This version of the form is not currently in use and is provided for reference only. Download this version of

Form LIQ-AUTH

for the current year.

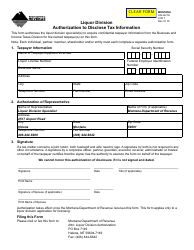

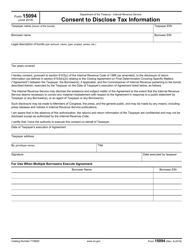

Form LIQ-AUTH Liquor Division Authorization to Disclose Tax Information - Montana

What Is Form LIQ-AUTH?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LIQ-AUTH?

A: Form LIQ-AUTH is a Liquor Division Authorization to Disclose Tax Information form.

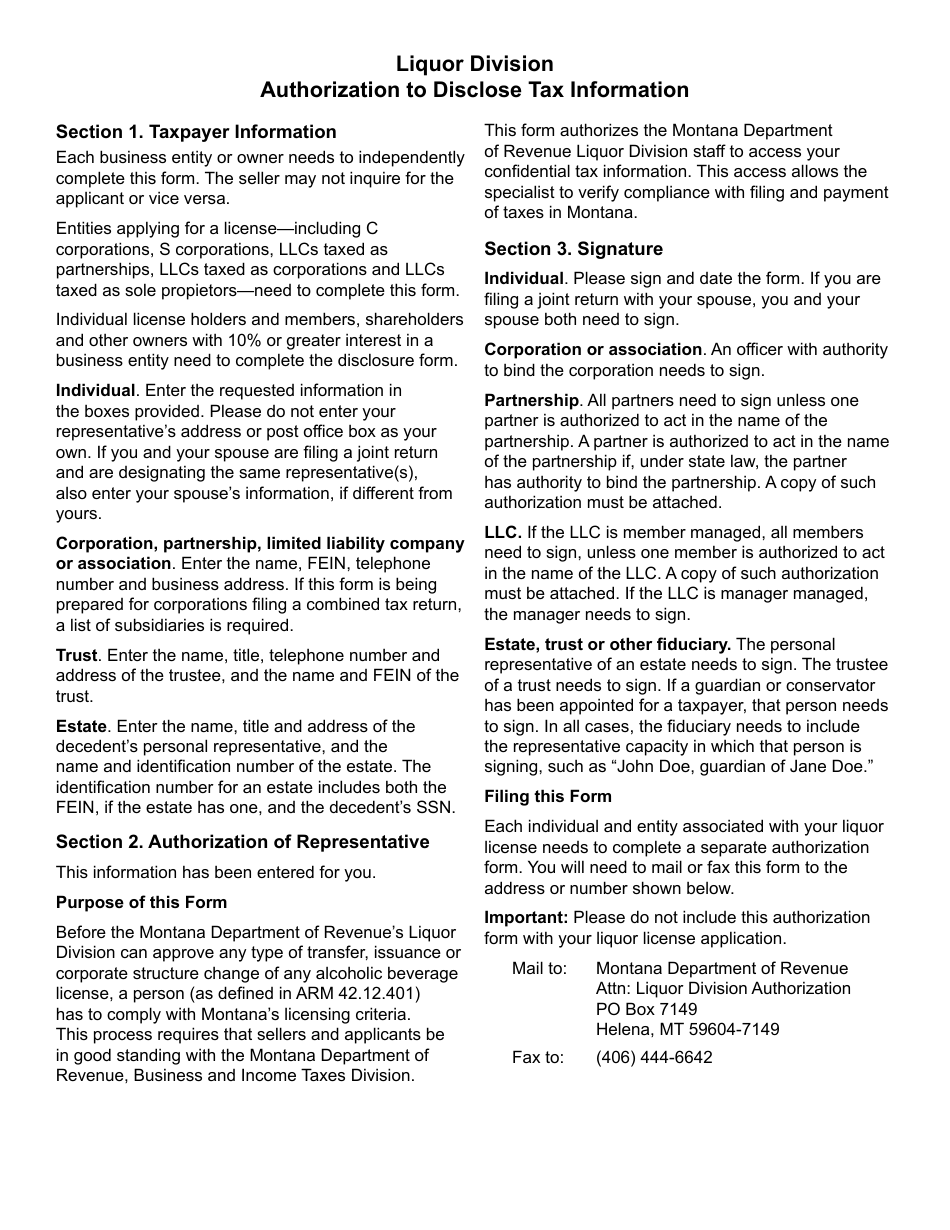

Q: What is the purpose of Form LIQ-AUTH?

A: The purpose of this form is to authorize the disclosure of tax information related to liquor sales in Montana.

Q: Who needs to fill out Form LIQ-AUTH?

A: Individuals or businesses involved in liquor sales in Montana may need to fill out this form.

Q: Is Form LIQ-AUTH mandatory?

A: The completion of Form LIQ-AUTH is mandatory for individuals or businesses involved in liquor sales in Montana.

Q: What information is required on Form LIQ-AUTH?

A: The form requires information such as the name, address, and tax identification number of the individual or business authorizing the disclosure of tax information.

Q: How should I submit Form LIQ-AUTH?

A: You can submit Form LIQ-AUTH by mail or in person to the Montana Liquor Division.

Q: Are there any fees associated with Form LIQ-AUTH?

A: There are no fees associated with submitting Form LIQ-AUTH.

Q: Can I authorize someone to receive my tax information without using Form LIQ-AUTH?

A: No, Form LIQ-AUTH is the required authorization form to disclose tax information related to liquor sales in Montana.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIQ-AUTH by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.