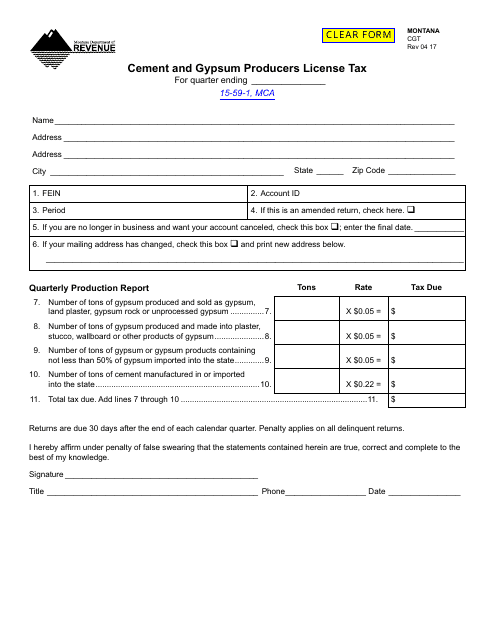

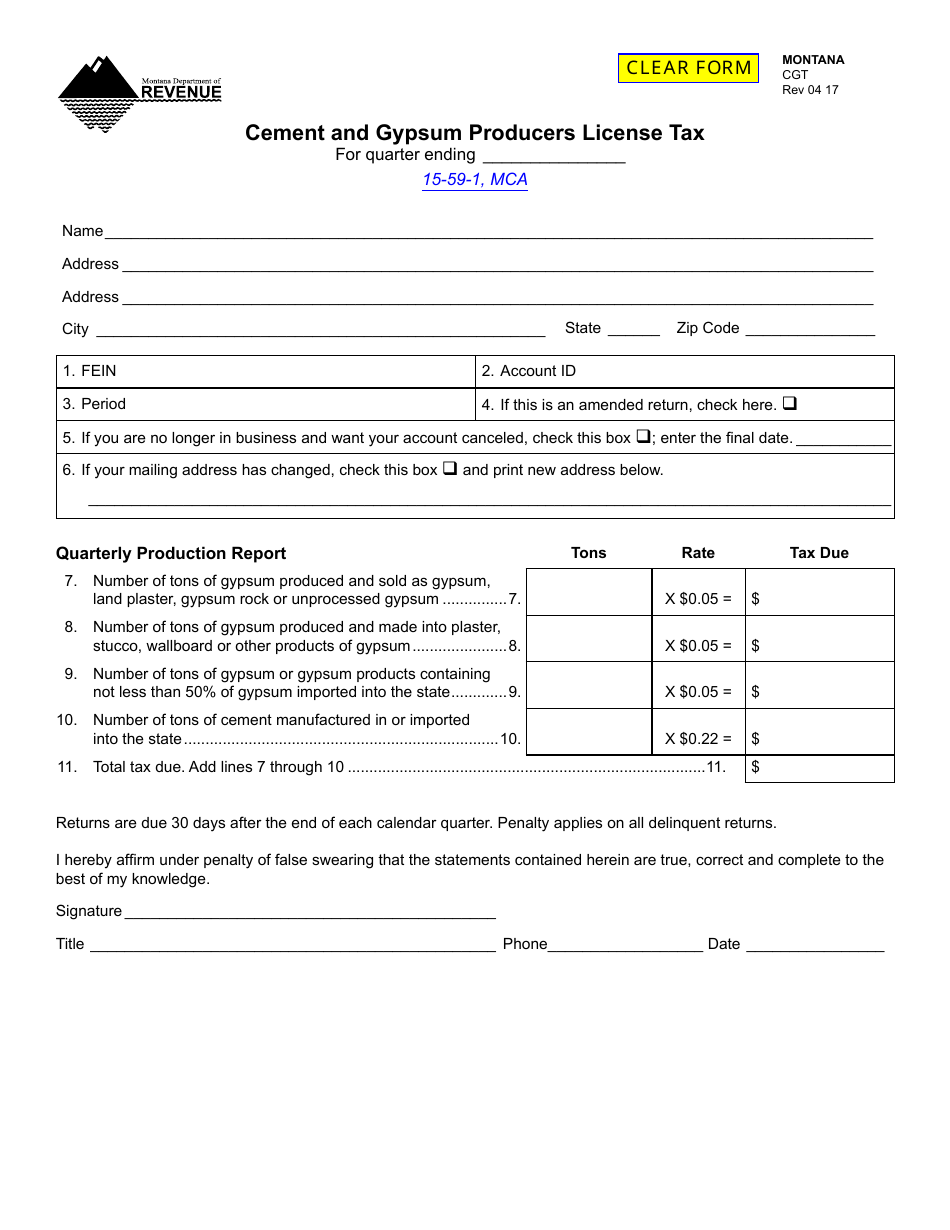

Form CGT Cement and Gypsum Producers License Tax - Montana

What Is Form CGT?

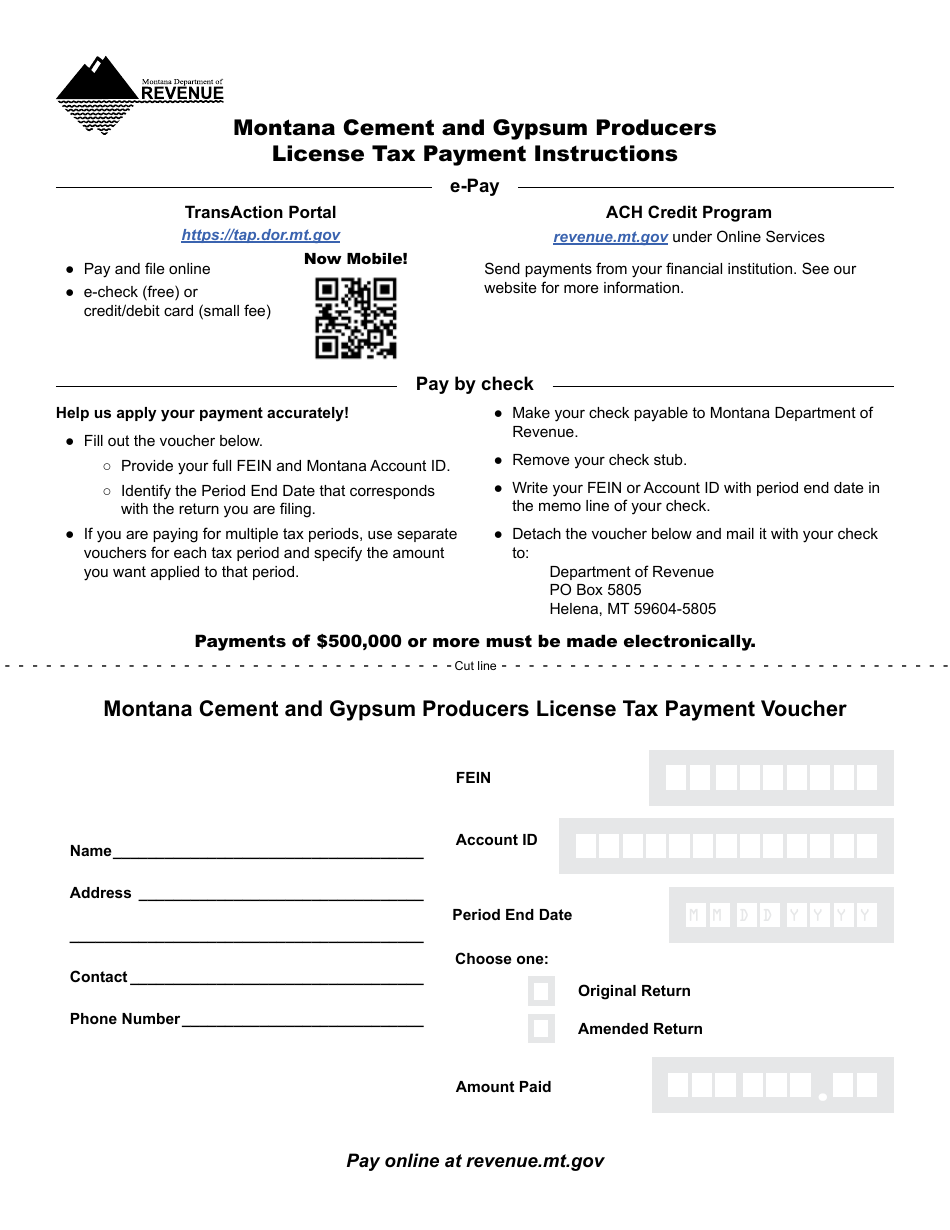

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CGT Cement and Gypsum Producers License Tax?

A: CGT Cement and Gypsum Producers License Tax is a tax imposed on companies involved in cement and gypsum production in the state of Montana.

Q: Who is subject to CGT Cement and Gypsum Producers License Tax?

A: Companies engaged in cement and gypsum production in Montana are subject to the CGT Cement and Gypsum Producers License Tax.

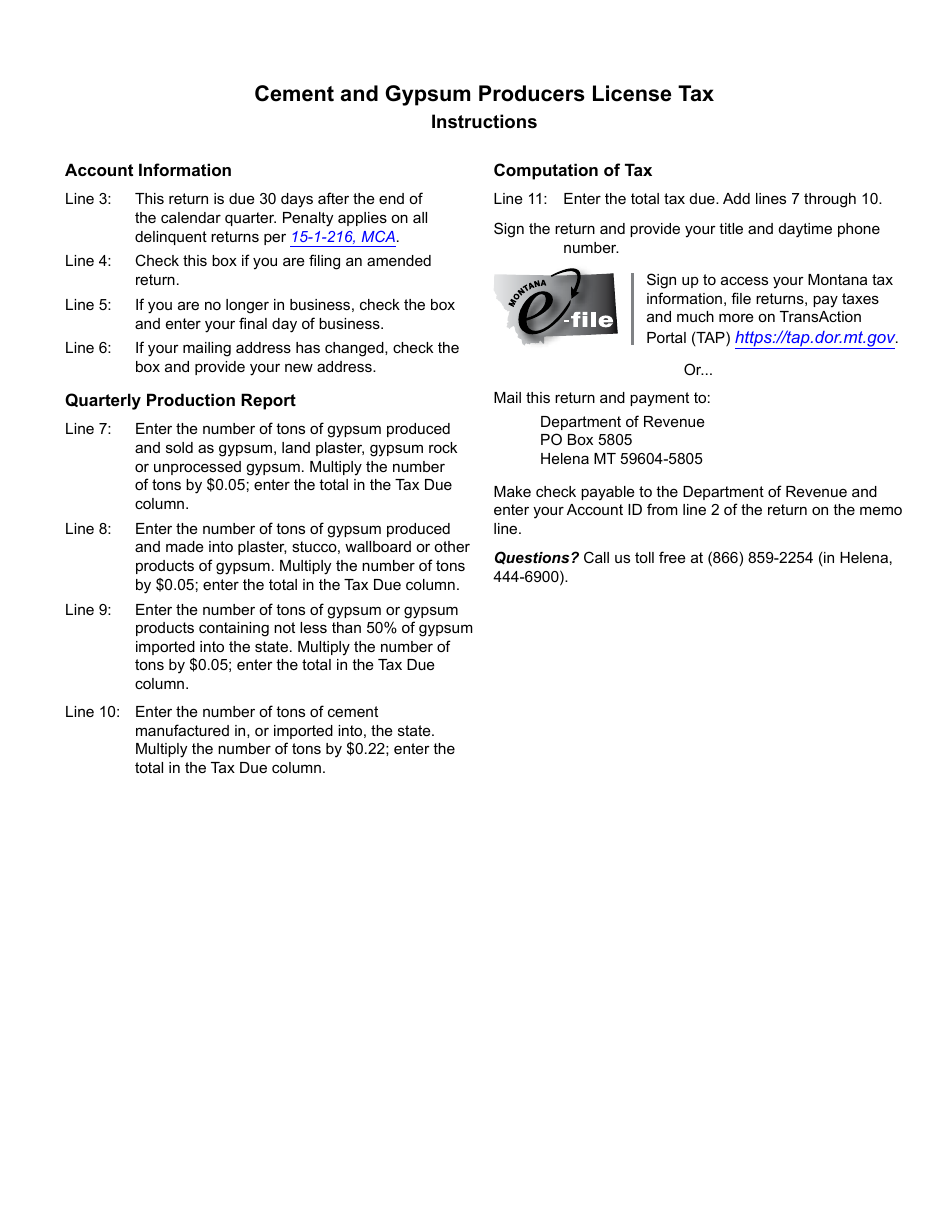

Q: How is CGT Cement and Gypsum Producers License Tax calculated?

A: The tax is calculated based on the producer's annual production capacity and the tax rate specified by the state of Montana.

Q: What is the purpose of CGT Cement and Gypsum Producers License Tax?

A: The purpose of the tax is to generate revenue for the state of Montana and regulate the cement and gypsum production industry.

Q: How often is CGT Cement and Gypsum Producers License Tax paid?

A: The tax is paid annually by companies engaged in cement and gypsum production in Montana.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

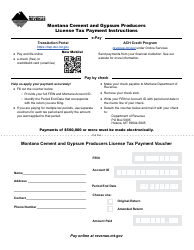

Download a fillable version of Form CGT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.