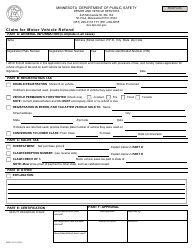

This version of the form is not currently in use and is provided for reference only. Download this version of

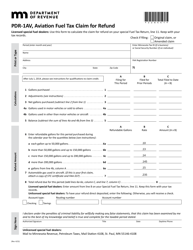

Form PDR-1T

for the current year.

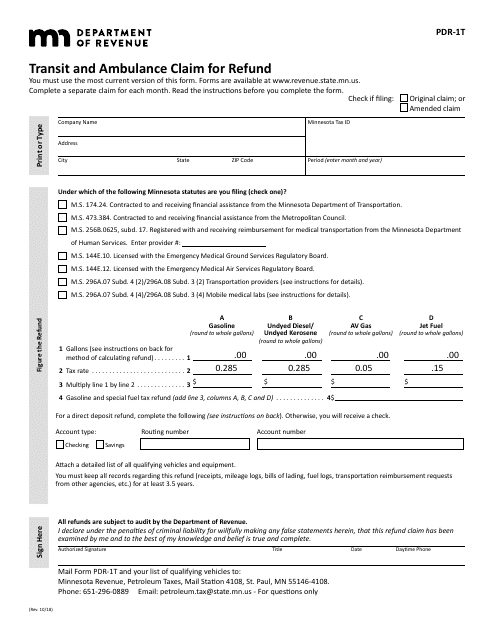

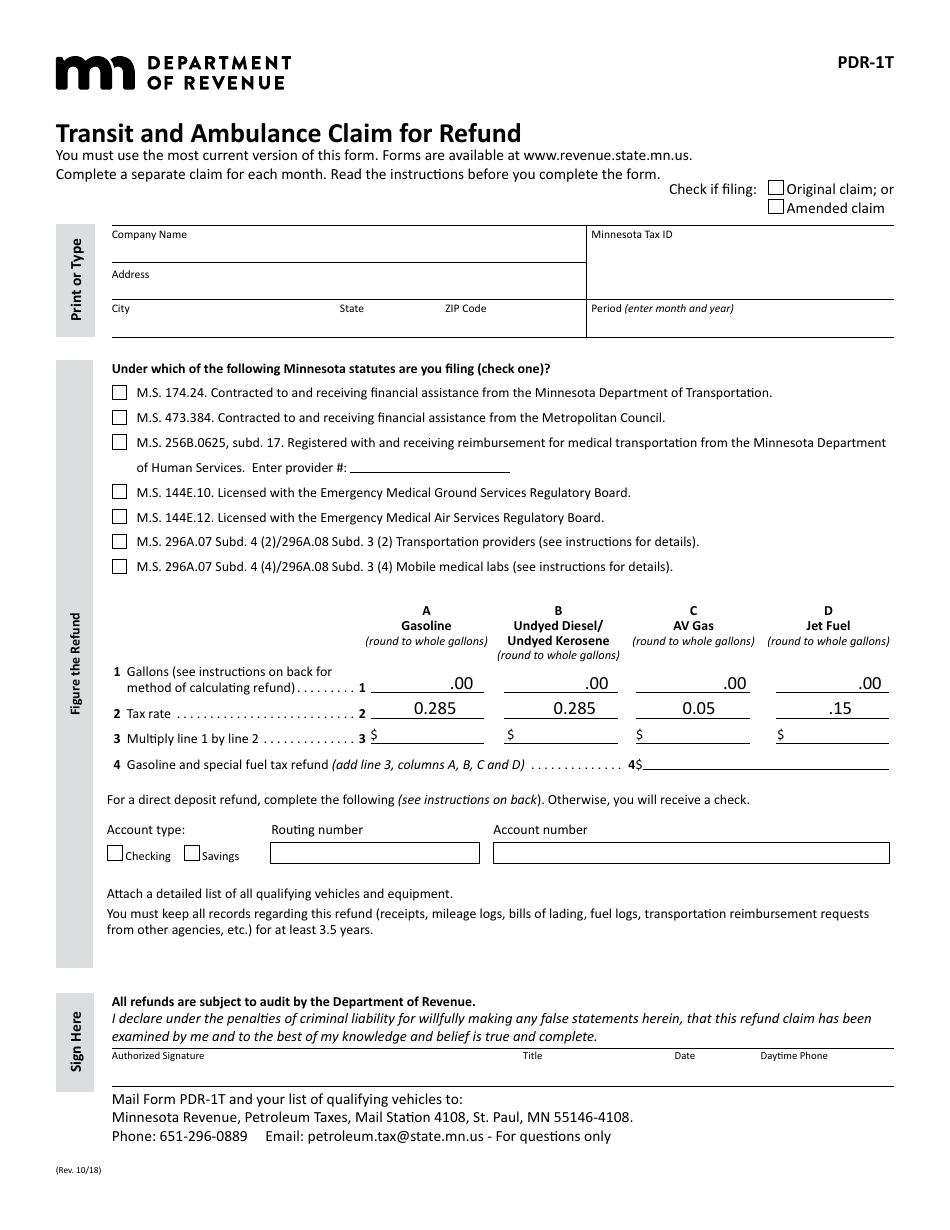

Form PDR-1T Transit and Ambulance Claim for Refund - Minnesota

What Is Form PDR-1T?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDR-1T?

A: Form PDR-1T is a claim for refund specifically for transit and ambulance service providers in Minnesota.

Q: Who is eligible to use Form PDR-1T?

A: Transit and ambulance service providers in Minnesota are eligible to use Form PDR-1T.

Q: What is the purpose of Form PDR-1T?

A: The purpose of Form PDR-1T is to claim a refund for the taxes paid on certain motor vehiclefuel usedin transit and ambulance services.

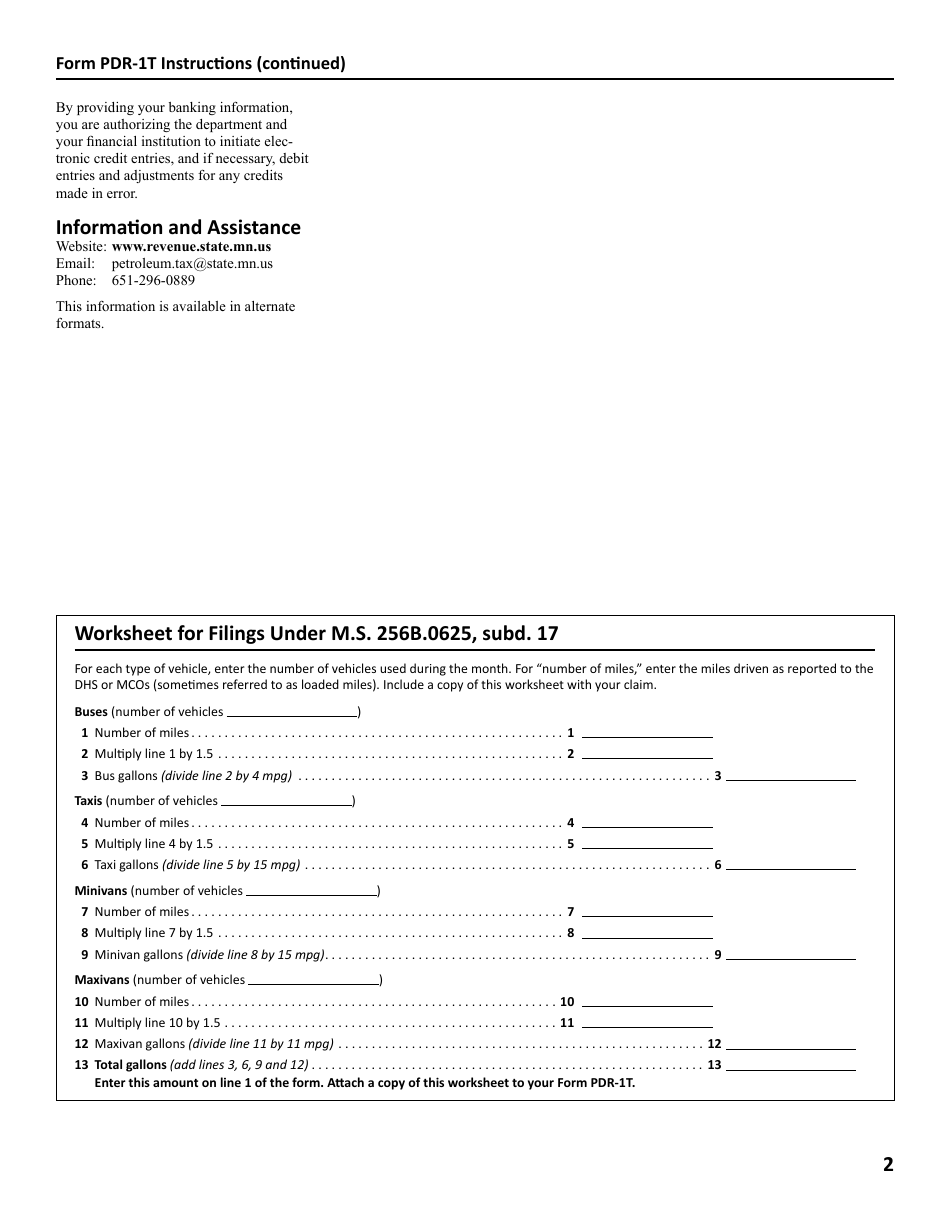

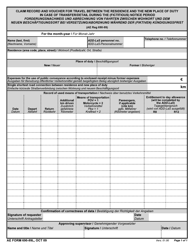

Q: What information do I need to fill out Form PDR-1T?

A: You will need to provide information such as your business name, address, and details of the fuel usage for transit and ambulance services.

Q: When should I file Form PDR-1T?

A: Form PDR-1T should be filed quarterly, no later than 30 days after the end of each quarter.

Q: Is there a deadline for filing Form PDR-1T?

A: Yes, Form PDR-1T must be filed within 30 days after the end of each quarter.

Q: Are there any supporting documents required with Form PDR-1T?

A: Yes, you must attach copies of invoices or receipts for fuel purchases and any other supporting documentation.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDR-1T by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.