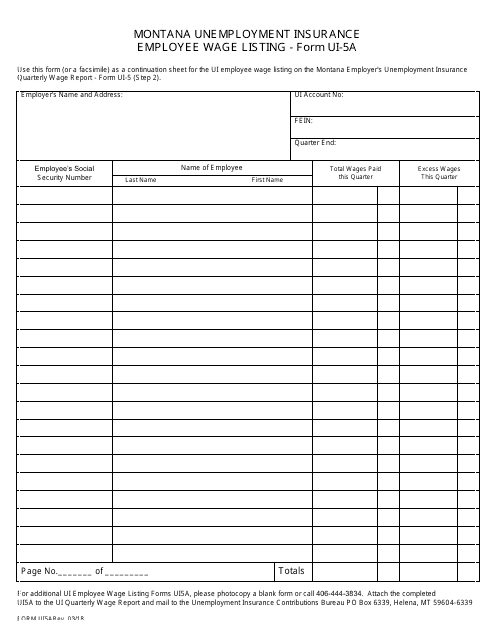

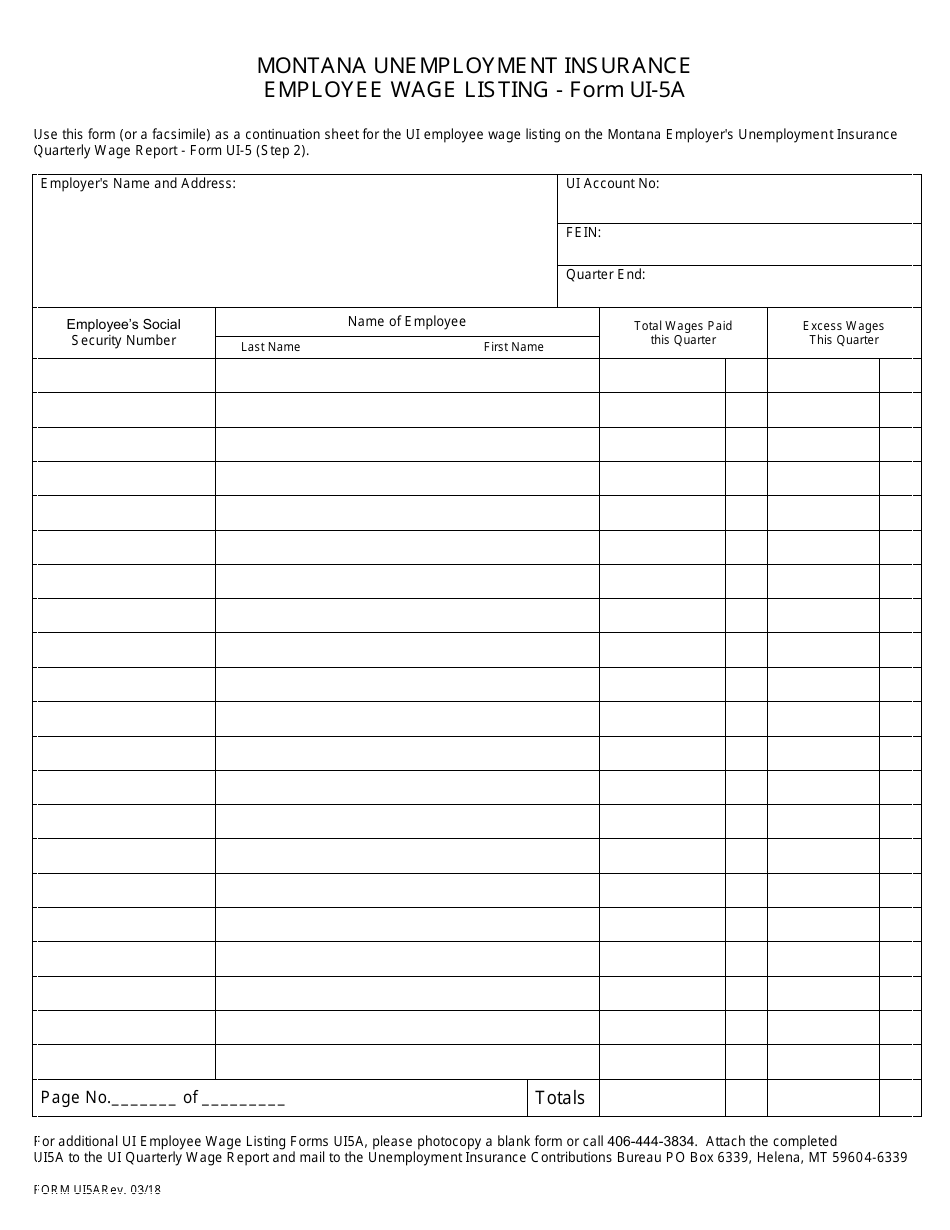

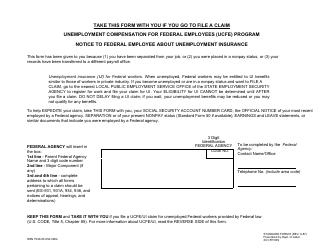

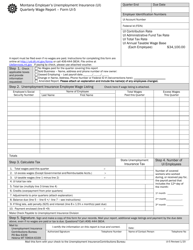

Form UI-5A Montana Unemployment Insurance Employee Wage Listing - Montana

What Is Form UI-5A?

This is a legal form that was released by the Montana Department of Labor and Industry - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the UI-5A Montana Unemployment Insurance Employee Wage Listing Form?

A: The UI-5A Form is a document used in Montana to report employee wages for unemployment insurance purposes.

Q: Who needs to file the UI-5A form?

A: Employers in Montana are required to file the UI-5A form to report employee wages for unemployment insurance.

Q: When is the UI-5A form due?

A: The UI-5A form is typically due quarterly, with specific due dates provided by the Montana Department of Labor and Industry.

Q: What information is required on the UI-5A form?

A: The UI-5A form requires employer information, employee information, and wage details for each employee.

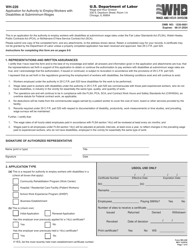

Q: Are there any penalties for not filing the UI-5A form?

A: Yes, failure to file the UI-5A form or providing false information may result in penalties imposed by the Montana Department of Labor and Industry.

Q: Can I request an extension for filing the UI-5A form?

A: Yes, employers can request an extension for filing the UI-5A form with the Montana Department of Labor and Industry.

Q: Is the UI-5A form only for employees in Montana?

A: Yes, the UI-5A form is specifically for reporting employee wages in Montana for unemployment insurance purposes.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Montana Department of Labor and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UI-5A by clicking the link below or browse more documents and templates provided by the Montana Department of Labor and Industry.