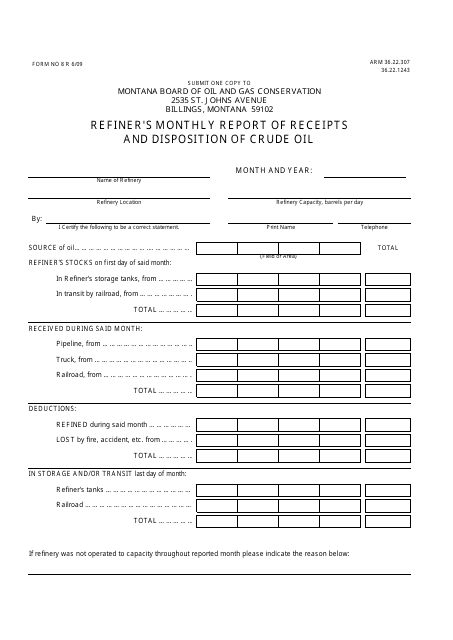

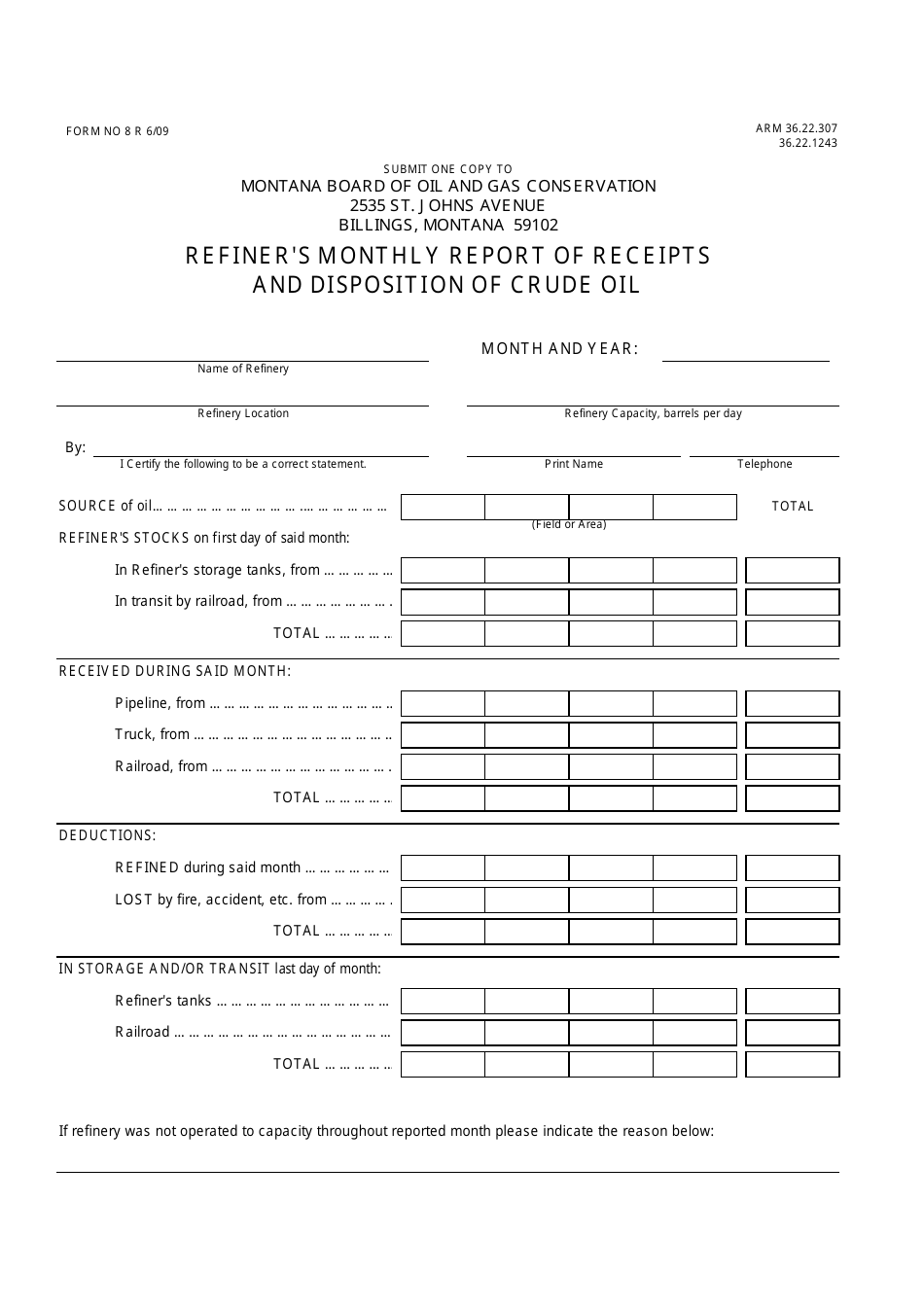

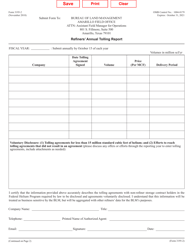

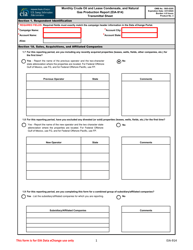

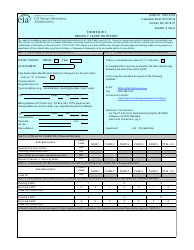

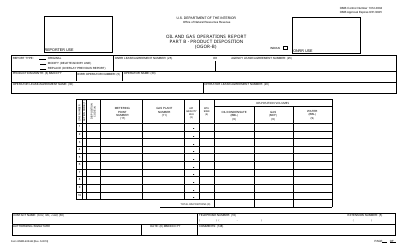

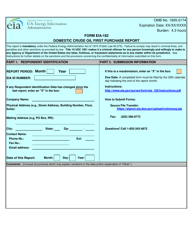

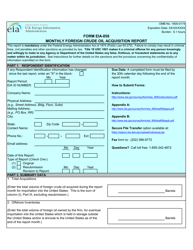

Form 8 Refiner's Monthly Report of Receipts and Disposition of Crude Oil - Montana

What Is Form 8?

This is a legal form that was released by the Montana Department of Natural Resources and Conservation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8?

A: Form 8 is a Refiner's Monthly Report of Receipts and Disposition of Crude Oil.

Q: Who needs to file Form 8?

A: Refiners of crude oil in Montana need to file Form 8.

Q: What is the purpose of Form 8?

A: The purpose of Form 8 is to track and report the receipts and disposition of crude oil by refiners in Montana.

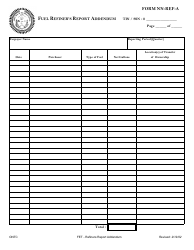

Q: What information is required on Form 8?

A: Form 8 requires refiners to report details such as the quantity and source of crude oil received, as well as the disposition of crude oil through refining, sale, or other means.

Q: How often should Form 8 be filed?

A: Form 8 needs to be filed monthly.

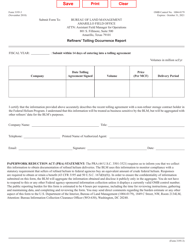

Q: Are there any penalties for not filing Form 8?

A: Failure to file Form 8 or providing false information may result in penalties and fines.

Q: Is there a deadline for filing Form 8?

A: Yes, there is a deadline for filing Form 8. The specific deadline should be stated in the instructions or guidelines provided by the regulatory authority.

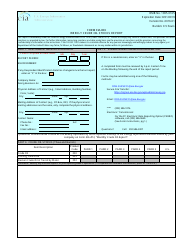

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Montana Department of Natural Resources and Conservation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8 by clicking the link below or browse more documents and templates provided by the Montana Department of Natural Resources and Conservation.