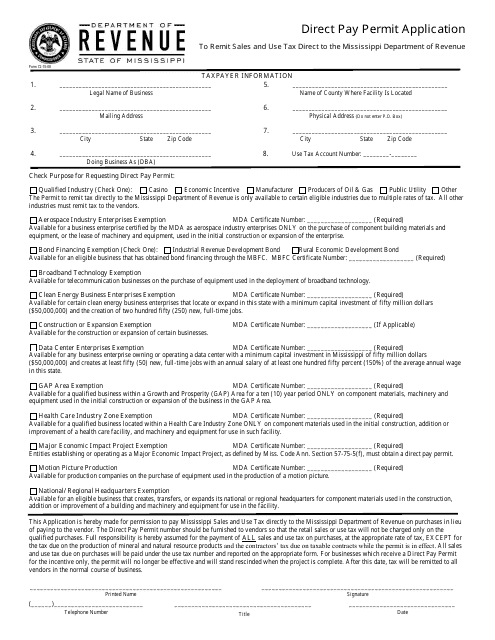

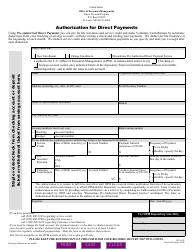

Form 72-15-08 Direct Pay Permit Application - Mississippi

What Is Form 72-15-08?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72-15-08?

A: Form 72-15-08 is the Direct Pay Permit Application in Mississippi.

Q: Who can use Form 72-15-08?

A: Businesses and individuals who want to apply for a direct pay permit in Mississippi can use Form 72-15-08.

Q: What is a direct pay permit?

A: A direct pay permit allows businesses and individuals to pay sales tax directly to the state of Mississippi, rather than to their vendors.

Q: Is there a fee for applying for a direct pay permit?

A: Yes, there is a non-refundable fee of $50 for applying for a direct pay permit in Mississippi.

Q: What supporting documents are required with Form 72-15-08?

A: You need to attach a copy of your Mississippi sales tax permit and a copy of your Federal Employer Identification Number (FEIN) certificate with Form 72-15-08.

Q: How long does it take to get a direct pay permit?

A: The processing time for a direct pay permit application in Mississippi is typically 30 days after the application is received by the Department of Revenue.

Q: Can I use my direct pay permit in other states?

A: No, a direct pay permit issued by Mississippi is only valid for paying sales tax directly to Mississippi and cannot be used in other states.

Q: Can I cancel my direct pay permit?

A: Yes, you can cancel your direct pay permit by submitting a written request to the Mississippi Department of Revenue.

Form Details:

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-15-08 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.