This version of the form is not currently in use and is provided for reference only. Download this version of

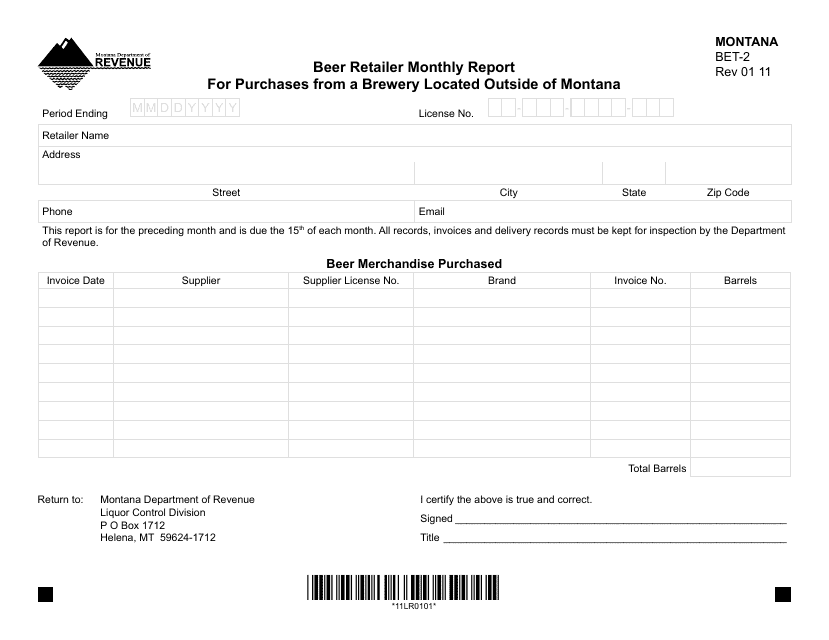

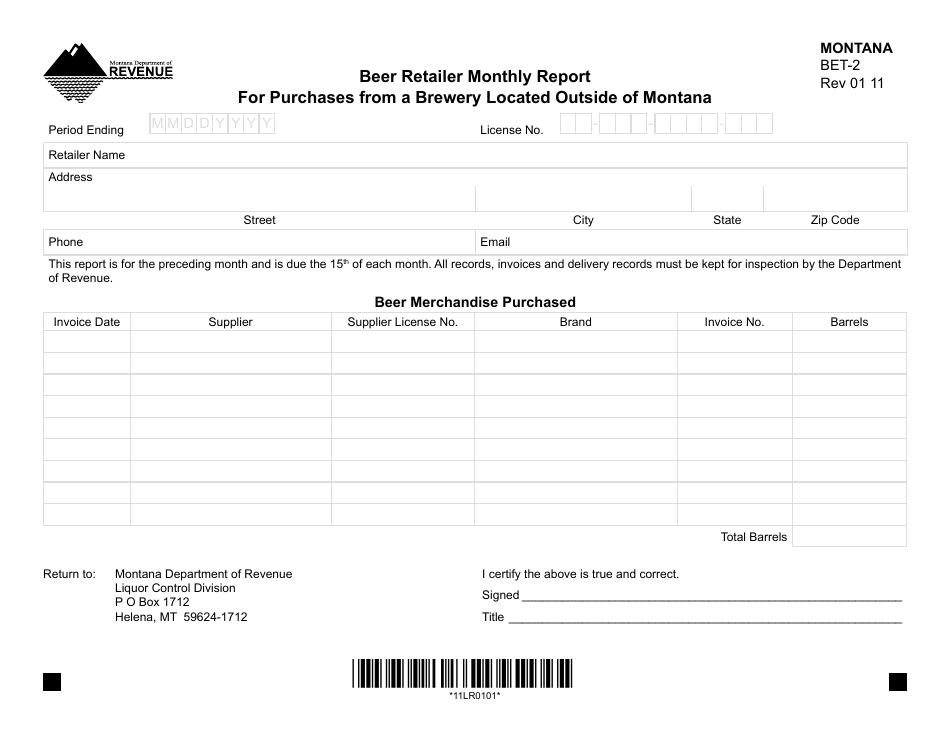

Form BET-2

for the current year.

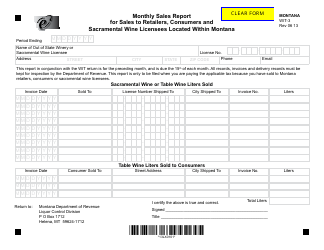

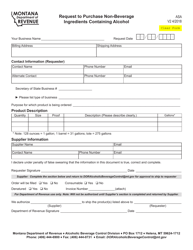

Form BET-2 Beer Retailer Monthly Report for Purchases From a Brewery Located Outside of Montana - Montana

What Is Form BET-2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BET-2 Beer Retailer Monthly Report?

A: BET-2 Beer Retailer Monthly Report is a form used by beer retailers in Montana to report their monthly beer purchases from a brewery located outside of Montana.

Q: Who needs to file the BET-2 Beer Retailer Monthly Report?

A: Beer retailers in Montana who make purchases from a brewery located outside of Montana need to file the BET-2 Beer Retailer Monthly Report.

Q: What information is required in the BET-2 Beer Retailer Monthly Report?

A: The BET-2 Beer Retailer Monthly Report requires information such as the name and address of the brewery, the type and brand of beer purchased, the quantity purchased, and the purchase price.

Q: How often do beer retailers need to file the BET-2 Beer Retailer Monthly Report?

A: Beer retailers in Montana need to file the BET-2 Beer Retailer Monthly Report on a monthly basis.

Q: Are there any penalties for not filing the BET-2 Beer Retailer Monthly Report?

A: Yes, there are penalties for not filing the BET-2 Beer Retailer Monthly Report, including possible suspension or revocation of the beer retailer's license.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BET-2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.