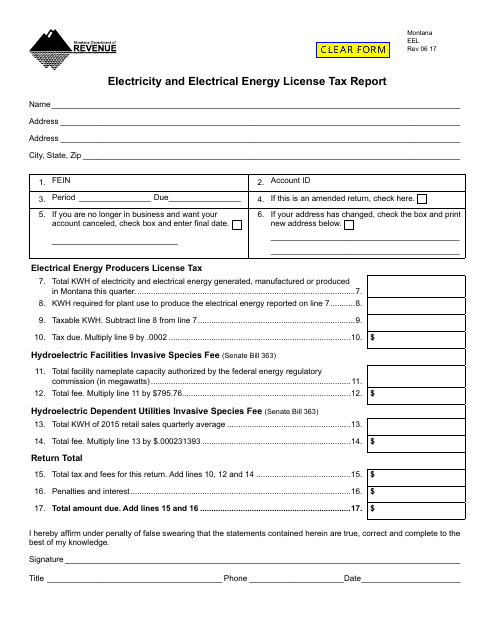

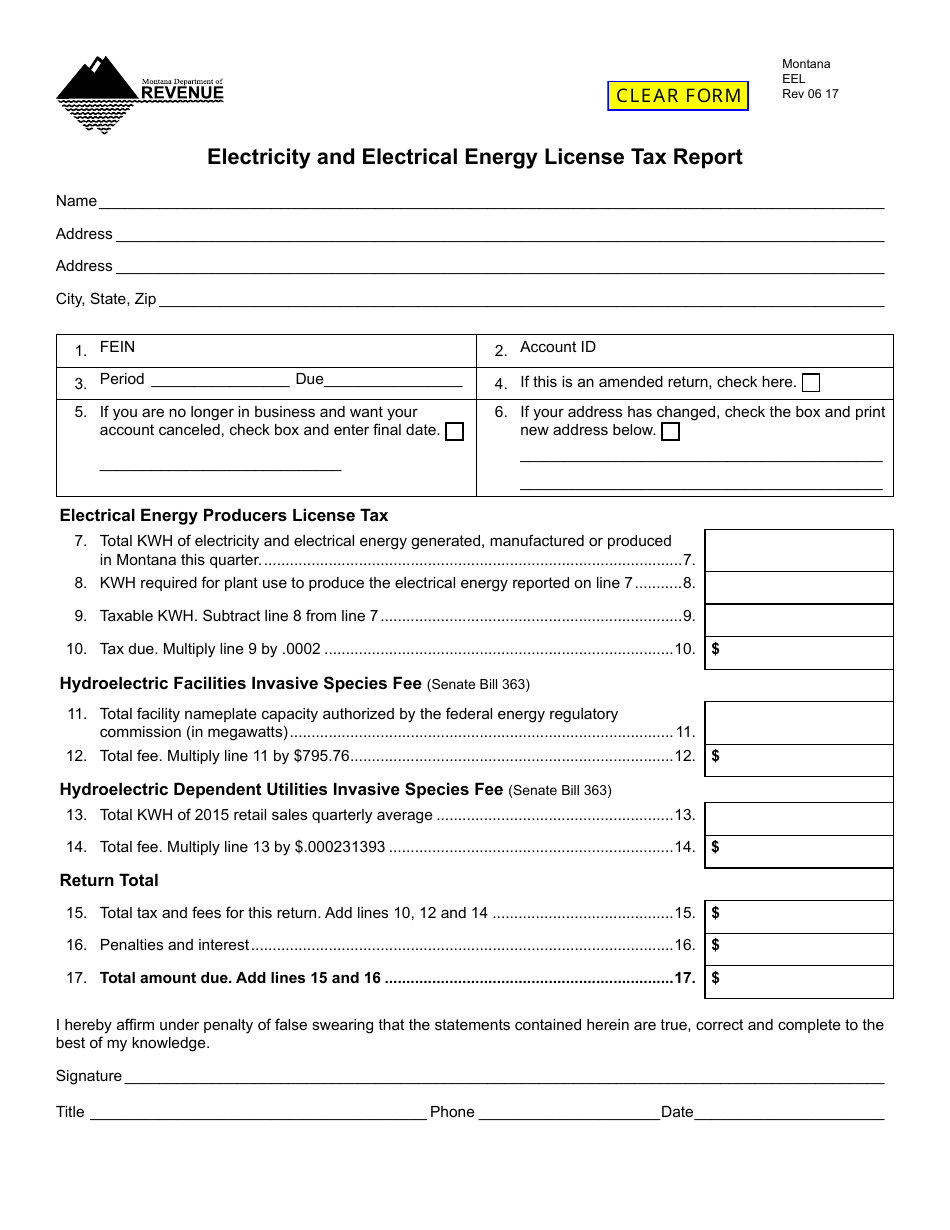

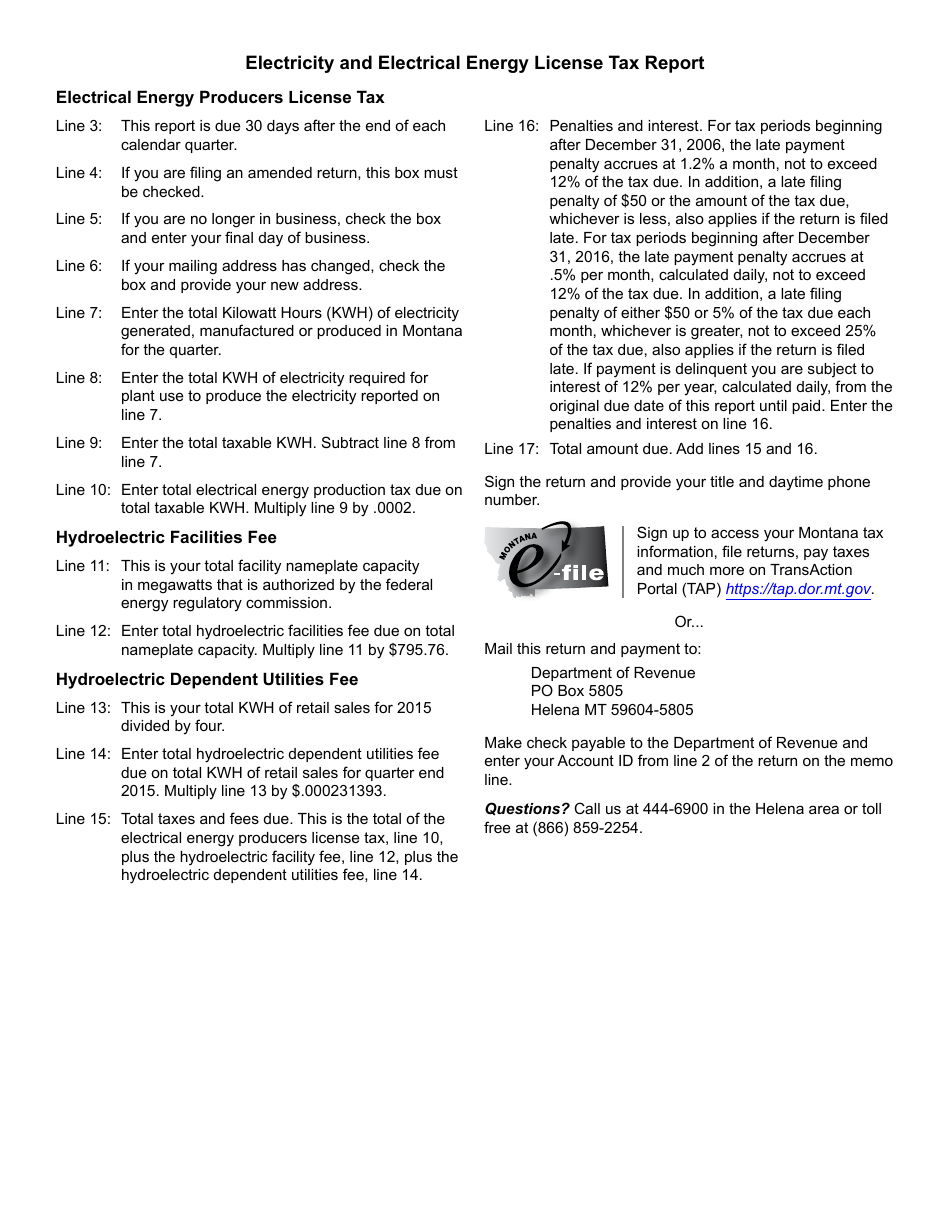

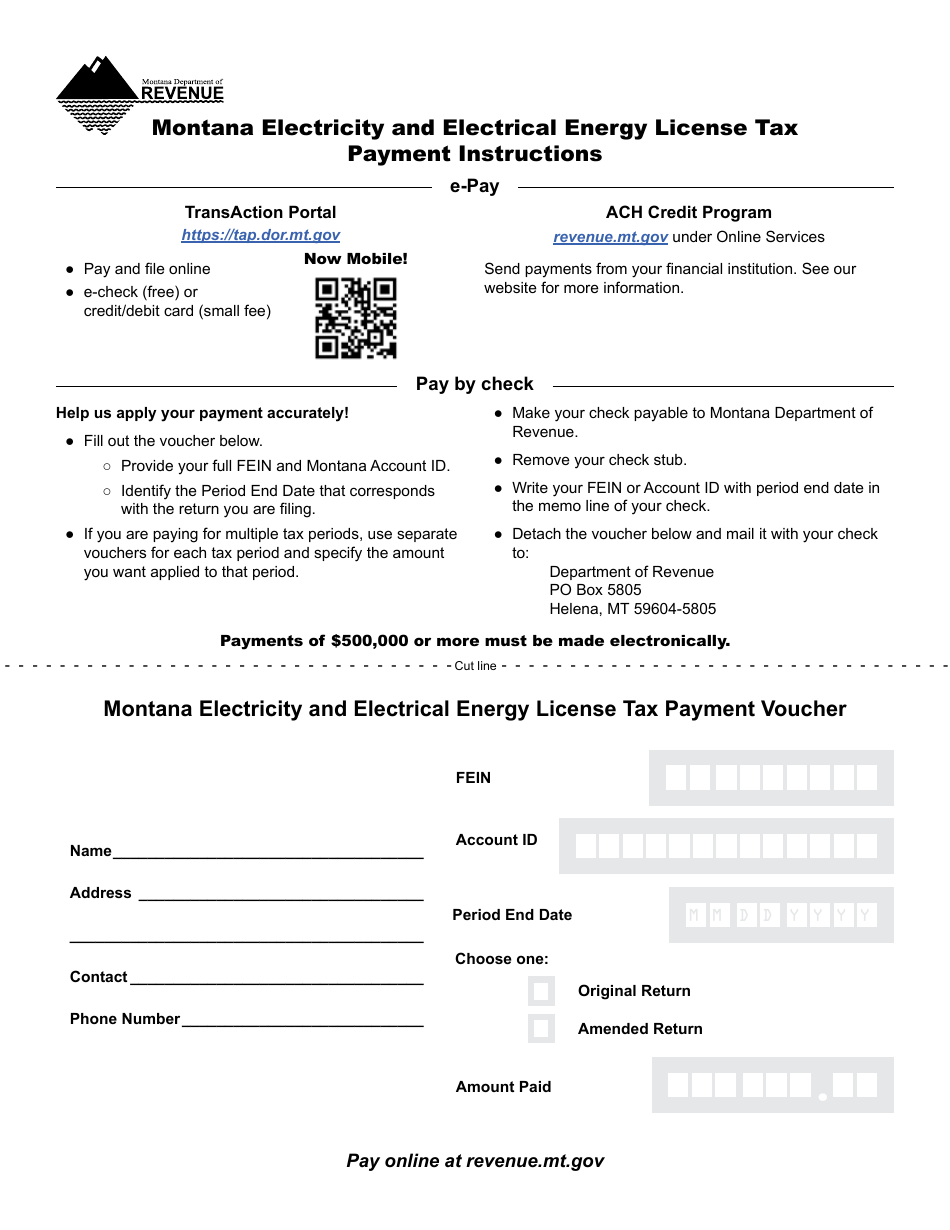

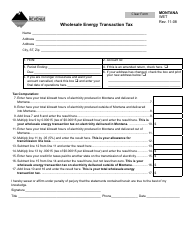

Form EEL Electricity and Electrical Energy License Tax Report - Montana

What Is Form EEL?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form EEL?

A: Form EEL is the Electricity and Electrical Energy License Tax Report.

Q: Who needs to file the Form EEL?

A: Businesses and individuals who generate, distribute, or sell electricity or electrical energy in Montana need to file the Form EEL.

Q: What is the purpose of the Form EEL?

A: The purpose of the Form EEL is to report and pay the electricity and electrical energy license tax in Montana.

Q: How often do I need to file the Form EEL?

A: The Form EEL is filed annually, with the tax due by the last day of the month following the end of the tax year.

Q: Are there any penalties for not filing the Form EEL?

A: Yes, there are penalties for not filing the Form EEL or for filing it late. It is important to file the form and pay the tax on time to avoid penalties.

Q: Is there any additional documentation required to be submitted with the Form EEL?

A: No, there is no additional documentation required to be submitted with the Form EEL.

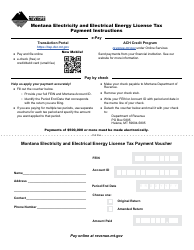

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EEL by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.