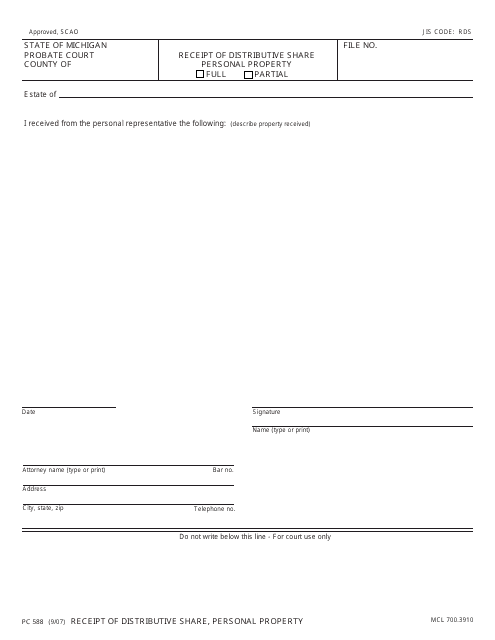

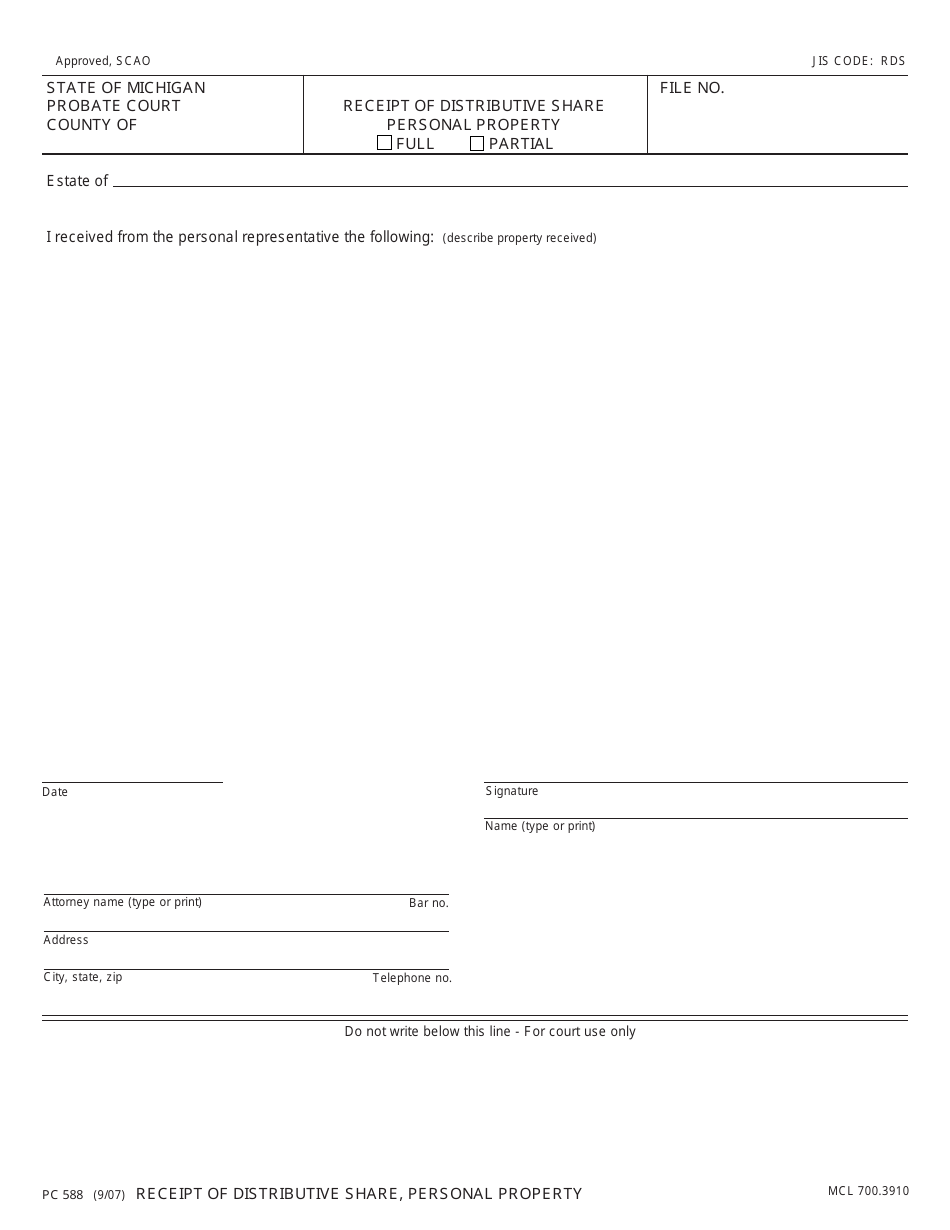

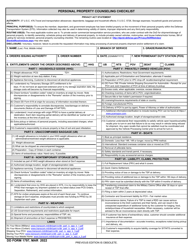

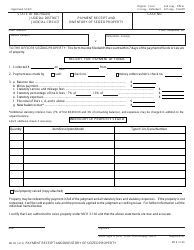

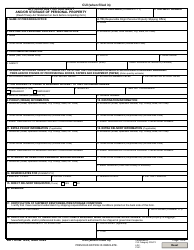

Form PC588 Receipt of Distributive Share - Personal Property - Michigan

What Is Form PC588?

This is a legal form that was released by the Michigan Probate Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PC588?

A: Form PC588 is a receipt of distributive share for personal property in the state of Michigan.

Q: Who needs to use form PC588?

A: Anyone who is receiving a share of personal property in Michigan needs to use form PC588 to acknowledge the receipt.

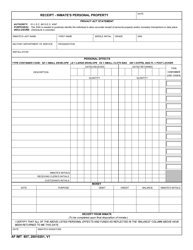

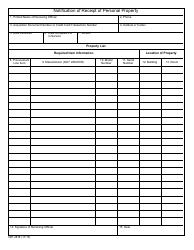

Q: What is considered personal property?

A: Personal property refers to any tangible items that are not real estate, such as furniture, vehicles, equipment, etc.

Q: Why is form PC588 used?

A: Form PC588 is used to acknowledge the receipt of personal property and to ensure that the distribution is properly recorded and documented.

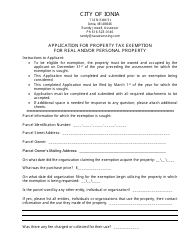

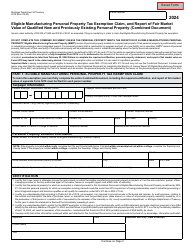

Q: Do I need to submit form PC588 with my taxes?

A: No, form PC588 is not required to be submitted with your taxes. It is solely for acknowledging the receipt of personal property.

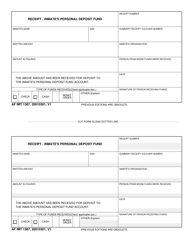

Q: Is there a deadline for submitting form PC588?

A: The deadline for submitting form PC588 may vary depending on the circumstances. It is recommended to refer to the instructions provided with the form for the specific deadline.

Q: What should I do if I lost form PC588?

A: If you lost form PC588, you may need to contact the sender or issuer of the personal property to request a replacement form.

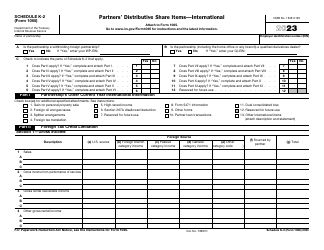

Q: Can I use form PC588 for real estate transactions?

A: No, form PC588 is specifically for personal property transactions and cannot be used for real estate transactions.

Q: Are there any fees associated with using form PC588?

A: There are no fees associated with using form PC588. It is a simple acknowledgement form for personal property transactions.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the Michigan Probate Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PC588 by clicking the link below or browse more documents and templates provided by the Michigan Probate Court.