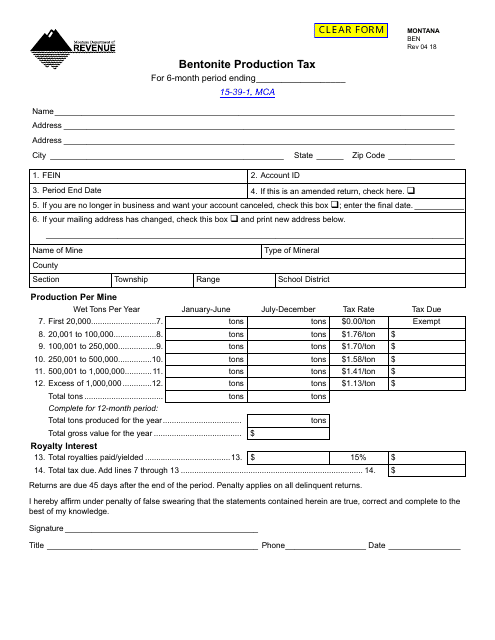

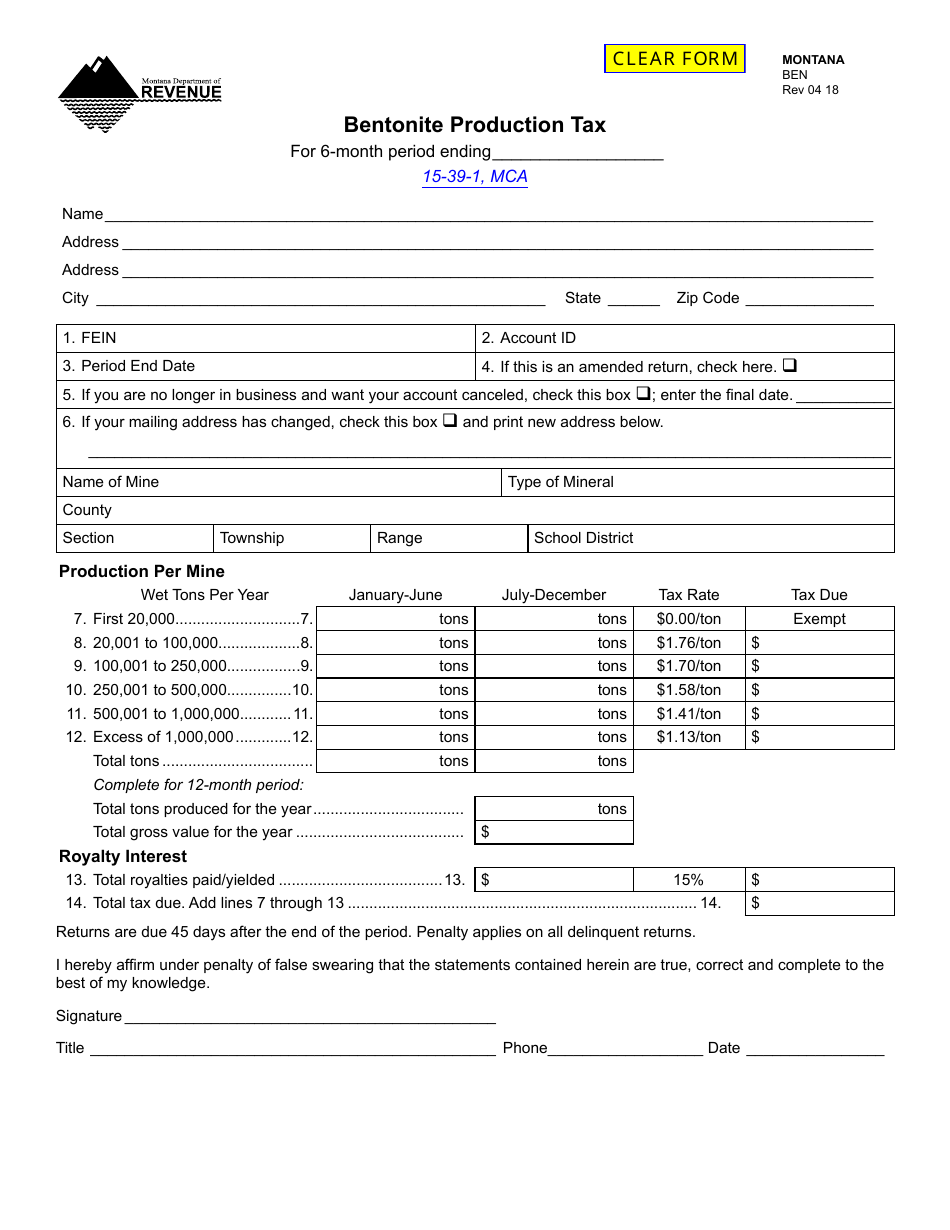

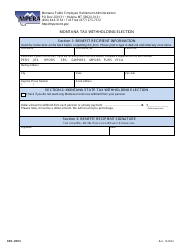

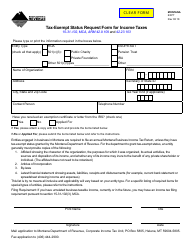

Form BEN Bentonite Production Tax - Montana

What Is Form BEN?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BEN Bentonite Production Tax in Montana?

A: The BEN Bentonite Production Tax is a tax imposed on the production of bentonite in the state of Montana.

Q: What is bentonite?

A: Bentonite is a type of clay that is used in a variety of industrial applications, including the production of drilling muds, foundry sands, and pet litter.

Q: Who is responsible for paying the BEN Bentonite Production Tax?

A: The tax is typically paid by the company or individual that is engaged in the production of bentonite in Montana.

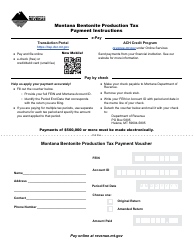

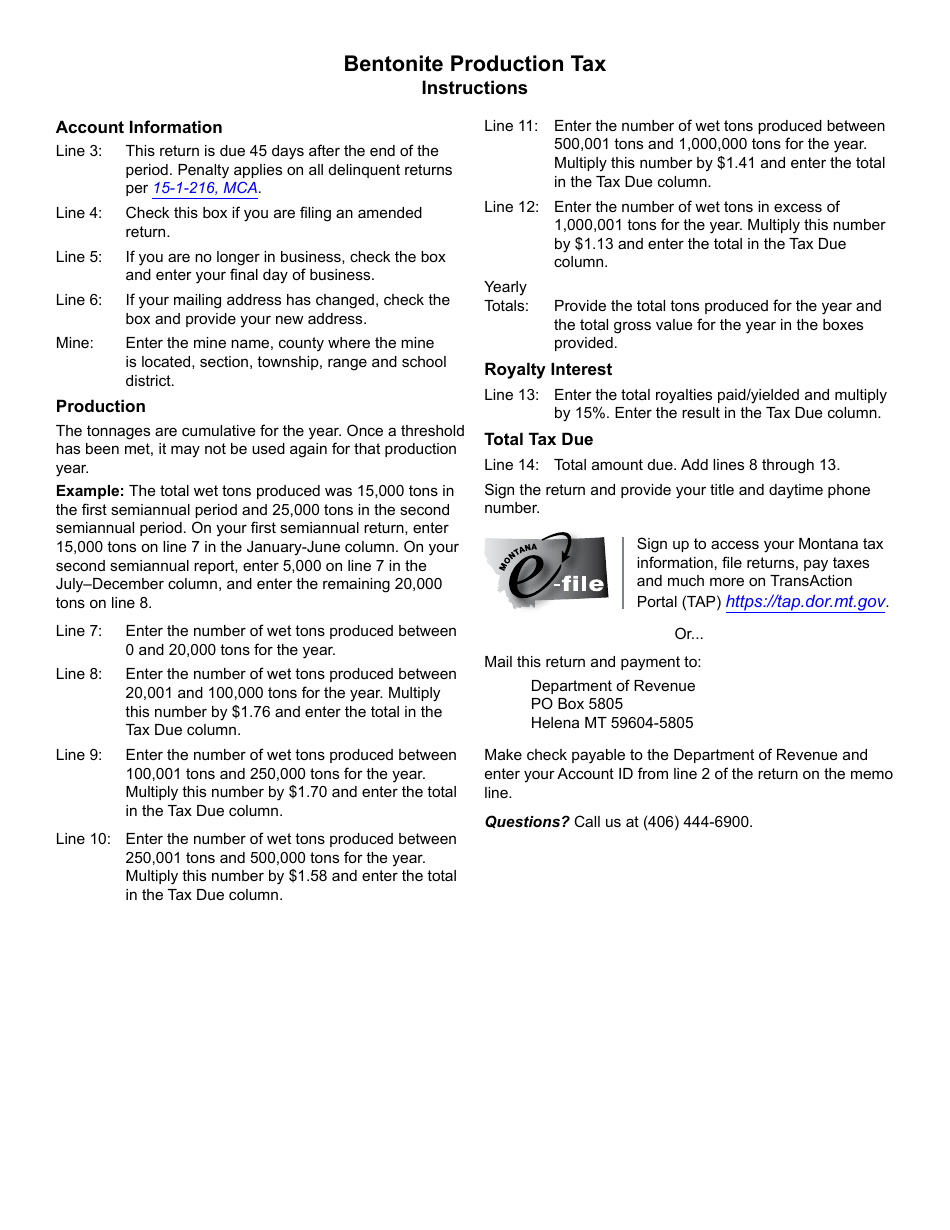

Q: How is the BEN Bentonite Production Tax calculated?

A: The tax is calculated based on the value of the bentonite produced, with different rates applied depending on the quantity produced.

Q: Are there any exemptions or deductions available for the BEN Bentonite Production Tax?

A: There may be certain exemptions or deductions available for the tax, depending on the specific circumstances and requirements set by the Montana Department of Revenue.

Q: What is the purpose of the BEN Bentonite Production Tax?

A: The tax helps to generate revenue for the state of Montana, which can be used to fund various public services and programs.

Form Details:

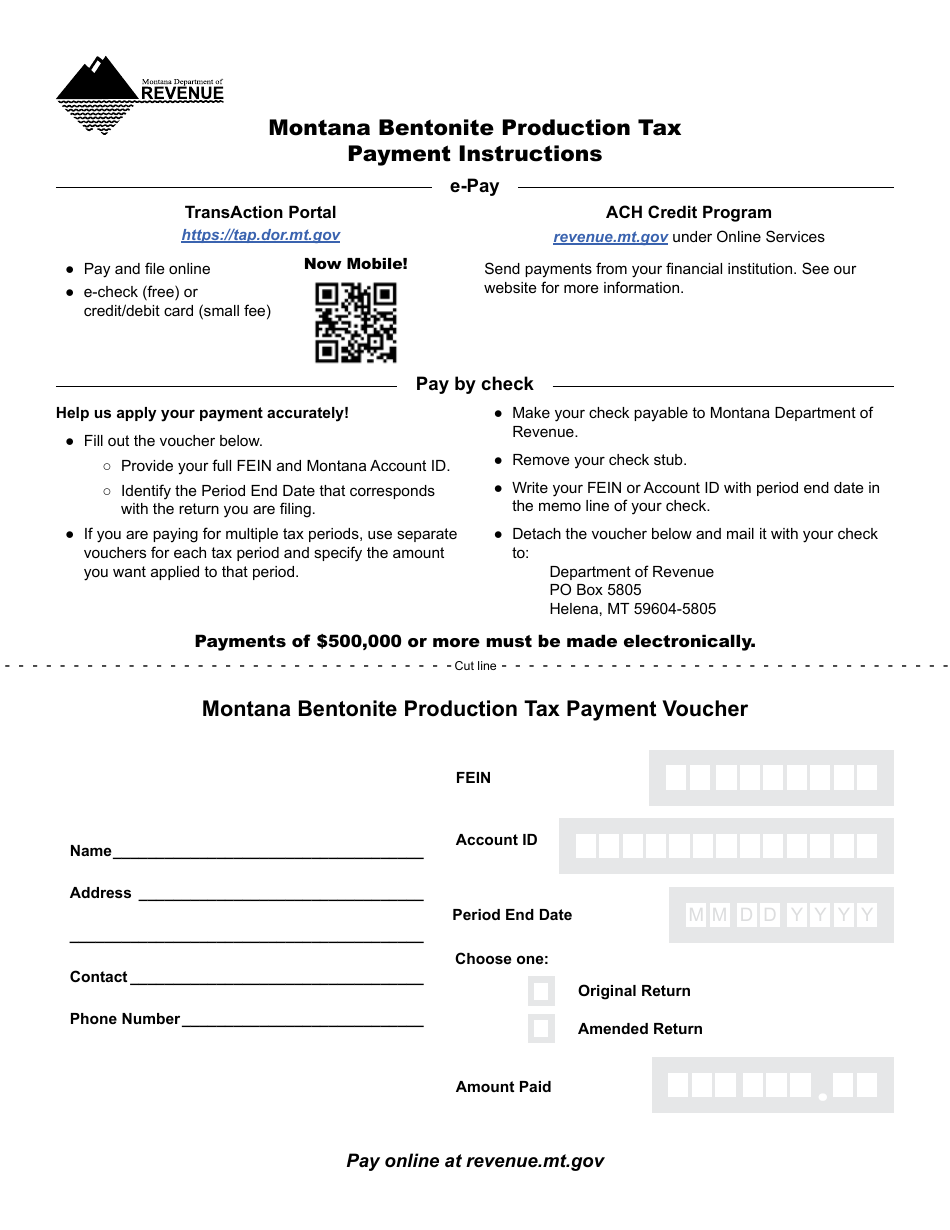

- Released on April 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BEN by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.