This version of the form is not currently in use and is provided for reference only. Download this version of

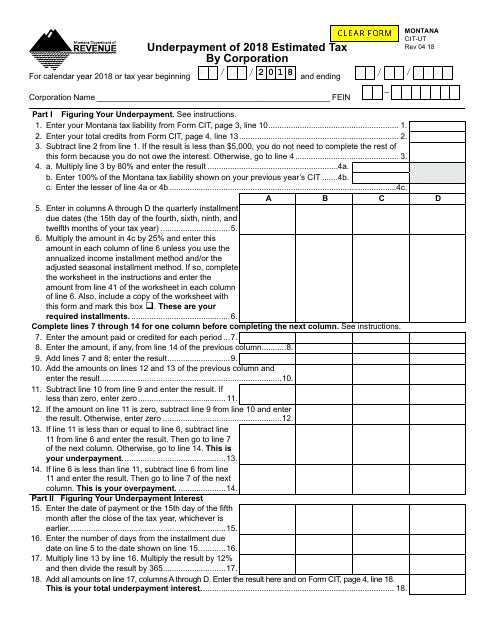

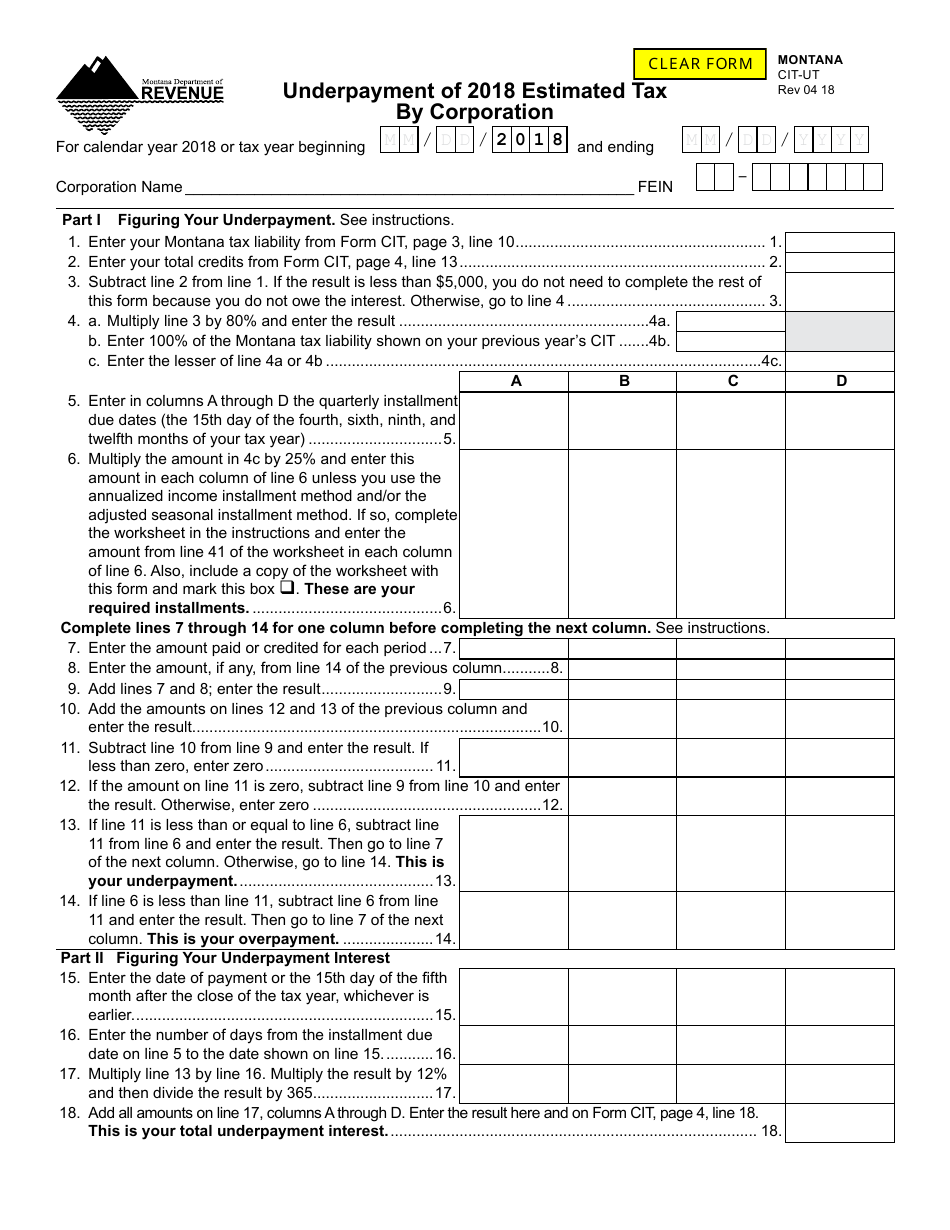

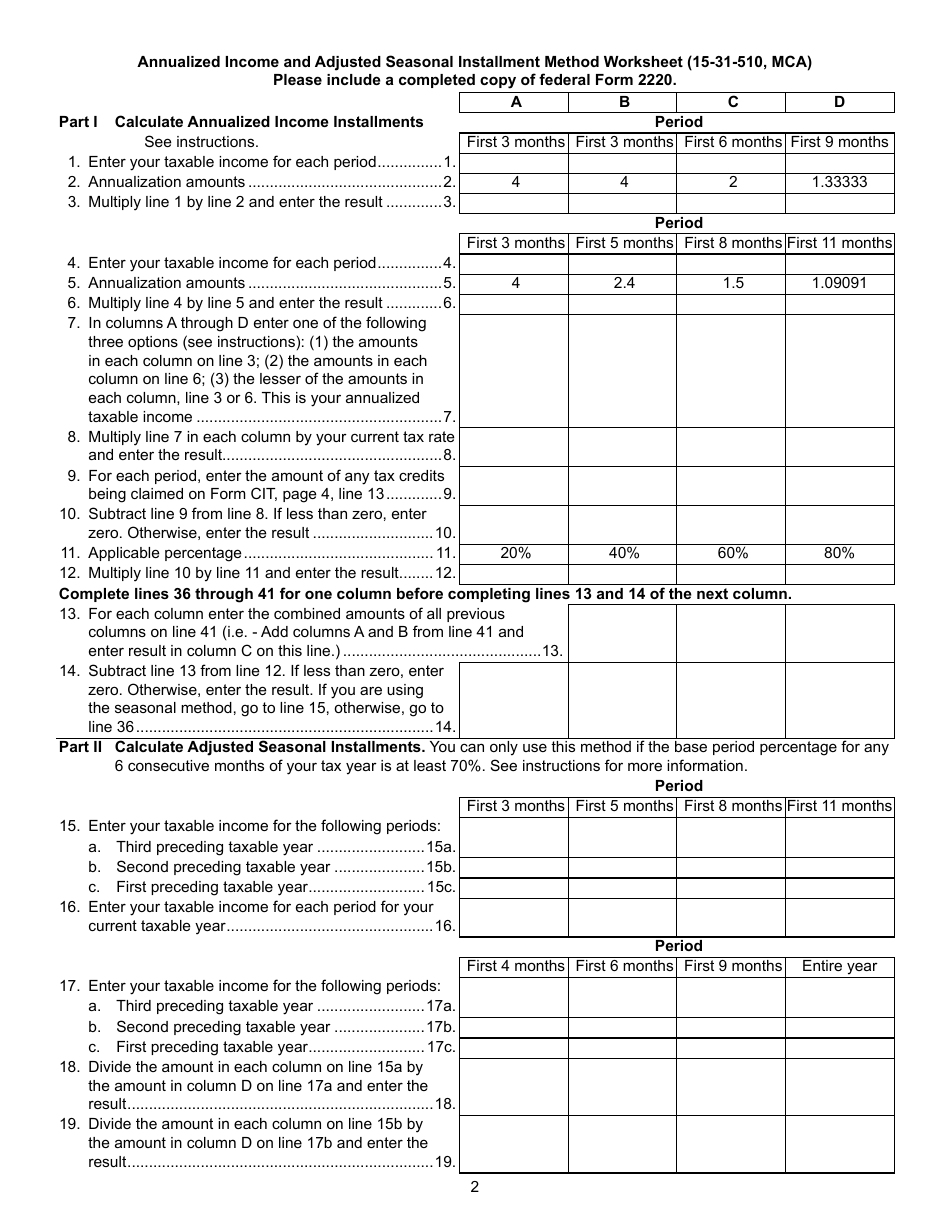

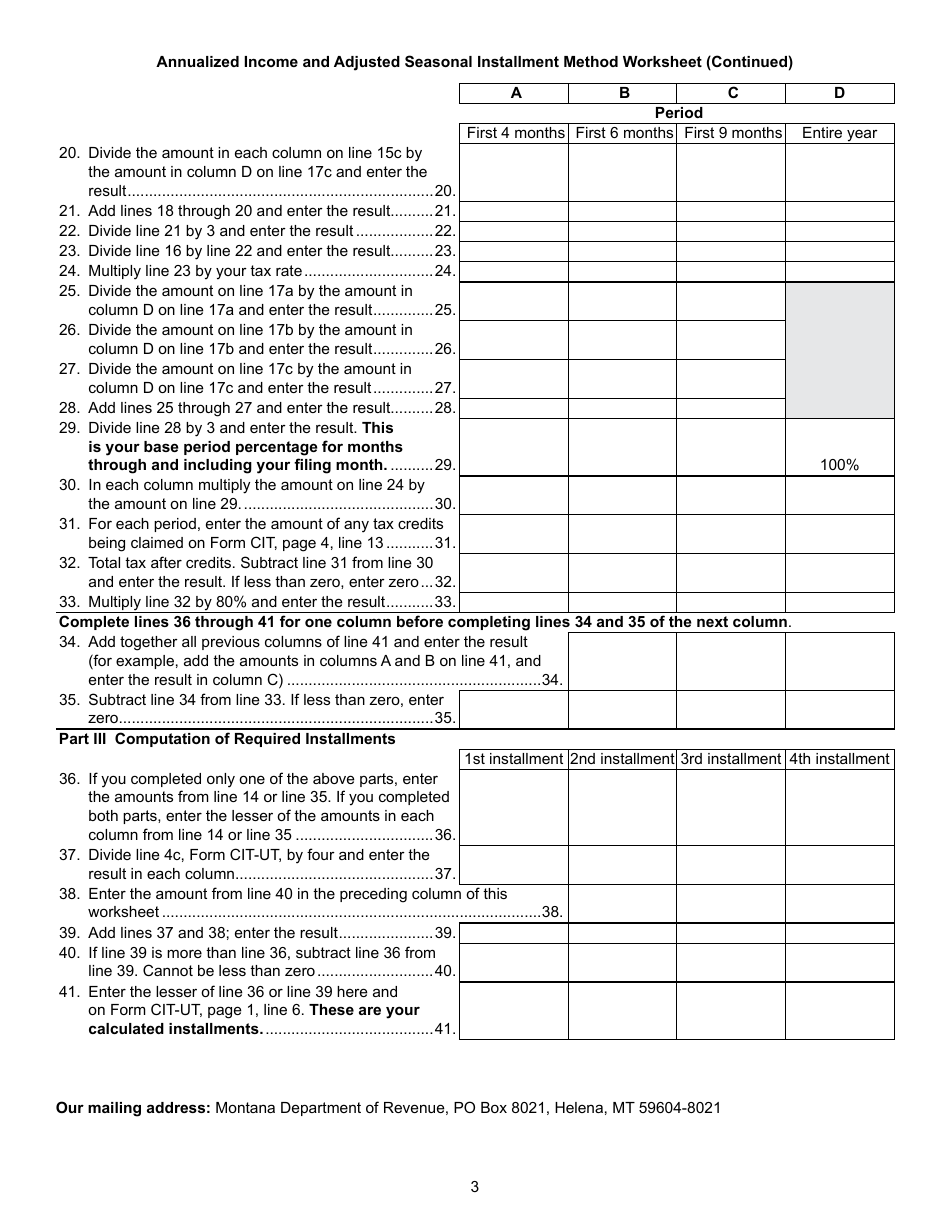

Form CIT-UT

for the current year.

Form CIT-UT Underpayment of Estimated Tax by Corporation - Montana

What Is Form CIT-UT?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

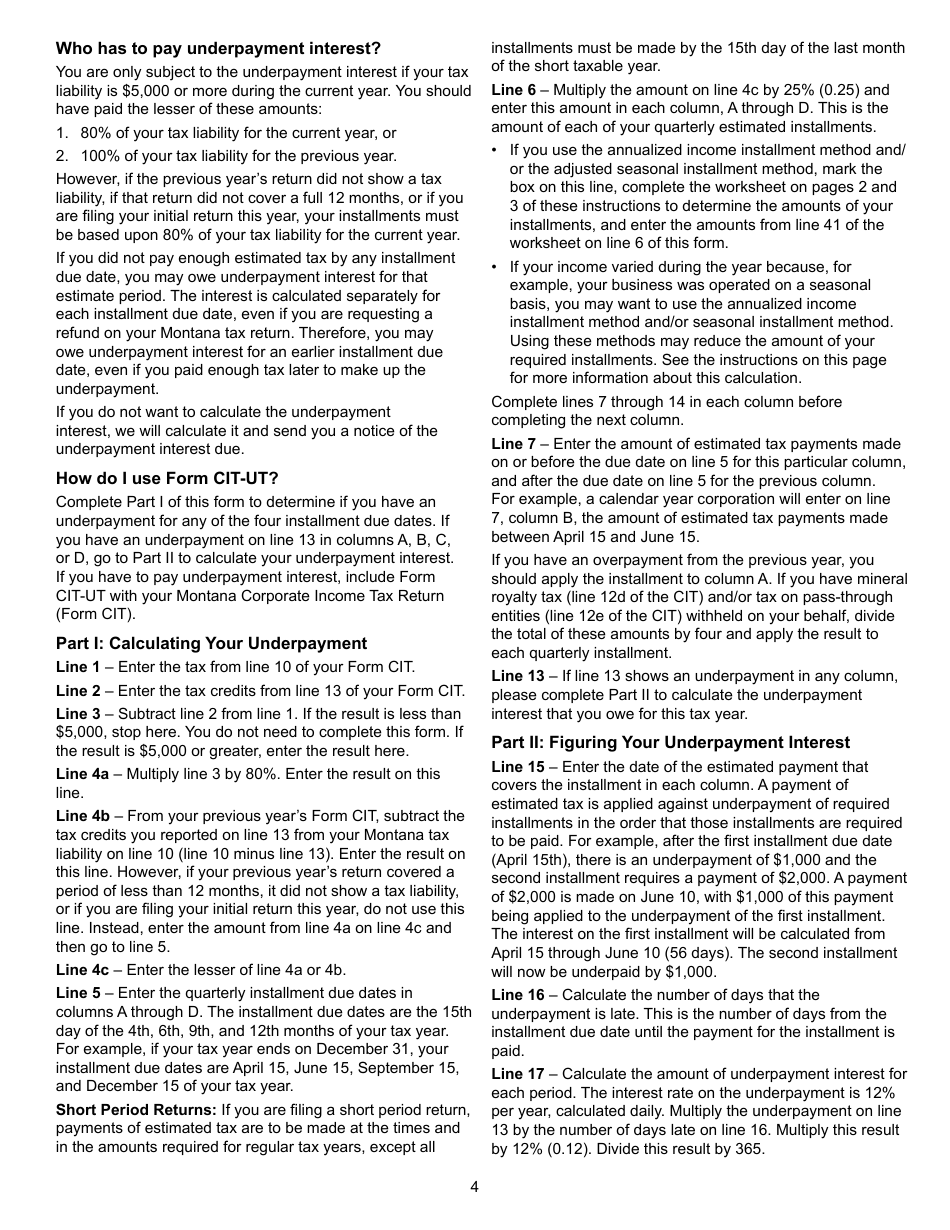

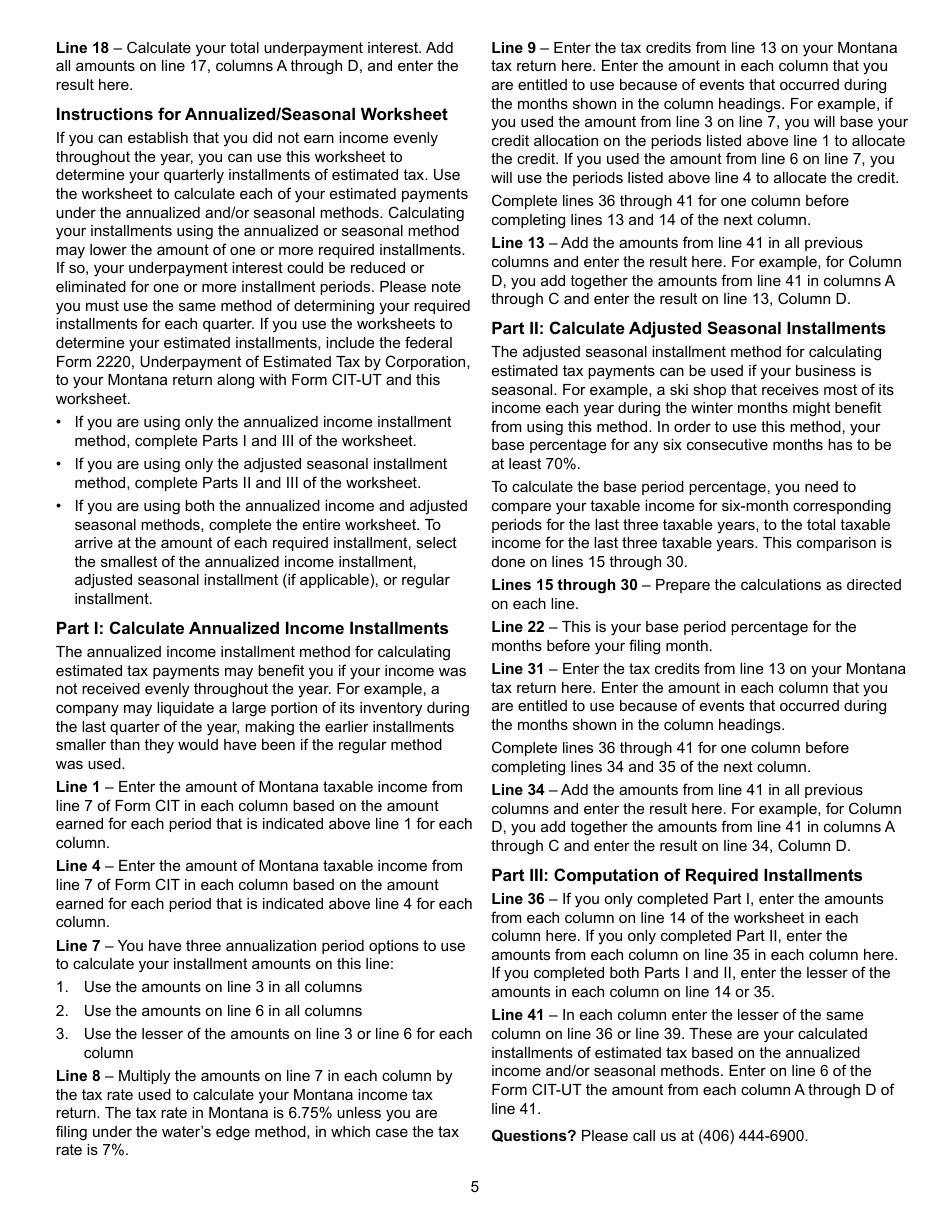

Q: What is the form CIT-UT?

A: The form CIT-UT is designed for corporations in Montana to report underpayment of estimated tax.

Q: Who needs to file form CIT-UT?

A: Corporations in Montana that have underpaid their estimated tax need to file form CIT-UT.

Q: What is the purpose of form CIT-UT?

A: The purpose of form CIT-UT is to report and pay the additional tax owed due to underpayment of estimated tax.

Q: When is form CIT-UT due?

A: Form CIT-UT is due on or before the original due date of the corporate income tax return.

Q: Are there any penalties for not filing form CIT-UT?

A: Yes, there may be penalties for not filing form CIT-UT or for underpaying estimated tax. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIT-UT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.