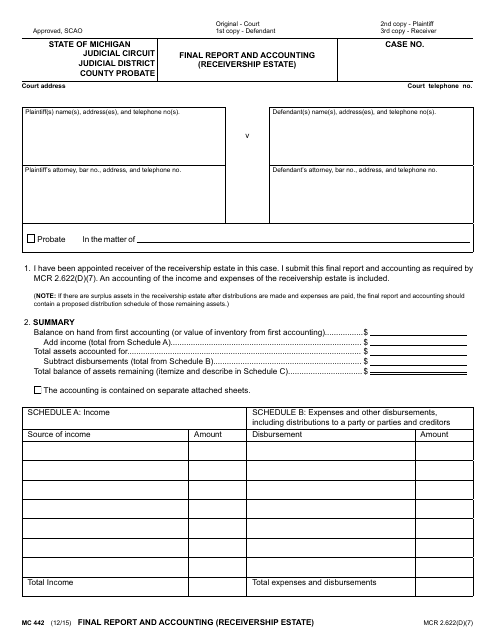

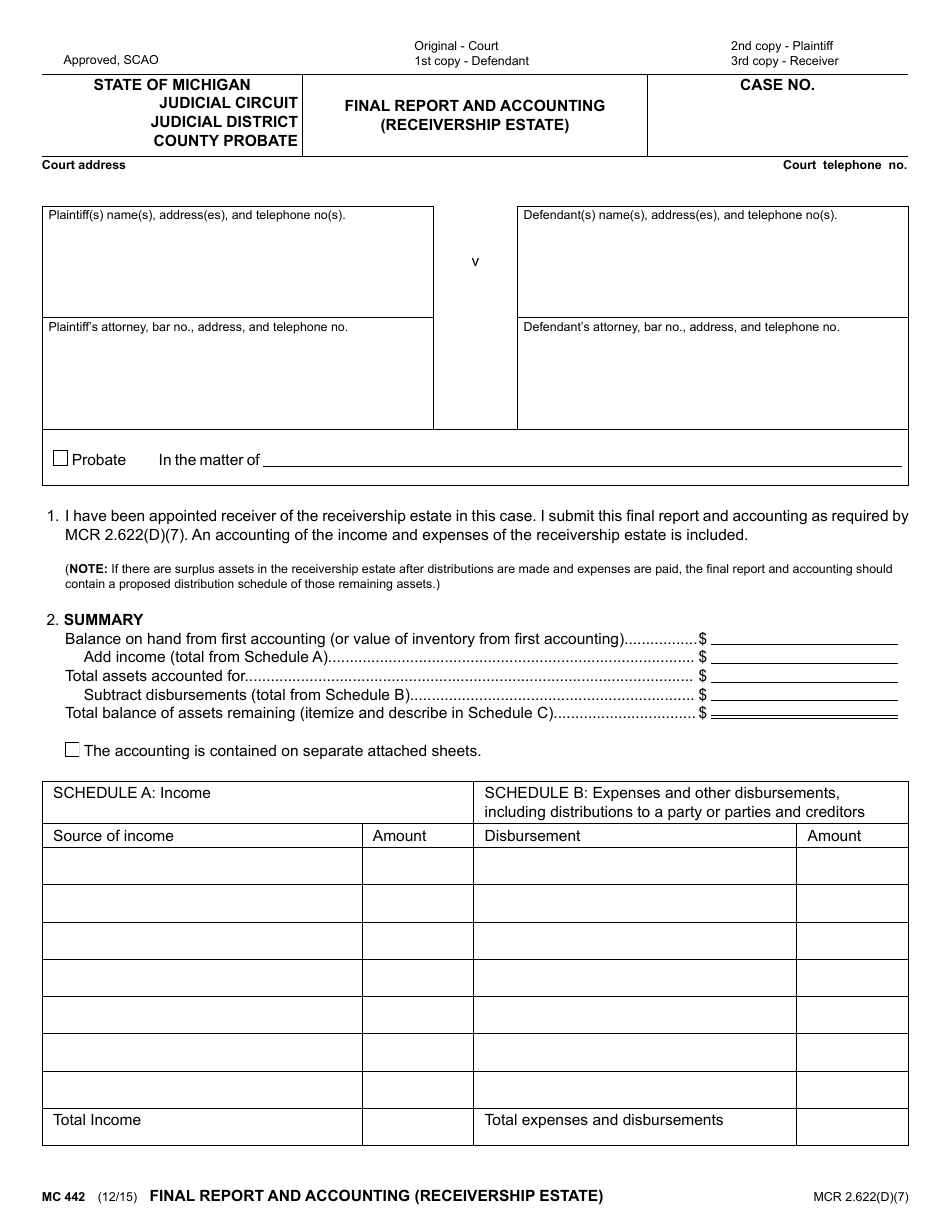

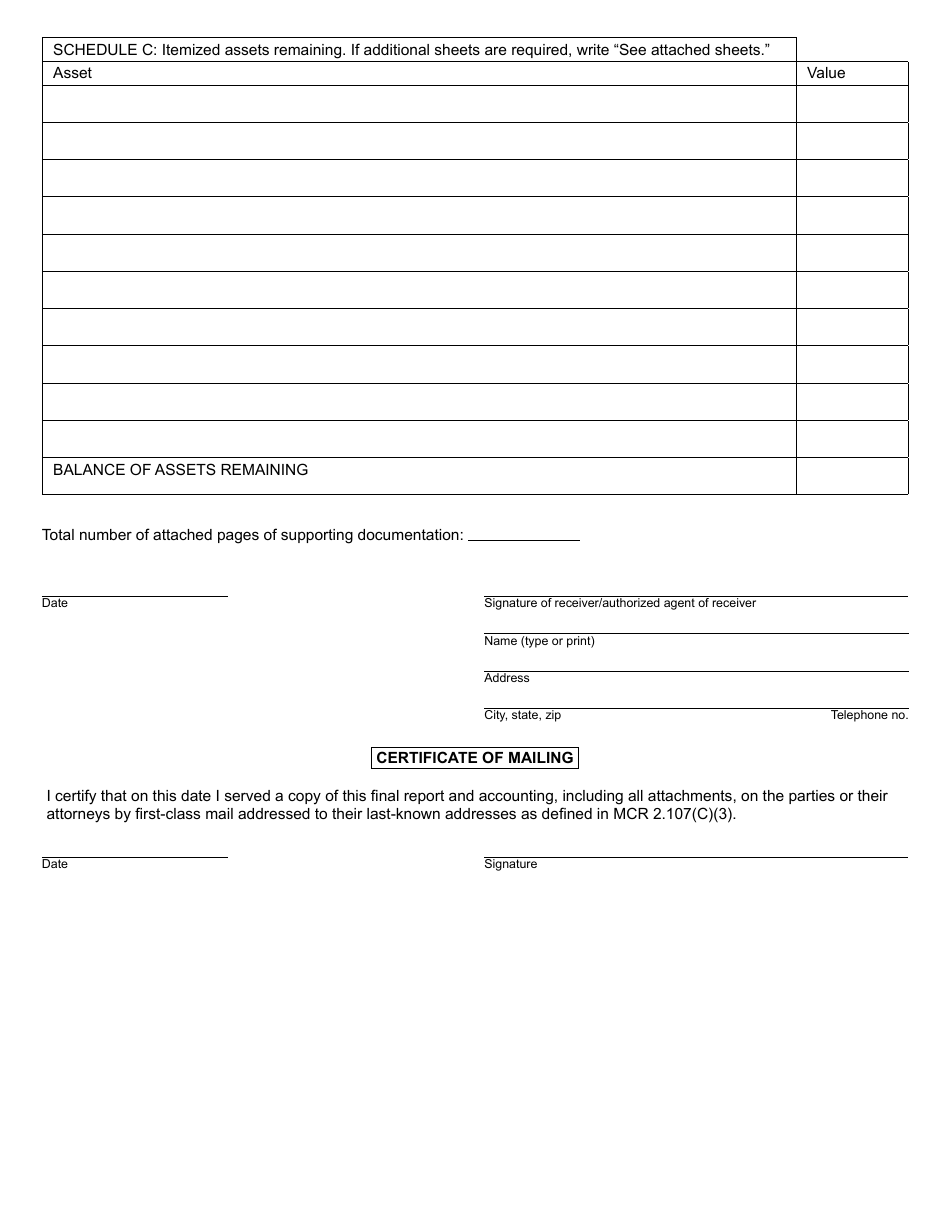

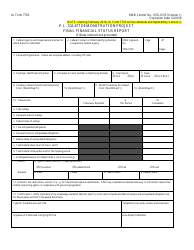

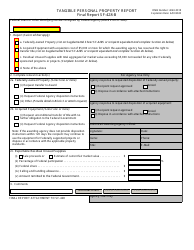

Form MC442 Final Report and Accounting (Receivership Estate) - Michigan

What Is Form MC442?

This is a legal form that was released by the Michigan Courts - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form MC442?

A: Form MC442 is a report and accounting form used in Michigan in a receivership estate.

Q: What is a receivership estate?

A: A receivership estate is a legal process where a court appoints a receiver to manage and administer the assets of a distressed company.

Q: What is the purpose of Form MC442?

A: The purpose of Form MC442 is to provide a report and accounting of the assets, income, and expenses of a receivership estate.

Q: Who needs to complete Form MC442?

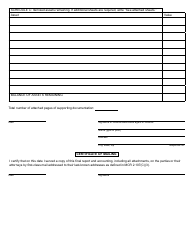

A: The receiver appointed by the court is responsible for completing Form MC442.

Q: What information is required in Form MC442?

A: Form MC442 requires information about the assets, income, expenses, and distributions of the receivership estate.

Q: Is there a deadline for submitting Form MC442?

A: The deadline for submitting Form MC442 is determined by the court and may vary depending on the specific case.

Q: Are there any fees associated with Form MC442?

A: There may be fees associated with filing Form MC442, which can also be determined by the court.

Q: Can I get assistance in completing Form MC442?

A: It is recommended to seek legal or professional assistance to ensure accurate and complete completion of Form MC442.

Q: Can I access past Form MC442 filings?

A: Past Form MC442 filings may be accessible through the court's records or by requesting them from the receiver.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Michigan Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC442 by clicking the link below or browse more documents and templates provided by the Michigan Courts.