This version of the form is not currently in use and is provided for reference only. Download this version of

Form M706Q

for the current year.

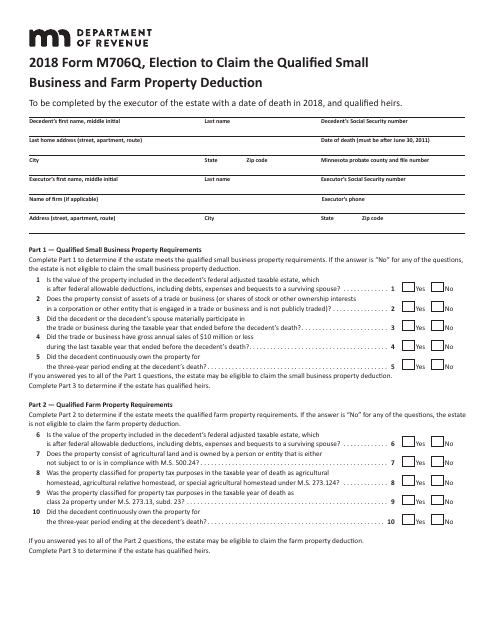

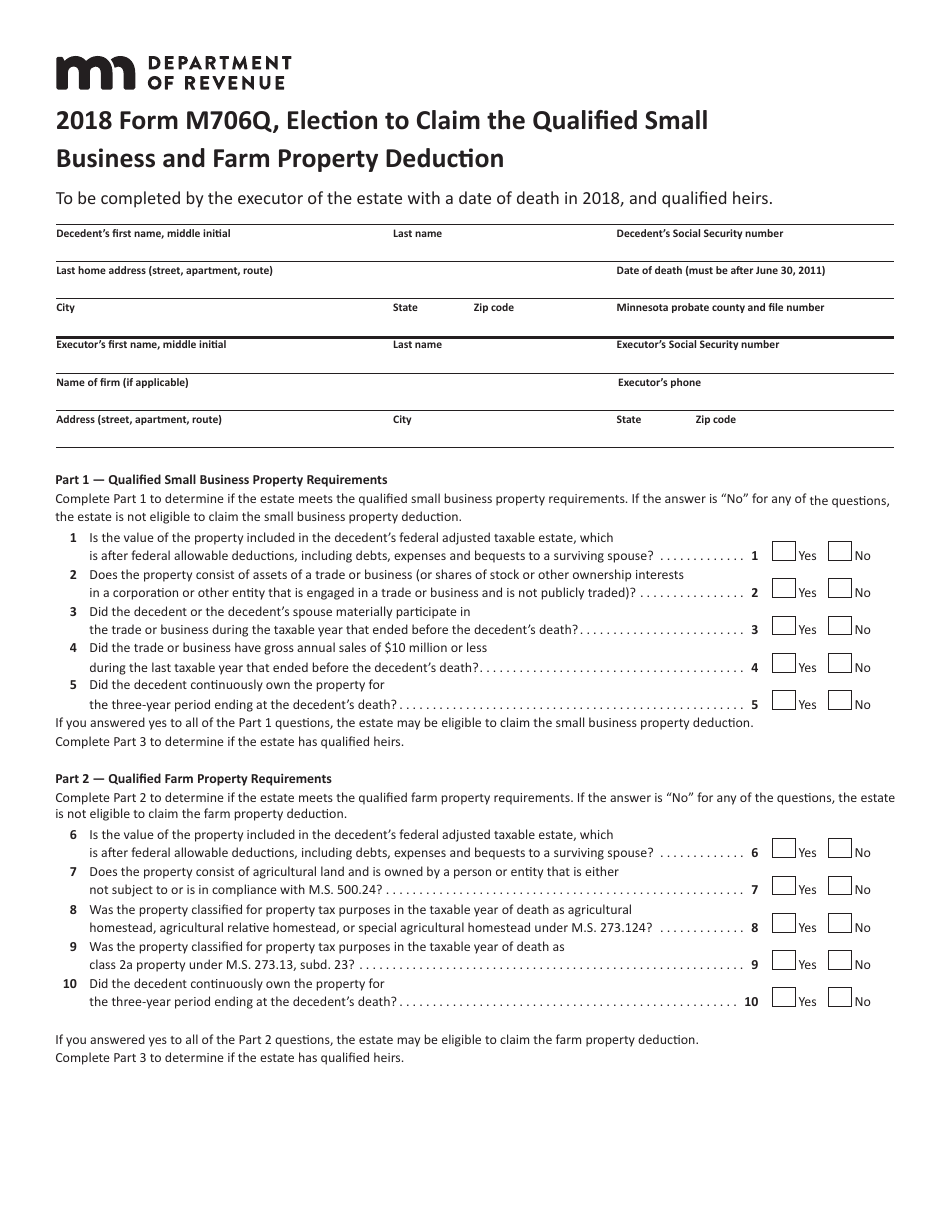

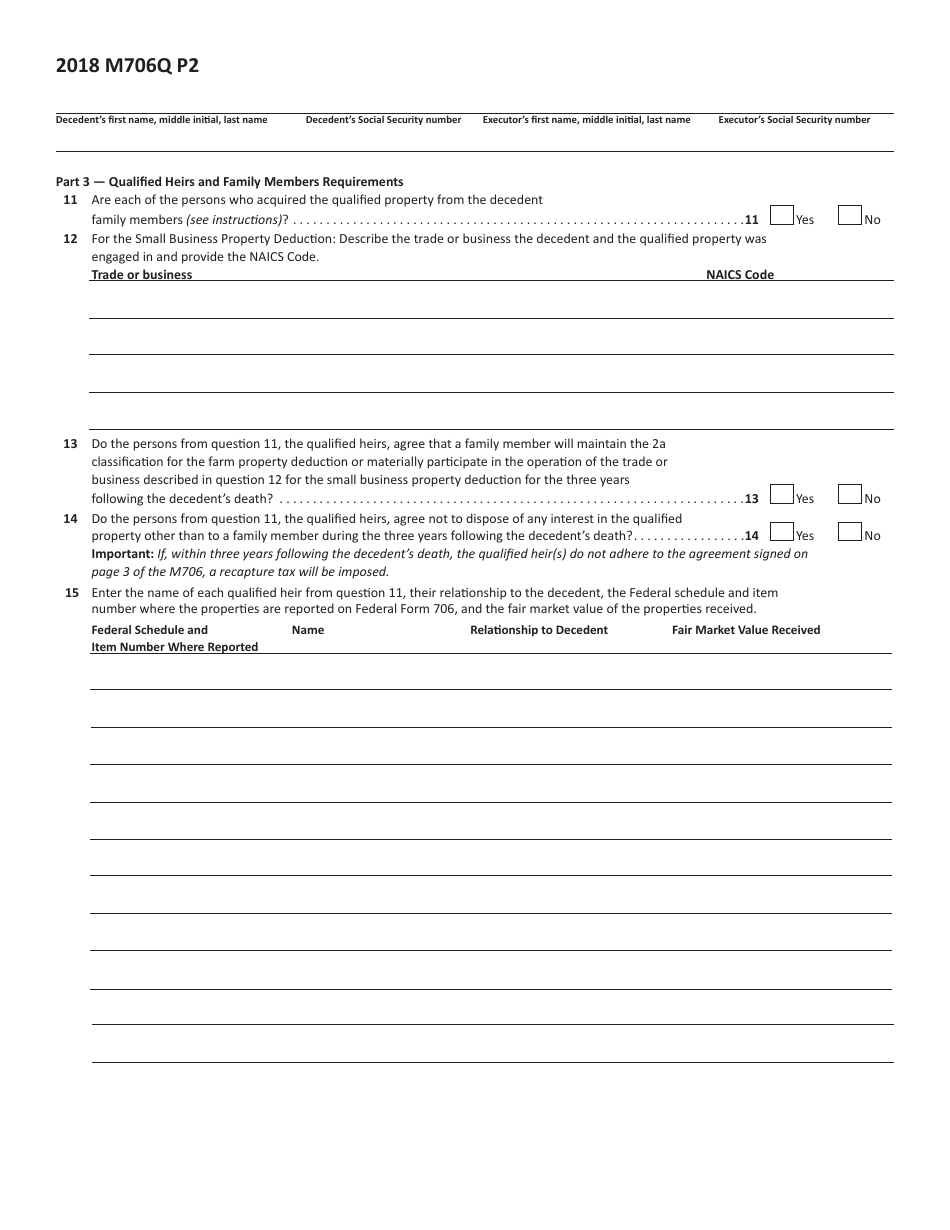

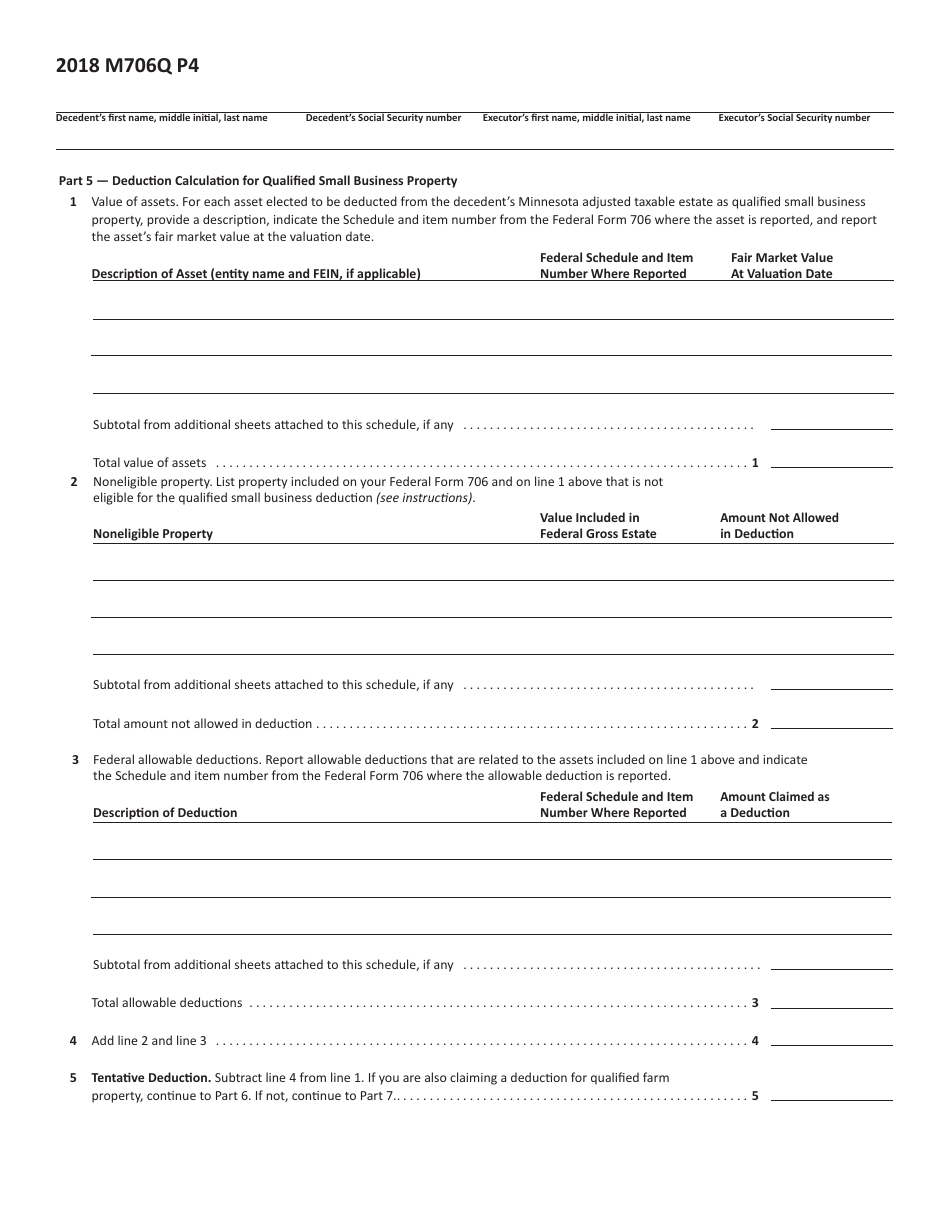

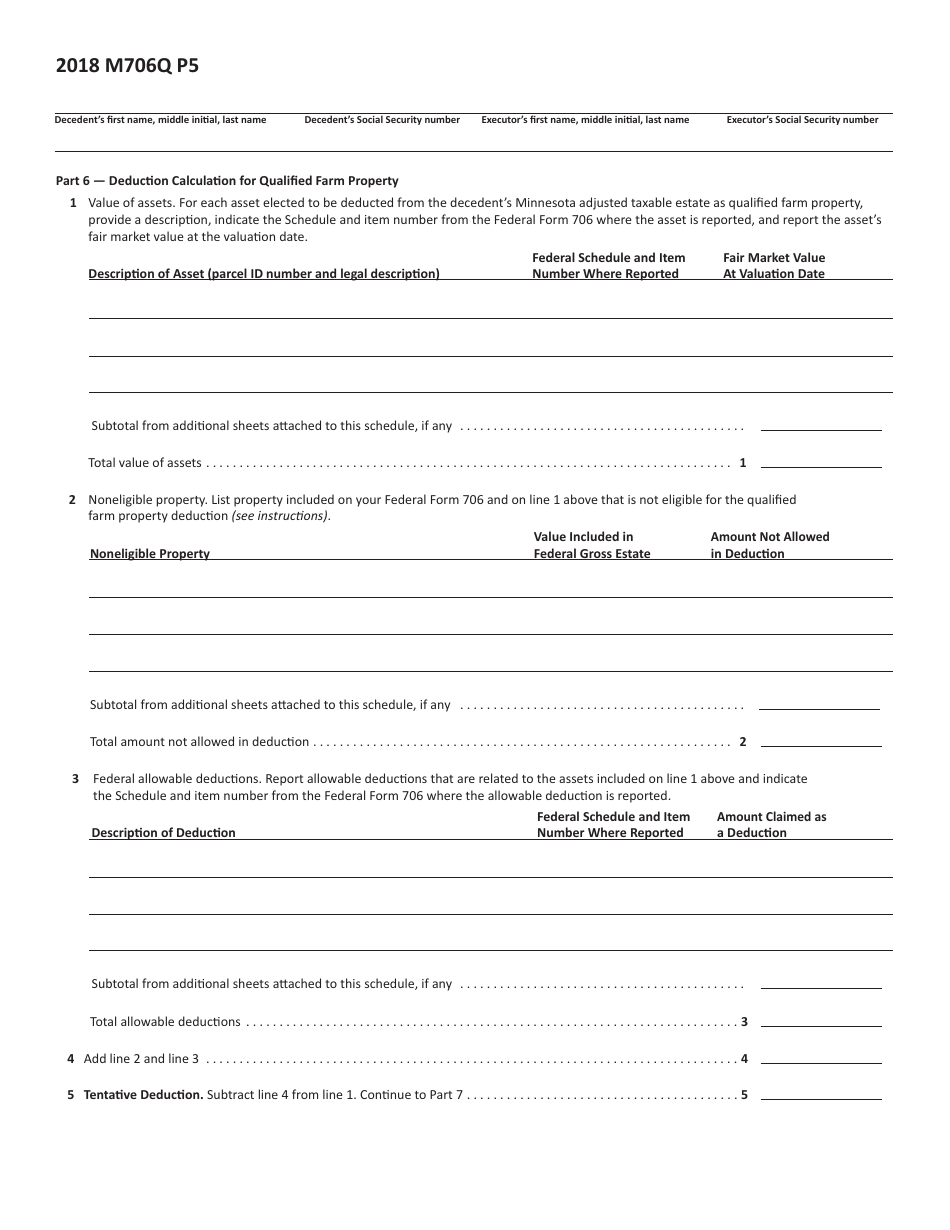

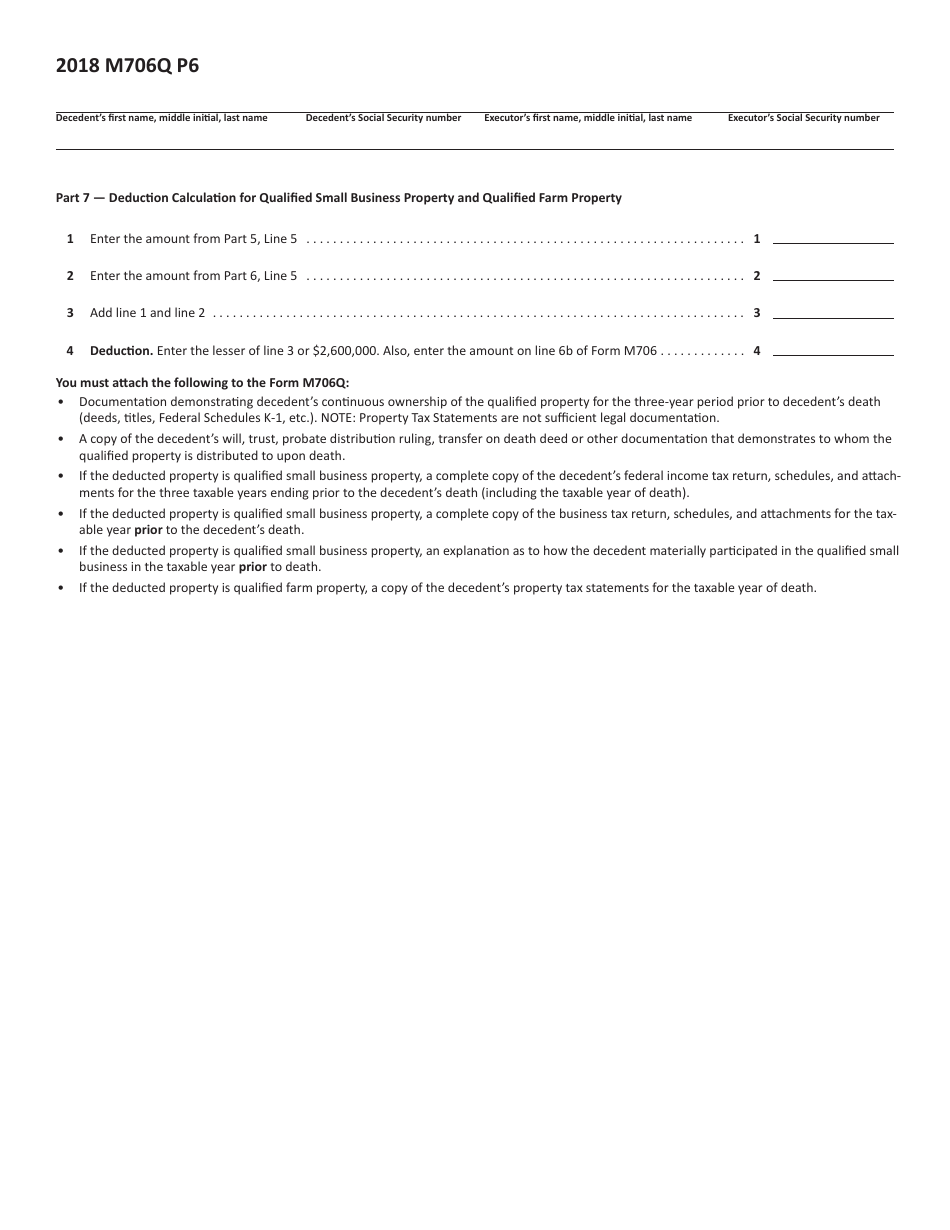

Form M706Q Election to Claim the Qualified Small Business and Farm Property Deduction - Minnesota

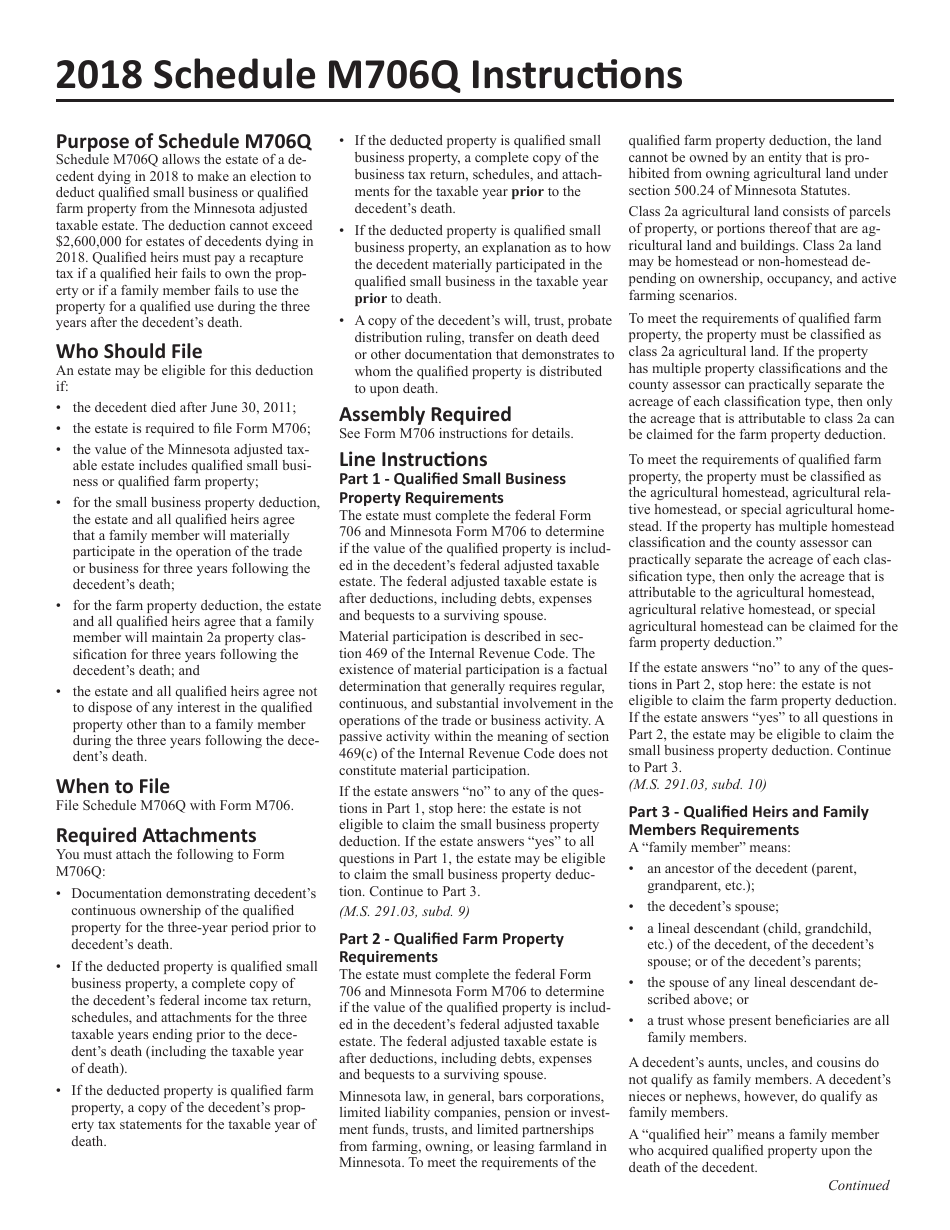

What Is Form M706Q?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M706Q?

A: Form M706Q is a tax form used in Minnesota for claiming the Qualified Small Business and Farm Property Deduction.

Q: What is the Qualified Small Business and Farm Property Deduction?

A: The Qualified Small Business and Farm Property Deduction is a tax deduction available to qualifying businesses and farms in Minnesota.

Q: Who is eligible to claim this deduction?

A: Eligible taxpayers include individuals, estates, and trusts that own and operate qualified small businesses or farms in Minnesota.

Q: What information is required to complete Form M706Q?

A: To complete Form M706Q, you will need to provide information about your business or farm, including the property value and income details.

Q: When is Form M706Q due?

A: Form M706Q is typically due on April 15th, or the following business day if it falls on a weekend or holiday.

Q: Are there any additional requirements for claiming this deduction?

A: Yes, in addition to filing Form M706Q, taxpayers must also meet certain eligibility criteria and maintain proper records to support their claim.

Q: What are the benefits of claiming the Qualified Small Business and Farm Property Deduction?

A: The deduction can help reduce your taxable income, resulting in potential tax savings for qualifying small businesses and farms in Minnesota.

Q: Can I file Form M706Q electronically?

A: Yes, Form M706Q can be filed electronically through the Minnesota Department of Revenue's e-Services system.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M706Q by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.