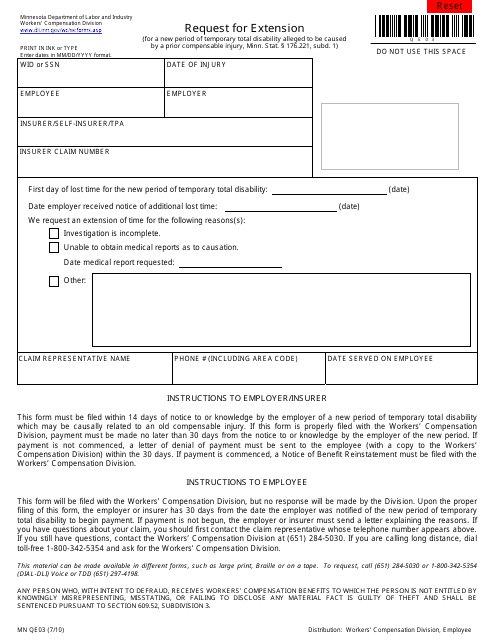

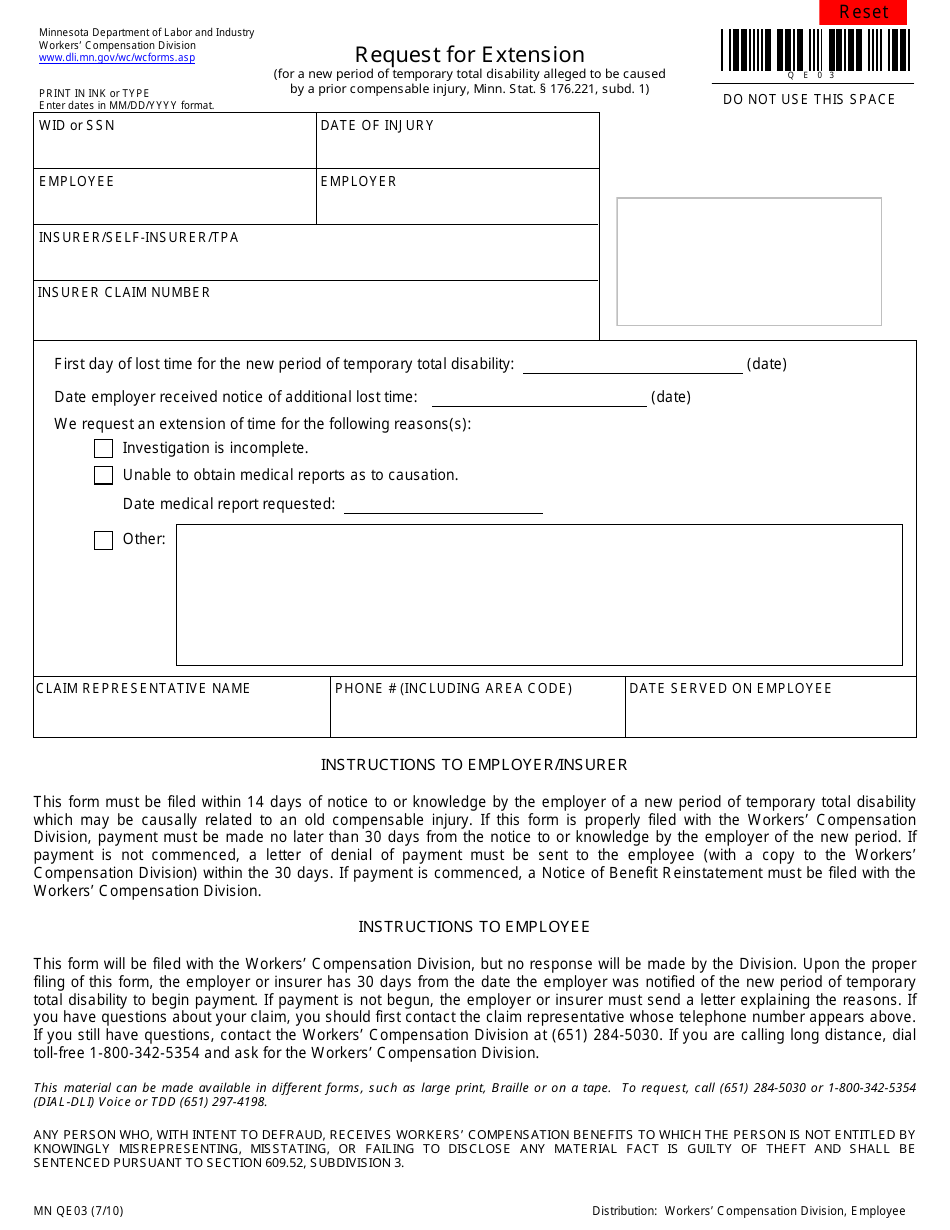

Form MN QE03 Request for Extension - Minnesota

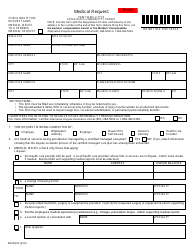

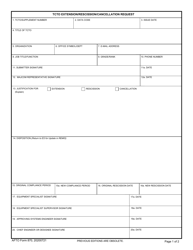

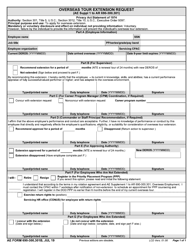

What Is Form MN QE03?

This is a legal form that was released by the Minnesota Department of Labor and Industry - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

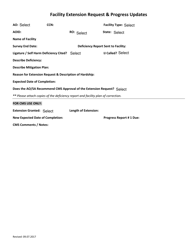

Q: What is Form MN QE03?

A: Form MN QE03 is a Request for Extension form for individuals filing their taxes in Minnesota.

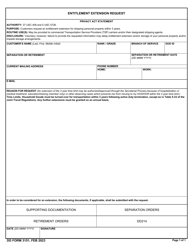

Q: Who needs to file Form MN QE03?

A: Any individual who needs additional time to file their Minnesota state taxes can file Form MN QE03.

Q: How do I complete Form MN QE03?

A: You can fill out Form MN QE03 by providing your personal information and the reason for requesting an extension.

Q: When is the deadline to file Form MN QE03?

A: Form MN QE03 must be filed by the original due date of your Minnesota state taxes, typically April 15th.

Q: Will filing Form MN QE03 automatically grant me an extension?

A: No, filing Form MN QE03 only requests an extension. You must wait for approval or denial from the Minnesota Department of Revenue.

Q: What happens if my request for extension is denied?

A: If your request for extension is denied, you must file your Minnesota state taxes by the original due date or face penalties.

Q: Is there a fee for filing Form MN QE03?

A: No, there is no fee for filing Form MN QE03.

Q: Can I e-file Form MN QE03?

A: No, currently Form MN QE03 can only be filed by mail.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the Minnesota Department of Labor and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MN QE03 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Labor and Industry.