This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-44

for the current year.

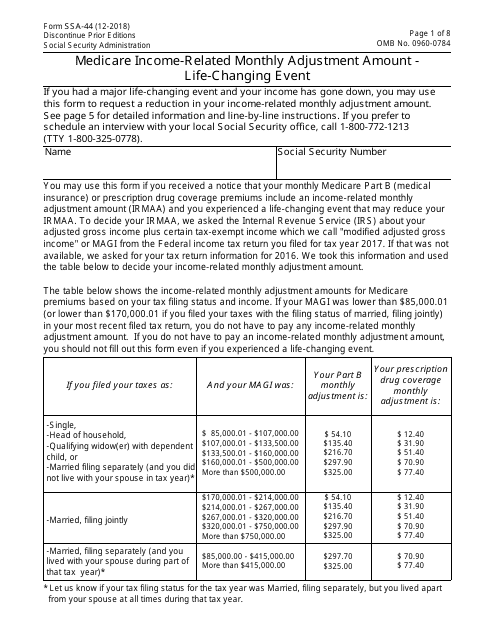

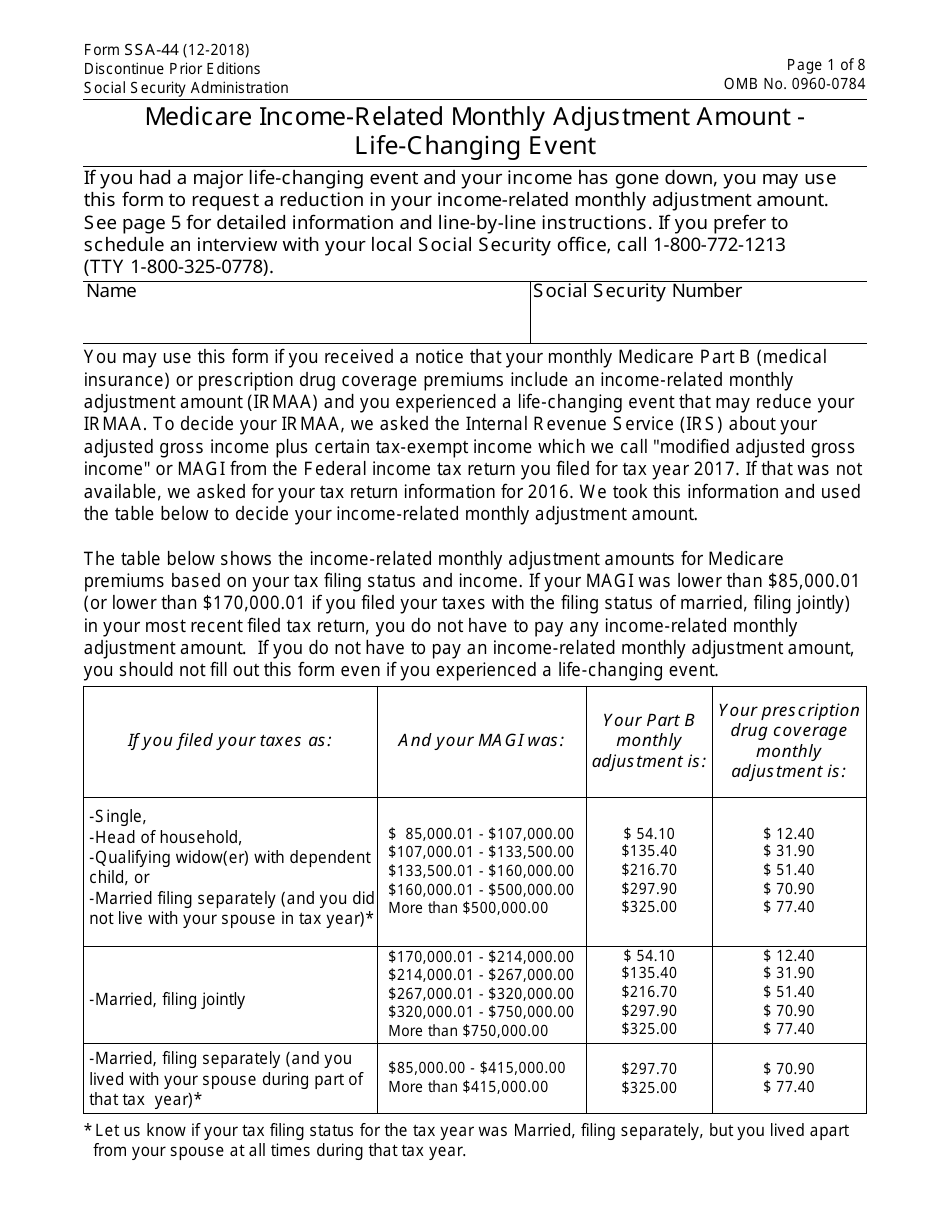

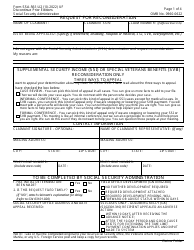

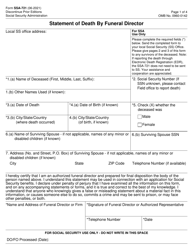

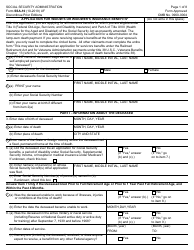

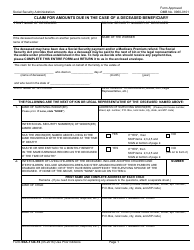

Form SSA-44 Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event

What Is Form SSA-44?

Form SSA-44, Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event , is a form used to notify the U.S. Social Security Administration (SSA) about a change in income and request a reduction of the Income-Related Monthly Adjustment Amount (IRMAA) of the Medicare premium because of a life-changing event.

Alternate Name:

- SSA Form 44.

The most recent version of this form was issued on December 1, 2018 . A fillable version of the form is available for download below. Life-changing events include marriages, divorces or annulments, death of a spouse, termination, loss of income-producing property, loss or reduction of pension income or employer settlement payments.

Where Do I File Form SSA-44?

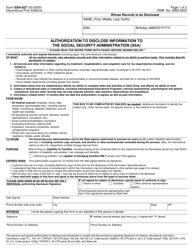

Form SSA-44 can be filed at a local SSA office and all supporting documentation can be presented in person. Alternatively, the form can be downloaded, filled out digitally, printed out, and mailed to the local SSA office with originals or certified copies of the supporting documentation.

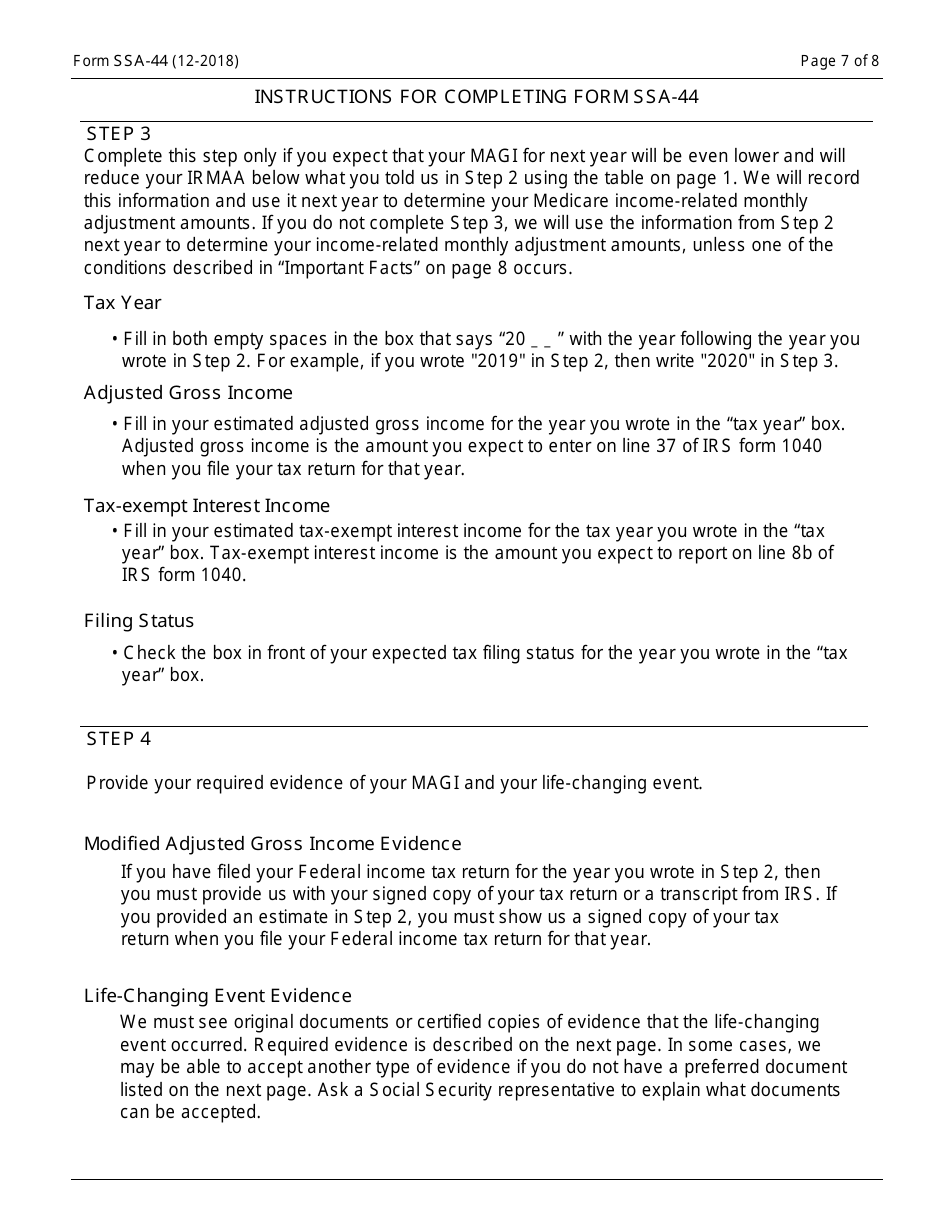

Form SSA-44 Instructions

Medicare Part B and Part D premiums partially depend on the individual's income. These standard parts are constant and the IRMAA is added if the individual's income exceeds a certain amount. The required income level depends on the individual's status when enrolling in Medicare and it changes later on. If the individual's income has increased, they will have to pay the IRMAA the difference. However, if a life-changing event has decreased their income, the individual should file the SSA form 44 to request a reduction of the IRMAA part of their premium. The individual can file an appeal within 60 days after the IRMAA determination notice was received.

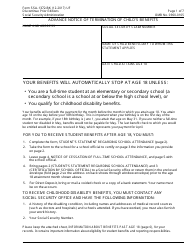

Medicare Part B is the part of Medicare insurance that covers medical services and supplies necessary to treat and prevent illnesses. This includes ambulance services, outpatient care, durable medical equipment, and preventive services. To be considered eligible for Medicare Plan B, the individual must be a U.S citizen or a permanent resident lawfully residing in the U.S for at least five years and be at least 65 years old. If the individual is eligible for premium-free Part A, they are also eligible for Part B. People receiving Social Security or Railroad Retirement Board disability benefits are automatically enrolled in Medicare Part B after two years of disability benefits, even if they are under the age of 65. Individuals with amyotrophic lateral sclerosis or end-stage renal disease are eligible for Part B before the age of 65.

Medicare Part D is an optional part of Medicare insurance covering prescription drugs. The individual enrolled in Part D pays a part of the prescription drug price - a copay - instead of a full price. The insurance company pays the rest to the pharmacy. Anyone enrolled in Medicare Part A and B is eligible for Part D. While Part B has a penalty for late enrollment, Part D is voluntary.

How to Fill Out Form SSA-44?

- Enter your name and Social Security Number (SSN) on the first page of the form.

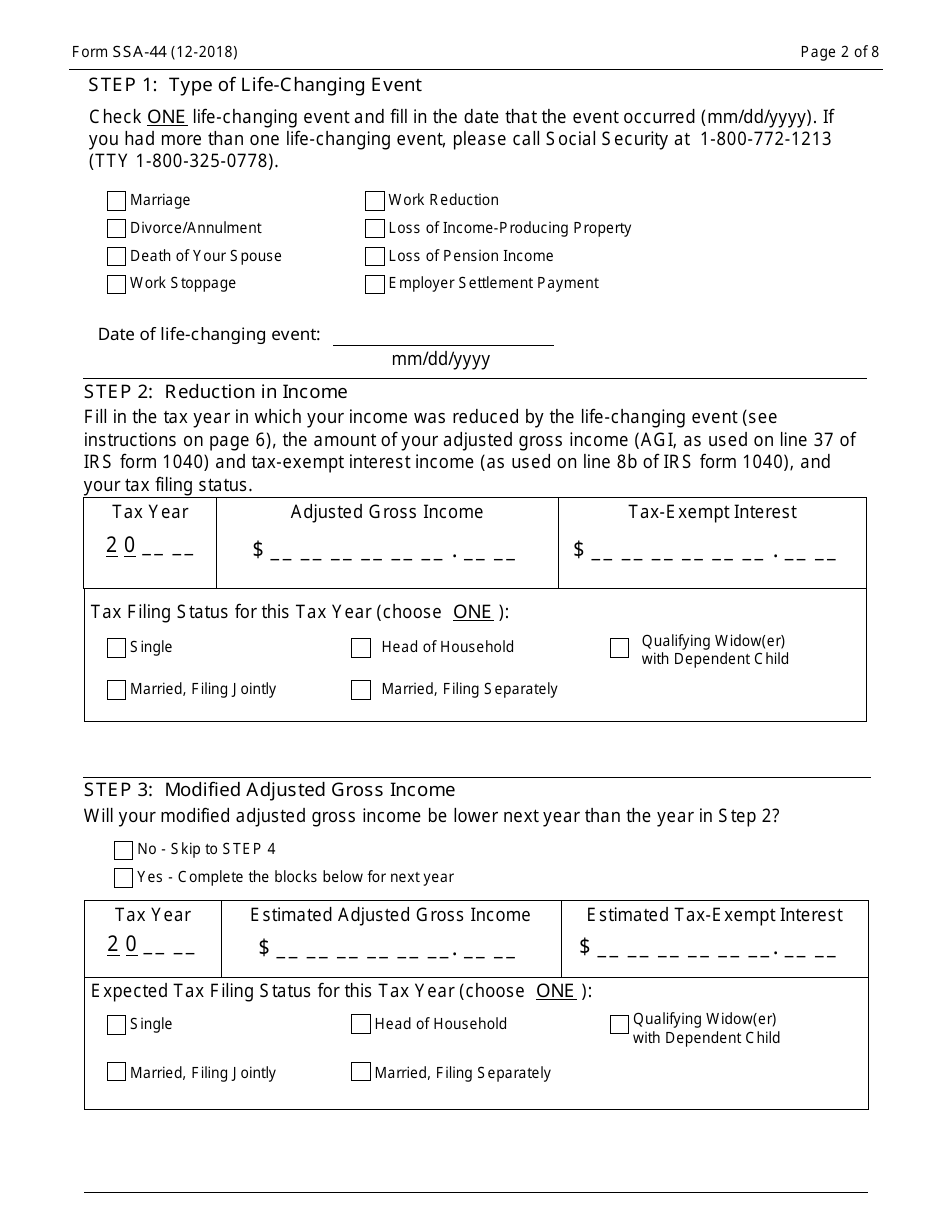

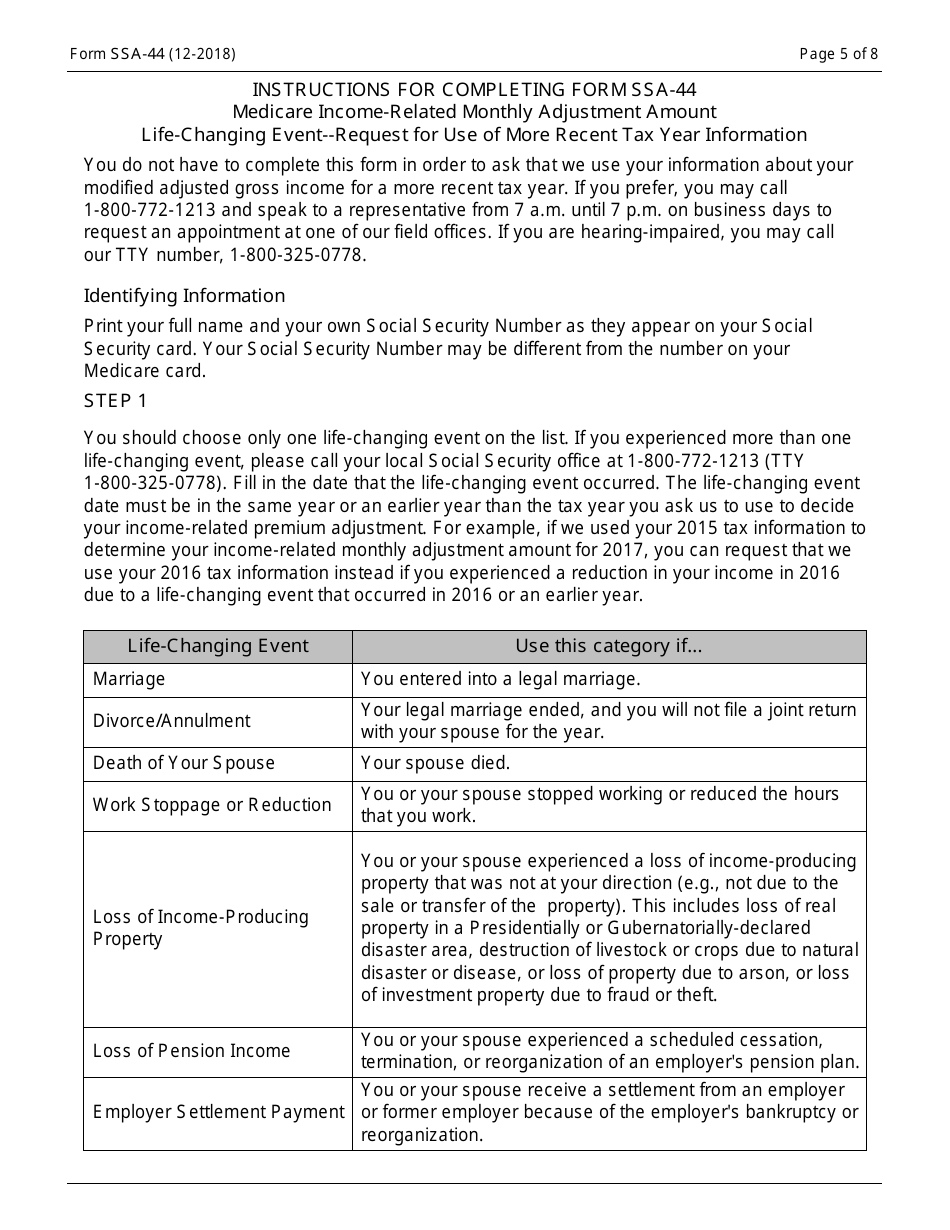

- Check the corresponding box indicating the type of your life-changing event in Step 1 ("Type of Life-Changing Event"). Provide the date when the event took place.

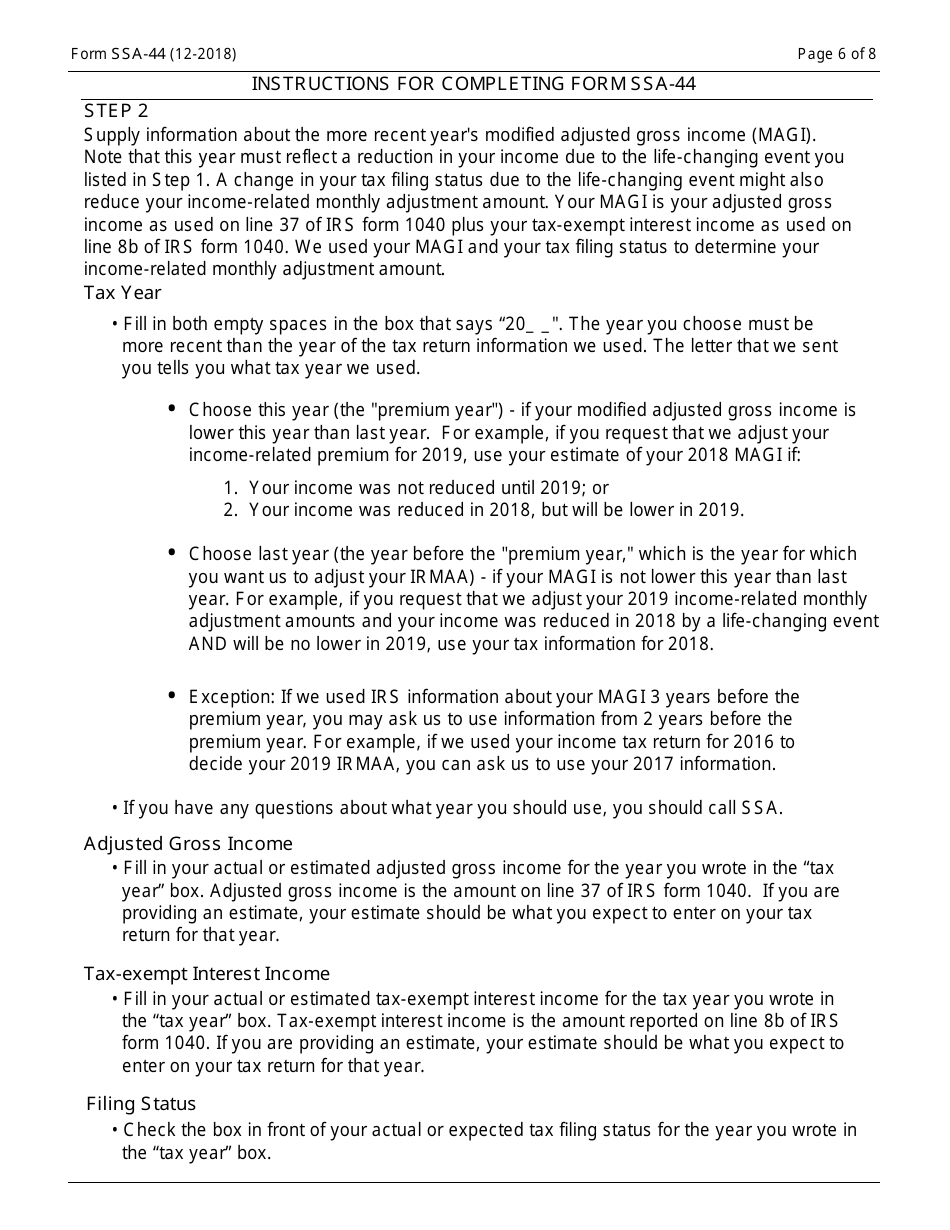

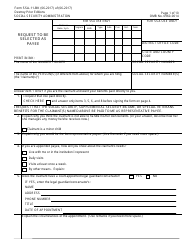

- Enter the tax year when your income was reduced in Step 2 ("Reduction of Income"). Enter the current year, if your adjusted gross income is lower this year than the year before. If the life-changing event took place last year and your income is not expected to decrease this year, enter the last year. Provide an estimated or actual adjusted gross income for the year you entered. Enter the actual tax-exempt interest income for the entered year. Tax-exempt income is the income that is not subject to federal income tax. The adjusted gross income and tax-exempt income can be found on IRS Form 1040. Check the corresponding box, indicating your status for the entered tax year.

- Check the corresponding box indicating whether your Modified Adjusted Gross Income (MAGI) is expected to be lower the year following the year entered in the previous step in Step 3 ("Modified Adjusted Gross Income"). If you do not expect it to be lower, check the corresponding box and skip this step. If you answered positively, provide the tax year after the year you entered in Step 2. Enter your estimated adjusted gross income and tax-exempt for that year. Check the corresponding box indicating your expected tax status for the next year;

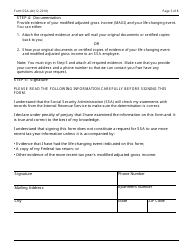

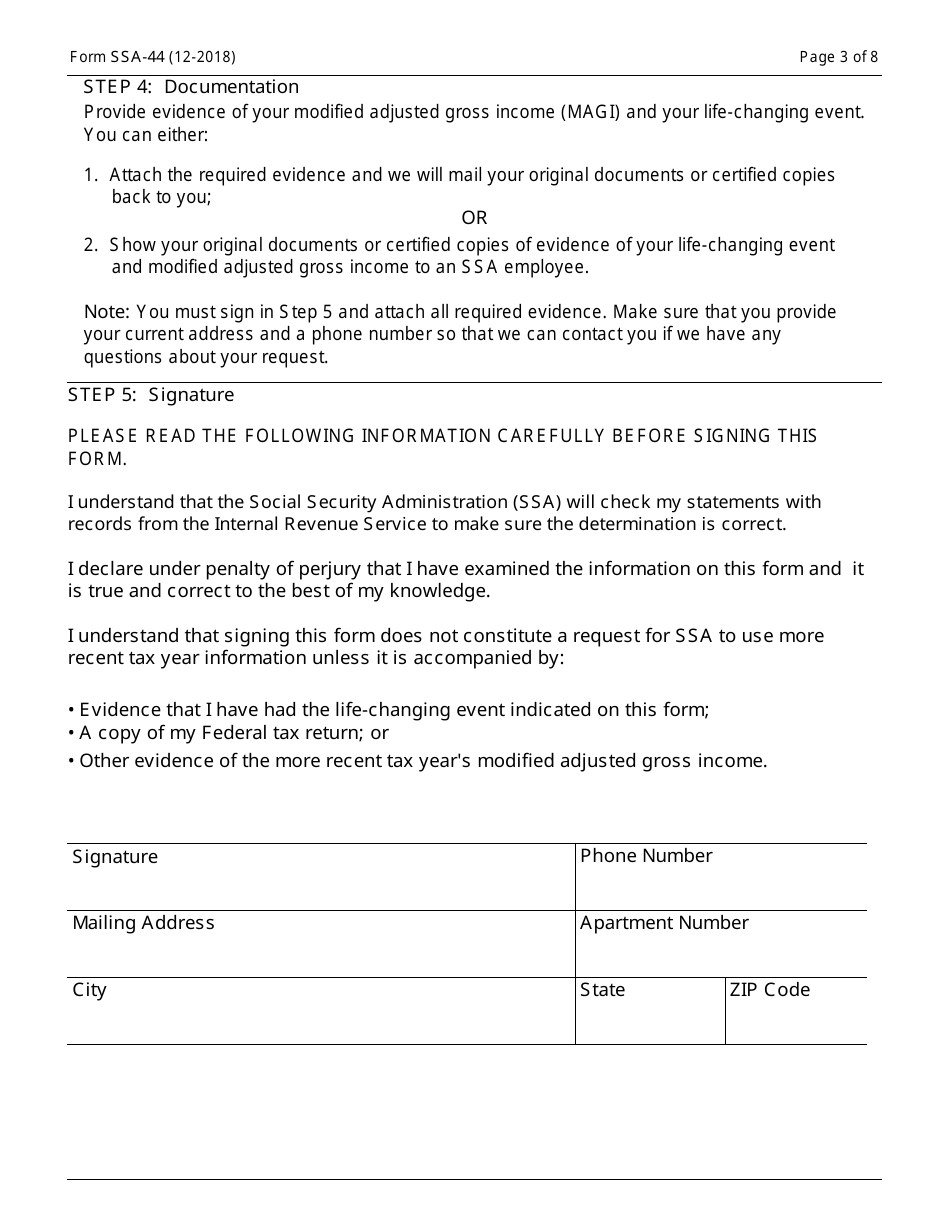

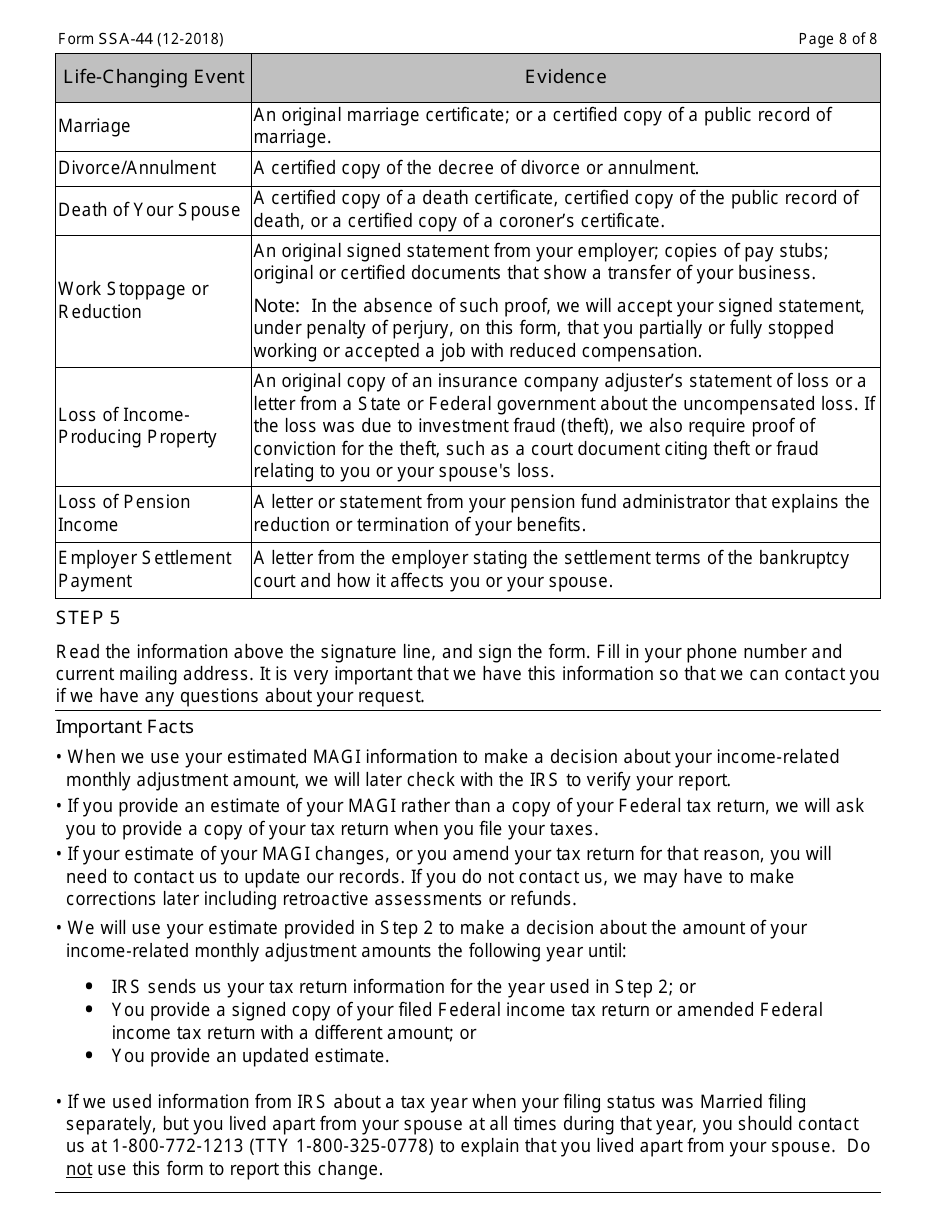

- Attach a certified copy or original of documents proving your life-changing event and MAGI in Step 4 ("Documentation"). A copy of a tax return or transcript from the Internal Revenue Service (IRS) can serve as proof of MAGI and the documents supporting the life-changing event depend on the event.

- Provide your phone number and mailing address in Step 5 ("Signature") and sign the form.

What Is Modified Adjusted Gross Income for SSA-44?

MAGI is calculated based on the Adjusted Gross Income (AGI). The AGI is a subtraction of allowable deductions from the gross income. Then the certain income types are included or subtracted to calculate MAGI. The IRS calculates it and provides the information to the SSA.

To calculate MAGI for Medicare Premium, the following should be added to MAGI: received or acquired tax-exempt interest income, interest from U.S. Savings bonds used to pay for higher education tuition and fees, earned income of U.S citizens living abroad that were excluded from gross income and income from sources within Guam, American Samoa, the Northern Mariana Islands or Puerto Rico, not otherwise included in AGI.

MAGI determines whether an individual must pay the IRMAA and its amount. MAGI for the previous tax year can be found on IRS Form 1040.

Where to Mail SSA-44 Form?

The completed form with the supporting documentation should be mailed to a local SSA office. Form SSA-44 mailing address can be found on the SSA website.