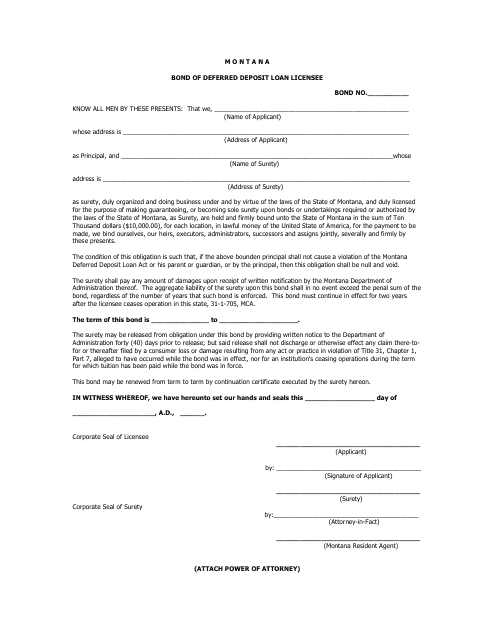

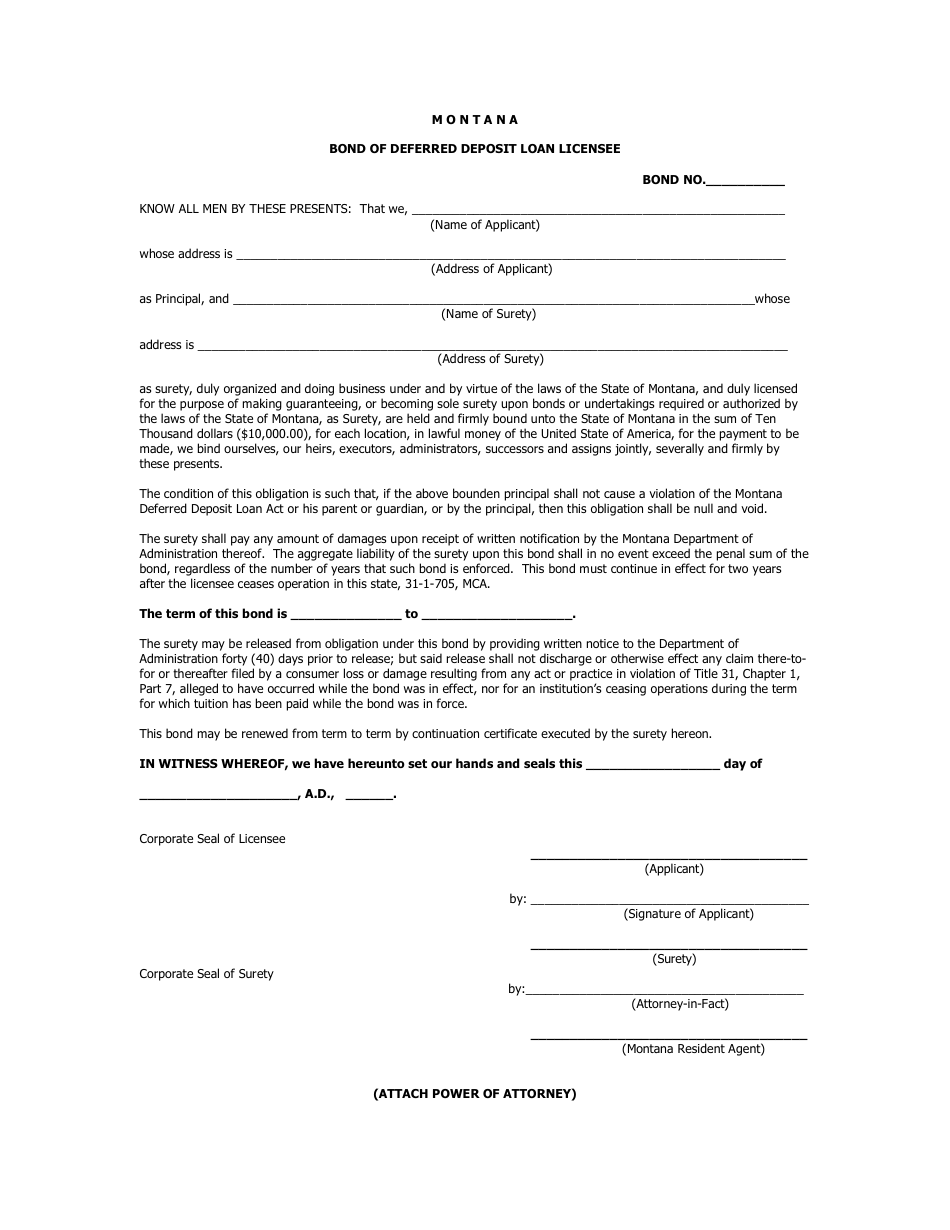

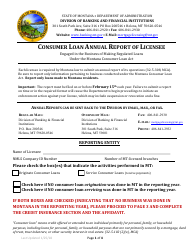

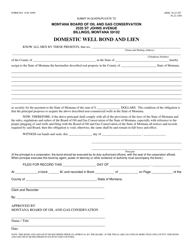

Bond of Deferred Deposit Loan Licensee - Montana

Bond of Deferred Deposit Loan Licensee is a legal document that was released by the Montana Department of Administration - a government authority operating within Montana.

FAQ

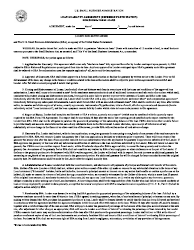

Q: What is a Bond of Deferred Deposit Loan Licensee in Montana?

A: A Bond of Deferred Deposit Loan Licensee is a type of surety bond required for businesses that offer deferred deposit loans (also known as payday loans) in the state of Montana.

Q: Why is a Bond of Deferred Deposit Loan Licensee required in Montana?

A: The bond is required to provide financial protection to consumers who obtain payday loans from licensed businesses in Montana. It ensures that the licensee will comply with all applicable laws and regulations.

Q: Who needs to obtain a Bond of Deferred Deposit Loan Licensee in Montana?

A: Any business that wants to offer deferred deposit loans in Montana needs to obtain this bond. This includes payday loan lenders and financial institutions offering these services.

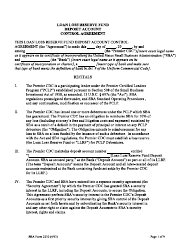

Q: How much does a Bond of Deferred Deposit Loan Licensee cost in Montana?

A: The cost of the bond varies depending on factors such as the loan amount and the financial strength of the applicant. Generally, the premium ranges from 1% to 10% of the bond amount.

Q: How can a business obtain a Bond of Deferred Deposit Loan Licensee in Montana?

A: To obtain this bond, a business must apply through a licensed surety bond provider. The business will need to provide certain financial and business information, and undergo a review process to determine eligibility.

Form Details:

- The latest edition currently provided by the Montana Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Administration.