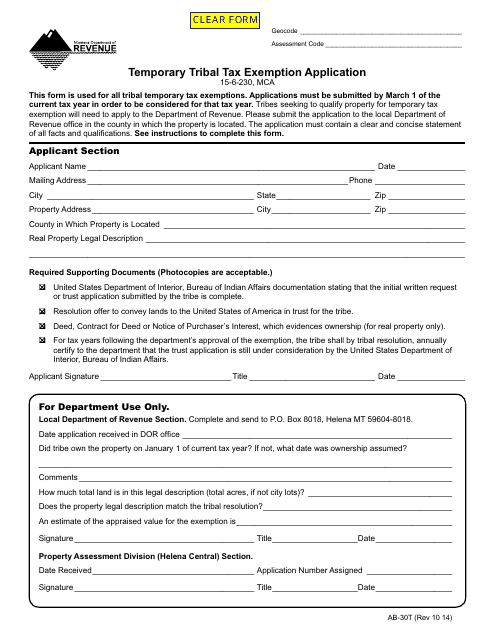

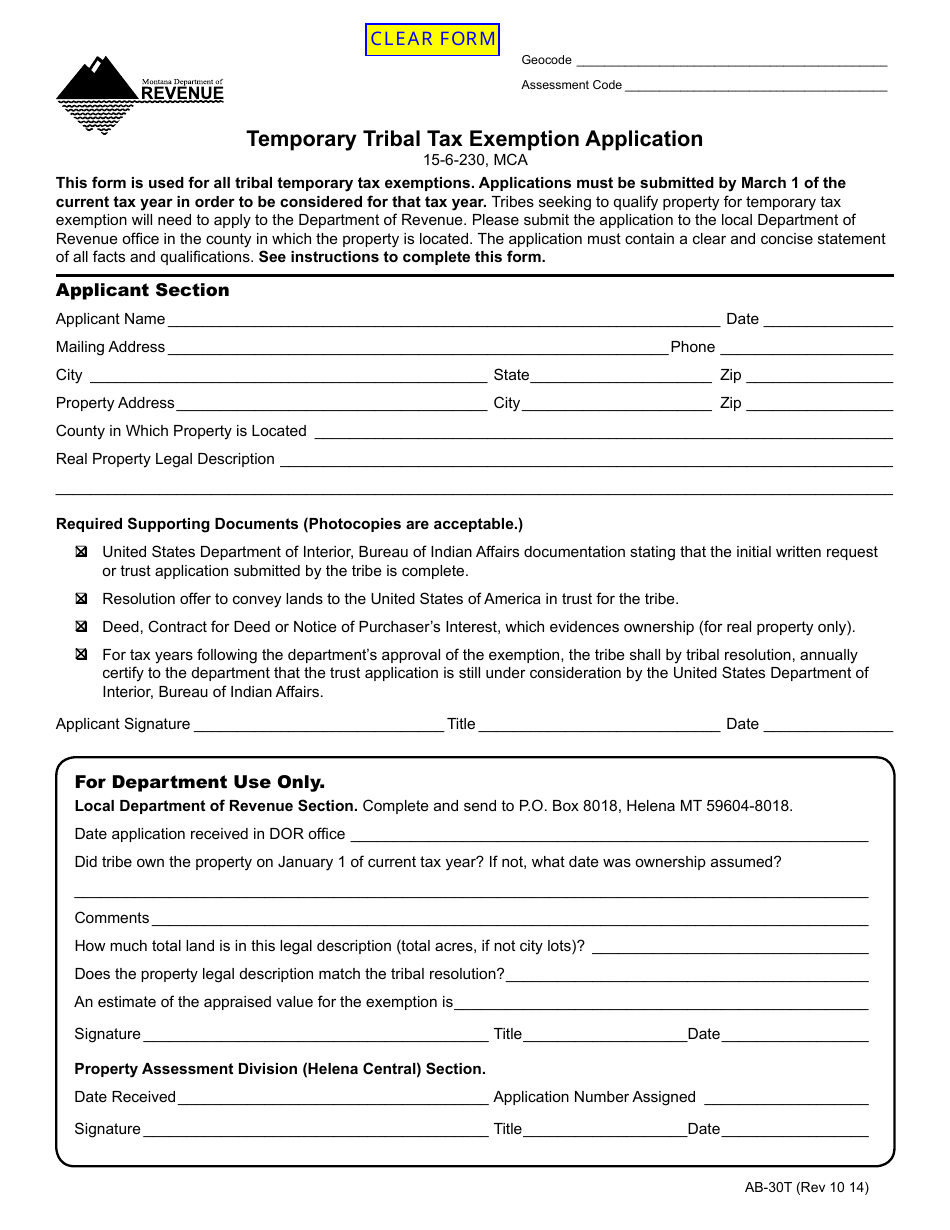

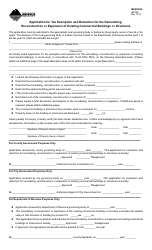

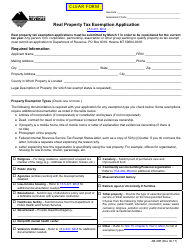

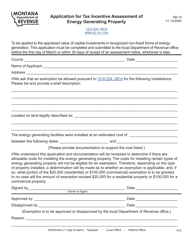

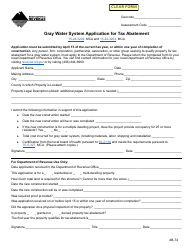

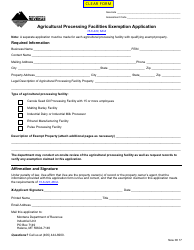

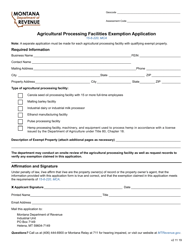

Form AB-30T Temporary Tribal Tax Exemption Application - Montana

What Is Form AB-30T?

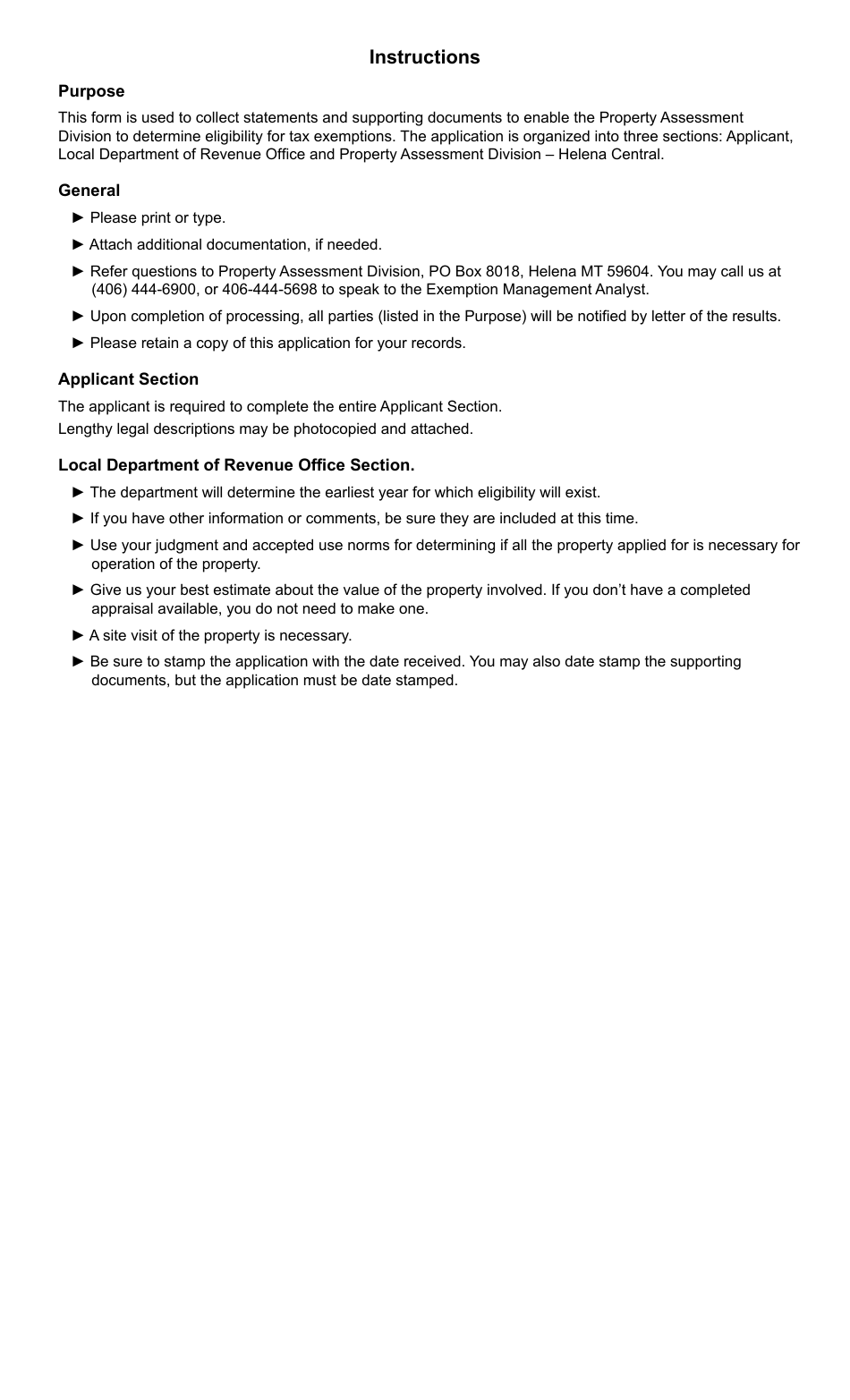

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-30T?

A: Form AB-30T is the Temporary Tribal Tax Exemption Application in Montana.

Q: What is the purpose of Form AB-30T?

A: The purpose of Form AB-30T is to apply for a temporary tax exemption on tribal lands in Montana.

Q: Who needs to fill out Form AB-30T?

A: Individuals or businesses conducting temporary activities on tribal lands in Montana need to fill out Form AB-30T.

Q: Is there a deadline for submitting Form AB-30T?

A: Yes, Form AB-30T must be submitted at least 15 days before the temporary activity begins.

Q: Do I have to pay taxes if my application is approved?

A: No, if your application is approved, you will be exempt from paying state and local taxes on the temporary activity.

Q: How long does the tax exemption last?

A: The tax exemption granted through Form AB-30T is valid for the duration of the temporary activity, up to 90 days.

Q: Can I apply for multiple temporary tax exemptions?

A: Yes, you can apply for multiple temporary tax exemptions using separate Form AB-30T applications for each activity.

Q: What should I do if there are changes to my temporary activity?

A: If there are any changes to your temporary activity, you must notify the Montana Department of Revenue within 15 days.

Q: Can I cancel my tax exemption once it's been approved?

A: No, once the tax exemption is approved, it cannot be canceled.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-30T by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.