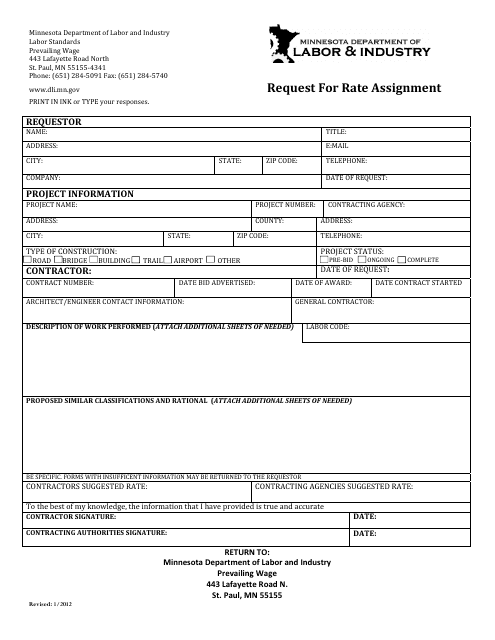

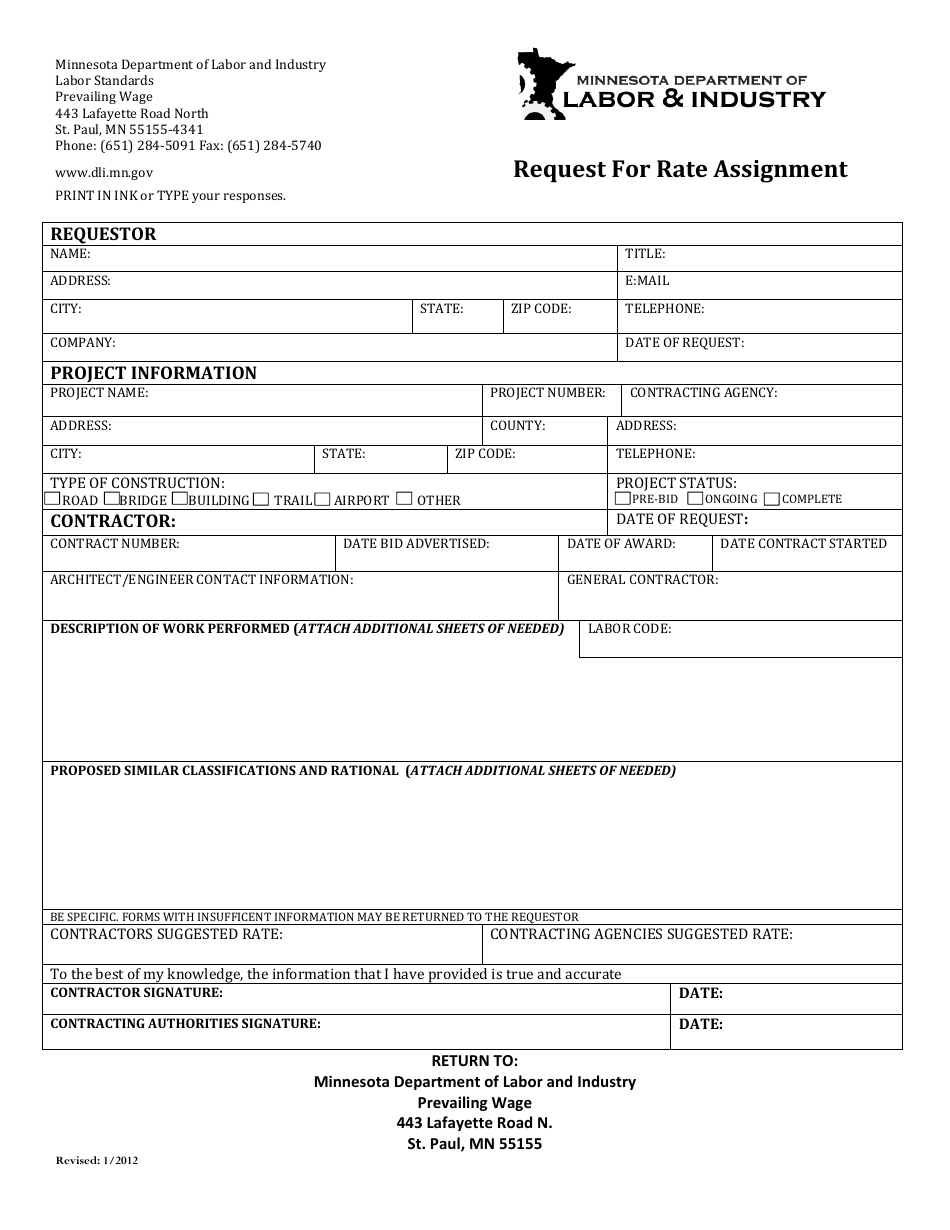

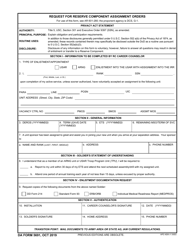

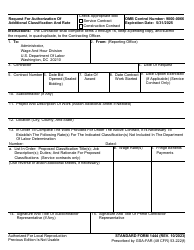

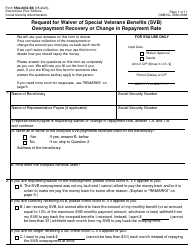

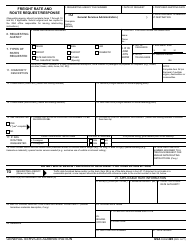

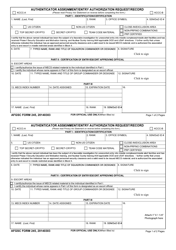

Request for Rate Assignment - Minnesota

Request for Rate Assignment is a legal document that was released by the Minnesota Department of Labor and Industry - a government authority operating within Minnesota.

FAQ

Q: What is the current sales tax rate in Minnesota?

A: The current sales tax rate in Minnesota is 6.875%.

Q: What is the income tax rate in Minnesota?

A: The income tax rate in Minnesota ranges from 5.35% to 9.85%, depending on income level.

Q: What is the property tax rate in Minnesota?

A: The property tax rate in Minnesota varies by county, but averages around 1.21% of a property's assessed value.

Q: Is there a use tax in Minnesota?

A: Yes, Minnesota imposes a use tax on purchases made out of state that would have been subject to sales tax if purchased in state.

Q: What is the gas tax rate in Minnesota?

A: The gas tax rate in Minnesota is 28.6 cents per gallon.

Q: Are there any special tax exemptions or credits available in Minnesota?

A: Yes, there are various tax exemptions and credits available in Minnesota, such as the Homestead Credit and the Minnesota Working Family Credit.

Q: What is the cigarette tax rate in Minnesota?

A: The cigarette tax rate in Minnesota is $3.04 per pack of 20 cigarettes.

Q: Is there a vehicle registration tax in Minnesota?

A: Yes, Minnesota has a vehicle registration tax based on the value of the vehicle.

Q: What is the inheritance tax rate in Minnesota?

A: Minnesota does not have an inheritance tax, but it does have a state estate tax with rates ranging from 13% to 16%.

Q: Are there any additional taxes or fees in Minnesota?

A: Yes, there may be additional taxes or fees depending on the specific situation, such as lodging taxes or special assessments.

Form Details:

- Released on January 1, 2012;

- The latest edition currently provided by the Minnesota Department of Labor and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Labor and Industry.