This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

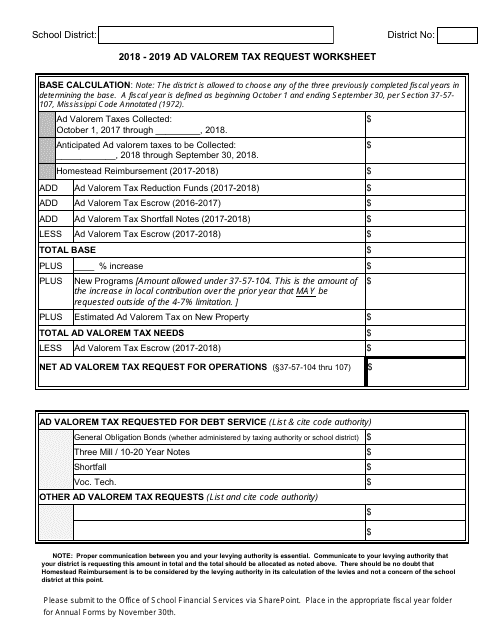

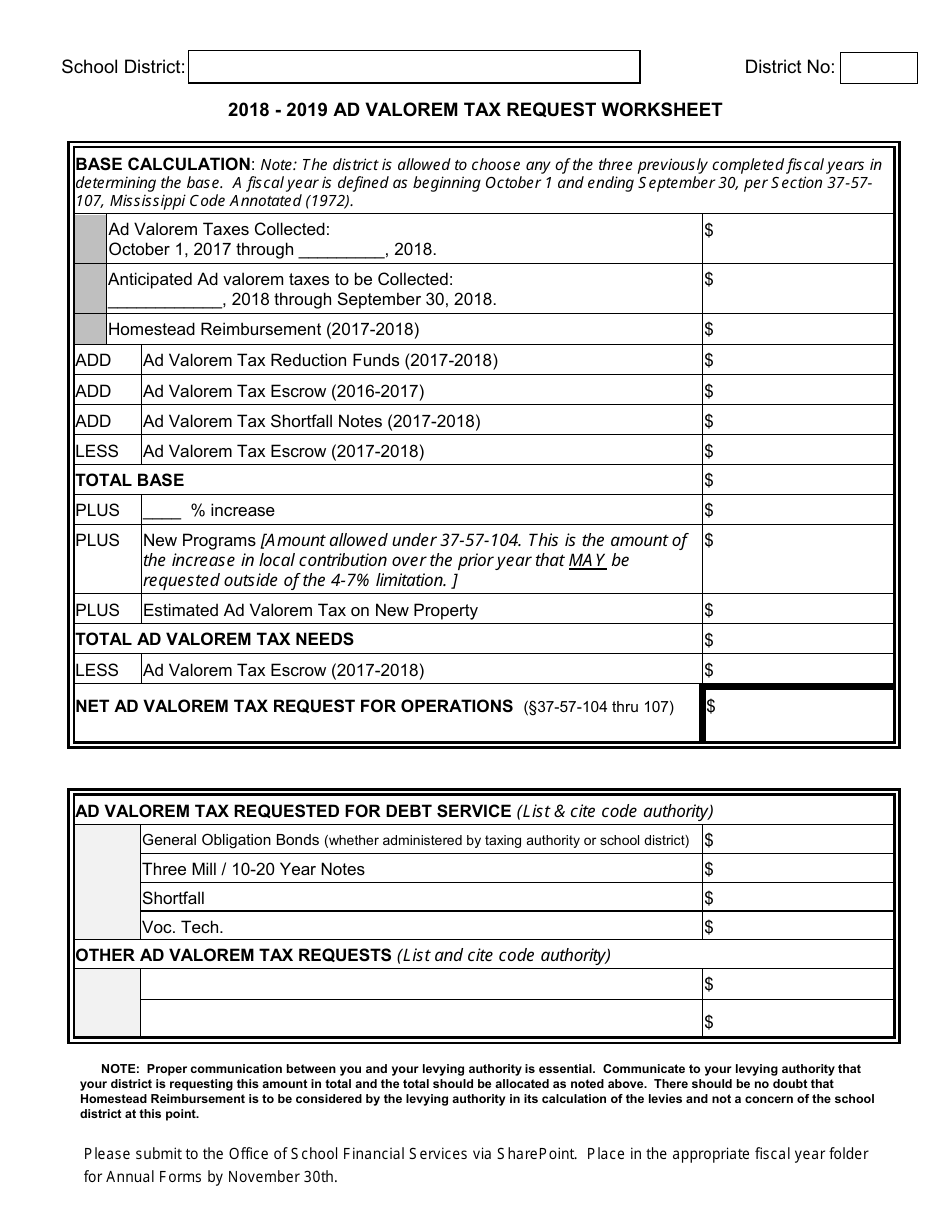

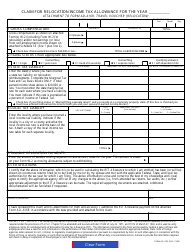

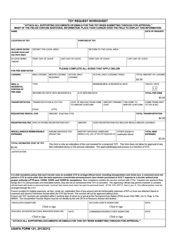

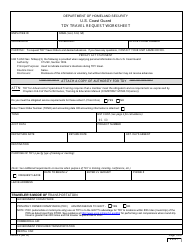

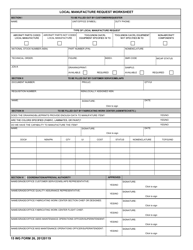

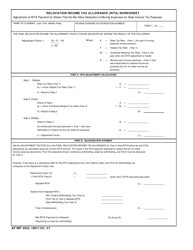

Ad Valorem Tax Request Worksheet - Mississippi

Ad Valorem Tax Request Worksheet is a legal document that was released by the Mississippi Department of Education - a government authority operating within Mississippi.

FAQ

Q: What is an ad valorem tax?

A: An ad valorem tax is a tax based on the assessed value of real or personal property.

Q: Who determines the assessed value of the property for ad valorem tax purposes?

A: The local county or municipal tax assessor determines the assessed value of the property.

Q: How is the assessed value of the property determined?

A: The assessed value is typically based on the fair market value of the property, taking into consideration factors such as location, size, and condition.

Q: What is the purpose of the Ad Valorem Tax Request Worksheet in Mississippi?

A: The Ad Valorem Tax Request Worksheet is used by property owners to estimate their ad valorem tax liability in Mississippi.

Q: What information is required on the Ad Valorem Tax Request Worksheet?

A: The worksheet typically requires information such as the property's assessed value, applicable tax rates, and any exemptions or special assessment considerations.

Q: How can property owners use the Ad Valorem Tax Request Worksheet?

A: Property owners can use the worksheet to calculate their estimated tax liability and plan for upcoming tax payments.

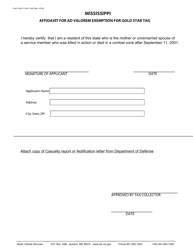

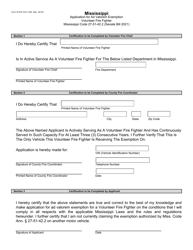

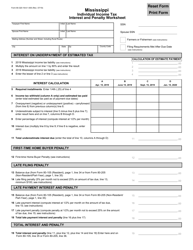

Q: What are some common exemptions or special assessments that may affect the ad valorem tax liability?

A: Common exemptions include homestead exemptions for primary residences, as well as exemptions for certain types of agricultural, religious, or non-profit properties. Special assessments may apply to properties within specific districts or municipalities for services like fire protection or street maintenance.

Q: Are there any penalties for not paying ad valorem taxes on time?

A: Yes, there may be penalties for late or delinquent payment of ad valorem taxes, such as interest charges or potential tax liens on the property.

Q: Do different counties or municipalities in Mississippi have different ad valorem tax rates?

A: Yes, ad valorem tax rates can vary between counties and municipalities in Mississippi. It's important to check the specific rates for your local area.

Q: Can property owners appeal the assessed value of their property for ad valorem tax purposes?

A: Yes, property owners typically have the right to appeal the assessed value of their property if they believe it is inaccurate or unfair. The specific process for appeals may vary by county or municipality.

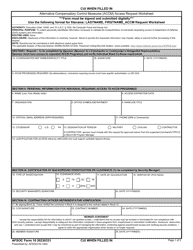

Form Details:

- The latest edition currently provided by the Mississippi Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Education.