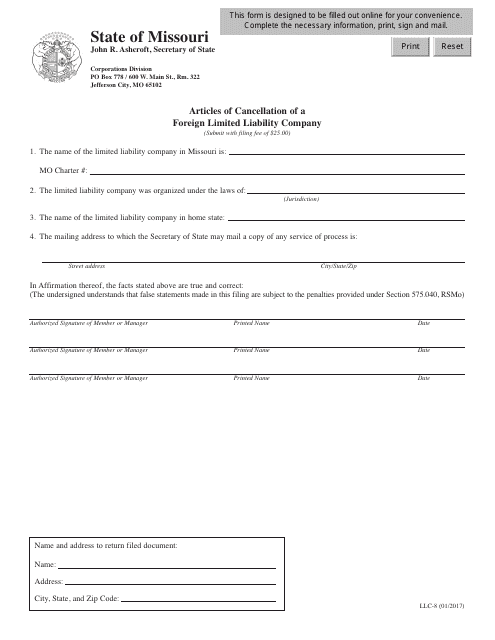

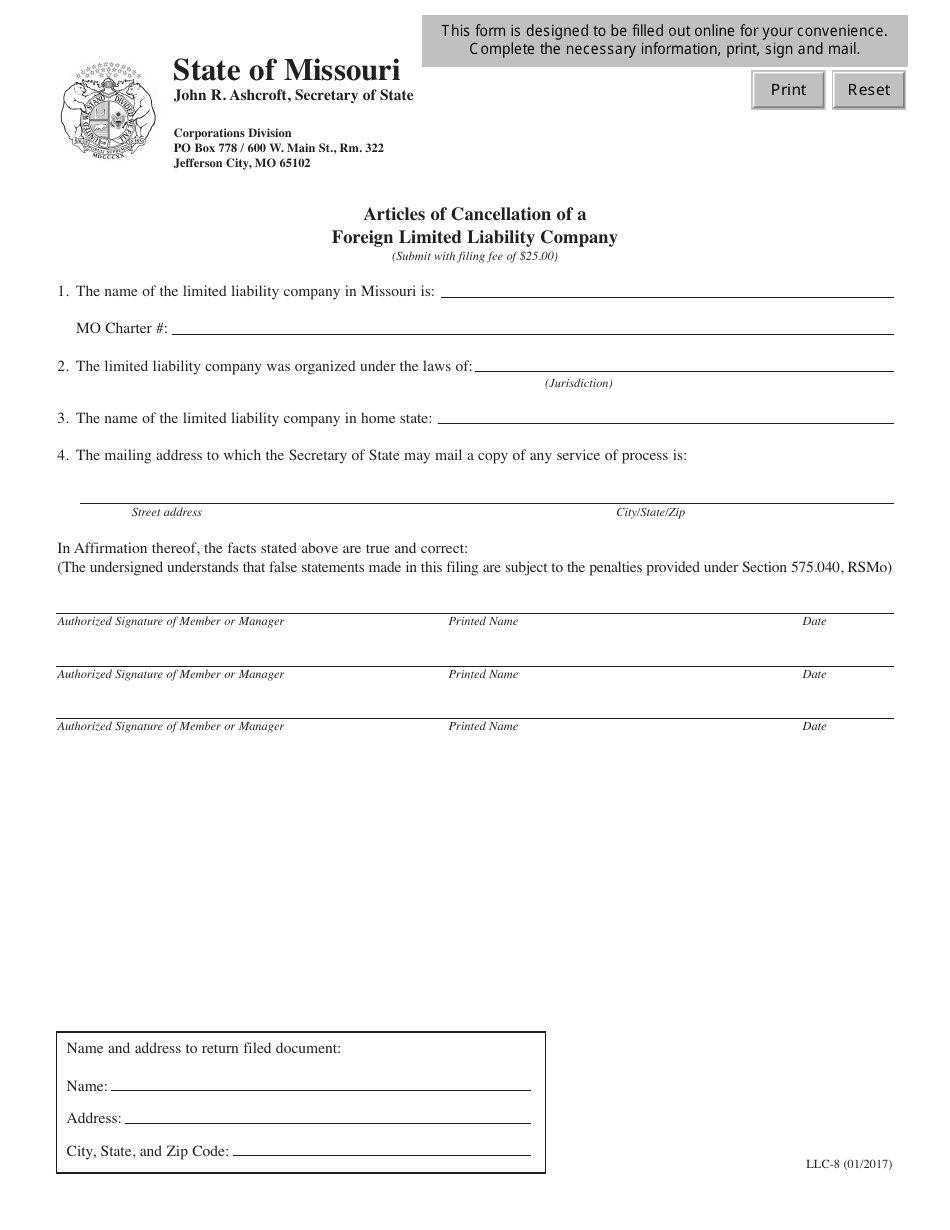

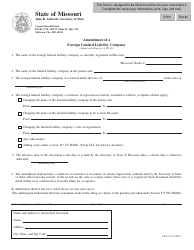

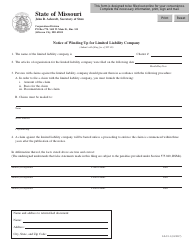

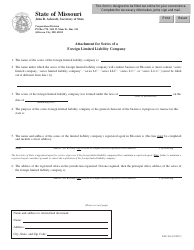

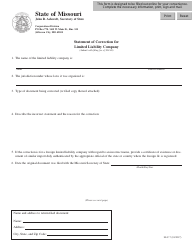

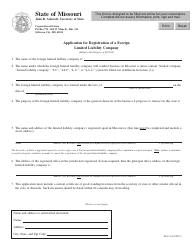

Form LLC-8 Articles of Cancellation of a Foreign Limited Liability Company - Missouri

What Is Form LLC-8?

This is a legal form that was released by the Missouri Secretary of State - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

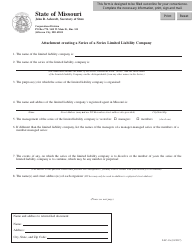

Q: What is an LLC-8 form?

A: The LLC-8 form is the Articles of Cancellation of a Foreign Limited Liability Company in the state of Missouri.

Q: What is a foreign limited liability company?

A: A foreign limited liability company is an LLC that is formed in a different state.

Q: When is the LLC-8 form used?

A: The LLC-8 form is used when a foreign LLC wants to cancel their registration in Missouri.

Q: What information is required in the LLC-8 form?

A: The LLC-8 form requires information such as the name of the LLC, the state of formation, the date of formation, and a statement of cancellation.

Q: How long does it take to process the LLC-8 form?

A: The processing time for the LLC-8 form varies, but it can take several weeks.

Q: Do I need to notify the IRS when filing the LLC-8 form?

A: No, you do not need to notify the IRS when filing the LLC-8 form.

Q: What happens after the LLC-8 form is approved?

A: Once the LLC-8 form is approved, the foreign LLC's registration in Missouri will be cancelled.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Missouri Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-8 by clicking the link below or browse more documents and templates provided by the Missouri Secretary of State.