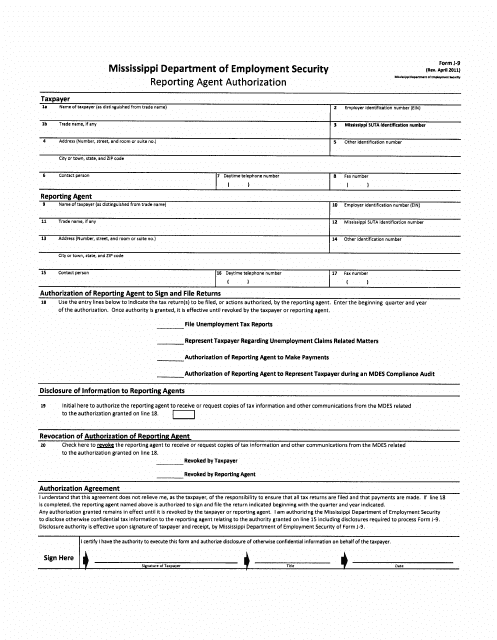

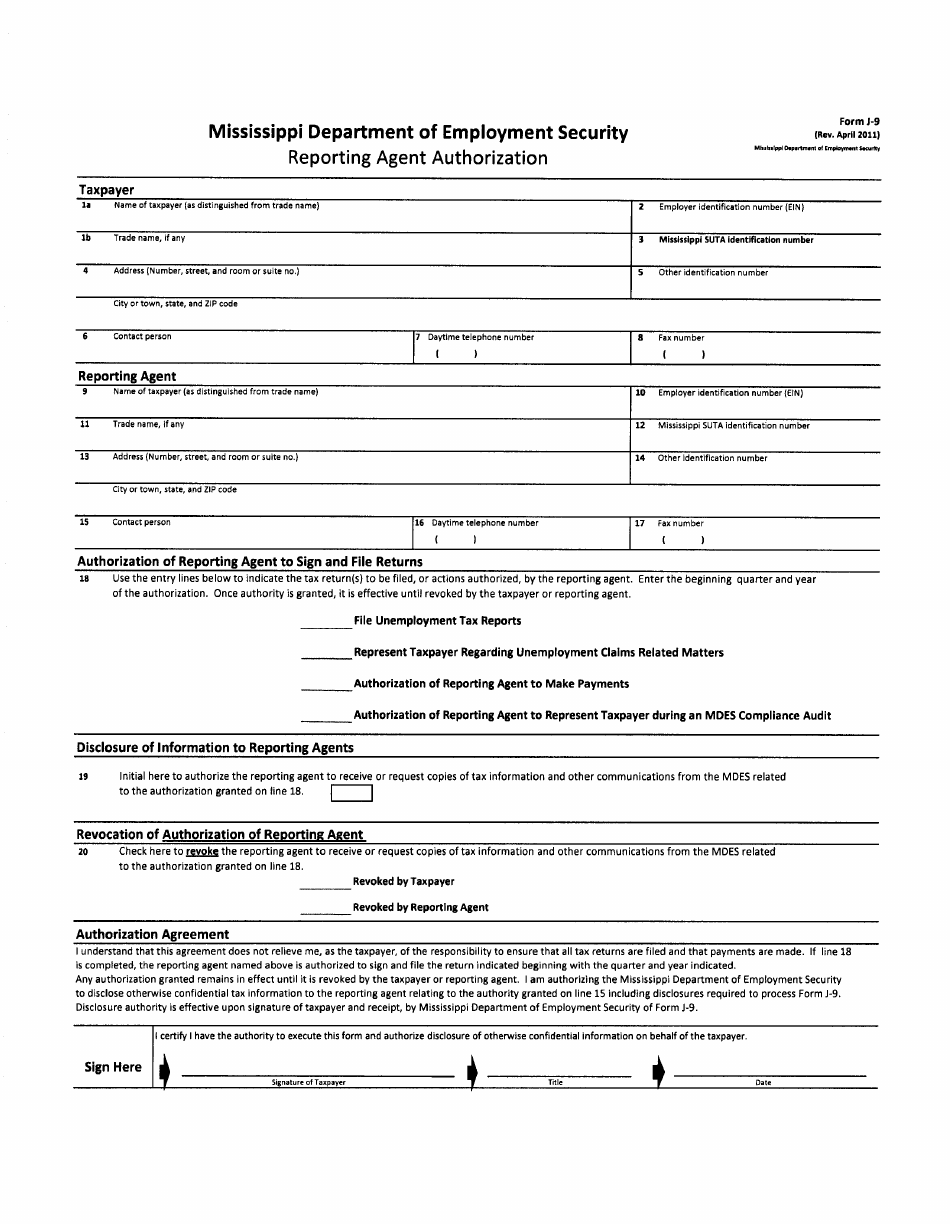

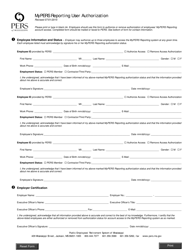

Form J-9 Reporting Agent Authorization - Mississippi

What Is Form J-9?

This is a legal form that was released by the Mississippi Department of Employment Security - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form J-9?

A: Form J-9 is a reporting agent authorization form in Mississippi.

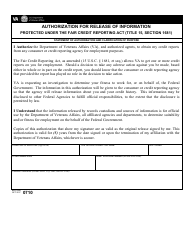

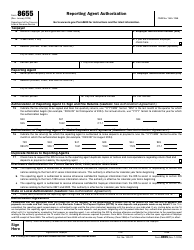

Q: What is the purpose of Form J-9?

A: The purpose of Form J-9 is to authorize a reporting agent to file and remit taxes on behalf of a taxpayer in Mississippi.

Q: Who needs to file Form J-9?

A: Taxpayers who want to authorize a reporting agent to file and remit taxes on their behalf in Mississippi need to file Form J-9.

Q: Are there any fees associated with filing Form J-9?

A: No, there are no fees associated with filing Form J-9 in Mississippi.

Q: What information is required on Form J-9?

A: Form J-9 requires the taxpayer's name, address, tax identification number, and the reporting agent's name, address, and tax identification number.

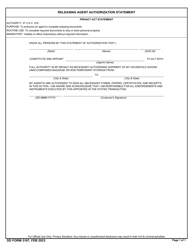

Q: Can I revoke the authorization on Form J-9?

A: Yes, you can revoke the authorization on Form J-9 at any time by submitting a written notice to the Mississippi Department of Revenue.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Mississippi Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form J-9 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Employment Security.