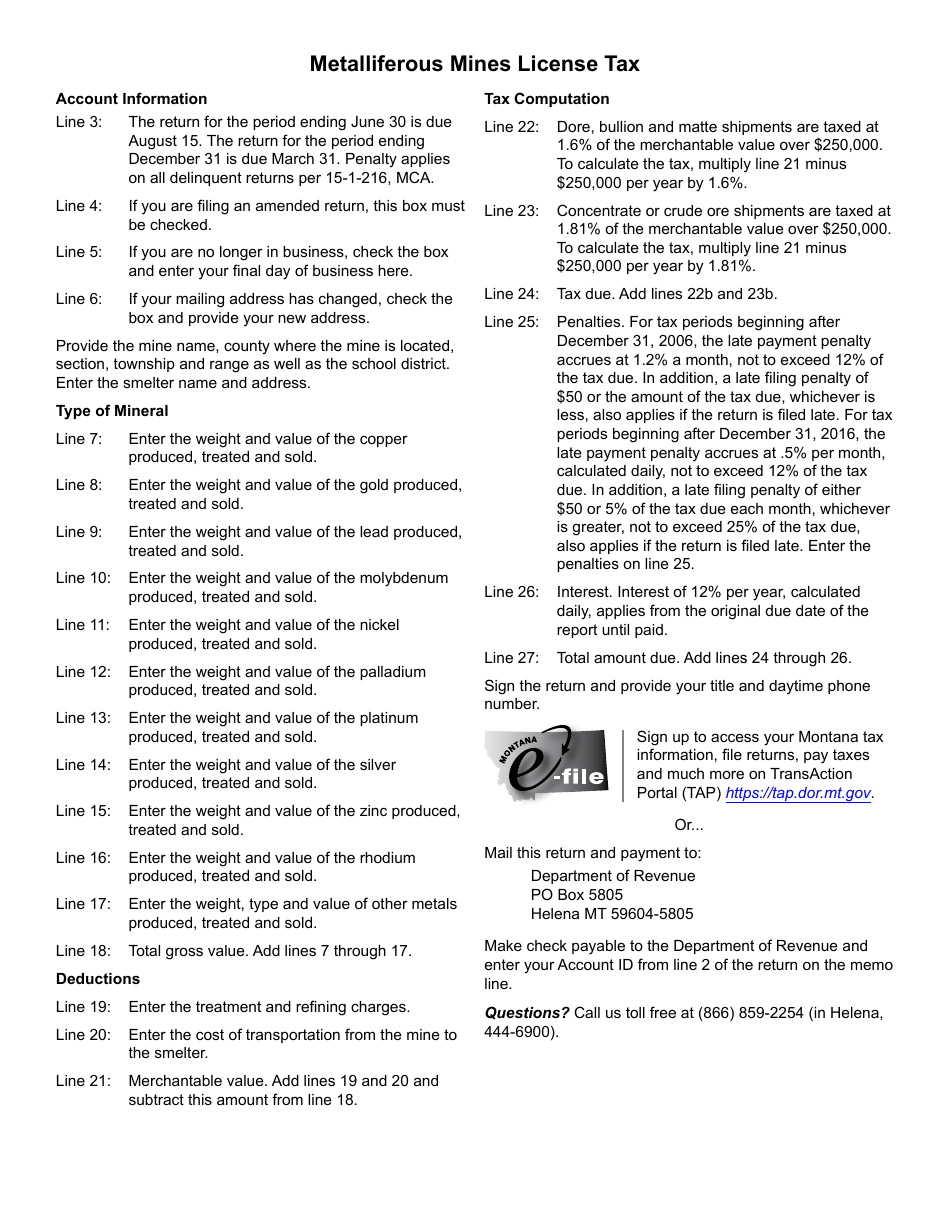

Q: When is Form MML due?

A: Form MML must be filed annually by April 30th.

Q: Are there any penalties for late filing of Form MML?

A: Yes, there are penalties for late filing of Form MML, including interest on the unpaid tax amount.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MML by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.