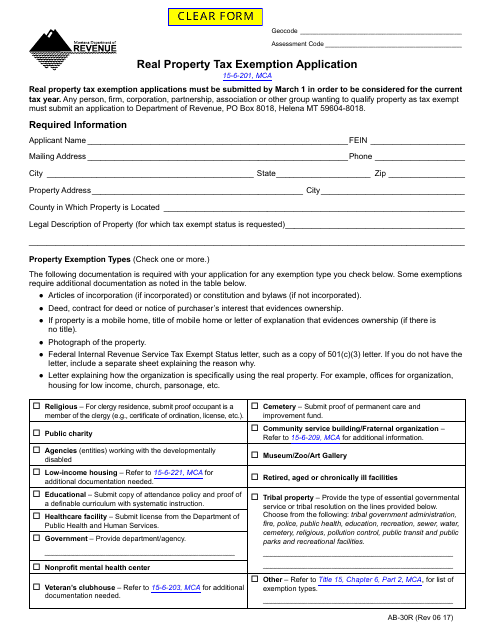

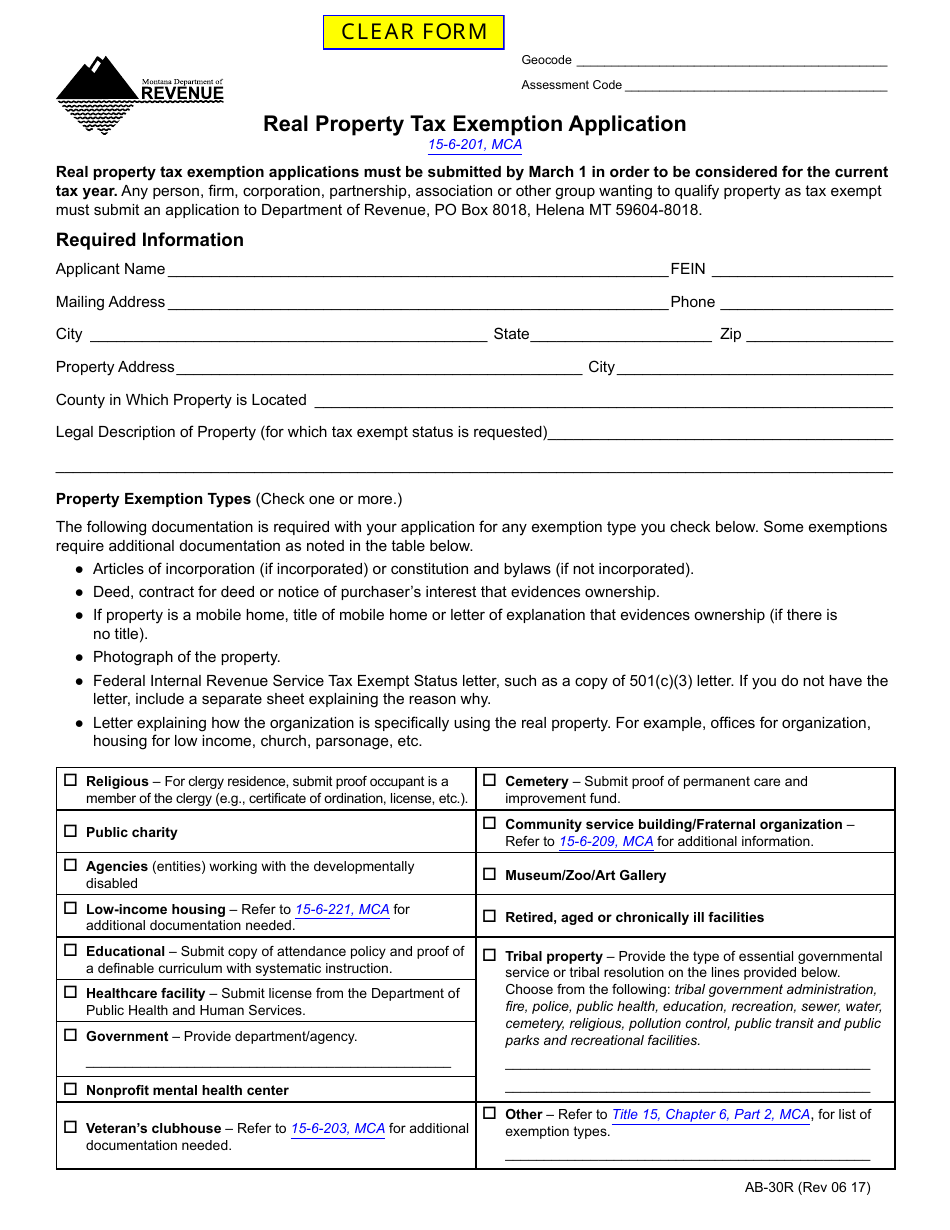

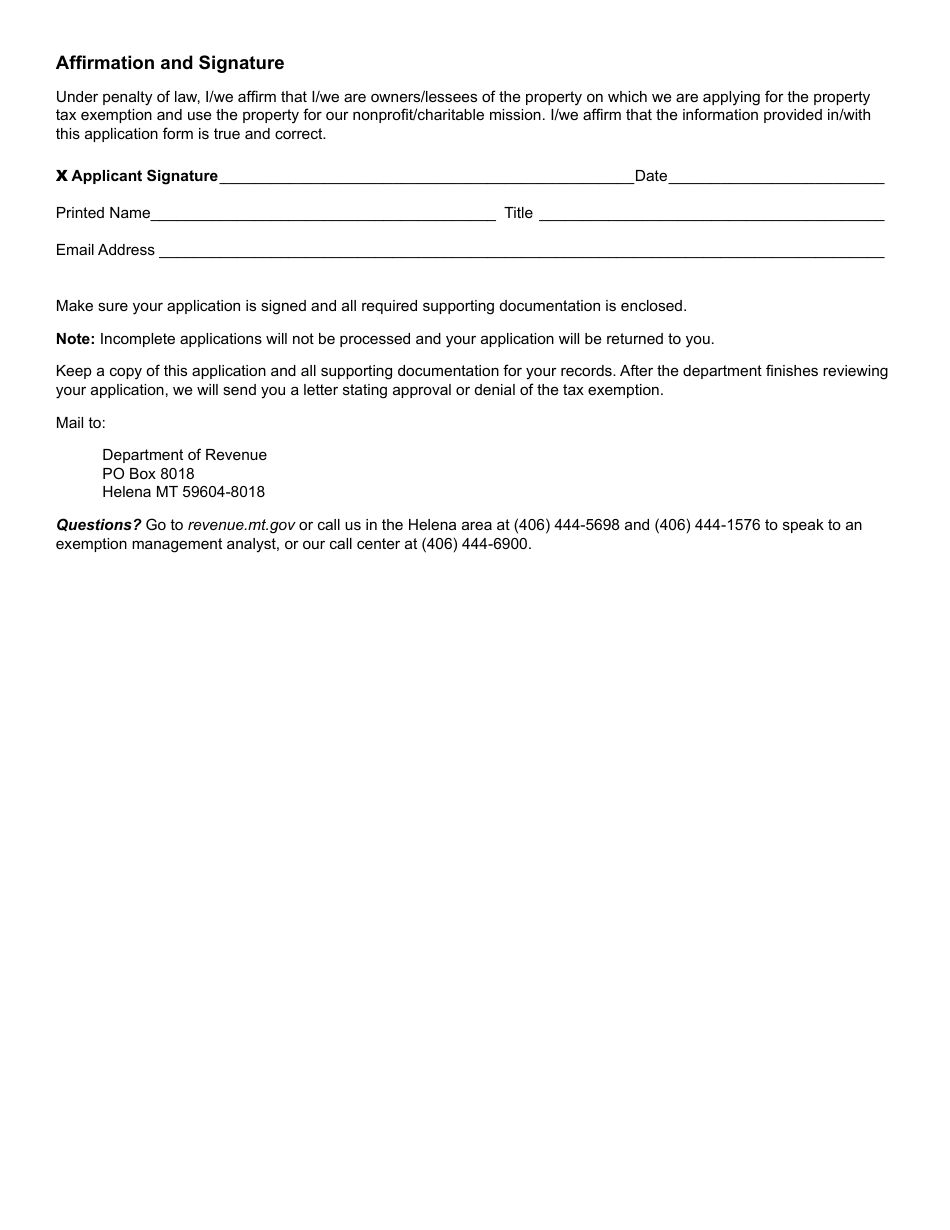

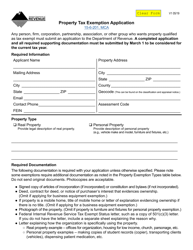

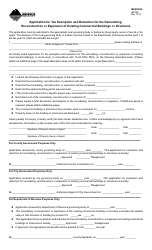

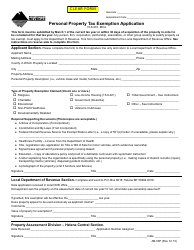

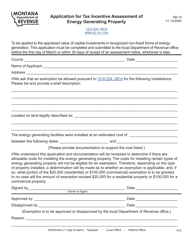

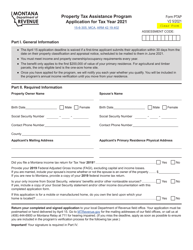

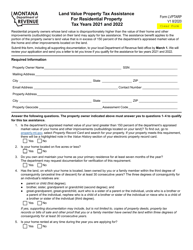

Form AB-30R Real Property Tax Exemption Application - Montana

What Is Form AB-30R?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AB-30R?

A: Form AB-30R is the Real Property Tax Exemption Application in Montana.

Q: What is the purpose of form AB-30R?

A: Form AB-30R is used to apply for a real property tax exemption in Montana.

Q: Who needs to fill out form AB-30R?

A: Property owners in Montana who wish to apply for a real property tax exemption need to fill out form AB-30R.

Q: What information do I need to provide on form AB-30R?

A: You will need to provide information about the property, including its location, use, and ownership information.

Q: Are there any fees associated with filing form AB-30R?

A: There is no fee to file form AB-30R.

Q: When is the deadline to file form AB-30R?

A: The deadline to file form AB-30R is typically April 15th of each year.

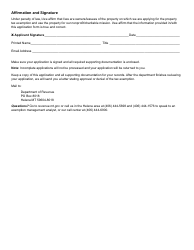

Q: What happens after I submit form AB-30R?

A: After you submit form AB-30R, the county assessor's office will review your application and determine if you qualify for a real property tax exemption.

Q: How long does it take to hear back about my application?

A: The processing time for real property tax exemption applications varies, but you can expect to hear back within a few weeks.

Q: What should I do if my application is approved?

A: If your application is approved, you will receive a notice from the county assessor's office and your property will be exempt from real property taxes.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-30R by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.