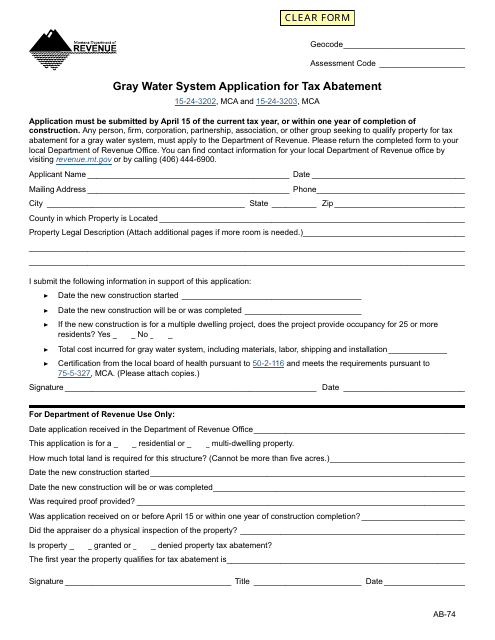

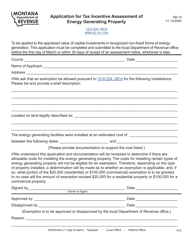

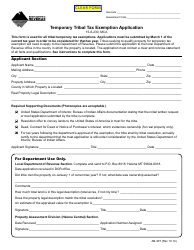

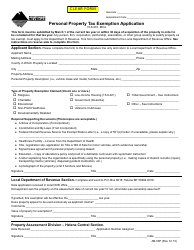

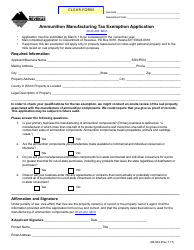

Form AB-74 Gray Water System Application for Tax Abatement - Montana

What Is Form AB-74?

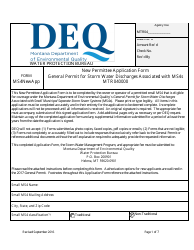

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-74?

A: Form AB-74 is the Gray Water System Application for Tax Abatement in Montana.

Q: What is a gray water system?

A: A gray water system is a system that collects and treats wastewater from sources like sinks, showers, and laundry machines for reuse, typically for non-potable purposes.

Q: What is tax abatement?

A: Tax abatement refers to a reduction or elimination of taxes, typically for a specified period of time, offered as an incentive to encourage certain behaviors or investments.

Q: How can I use Form AB-74?

A: You can use Form AB-74 to apply for tax abatement for installing a gray water system in Montana.

Q: Who is eligible for tax abatement with Form AB-74?

A: Property owners in Montana who install a gray water system may be eligible for tax abatement.

Q: What is the purpose of the tax abatement?

A: The purpose of the tax abatement is to promote the use of gray water systems, which can help conserve water and reduce strain on water resources.

Q: Are gray water systems legal in Montana?

A: Yes, gray water systems are legal in Montana, and the state encourages their installation through tax abatement incentives.

Q: What are the benefits of installing a gray water system?

A: Installing a gray water system can help conserve water, reduce water bills, and lessen the environmental impact of wastewater disposal.

Q: What other requirements or considerations are there for tax abatement with Form AB-74?

A: It is important to review the specific requirements and guidelines outlined in Form AB-74 and consult with the Montana Department of Revenue to ensure eligibility and compliance.

Form Details:

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-74 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.