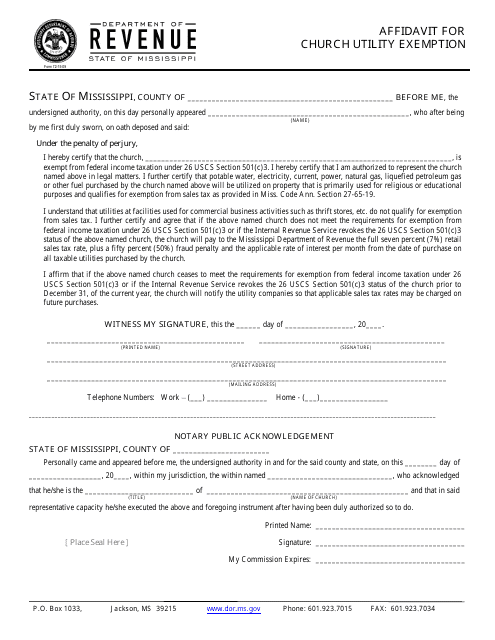

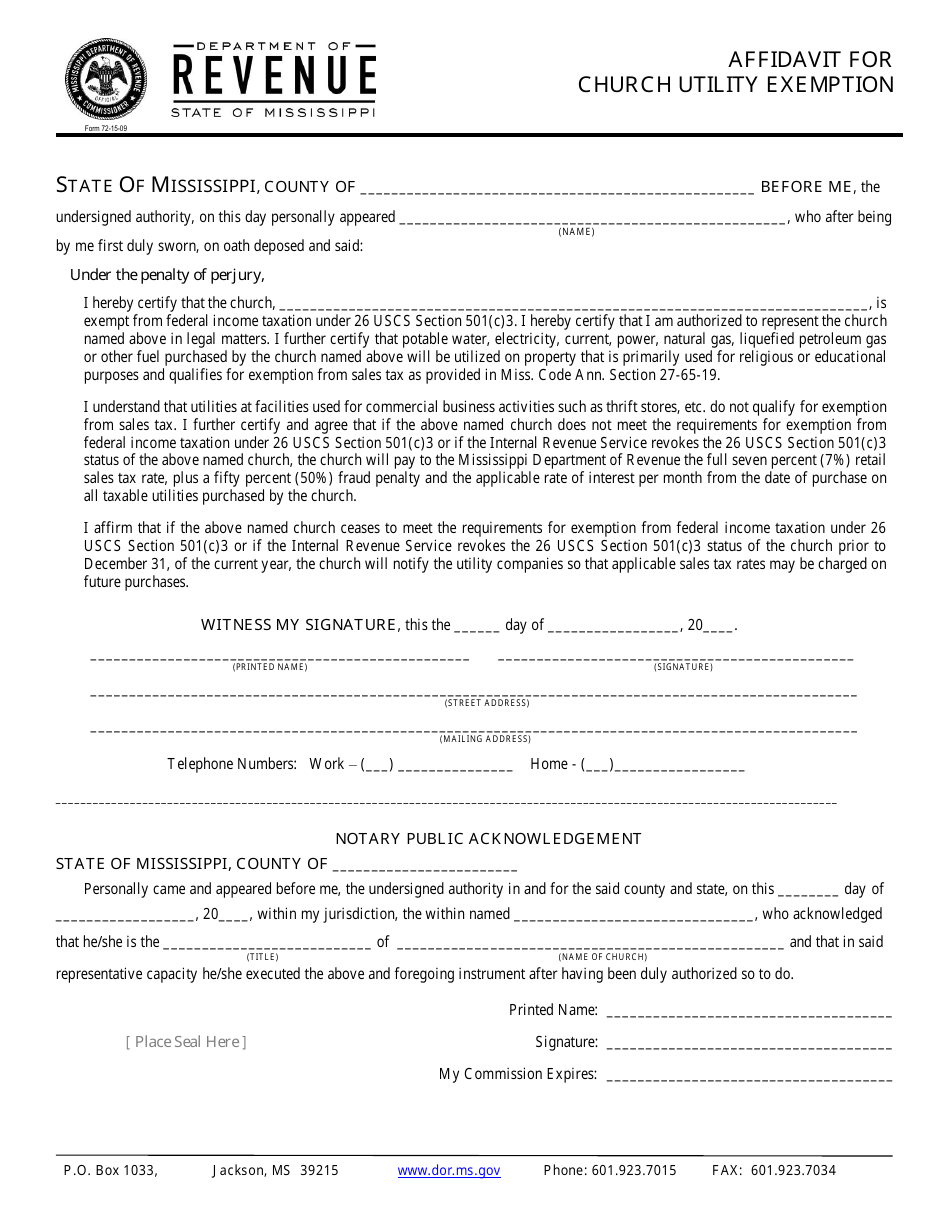

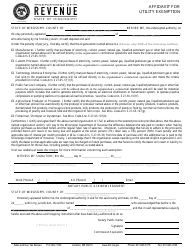

Form 72-15-09 Affidavit for Church Utility Exemption - Mississippi

What Is Form 72-15-09?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72-15-09?

A: Form 72-15-09 is the Affidavit for Church Utility Exemption in Mississippi.

Q: Who needs to complete Form 72-15-09?

A: Churches in Mississippi that wish to claim an exemption from utility taxes.

Q: What is the purpose of Form 72-15-09?

A: The purpose of Form 72-15-09 is to allow churches to claim an exemption from utility taxes in Mississippi.

Q: What information is required on Form 72-15-09?

A: Form 72-15-09 requires the church's name, address, contact information, and other details about the utility services being claimed for exemption.

Q: Are there any filing fees for Form 72-15-09?

A: No, there are no filing fees for Form 72-15-09.

Q: When is Form 72-15-09 due?

A: Form 72-15-09 should be filed annually by April 15th.

Q: What happens after submitting Form 72-15-09?

A: Once Form 72-15-09 is submitted, the Mississippi Department of Revenue will review the application and determine if the church qualifies for the utility exemption.

Q: Is there any penalty for not filing Form 72-15-09?

A: Failure to file Form 72-15-09 may result in the church being liable for utility taxes.

Form Details:

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-15-09 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.