This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

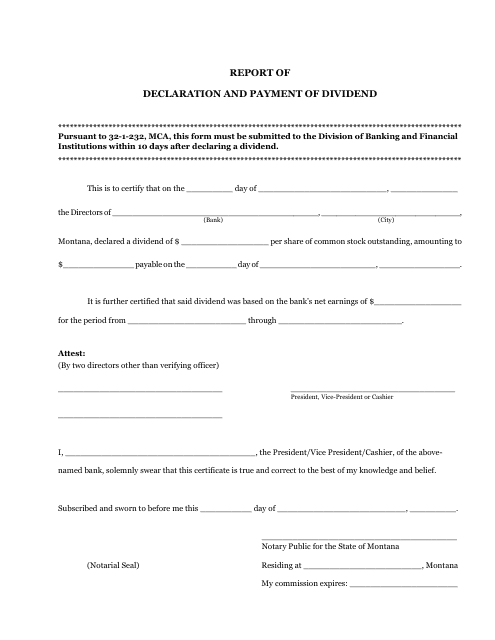

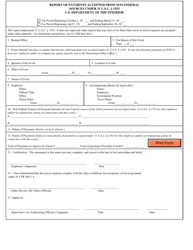

Report of Declaration and Payment of Dividend - Montana

Report of Declaration and Payment of Dividend is a legal document that was released by the Montana Department of Administration - a government authority operating within Montana.

FAQ

Q: What is a Declaration and Payment of Dividend?

A: A declaration and payment of dividend is a process where a company announces and distributes profits to its shareholders.

Q: Why do companies declare dividends?

A: Companies declare dividends to distribute a portion of their profits to their shareholders as a return on their investment.

Q: Who receives the dividends?

A: The dividends are received by the shareholders of the company.

Q: How are dividends paid?

A: Dividends are typically paid in cash, but can also be paid in the form of additional shares or other assets.

Q: What is the purpose of this report?

A: The purpose of this report is to provide information about the declaration and payment of dividends for the state of Montana.

Q: Are dividends taxable?

A: Yes, dividends are generally subject to taxation.

Q: Who is required to report the declaration and payment of dividends?

A: Companies are required to report the declaration and payment of dividends to the relevant regulatory authorities in Montana.

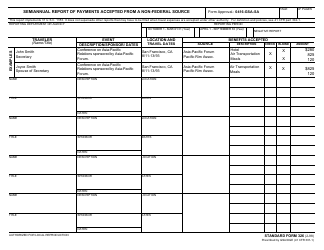

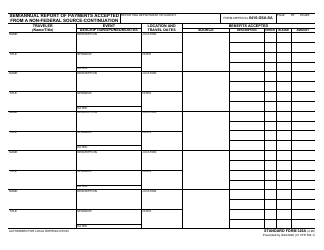

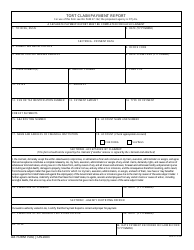

Q: What information is included in the report?

A: The report includes details about the company, the amount of dividends declared and paid, the dates of declaration and payment, and any relevant tax information.

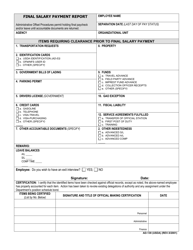

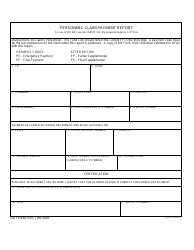

Form Details:

- The latest edition currently provided by the Montana Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Administration.