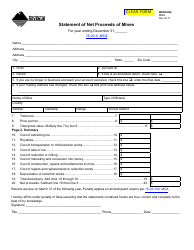

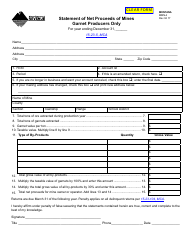

Form MMN Statement of Net Proceeds of Mines - Montana

What Is Form MMN?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form MMN?

A: Form MMN is a statement of net proceeds of mines.

Q: Who uses Form MMN?

A: Form MMN is used by mines in Montana.

Q: What does Form MMN report?

A: Form MMN reports the net proceeds of mines in Montana.

Q: What are net proceeds of mines?

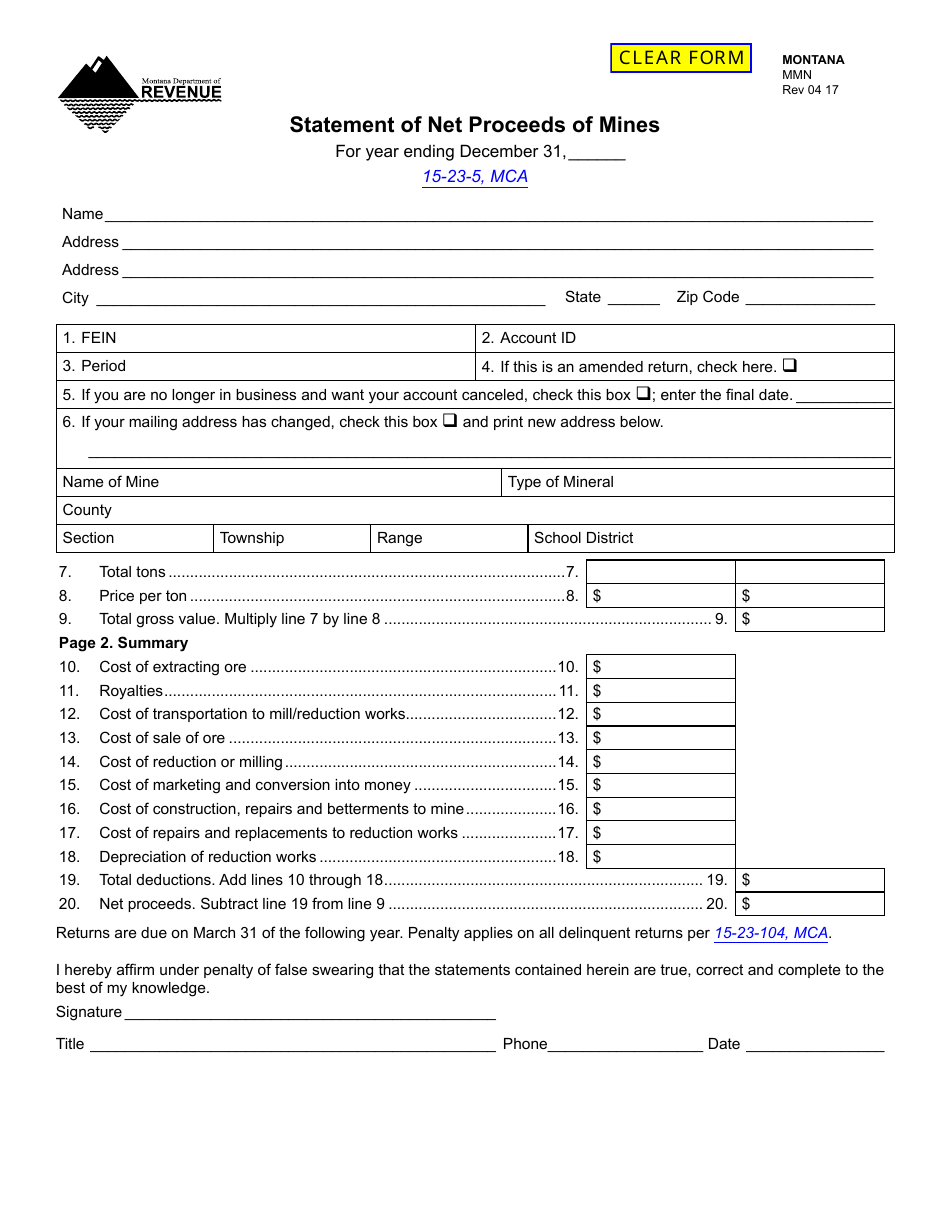

A: Net proceeds of mines are the revenues earned from mining operations after deducting expenses.

Q: What is the purpose of Form MMN?

A: The purpose of Form MMN is to provide an accounting of the net proceeds of mines for tax and regulatory purposes.

Q: Are there any deadlines for filing Form MMN?

A: Yes, Form MMN must be filed annually by a specified deadline, which may vary.

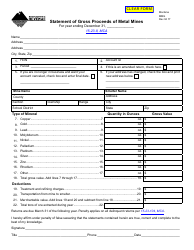

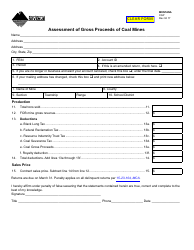

Q: What information is required on Form MMN?

A: Form MMN requires details of the mine's gross proceeds, deductions, and net proceeds, along with other relevant information.

Q: Is Form MMN subject to audit?

A: Yes, Form MMN may be subject to audit by the Montana Department of Revenue.

Q: Are there penalties for non-compliance with Form MMN?

A: Yes, failure to file or inaccurately reporting on Form MMN may result in penalties or legal consequences.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MMN by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.