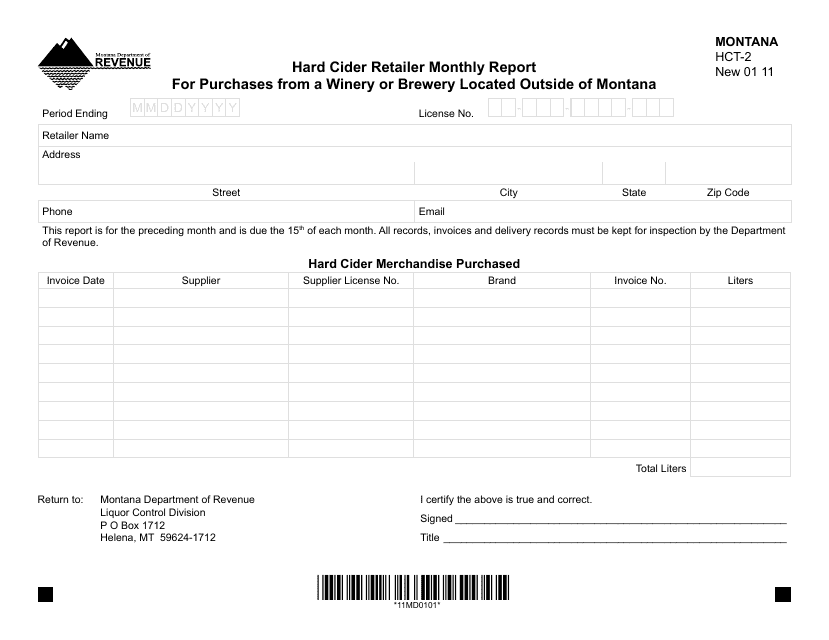

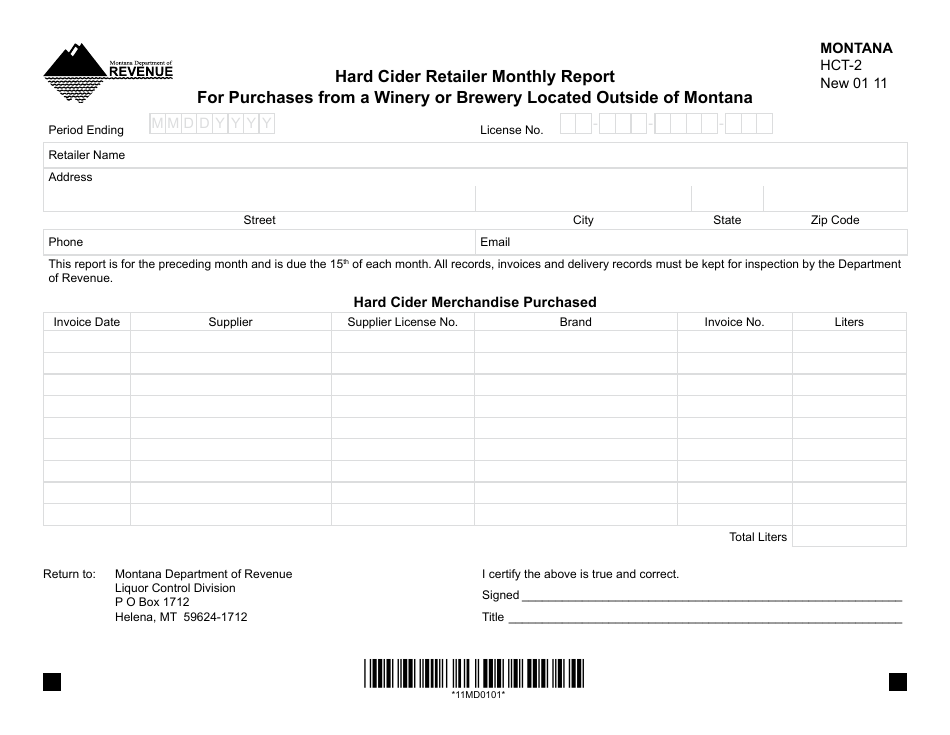

Form HCT-2 Hard Cider Retailer Monthly Report for Purchases From a Winery or Brewery Located Outside of Montana - Montana

What Is Form HCT-2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form HCT-2?

A: Form HCT-2 is the Hard Cider Retailer Monthly Report.

Q: Who needs to file the Form HCT-2?

A: Retailers who purchase hard cider from a winery or brewery located outside of Montana need to file the Form HCT-2.

Q: What is the purpose of the Form HCT-2?

A: The purpose of the Form HCT-2 is to report monthly hard cider purchases from wineries or breweries located outside of Montana.

Q: When is the Form HCT-2 due?

A: The Form HCT-2 is due on or before the 15th day of the month following the reporting period.

Q: Are there any penalties for not filing the Form HCT-2?

A: Yes, failure to file the Form HCT-2 or filing it late may result in penalties and interest.

Q: Is the Form HCT-2 only for retailers in Montana?

A: Yes, the Form HCT-2 is specifically for retailers located in Montana.

Q: Do I need to file the Form HCT-2 if I only purchase hard cider from Montana wineries or breweries?

A: No, the Form HCT-2 is only required for purchases from wineries or breweries located outside of Montana.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HCT-2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.