This version of the form is not currently in use and is provided for reference only. Download this version of

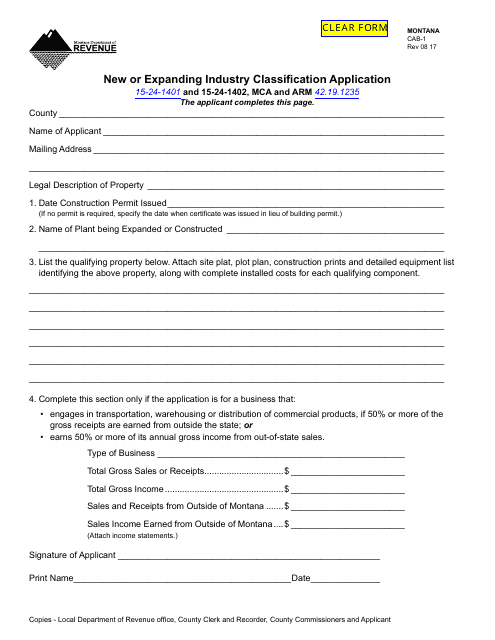

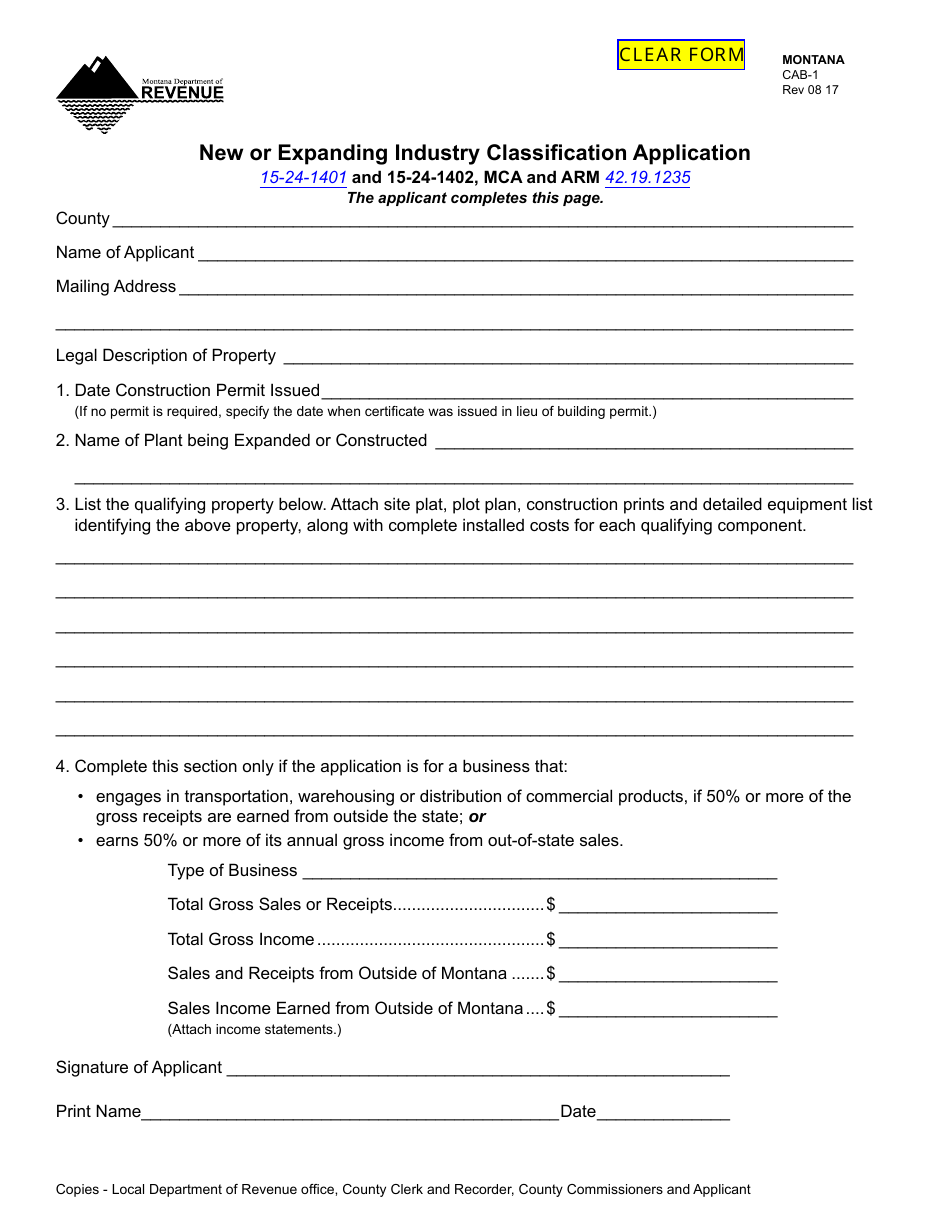

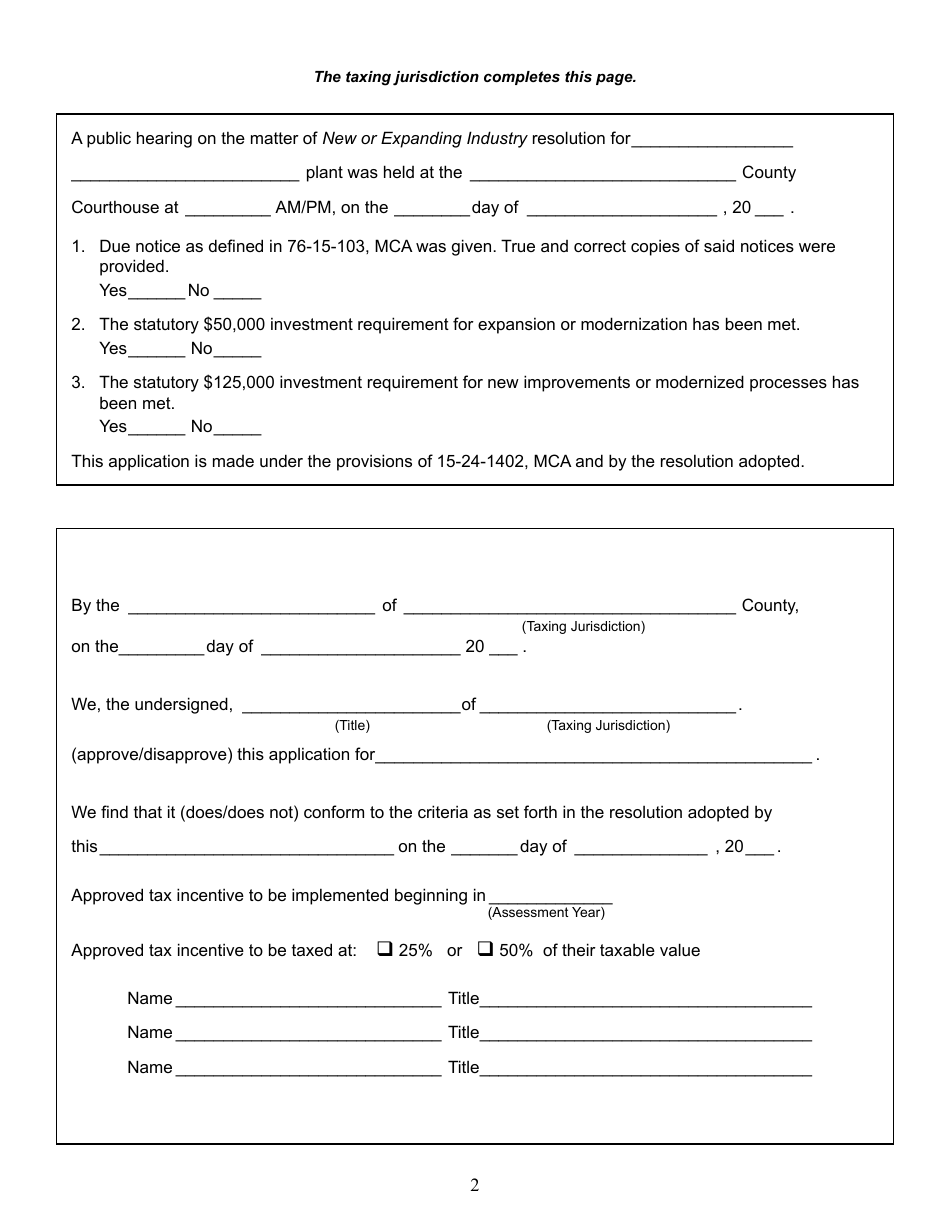

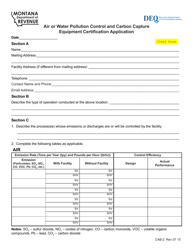

Form CAB-1

for the current year.

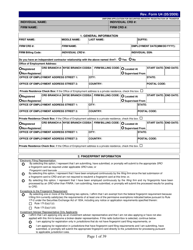

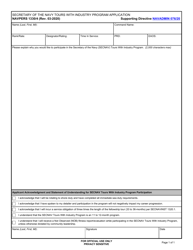

Form CAB-1 New or Expanding Industry Classification Application - Montana

What Is Form CAB-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-1?

A: CAB-1 refers to the New or Expanding Industry Classification Application form in Montana.

Q: What is the purpose of CAB-1?

A: The purpose of CAB-1 is to apply for a new or expanding industry classification in Montana.

Q: What information do I need to provide in CAB-1?

A: You will need to provide information about your new or expanding industry, including its classification and other relevant details.

Q: Are there any fees associated with CAB-1?

A: There may be fees associated with CAB-1 depending on the type and scope of your new or expanding industry.

Q: What happens after I submit CAB-1?

A: After you submit CAB-1, the appropriate Montana state agency will review your application and notify you of their decision.

Q: Is CAB-1 specific to Montana?

A: Yes, CAB-1 is specific to Montana and is used for new or expanding industry classification in the state.

Q: Can CAB-1 be used for other purposes?

A: No, CAB-1 is specifically designed for applying for a new or expanding industry classification in Montana.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.