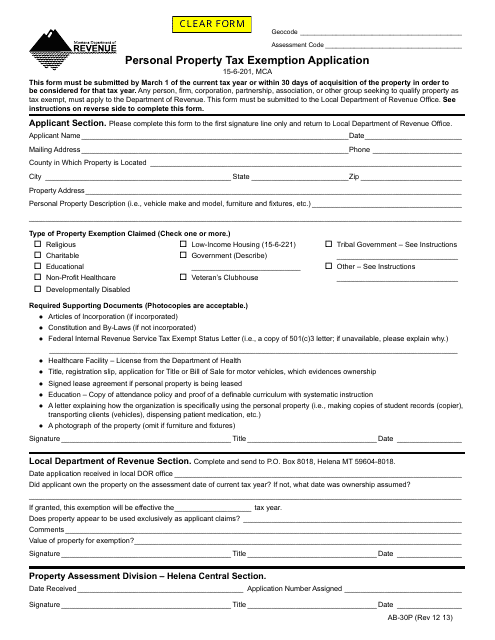

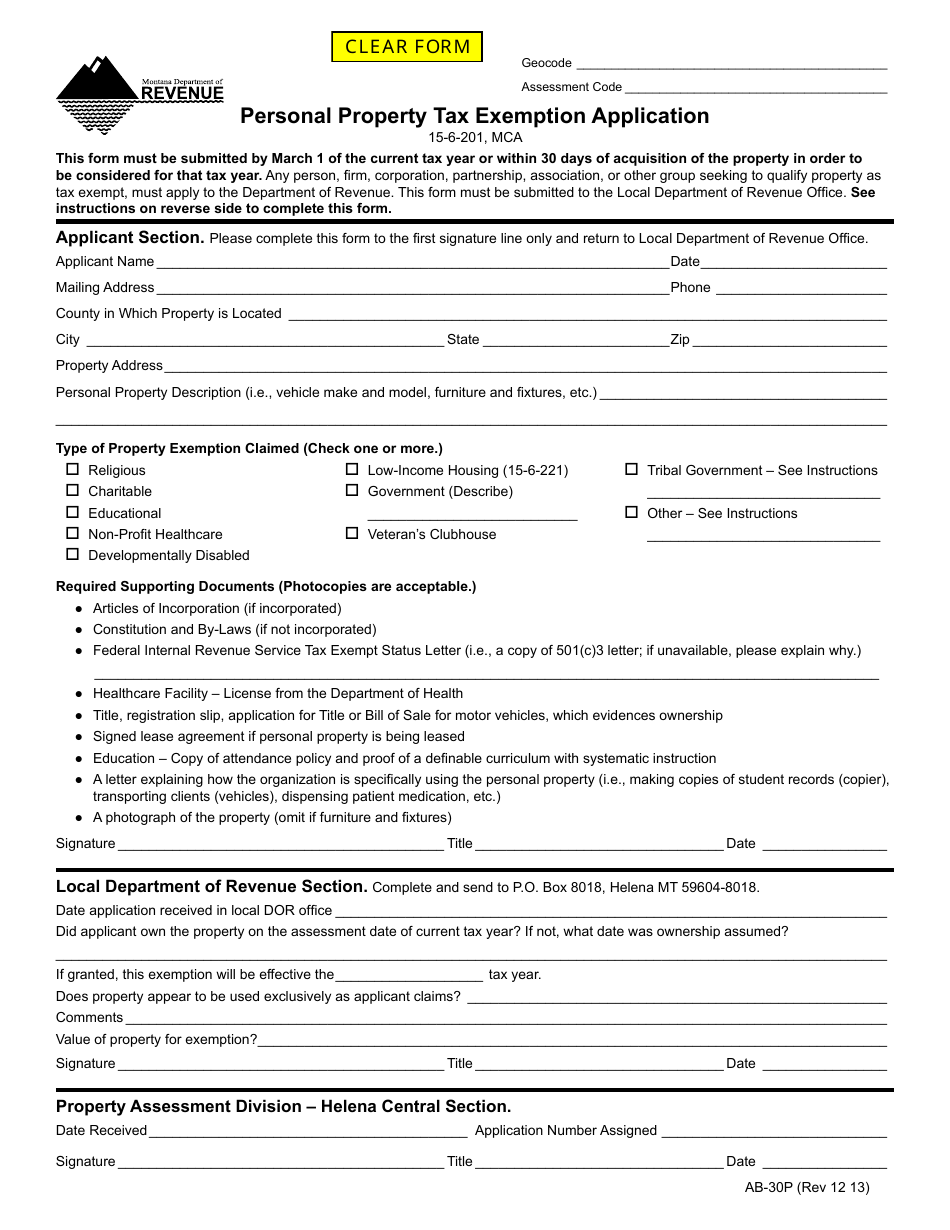

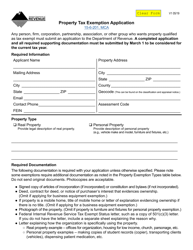

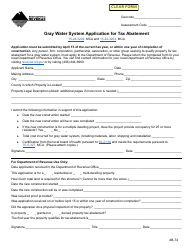

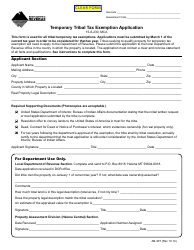

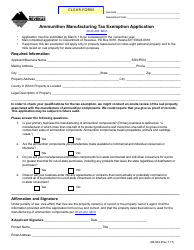

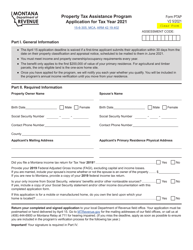

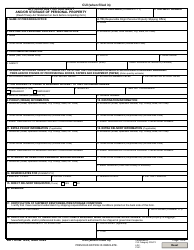

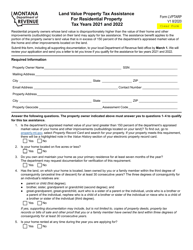

Form AB-30P Personal Property Tax Exemption Application - Montana

What Is Form AB-30P?

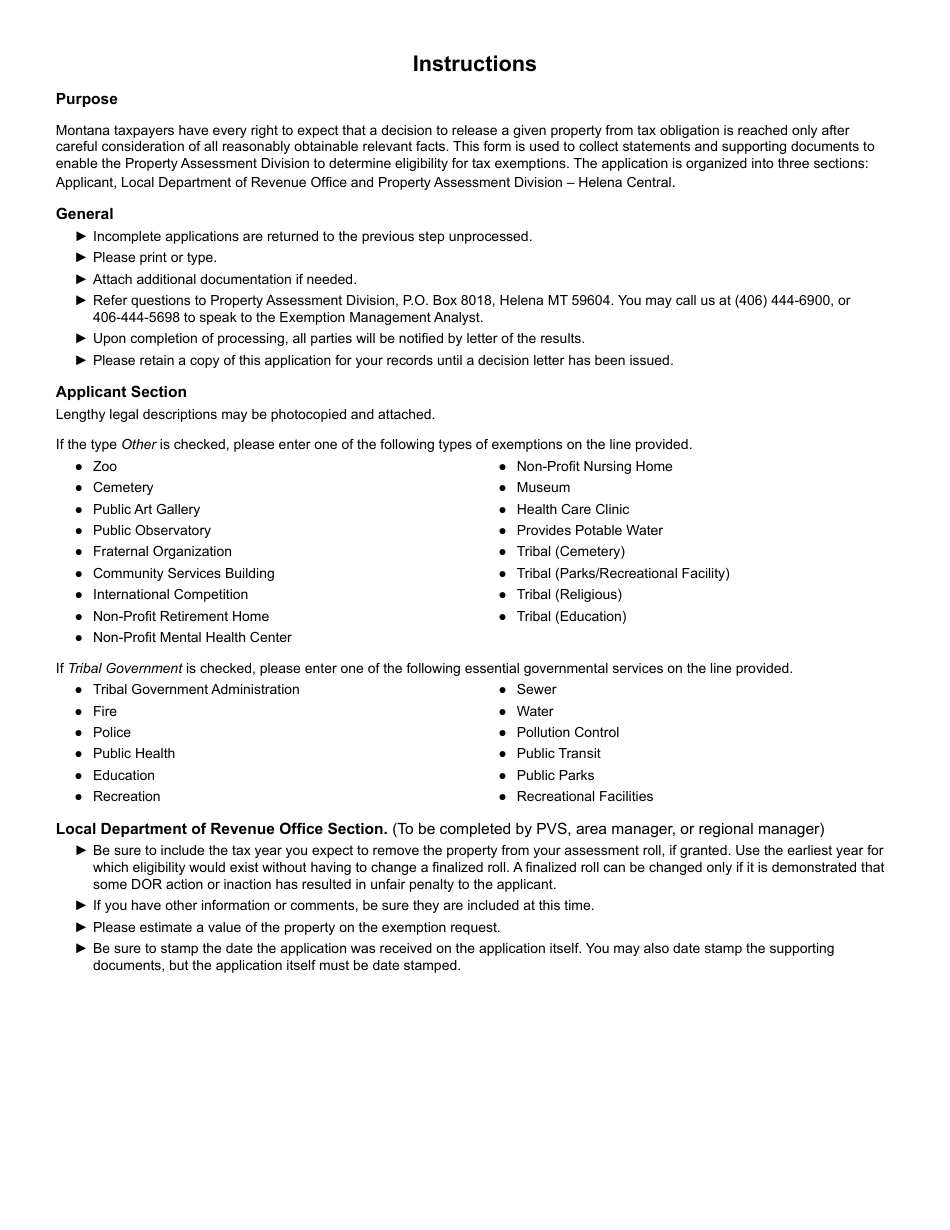

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AB-30P Personal Property Tax Exemption Application?

A: The AB-30P is an application form for personal property tax exemption in Montana.

Q: Who is eligible to apply for the Personal Property Tax Exemption?

A: Montana residents who meet certain criteria may be eligible to apply for the exemption.

Q: What is the purpose of the Personal Property Tax Exemption?

A: The exemption is designed to provide relief from paying taxes on personal property in Montana.

Q: What documents do I need to submit with the AB-30P application?

A: The application requires supporting documentation such as proof of residency and a detailed list of the personal property for which exemption is being sought.

Q: Is there a deadline for submitting the Personal Property Tax Exemption Application?

A: Yes, the application must be submitted by the specified deadline, usually before the tax year begins.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-30P by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.