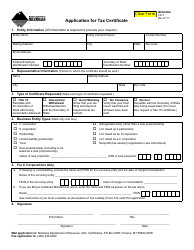

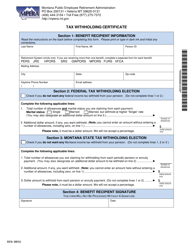

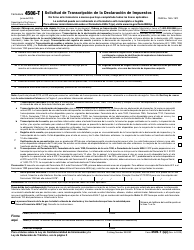

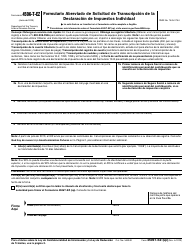

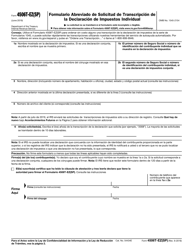

Form CR-T Application for Tax Certificate - Montana

What Is Form CR-T?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CR-T Application?

A: A CR-T Application is a form used to apply for a Tax Certificate in Montana.

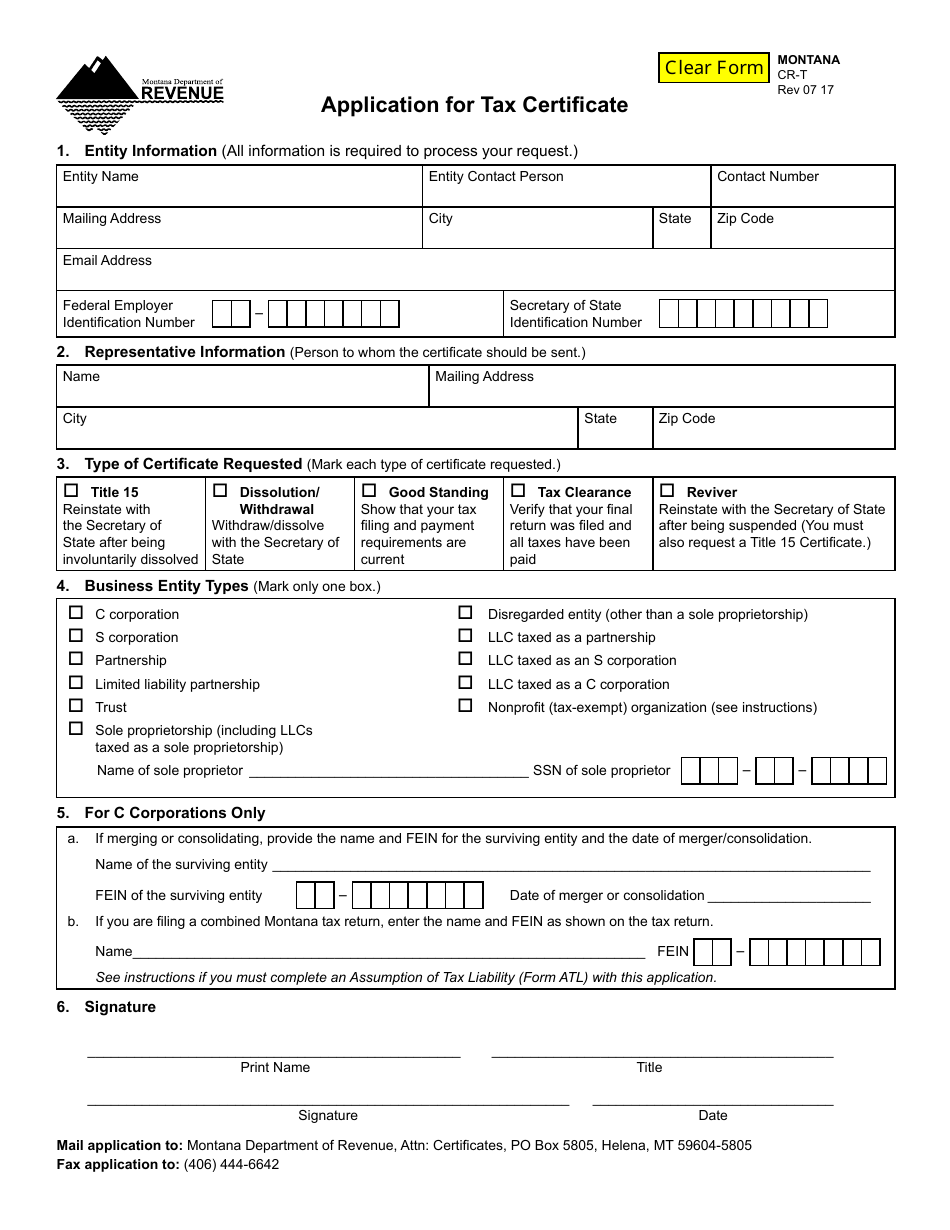

Q: What is a Tax Certificate?

A: A Tax Certificate is a document issued by the state of Montana that certifies that a person or business is in compliance with their tax obligations.

Q: Why would I need a Tax Certificate?

A: You may need a Tax Certificate for various purposes, such as applying for certain licenses or permits, securing a loan, or bidding on government contracts.

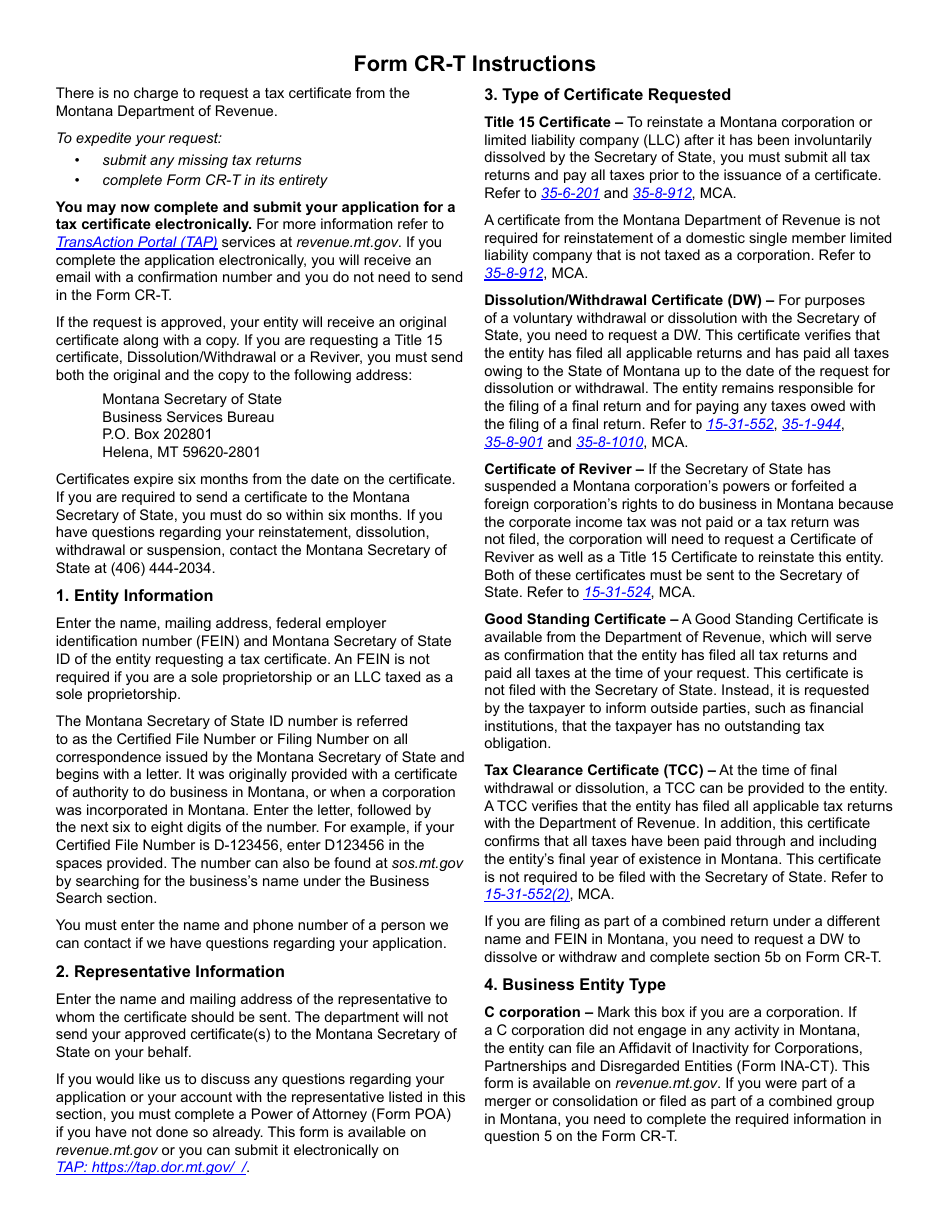

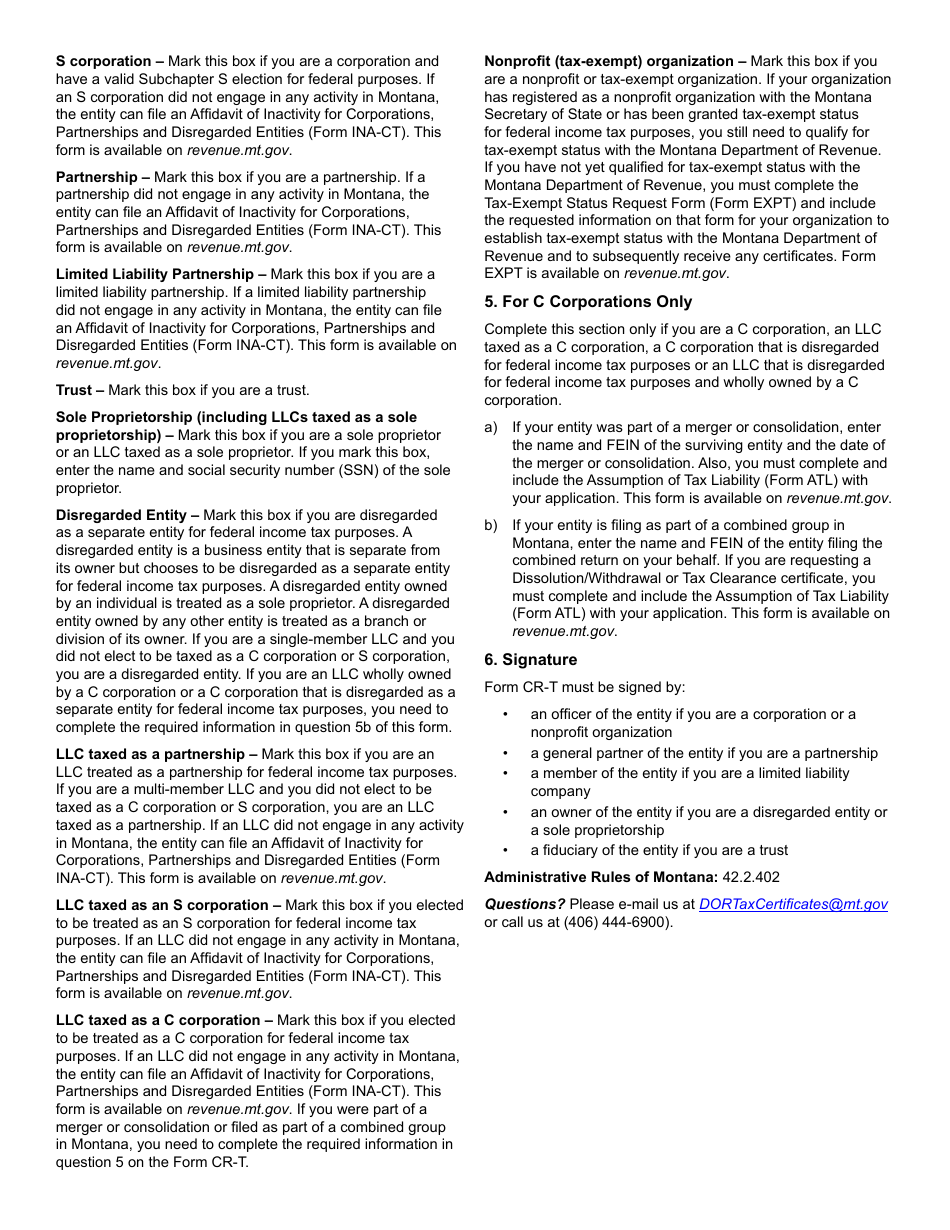

Q: What information do I need to provide on the CR-T Application?

A: You will need to provide your personal or business information, such as name, address, tax identification number, and a description of the taxes for which you are applying.

Q: Are there any fees associated with the CR-T Application?

A: Yes, there is a non-refundable fee for submitting a CR-T Application. The fee amount may vary depending on the type of tax certificate you are applying for.

Q: How long does it take to process a CR-T Application?

A: The processing time for a CR-T Application may vary, but it typically takes a few weeks for the Montana Department of Revenue to review and issue the tax certificate.

Q: What happens after I submit the CR-T Application?

A: After you submit the CR-T Application, the Montana Department of Revenue will review your application and notify you of their decision.

Q: Can I apply for a Tax Certificate in person or by mail?

A: Yes, you can also apply for a Tax Certificate in person at a Montana Department of Revenue office or by mailing in a paper application.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-T by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.