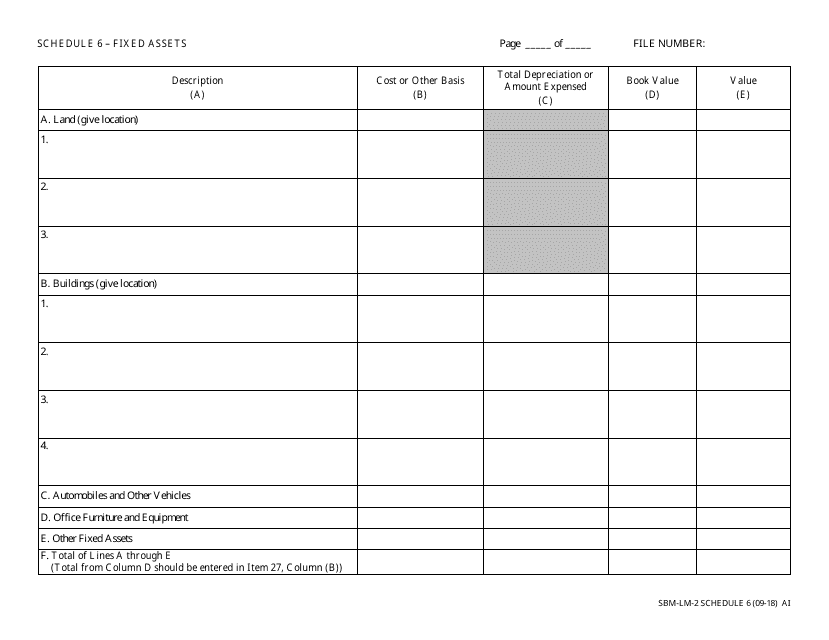

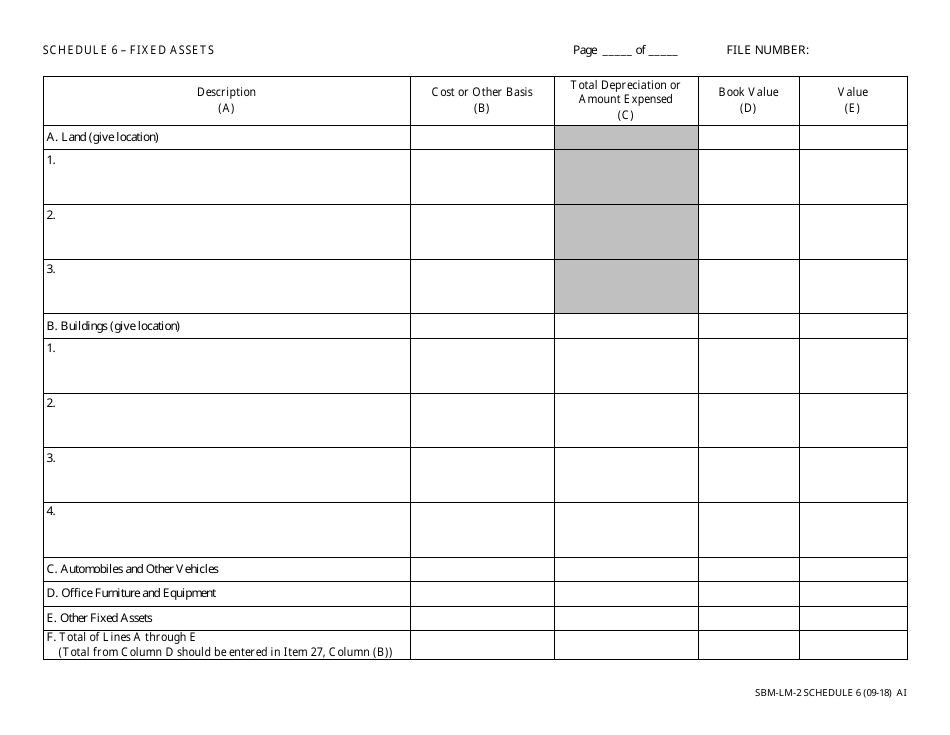

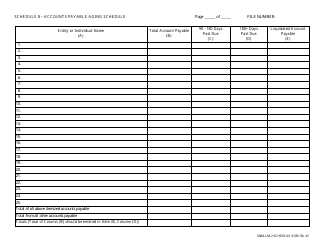

Form SBM-LM-2 Schedule 6 Fixed Assets - Missouri

What Is Form SBM-LM-2 Schedule 6?

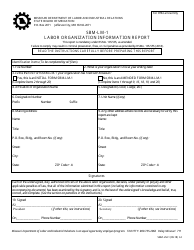

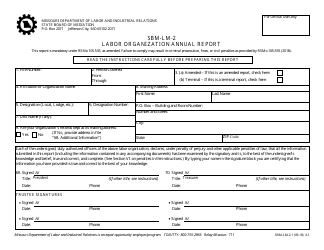

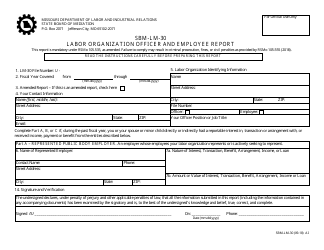

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri.The document is a supplement to Form SBM-LM-2, Labor Organization Annual Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SBM-LM-2 Schedule 6?

A: Form SBM-LM-2 Schedule 6 is a document used to report fixed assets in the state of Missouri.

Q: What are fixed assets?

A: Fixed assets are long-term tangible assets used in the operation of a business, such as buildings, land, machinery, and equipment.

Q: Why is it important to report fixed assets?

A: Reporting fixed assets is important for tax and accounting purposes, as it helps determine the value and depreciation of these assets.

Q: Who needs to complete Form SBM-LM-2 Schedule 6?

A: Businesses operating in Missouri that have fixed assets need to complete Form SBM-LM-2 Schedule 6.

Q: What information is required on Form SBM-LM-2 Schedule 6?

A: Form SBM-LM-2 Schedule 6 requires information about the fixed assets, such as their description, acquisition date, cost, and depreciation.

Q: When is the deadline to file Form SBM-LM-2 Schedule 6?

A: The deadline to file Form SBM-LM-2 Schedule 6 is typically the same as the deadline for filing the business's annual tax return.

Q: Are there any penalties for not filing Form SBM-LM-2 Schedule 6?

A: Yes, there may be penalties for not filing Form SBM-LM-2 Schedule 6, including fines and interest on any unpaid tax liabilities.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SBM-LM-2 Schedule 6 by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.