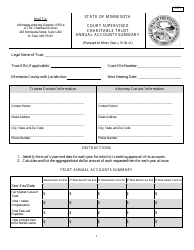

Form T3 Charitable Trust Exemption Form - Minnesota

What Is Form T3?

This is a legal form that was released by the Office of the Minnesota Attorney General - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T3?

A: Form T3 is the Charitable Trust Exemption Form in Minnesota.

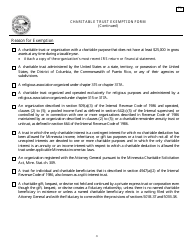

Q: Who needs to file Form T3?

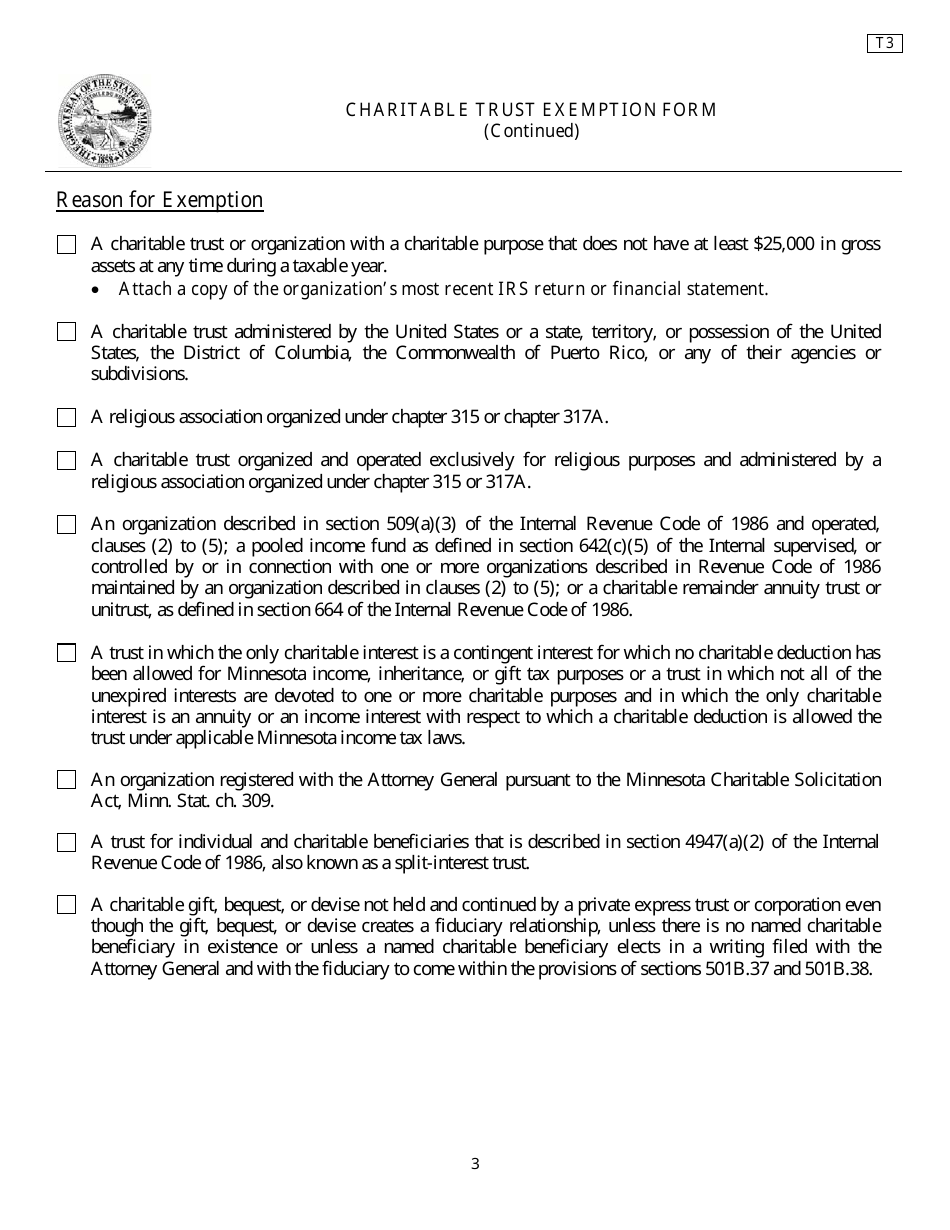

A: Nonprofit organizations that qualify for a charitable trust exemption in Minnesota need to file Form T3.

Q: What is the purpose of Form T3?

A: The purpose of Form T3 is to request an exemption from property taxes for charitable trusts in Minnesota.

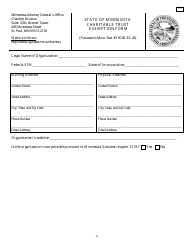

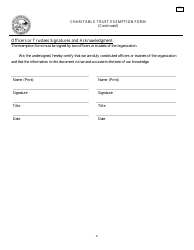

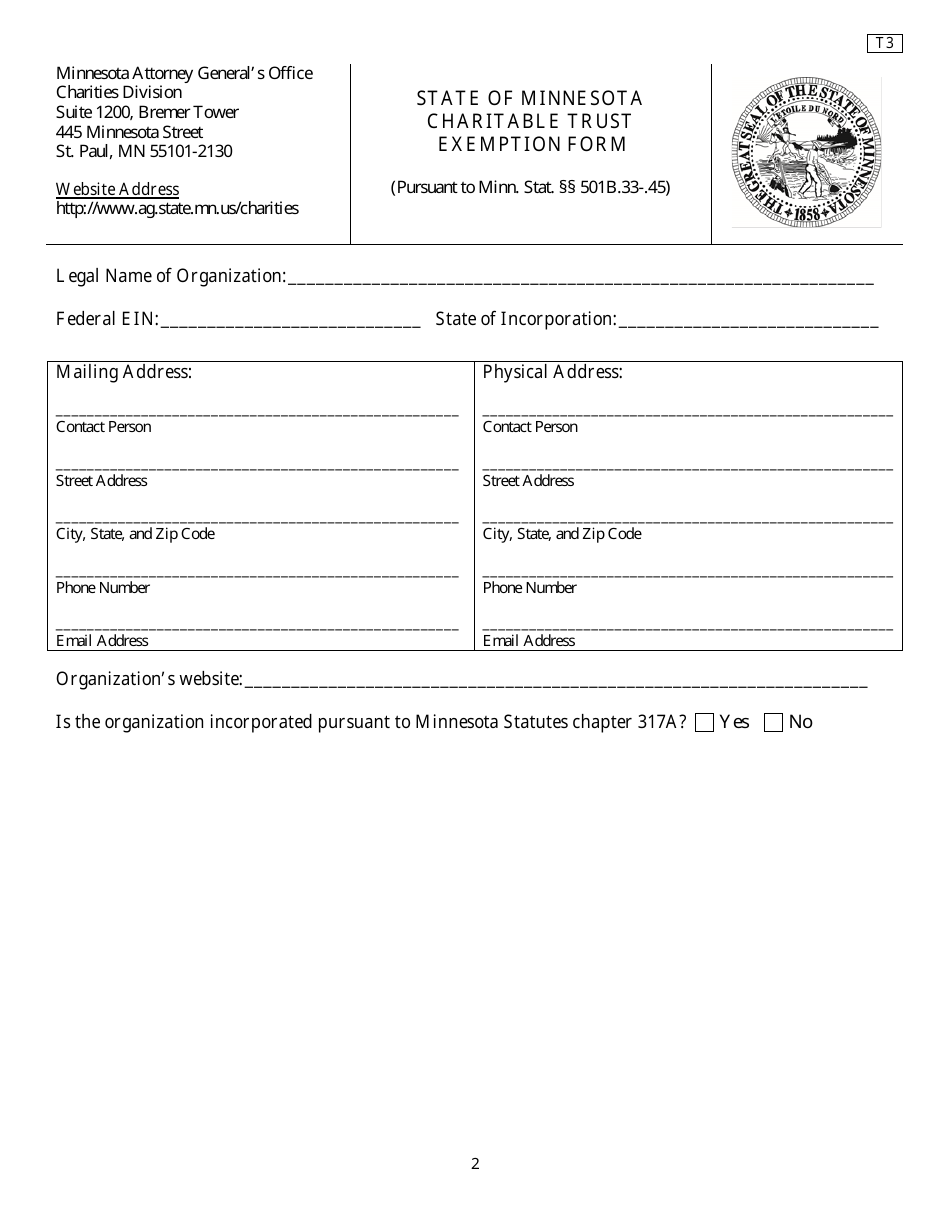

Q: What information is required on Form T3?

A: Form T3 requires information about the nonprofit organization, its activities, and the property that qualify for the exemption.

Q: When is the deadline to file Form T3?

A: Form T3 must be filed by February 1st of each year.

Q: Is there a fee to file Form T3?

A: There is no fee to file Form T3.

Q: What happens after I file Form T3?

A: After you file Form T3, the Minnesota Department of Revenue will review your application and determine if your organization qualifies for the charitable trust exemption.

Form Details:

- The latest edition provided by the Office of the Minnesota Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T3 by clicking the link below or browse more documents and templates provided by the Office of the Minnesota Attorney General.