This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

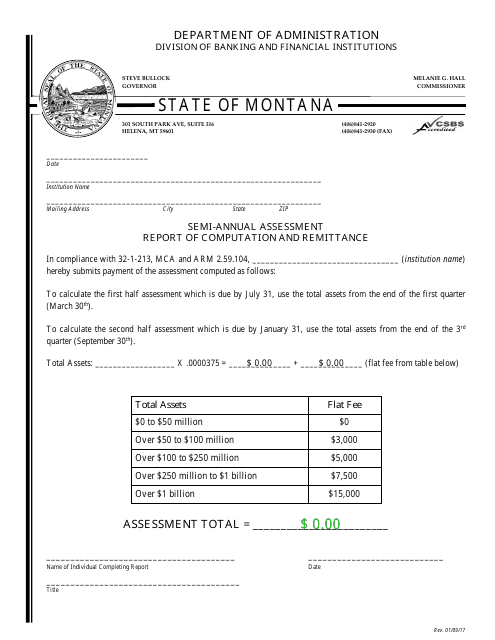

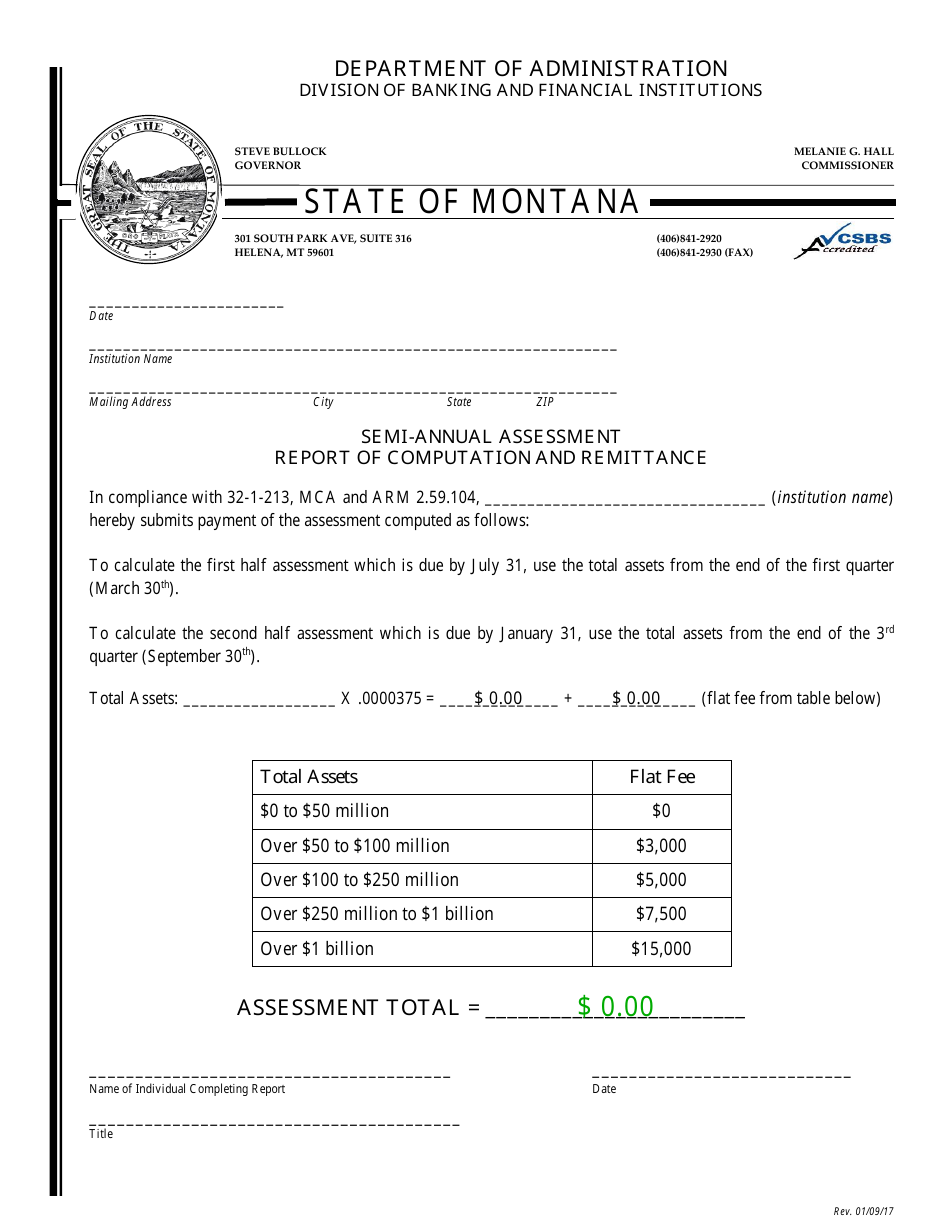

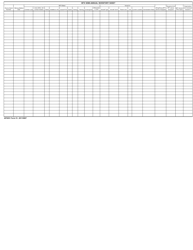

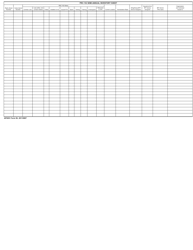

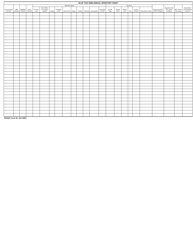

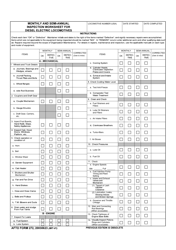

Semi-annual Assessment Report of Computation and Remittance - Montana

Semi-annual Assessment Report of Computation and Remittance is a legal document that was released by the Montana Department of Administration - a government authority operating within Montana.

FAQ

Q: What is the Semi-annual Assessment Report of Computation and Remittance?

A: The Semi-annual Assessment Report of Computation and Remittance is a report that needs to be filed by certain businesses in Montana.

Q: Who needs to file the Semi-annual Assessment Report of Computation and Remittance?

A: Businesses that sell tobacco products, alcoholic beverages, or rental vehicles in Montana need to file this report.

Q: How often does the report need to be filed?

A: The report needs to be filed semi-annually, meaning every six months.

Q: What information is required in the report?

A: The report requires information on the sales and purchases of the specified products, as well as the calculation of the assessed tax amount.

Form Details:

- Released on January 9, 2017;

- The latest edition currently provided by the Montana Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Administration.