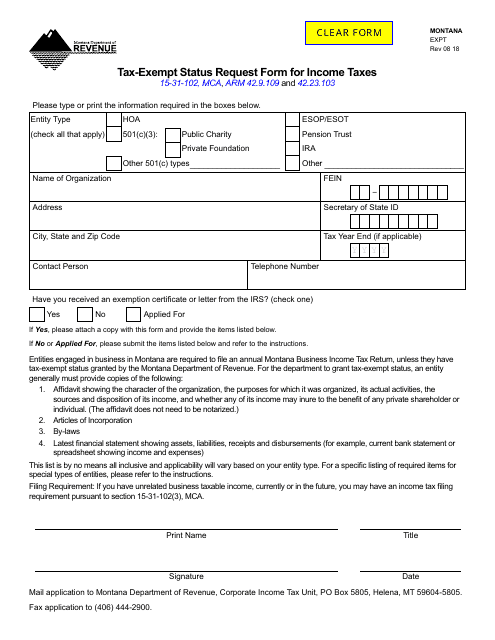

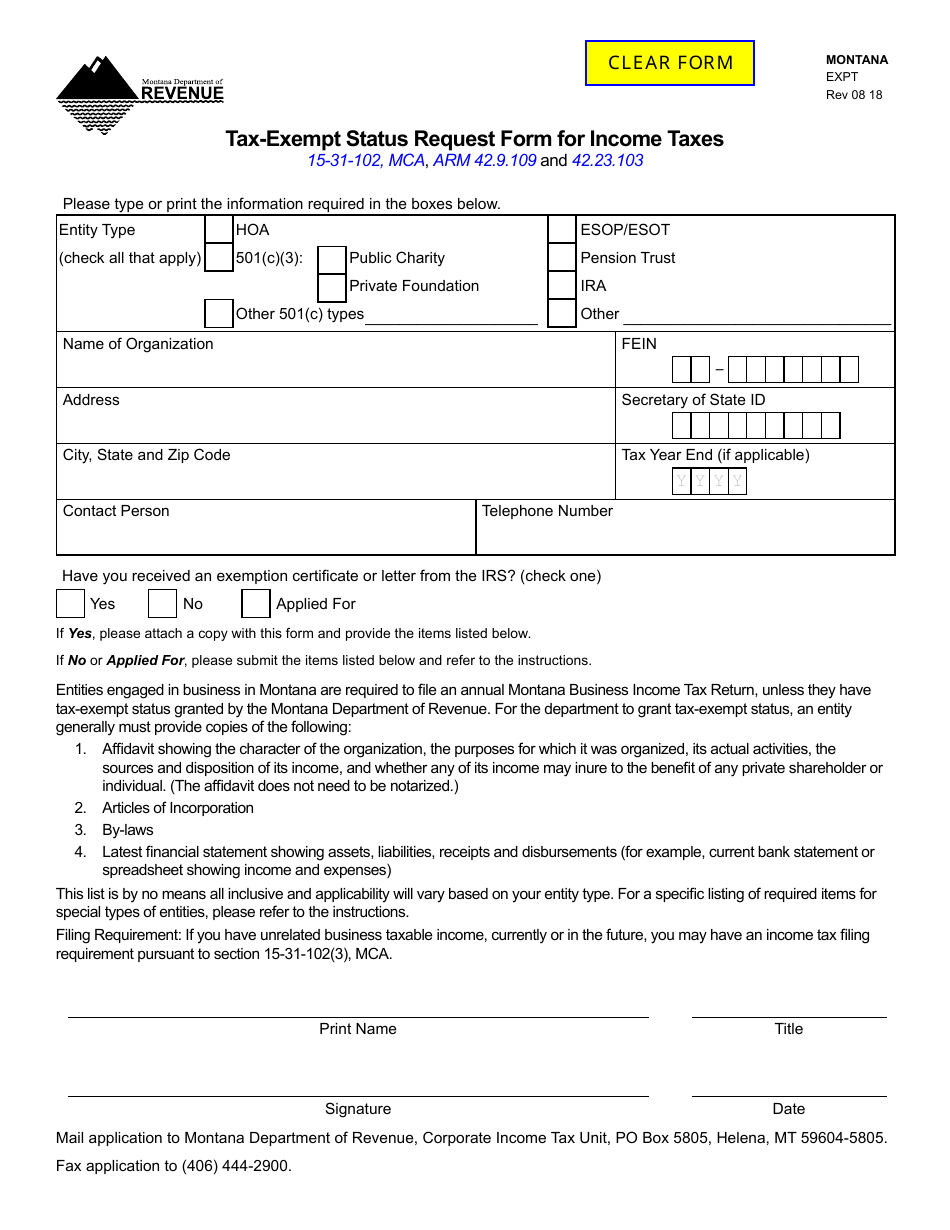

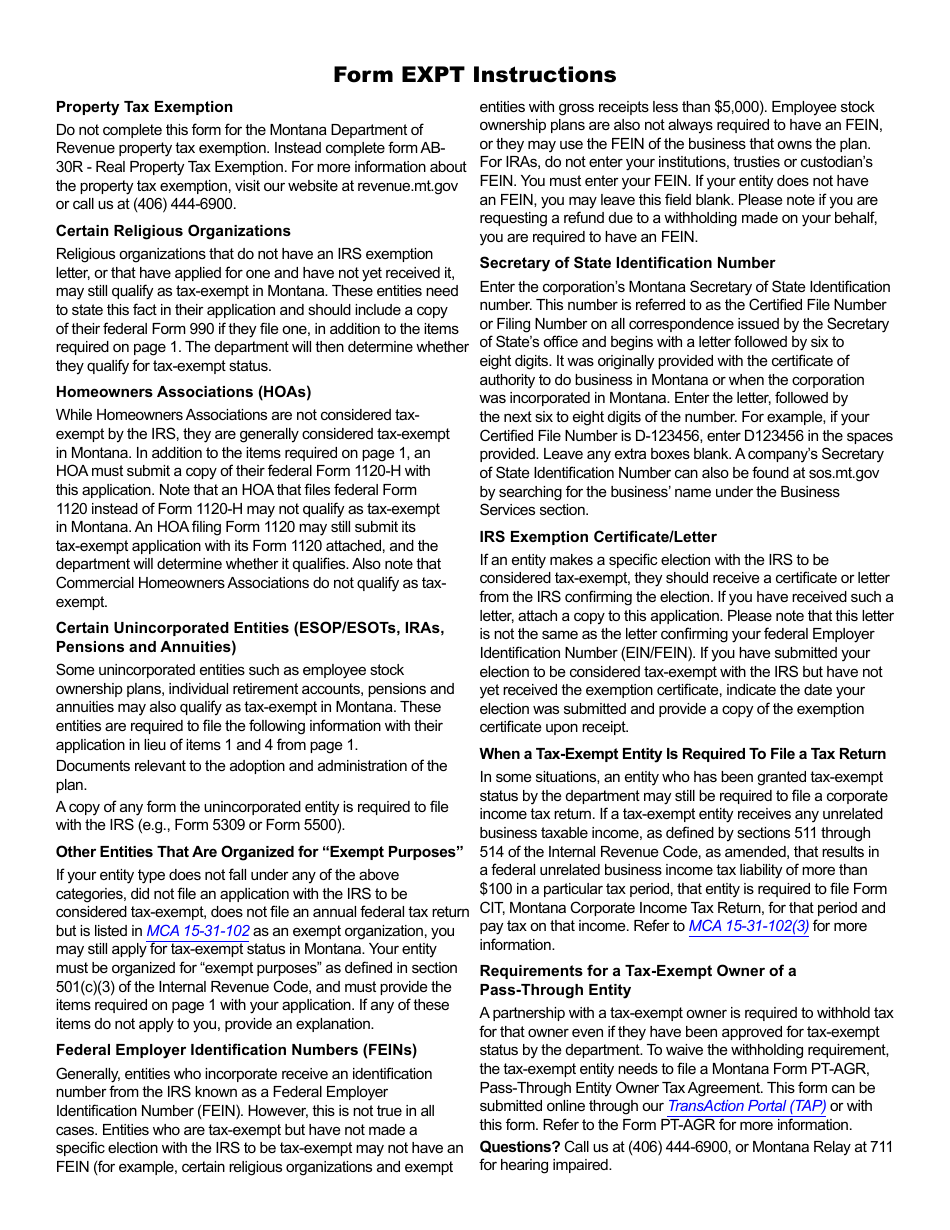

Form EXPT Tax-Exempt Status Request Form for Income Taxes - Montana

What Is Form EXPT?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form EXPT?

A: The purpose of Form EXPT is to request tax-exempt status for income taxes in Montana.

Q: Who needs to use Form EXPT?

A: Any individual or organization seeking tax-exempt status for income taxes in Montana needs to use Form EXPT.

Q: Is there a filing fee for Form EXPT?

A: No, there is no filing fee for Form EXPT.

Q: What supporting documents are required with Form EXPT?

A: You need to submit a copy of the organization's federal exemption determination letter and any other relevant documentation.

Q: How long does it take to process Form EXPT?

A: The processing time for Form EXPT may vary, but it typically takes several weeks.

Q: Can I check the status of my Form EXPT application?

A: Yes, you can check the status of your Form EXPT application by contacting the Montana Department of Revenue.

Q: Are there any time limits for submitting Form EXPT?

A: There are no specific time limits for submitting Form EXPT, but it is recommended to submit it as soon as possible.

Q: Is Form EXPT available for other states?

A: No, Form EXPT is specifically for requesting tax-exempt status for income taxes in Montana.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EXPT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.