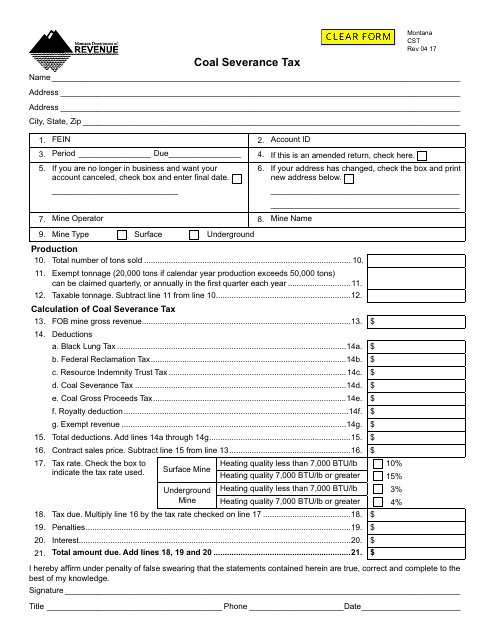

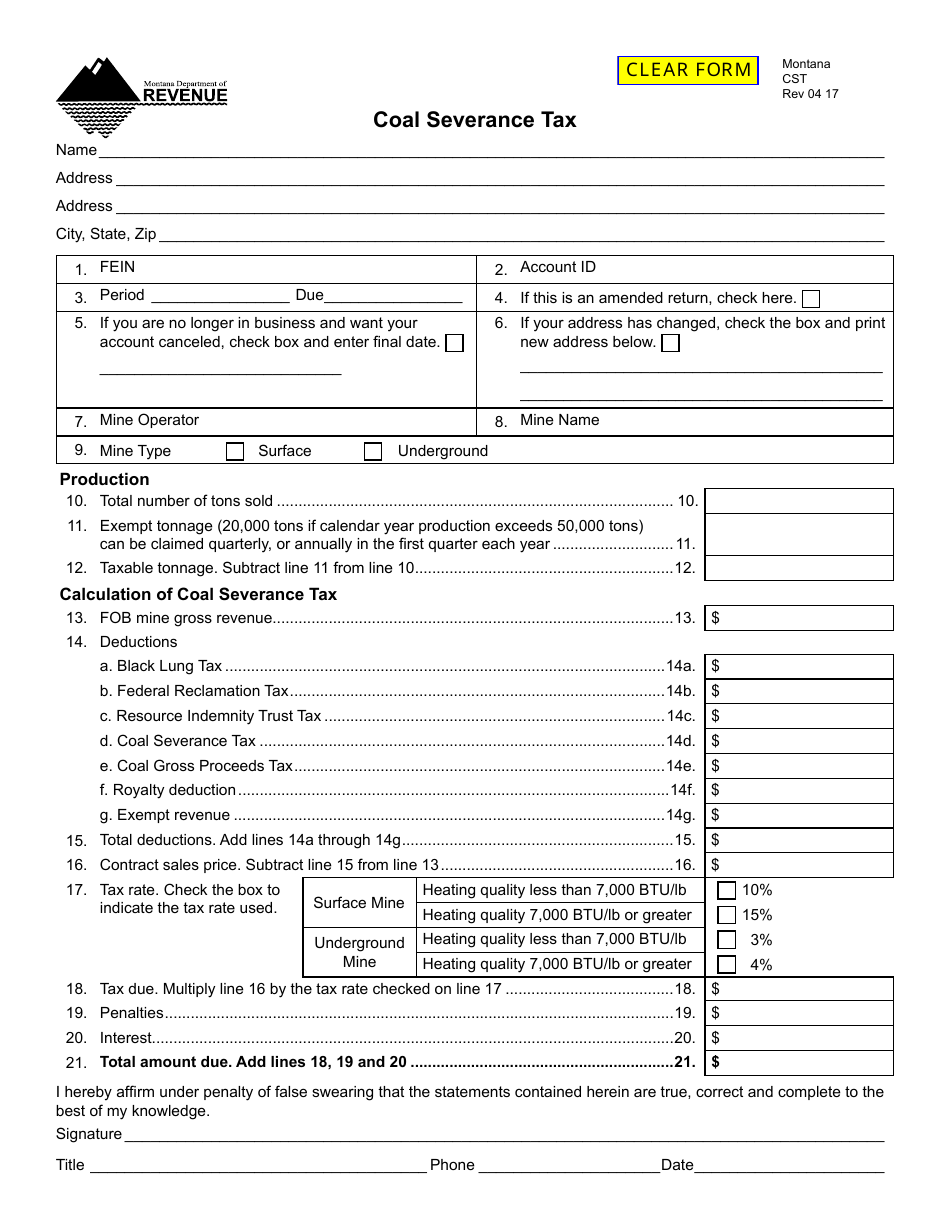

Form CST Coal Severance Tax - Montana

What Is Form CST?

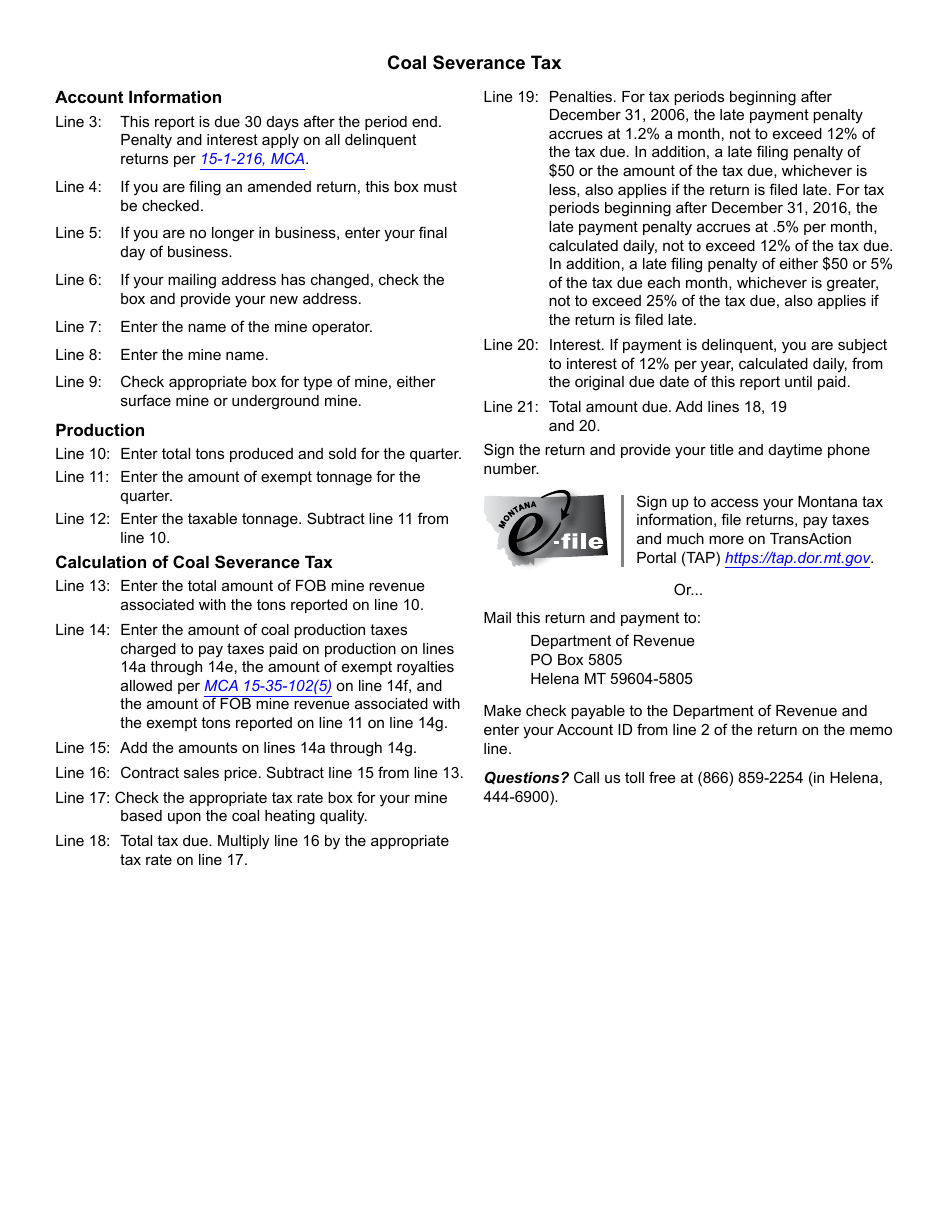

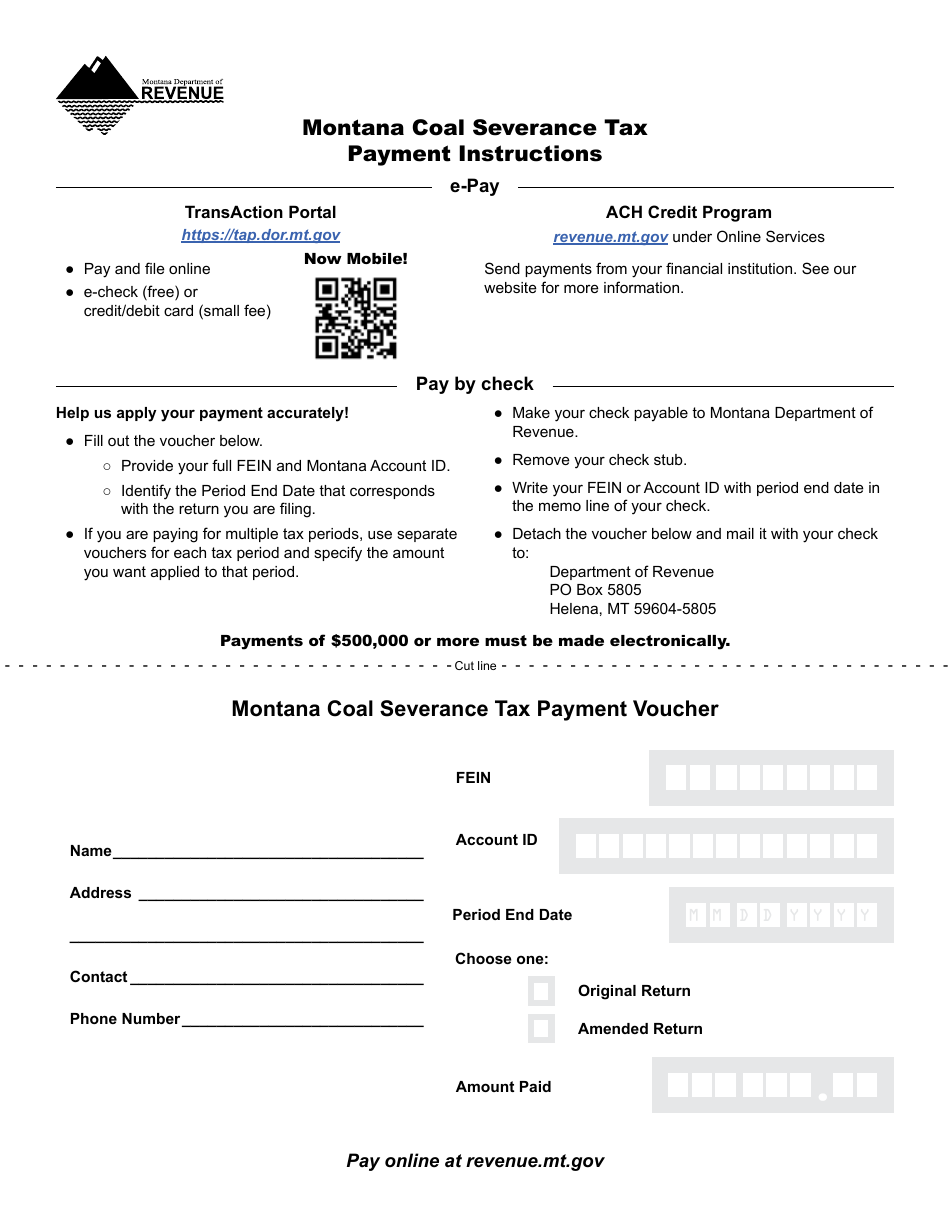

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CST Coal Severance Tax?

A: The CST Coal Severance Tax is a tax imposed on the extraction of coal in Montana.

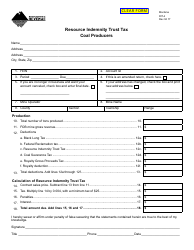

Q: How is the CST Coal Severance Tax calculated?

A: The tax is calculated based on the gross proceeds from the sale of coal, less any transportation and processing costs.

Q: What is the current rate of the CST Coal Severance Tax?

A: As of 2021, the standard rate of the tax is 5% of the gross proceeds from the sale of coal.

Q: Who is responsible for paying the CST Coal Severance Tax?

A: The person or entity that extracts the coal is responsible for paying the tax.

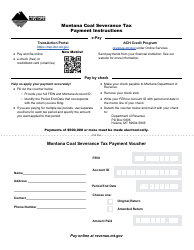

Q: How is the CST Coal Severance Tax collected?

A: The tax is collected by the Montana Department of Revenue.

Q: What is the purpose of the CST Coal Severance Tax?

A: The tax serves as a revenue source for the state and helps fund various public services and programs.

Q: Are there any exemptions or deductions available for the CST Coal Severance Tax?

A: Yes, there are certain exemptions and deductions available, such as the allowance for certain mining costs and exemptions for coal used for industrial purposes.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CST by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.