This version of the form is not currently in use and is provided for reference only. Download this version of

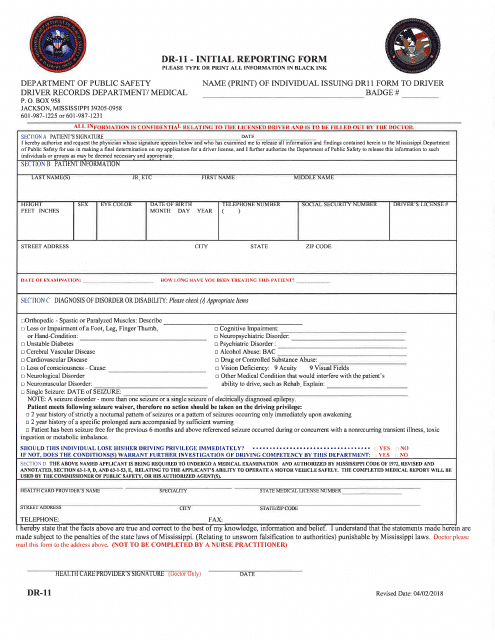

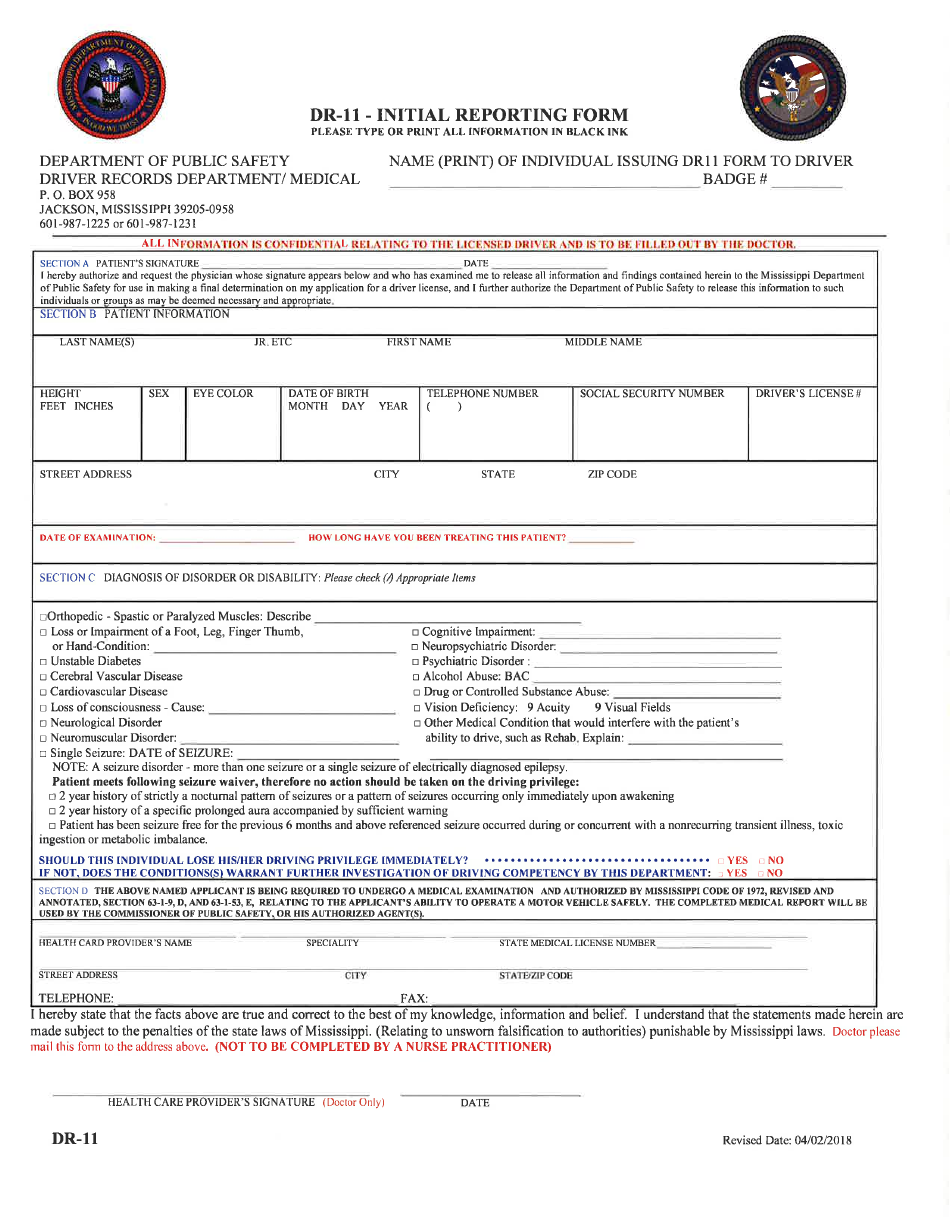

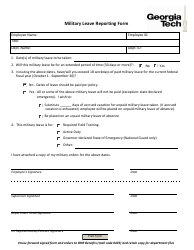

Form DR-11

for the current year.

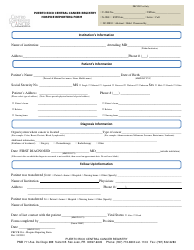

Form DR-11 Initial Reporting Form - Mississippi

What Is Form DR-11?

This is a legal form that was released by the Mississippi Department of Public Safety - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-11?

A: Form DR-11 is the Initial Reporting Form in Mississippi.

Q: What is the purpose of Form DR-11?

A: The purpose of Form DR-11 is to report initial information about a business or organization to the Mississippi Department of Revenue.

Q: Who needs to file Form DR-11?

A: Businesses or organizations that are starting operations in Mississippi need to file Form DR-11.

Q: What information is required on Form DR-11?

A: Form DR-11 requires information such as the business or organization's name, address, federal employer identification number (FEIN), and type of business.

Q: When is Form DR-11 due?

A: Form DR-11 is due within 60 days after starting operations in Mississippi.

Q: Are there any fees associated with filing Form DR-11?

A: There are no fees associated with filing Form DR-11.

Q: What happens after I file Form DR-11?

A: After filing Form DR-11, the Mississippi Department of Revenue will assign a taxpayer identification number and provide further instructions on tax requirements.

Q: Is Form DR-11 required for all businesses in Mississippi?

A: Yes, Form DR-11 is required for all businesses or organizations starting operations in Mississippi.

Q: What should I do if there are changes to the information provided on Form DR-11?

A: If there are changes to the information provided on Form DR-11, you should contact the Mississippi Department of Revenue to update your records.

Form Details:

- Released on April 2, 2018;

- The latest edition provided by the Mississippi Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-11 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Public Safety.