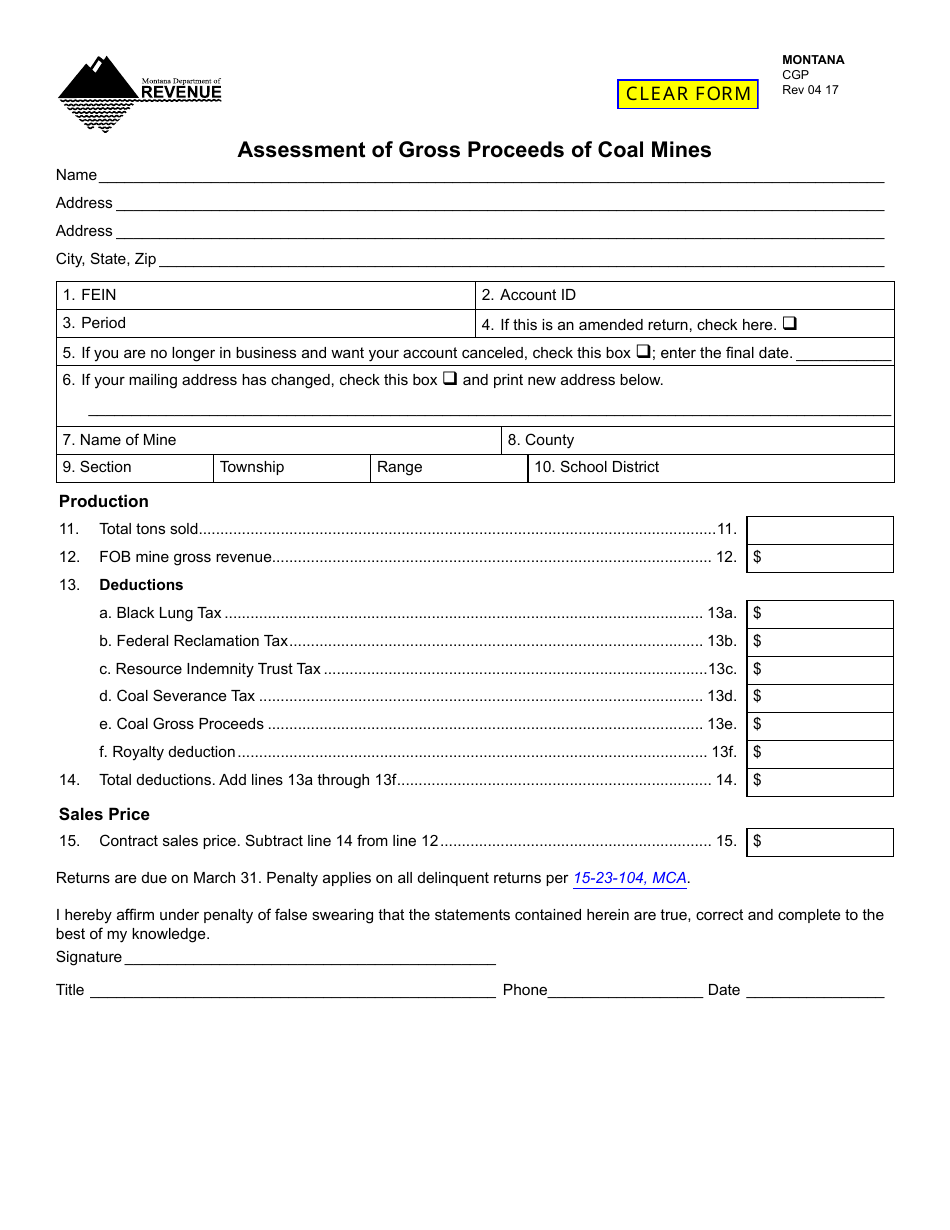

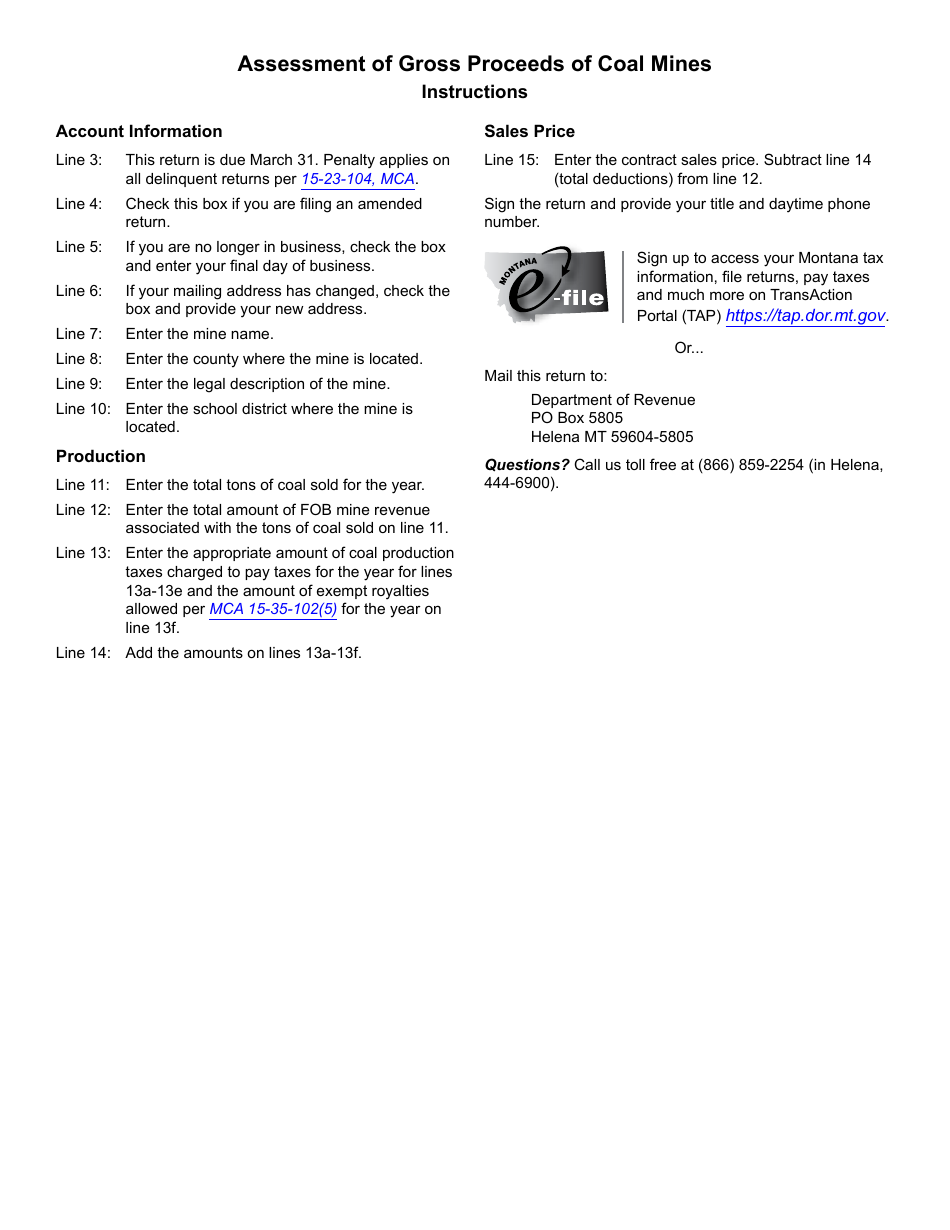

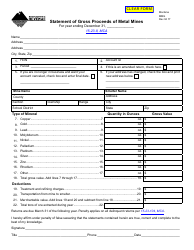

Form CGP Assessment of Gross Proceeds of Coal Mines - Montana

What Is Form CGP?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CGP Assessment of Gross Proceeds of Coal Mines?

A: The CGP Assessment of Gross Proceeds of Coal Mines is a form used in Montana to determine the taxes owed by coal mine operators based on their gross proceeds.

Q: Who needs to file the CGP Assessment form?

A: Coal mine operators in Montana need to file the CGP Assessment form.

Q: What are gross proceeds?

A: Gross proceeds refer to the total revenue generated from the sale of coal extracted from a mine.

Q: How is the CGP Assessment calculated?

A: The CGP Assessment is calculated by applying a tax rate to the gross proceeds of coal mines.

Q: What is the purpose of the CGP Assessment?

A: The purpose of the CGP Assessment is to ensure that coal mine operators in Montana pay their fair share of taxes based on the revenue they generate.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CGP by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.