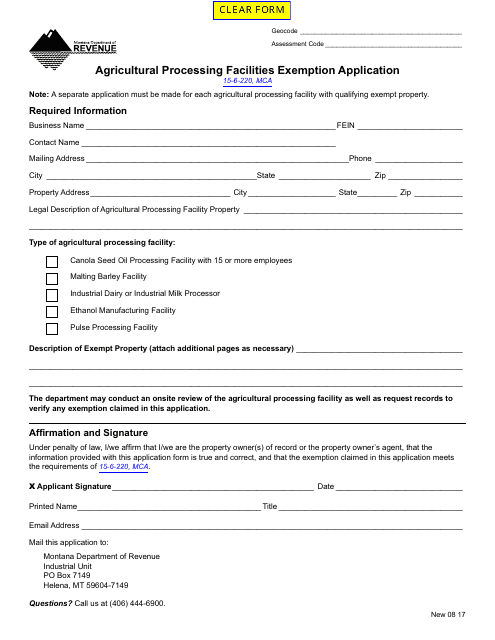

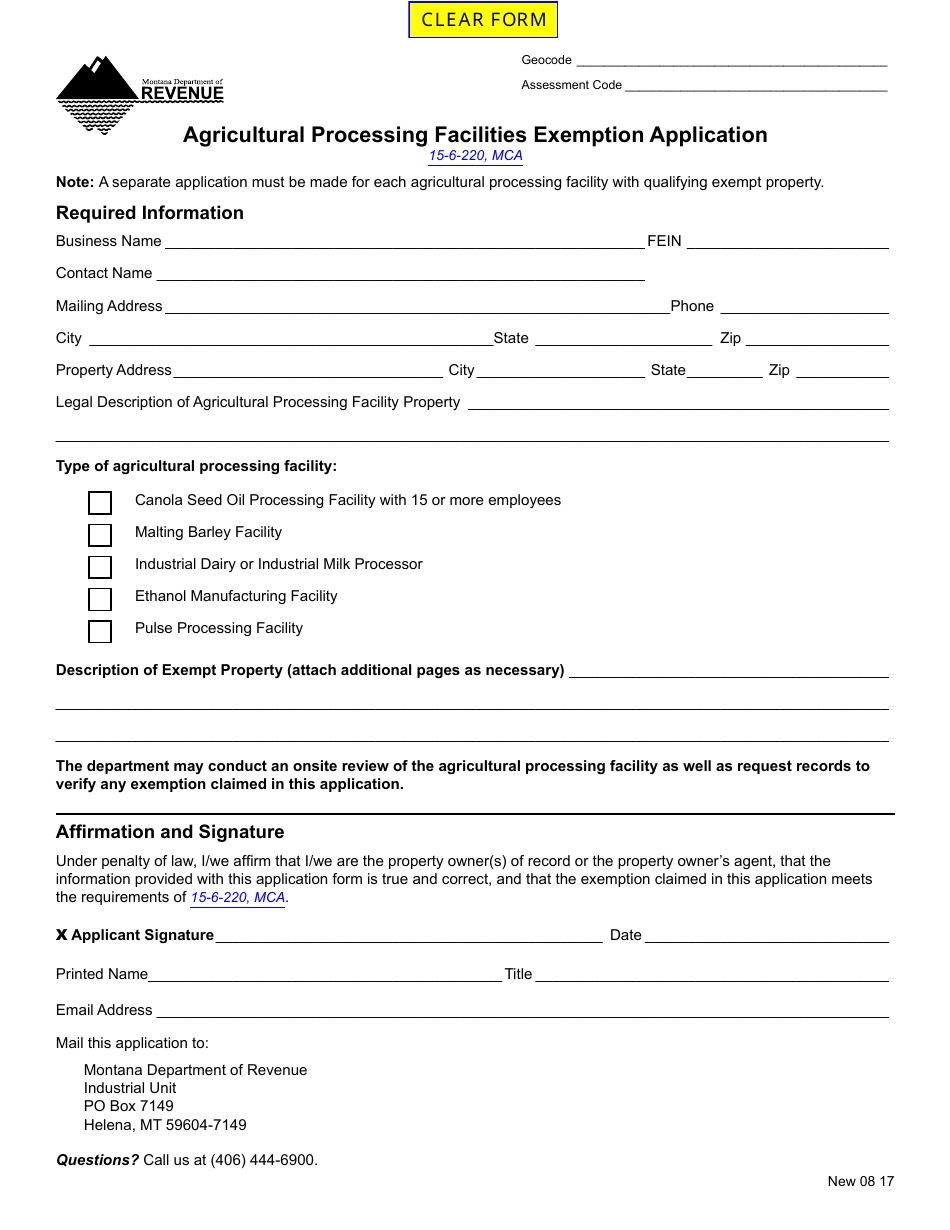

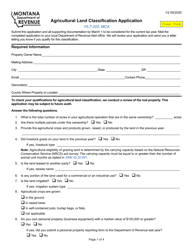

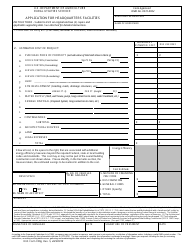

Agricultural Processing Facilities Exemption Application Form - Montana

Agricultural Processing Facilities Exemption Application Form is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is the Agricultural Processing Facilities Exemption Application Form?

A: It is a form used in Montana to apply for an exemption for agricultural processing facilities.

Q: Who can apply for the exemption?

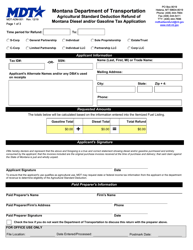

A: Any individual, partnership, corporation, or cooperative engaged in agricultural processing can apply.

Q: What does the exemption allow?

A: The exemption allows eligible agricultural processing facilities to be exempt from certain taxes and fees.

Q: What taxes and fees are exempted?

A: The exemption applies to property taxes, income taxes, sales taxes, and certain other fees.

Q: Are there any eligibility criteria for the exemption?

A: Yes, the facility must meet certain criteria related to agricultural processing and production.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted by a specific deadline, typically annually.

Q: Is there a fee for filing the application?

A: No, there is no fee for filing the application.

Q: What documents should be included with the application?

A: You may need to include documents such as financial statements, business plans, and proof of agricultural processing activities.

Form Details:

- Released on August 1, 2017;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.