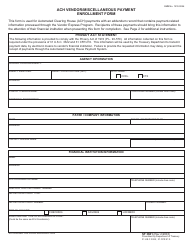

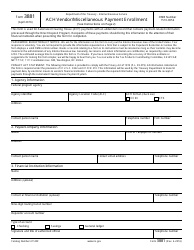

Form ETR Montana ACH Credit Payment Registration - Montana

What Is Form ETR?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

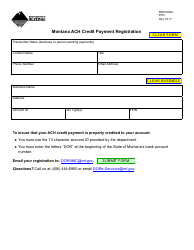

Q: What is the Form ETR Montana ACH Credit Payment Registration?

A: The Form ETR Montana ACH Credit Payment Registration is a form used to register for Electronic Funds Transfer (ACH) for making credit payments to the state of Montana.

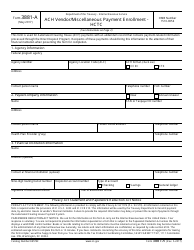

Q: How do I use the Form ETR Montana ACH Credit Payment Registration?

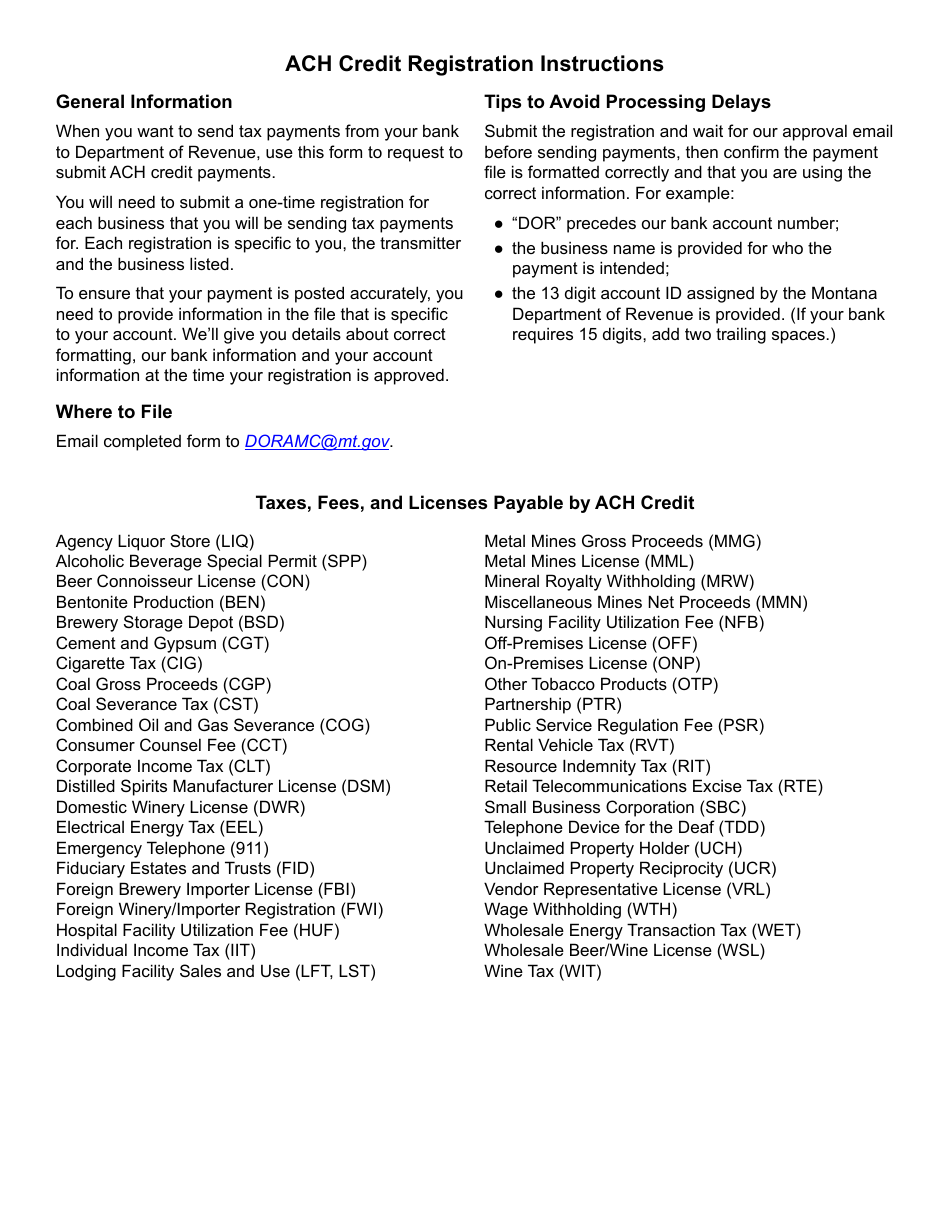

A: To use the form, you need to provide your business information, banking information, and select the tax types for which you want to make ACH credit payments.

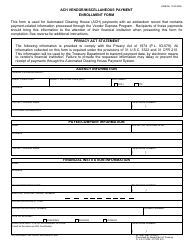

Q: Why would I need to register for ACH credit payments in Montana?

A: Registering for ACH credit payments allows you to conveniently and securely pay your taxes to the state of Montana directly from your bank account.

Q: Are there any fees associated with using ACH credit payments in Montana?

A: No, there are no additional fees for using ACH credit payments in Montana.

Q: What tax types can I make ACH credit payments for using the Form ETR Montana ACH Credit Payment Registration?

A: You can make ACH credit payments for various tax types, including individual income tax, corporation income tax, and withholding tax, among others.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ETR by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.